The election of Joe Biden to the US presidency has boosted clean energy stocks. A few months into the new administration, the White House has already signaled a willingness to extend the tax breaks afforded to firms working in the electric vehicle industry for another five years.

Even though the battery energy market looks set to register solid growth numbers this year, investors who want to shield themselves from the price volatility associated with high growth stocks like Tesla Inc., NIO Inc., and Plug Power Inc. often minimizes risk by investing in funds that offer exposure to the electric vehicle and battery industry. Like the ARK Innovation ETF, some of these funds have returned more than 152% to investors over the past year.

Let’s discuss the five best funds to buy now.

What are battery ETFs?

These ETFs offer investors exposure to electric vehicle and energy storage firms and companies working in the materials and mining segments involved in the production of high-end electric cars or battery storage solutions.

One way for investors to minimize shocks to individual stocks is to invest in these funds.

How to buy battery ETFs?

Before buying shares in a battery ETF, you need to sign up with a broker. ETFs are collections of stocks that trade on stock exchanges, and you can easily buy or sell them through your brokerage account. Getting the most significant value on a futures contract starts with talking to your futures broker.

Top five battery ETFs to buy in 2022

When choosing a battery technology, ETF, one should consider several other factors and the methodology of the underlying index and performance of fund. For better comparison, you will find a list of all battery technology funds with details.

№ 1.Global X Lithium & Battery Tech ETF (LIT)

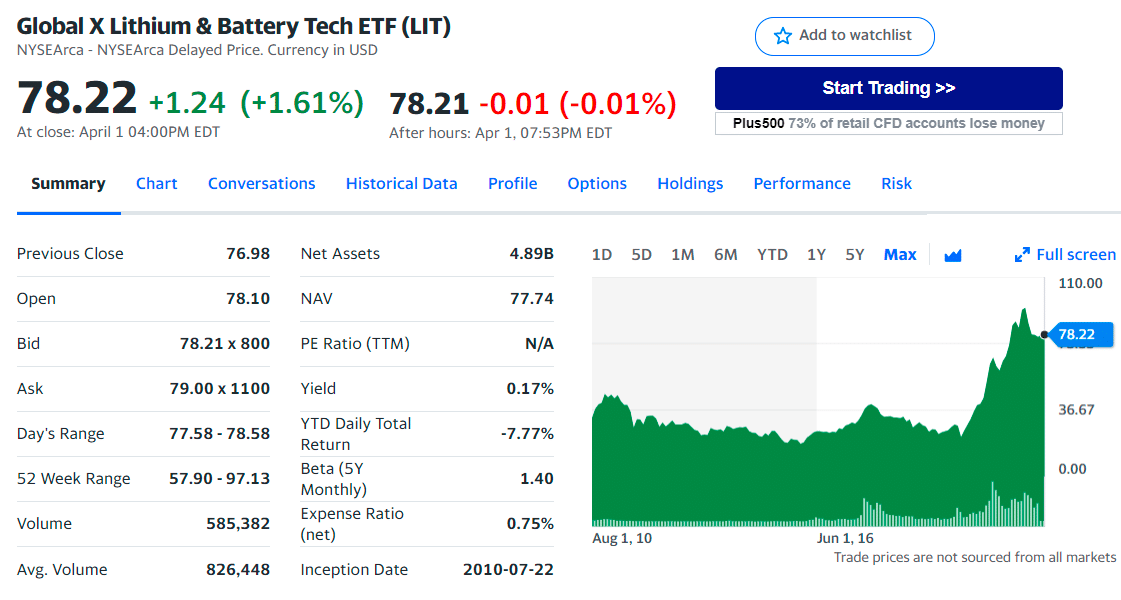

LIT ETF summary

Launched in 2010, LIT is the largest lithium and battery fund. It isn’t a direct play on EVs themselves. Instead, it offers exposure to global EV or lithium equities, which are crucial to the EV revolution. Its one-year return of 20% and $4.8 billion in assets under management.

This passively managed fund tracks the Solactive Global Lithium Index, which comprises some of the world’s most significant lithium explorers and miners. As lithium prices continue to climb, companies in this fund are affected by commodities pricing, so keep that in mind. LIT’s expense ratio is 0.75% or $75 for every $10,000 invested annually.

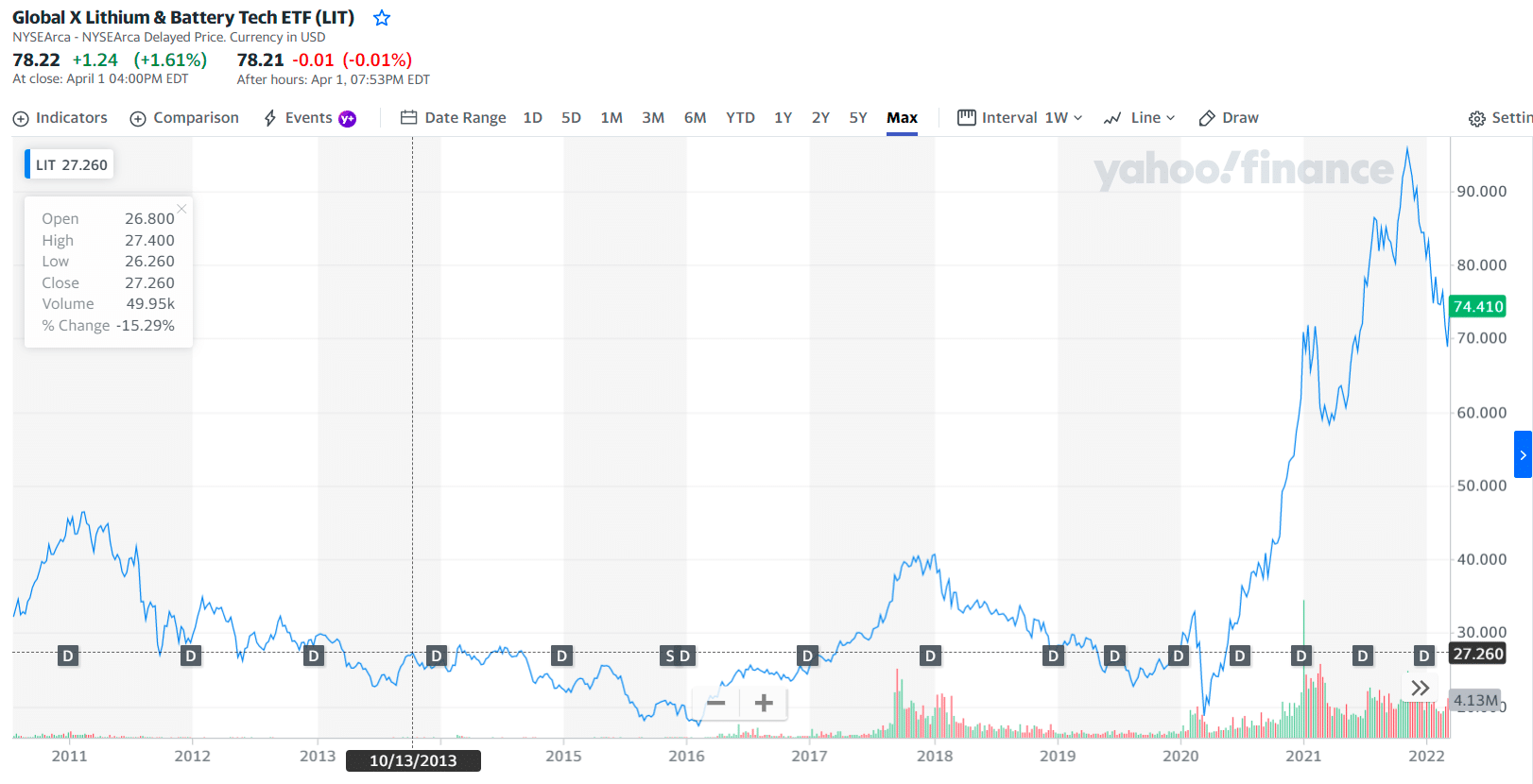

LIT price chart

The fund’s holdings are very concentrated. Its top ten investments are over 50% of its assets and include lithium miners Albemarle and Ganfeng Lithium and battery manufacturers CATL and BYD. LIT is market-cap weighted, meaning that the ETF assigns a higher percentage of assets to the largest companies.

The fund costs 0.75% ($75 annually on a $10,000 investment). It has been volatile in the past, though it had a great run in 2021, returning over 30%. However, the fund is down roughly 9% in 2022.

The first three holdings with their asset percentage are:

- Albemarle Corp. — 9.94%

- TDK Corp. — 6.33%

- Tesla Inc. — 5.42%

№ 2. Amplify Advanced Battery Metals & Materials ETF (BATT)

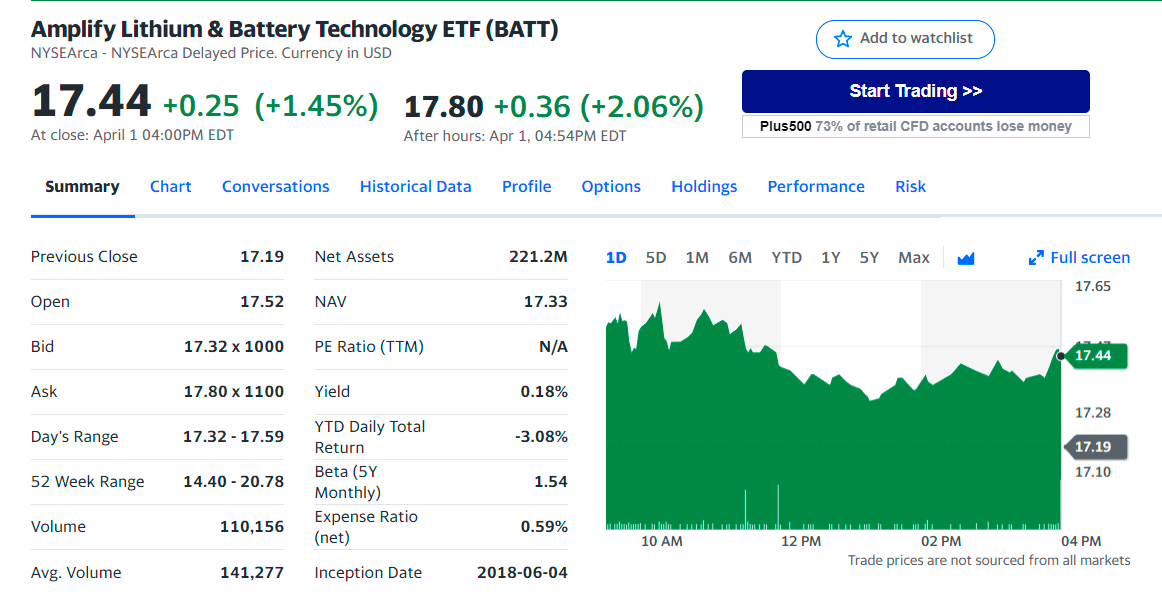

BATT ETF summary

BATT, another battery-focused fund, is smaller than LIT, with only $215 million under management versus LIT’s $4.8 billion. BATT costs significantly less, however, with an expense ratio of 0.59%.

It is another passively managed fund tracking the EQM Lithium & Battery Technology Index. This index tracks global companies that mine and produce battery materials. Although this is a similar index to LIT’s, BATT’s top-five holdings are very different. The only company LIT and BATT hold in their top-five holdings is Tesla.

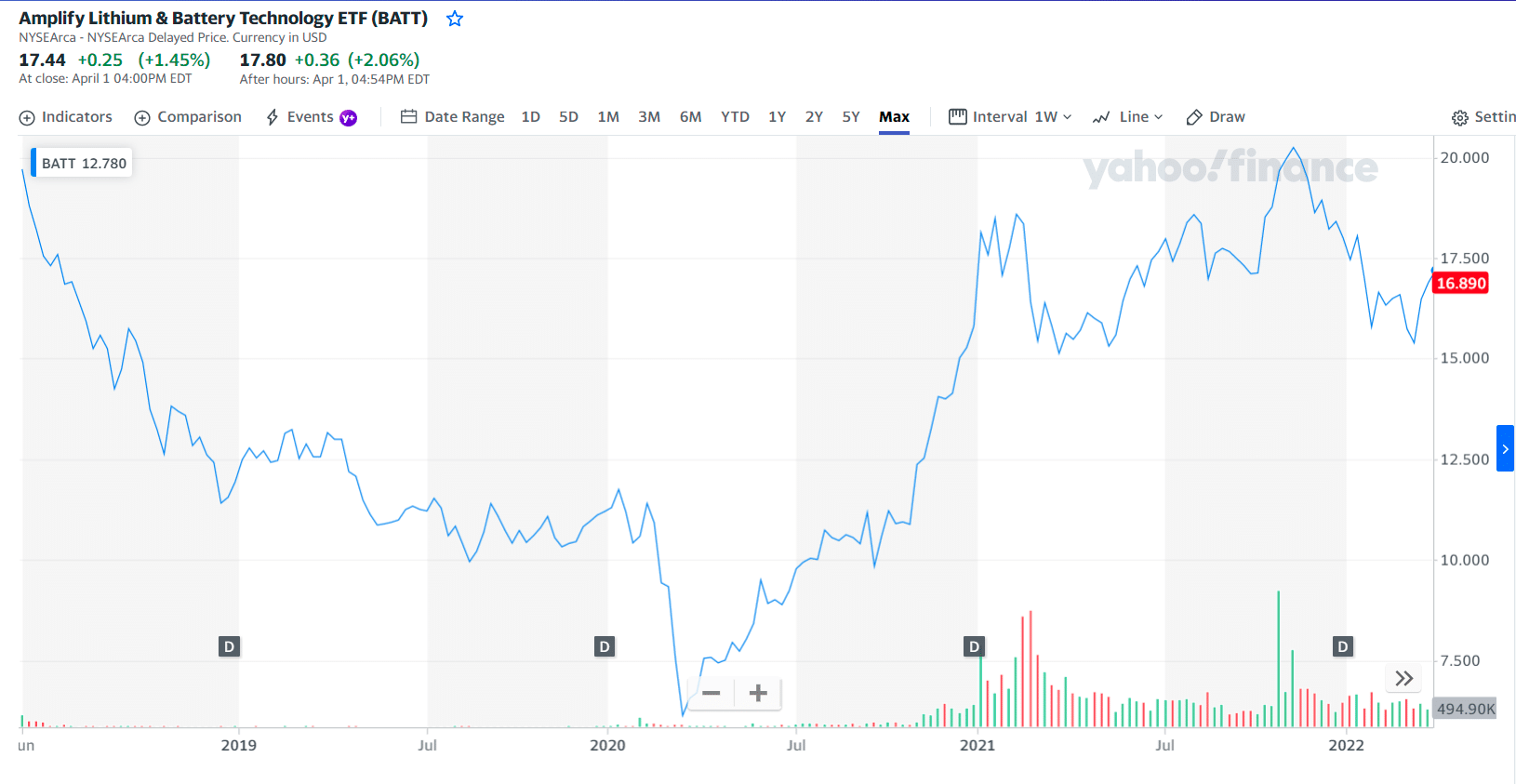

BATT price chart

More than half of BATT’s portfolio is allocated to specialty mining and metals companies, compared to just 3% of LIT’s. The fund also holds uranium (3%), gold stocks (3%), and even coal miners (3%) — one of the worst-performing miner sectors of 2021.

On the other hand, LIT’s highest weighting is in electrical components and equipment manufacturers (29%), a segment that doesn’t even show up in BATT; ditto for LIT’s 18% weighting in auto and truck manufacturers. The fund also has nearly double the allocation in commodity chemicals as BATT (25% versus 14%).

In other words, despite hefty crossover in individual stocks, BATT’s primary focus is on the metals themselves — the production side of metals production. Meanwhile, LIT focuses on the end applications of those metals.

The first three holdings with their asset percentage are:

- BHP Group Ltd. ADR — 7.10%

- Tesla Inc. — 6.25%

- Contemporary Amperex Technology Co Ltd ORD — 6.25%

№ 3. SPDR S&P Kensho Smart Mobility ETF (HAIL)

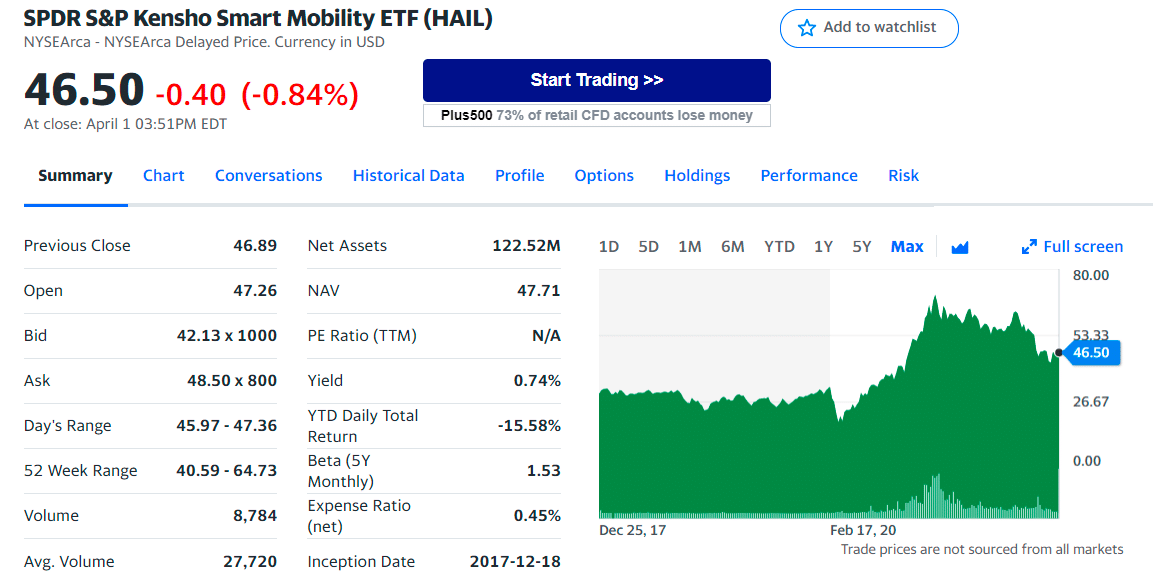

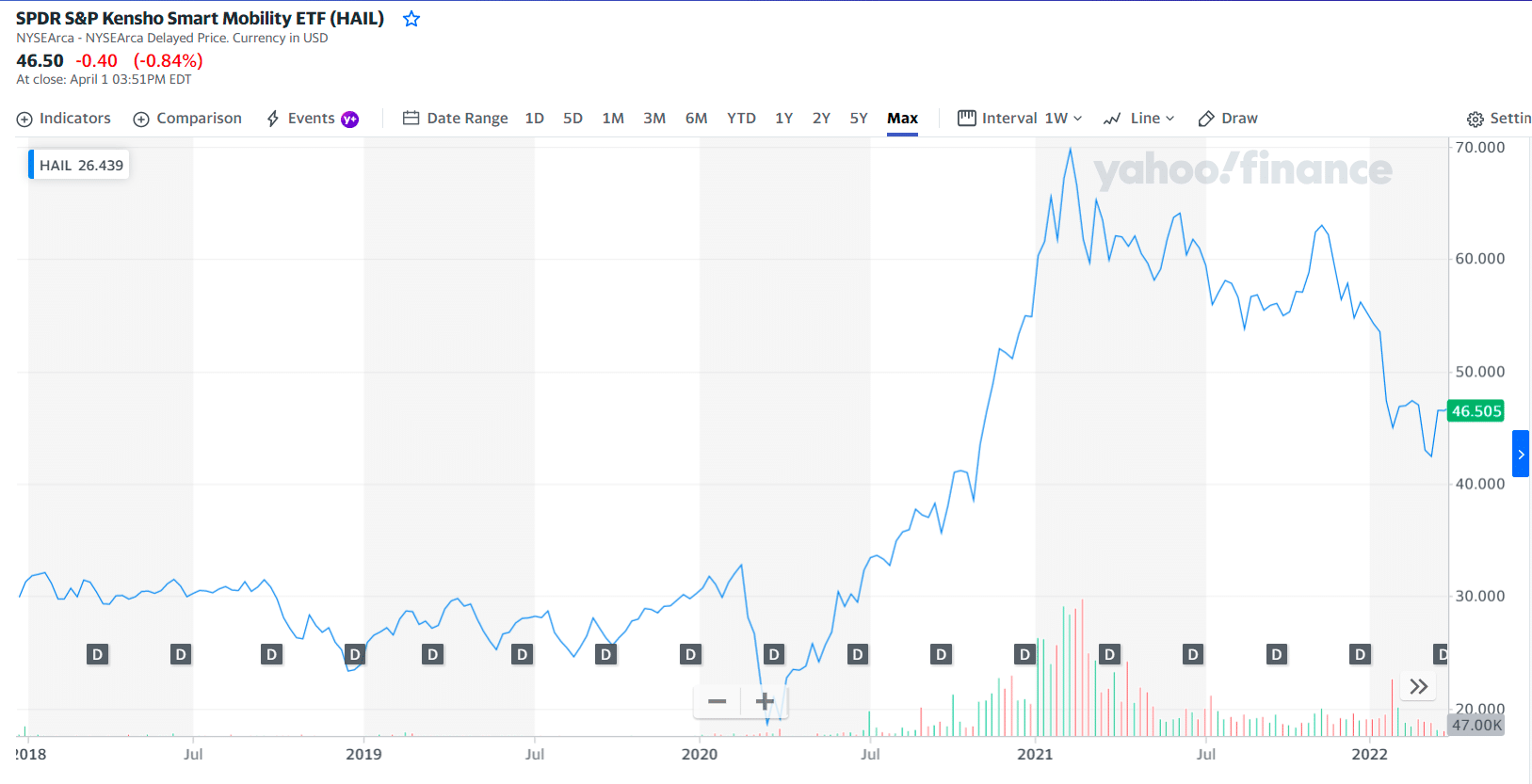

HAIL ETF summary

HAIL was founded in December 2017, making it the second-oldest fund on this list after LIT. A passively managed fund, it tracks the S&P Kensho Smart Transportation Index. The stocks on this index are US-listed developed and emerging market companies in the smart transportation sector.

The fund has 85 equity holdings in its portfolio, and only 17% of its total assets are in the top ten. It has a total return of 59% since inception. With just $116 million under management, it is still a relatively small fund, but it does have a competitive expense ratio of 0.45%. The fund’s price has hovered between $28 and $71 over the past 52 weeks.

HAIL price chart

The fund seeks to provide investment results that correspond to the total return performance of the Kensho Smart Transportation Index. The fund invests at least 80% of its assets in the index’s components designed to capture companies whose products and services drive the innovation behind smart transportation.

The first three holdings with their asset percentage are:

- Allison Transmission Holdings Inc. — 1.90%

- Honda Motor Co. Ltd. ADR — 1.85%

- Visteon Corp. — 1.76%

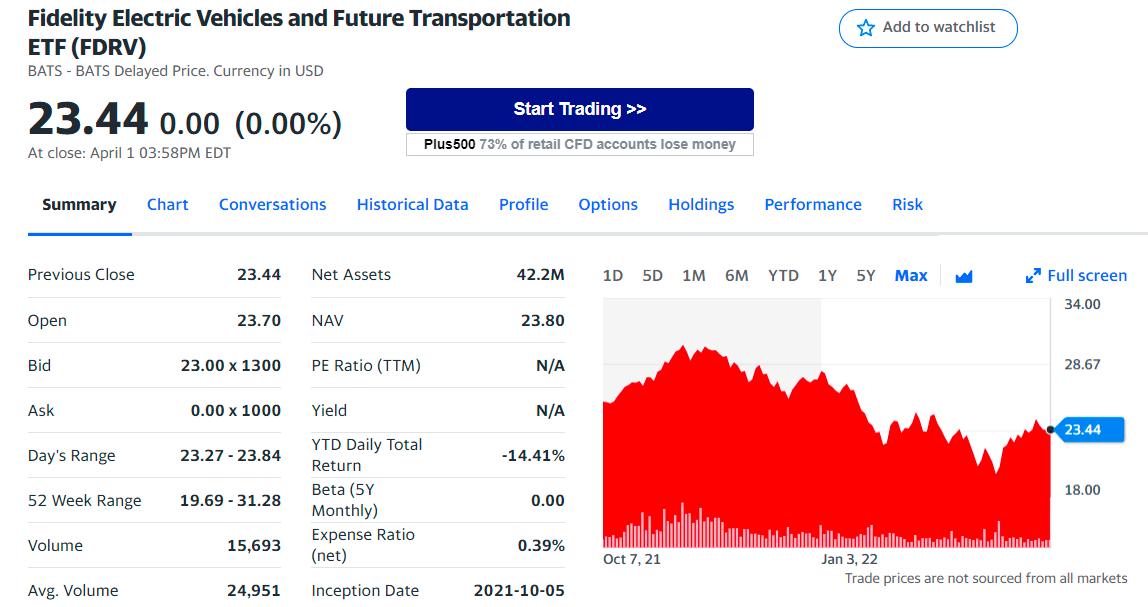

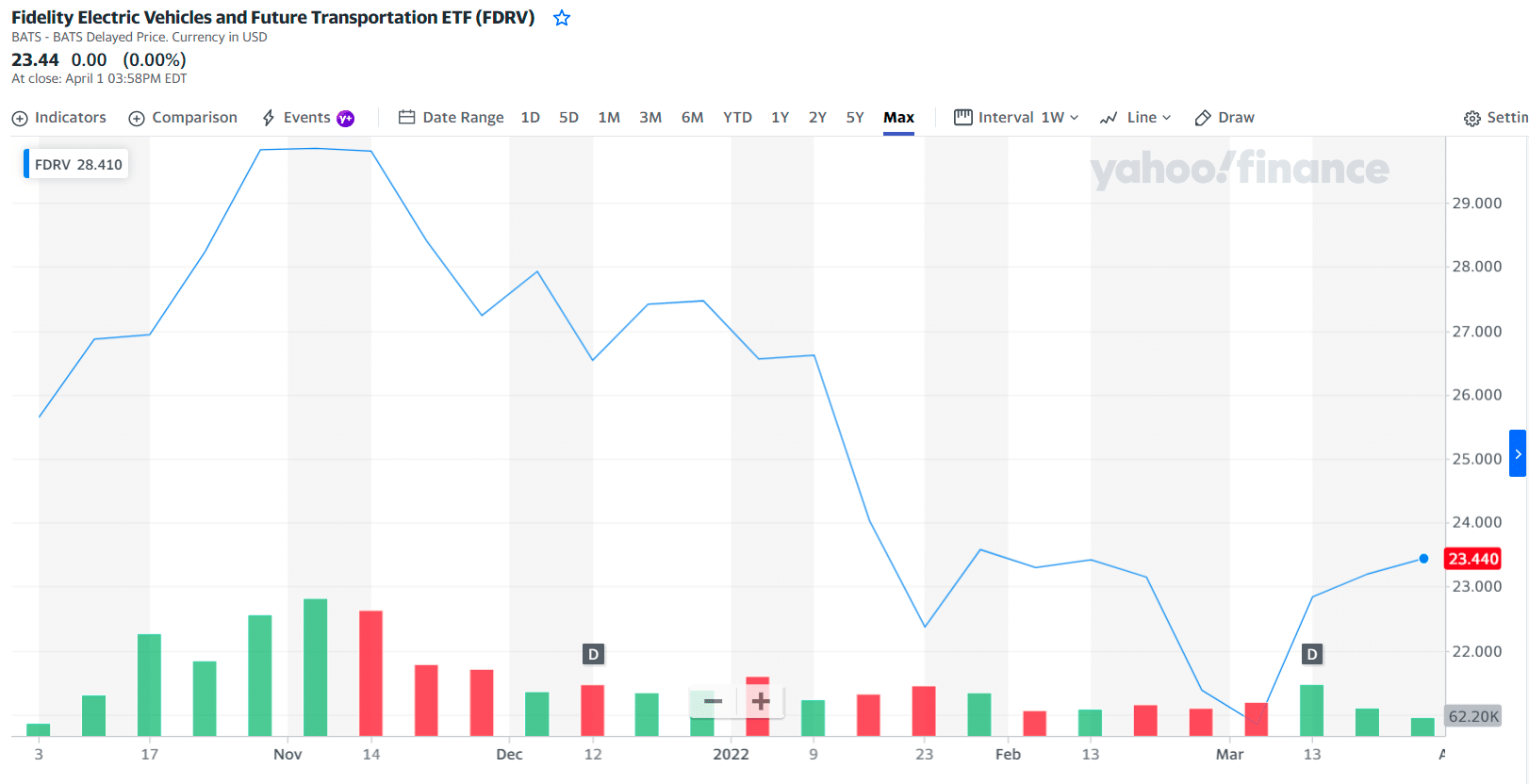

№ 4. Fidelity Electric Vehicles and Future Transportation ETF (FDRV)

FDRV ETF summary

At only 0.39%, FDRV has the lowest expense ratio on this list. Founded in October 2021, however, it is also the newest fund on this list and has only $40 million under management. Unfortunately, market conditions haven’t favored it so far, and it’s lost more than 13% since inception.

On the bright side, Fidelity is an established and well-respected fund manager, so this fund should have a solid future once the market picks up again. This passively managed ETF tracks the Fidelity Electric Vehicles and Future Transportation Index.

FDRV price chart

Like the other EV funds on this list, this index tracks a global basket of companies producing EV and autonomous transportation technology. FDRV’s top holdings include many familiar faces from the other funds on this list.

The first three holdings with their asset percentage are:

- Uber Technologies Inc — 4.67%

- Tesla Inc. — 4.34%

- Qualcomm Inc. — 4.27%

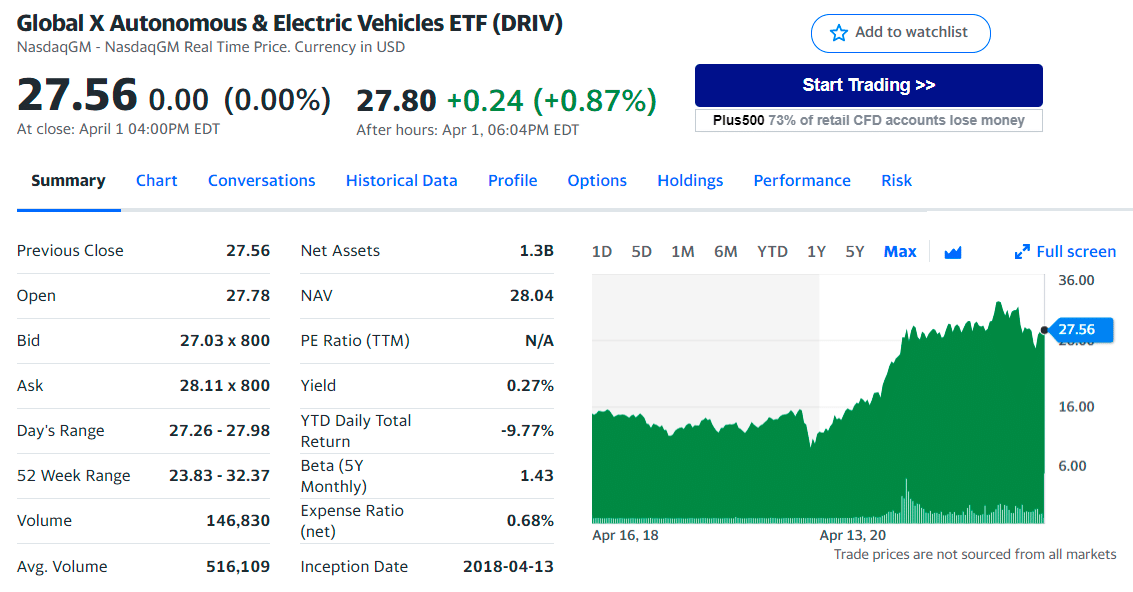

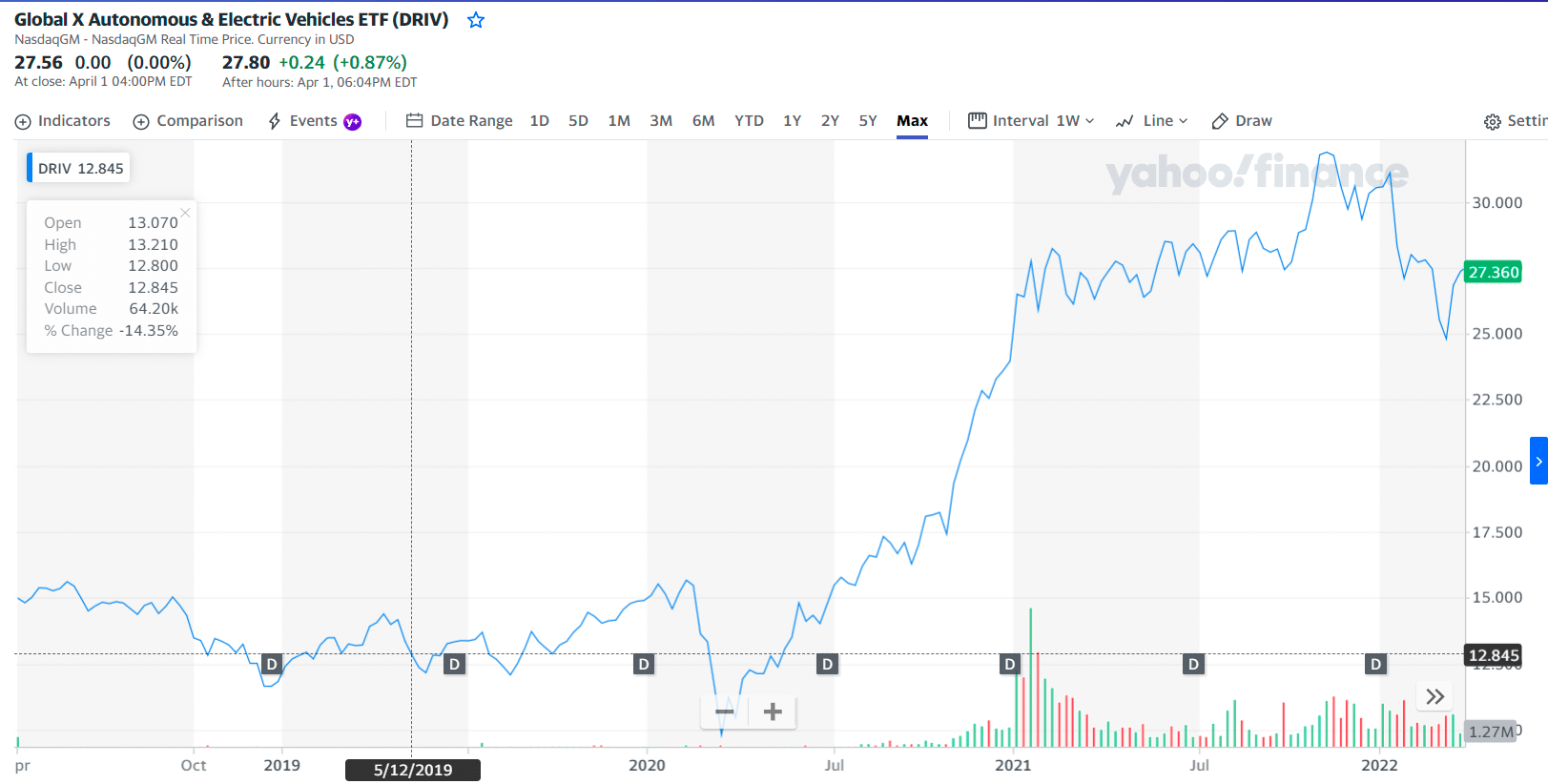

№ 5. Global X Autonomous & Electric Vehicles ETF (DRIV)

DRIV ETF summary

DRIV is a non-diversified exchange-traded fund that tracks the Solactive Autonomous & Electric Vehicles Index’s investment returns, which comprises publicly traded and involved in developing electric vehicles, components and materials, and autonomous driving products as network-connected devices.

The fund has more than $900 million in net assets under management. It has a year-to-date daily total return of 17.4% and a net expense ratio of 0.68%. The 52-week price range of the fund lies between $13 and $28.

DRIV price chart

One of the firm’s top holdings is Alphabet Inc., the California-based technology company pursuing autonomous vehicle technology. At the end of the first quarter of 2021, 159 hedge funds in the database of Insider Monkey held stakes worth $29 billion in Alphabet Inc., up from 157 in the previous quarter worth $20 billion.

The first three holdings with their asset percentage are:

- Alphabet Inc. Cl A — 3.25%

- Apple Inc. — 3.20%

- Qualcomm Inc. — 3.14%

Final thoughts

Lithium-ion batteries need metals beyond lithium.

- Check out this list of the top cobalt stocks.

- An electric car contains four times as much copper as a gasoline-powered car. Learn about copper ETFs.

Nickel is another “green metal” you should know about. Learn which ETFs invest in nickel.

Comments