Over the past few years, cryptocurrencies have proven themselves as more than just a fad. This asset class is slowly becoming the new medium of exchange away from traditional fiat currencies.

However, dealing with cryptocurrencies is often complex, particularly for newbies. Learning the necessary information about exchanges is one crucial element of this equation to ensure the safest experience when trading in this market.

Are you wondering where to buy cryptocurrency or looking for the best cryptocurrency exchange for 2022? This guide provides an extensive choice of reputable options in this regard.

Before getting to this stage, this article will provide some brief but beneficial education about how exchanges work and some key things to note.

Our website does not give financial advice and this guide should be used for the sole aim of financial education. It is important to conduct your own research and analysis before making any decisions on your investments to avoid the risk of losing capital.

Table of Contents

Crypto exchange: what is it?

A crypto exchange is simply a ‘matchmaking service’ or marketplace for buying and selling an extensive range of cryptocurrencies. In more technical terms, these companies are the middlemen between liquidity providers or brokers and traders.

Unlike other exchanges such as those in equities, digital currencies trading happens 24/7. As with many exchanges in other markets, a crypto exchange uses an order book, essentially a matching engine with a list of orders produced by buyers and sellers for every cryptocurrency.

The order book is the central mechanism for most exchanges as it connects orders to different external liquidity providers. For instance, when you buy BTC, this system will find another client or broker willing to sell you BTC, and vice versa.

For these efforts, an exchange will apply a commission or fee for every successfully fulfilled order. Customers need to fund their accounts using the available depositing methods.

This account may be denoted in a local fiat currency or another cryptocurrency. If the exchange has a wallet, you can trade different assets on the exchange and accept payments from other people.

Not all exchanges have an in-built wallet, meaning customers may need to source one from a third-party service.

Cryptocurrency apps and fees included

There are numerous fees to keep in mind when using any crypto exchange.

Deposit fees

These will vary widely from exchange to exchange. The general premise is depositing using a debit/credit card is typically free or incurs a low cost, meaning it’s probably the best method. Fees are likely to apply if you’re funding with an e-wallet service like PayPal or Skrill.

Bank wire transfers are notoriously expensive, meaning they should never be used except where no option is available. Many exchanges also allow crypto deposits. However, there are no set fee schedules.

In some instances, these may be costless, but in many cases, they can have their own costs, which are hard to predict beforehand.

Trading fees

The main trading-related costs with most crypto exchanges are known as maker-taker fees. This model differentiates between orders that add liquidity (‘maker’) and remove liquidity (‘taker’).

An exchange will observe your trading volume over the past 30 days across all available markets. Afterward, a client will be assigned a fee tier based on this volume—generally, the higher your volume, the lower the fees.

The industry standard is around 0.25% maker and 0.20% taker fees. Top crypto exchanges will aim to offer lower than these figures to make trading cheaper.

Withdrawal fees

Finally, the other fee to consider with any crypto exchange is the withdrawal costs. Similar to deposits, these vary depending on the exchange and the withdrawal method.

You can withdraw in many ways, like via a credit/debit card or e-wallet (both fairly reasonable in cost) or bank account (usually pricey, unless the exchange has a local bank account). If you’re withdrawing to another cryptocurrency, the costs will differ tremendously depending on the chosen coin.

What is the difference between a crypto exchange and a broker?

A broker and exchange in the context of cryptocurrencies are similar concepts as both act as middlemen between the market and traders. However, they primarily differ in two ways.

An exchange is a marketplace where customers trade with one another for other cryptocurrencies at different prices. On the other hand, with a broker, you transact with that company through prices they’ve set.

Another distinction is, when we refer to a broker, we often mean a service allowing for speculative online CFD trading using complex mechanisms like margin, futures, options, perpetuals, etc. Of course, there are some exchanges with both facilities.

However, many exchanges don’t provide this type of trading, only buying and selling actual cryptocurrencies.

Types of crypto exchanges

Presently, we have three main types of crypto exchanges, although the first two are the most prevalent.

Centralized exchanges

A centralized exchange (CEX) is the most common and accessible type of crypto exchange. Services like Coinbase, Binance, Gemini, Kraken, and many others are examples of a CEX.

One of the defining features of these brands is how they maintain custody of their clients’ funds. More specifically, a centralized crypto exchange retains control of your private keys for every coin you trade on their platform.

Another feature is these services require clients to verify their identity through a KYC (Know Your Customer) process. Overall, centralized exchanges are characterized by possessing immense liquidity, user-friendliness, and accessible customer support.

Yet, they are less private and prone to hacking risks since they retain their customers’ private keys and rely on one single point of failure.

Decentralized exchanges

Decentralized exchanges (DEXs) tend to be more autonomous where liquidity is provided peer-to-peer without a middleman. One distinct attribute of these services is affording traders total anonymity.

There is no signup process involved, meaning traders don’t need to provide personal information. One simply connects a supported wallet to get started. Moreover, you retain the private keys of all your traded coins. Although most agree this is beneficial, you need to take great care in safeguarding this data.

The main benefits of a DEX are anonymity, no withdrawal limits, and no involvement in a signup process. On the downside, these services aren’t straightforward to navigate, have lower liquidity, and may only deal in crypto-to-crypto trading.

Hybrid exchanges

Experts tout hybrid exchanges as the next generation of exchanges. The first-ever service in this realm was Qurrex, launched in 2018. A hybrid exchange combines the elements of a CEX and DEX and improves on their limitations.

It achieves this quality by having a user-friendly platform and the massive liquidity of a centralized crypto exchange while maintaining the anonymity of a decentralized crypto exchange. While this idea is innovative, there aren’t many hybrid exchanges presently.

What to look for in the best crypto exchange

Below are the following things to consider before choosing any crypto exchange.

- Security measures: All reputable exchanges must possess the best security in data encryption (for instance, HTTPS instead of HTTP), two-factor authentication, cold storage, and identity verification.

- Widest range of coins possible: As new altcoins are gaining prominence in the market, you’ll want a provider having the widest selection of coins possible, so you don’t need to open accounts with multiple exchanges.

- Payment methods: Again, the more, the better. An excellent exchange should allow users to deposit and withdraw using as many payment options as possible for added convenience.

- Type of trading: Are you looking for simple buying and selling? Or do you prefer more broker-like functions of derivatives with margin? You need to factor this when considering an exchange.

This aspect is along the same lines as to whether you need fiat-to-crypto or crypto-to-crypto. Your preference here depends on your needs.

- Trading costs: Although we’ve mentioned the main fees to expect with your average exchange, it’s crucial to note any hidden charges which aren’t mentioned from the get-go.

- Customer service: In this regard, a functioning live chat is essential to solve most account-specific queries. Other necessary channels also include responsive phone and email support. Moreover, any exchange providing dedicated 24/7 customer service is a bonus.

- Wallet provision: An exchange with an in-built wallet, whether proprietary or from a third-party service, is beneficial, so you keep your trading and coins in one place. Yet, experts generally recommend investors store their holdings in a hardware wallet, particularly if they have large amounts.

What are the best crypto exchanges?

Below we’ve reviewed all the best options for you in crypto exchanges, including a brief overview, a list of critical features, and notable pros and cons.

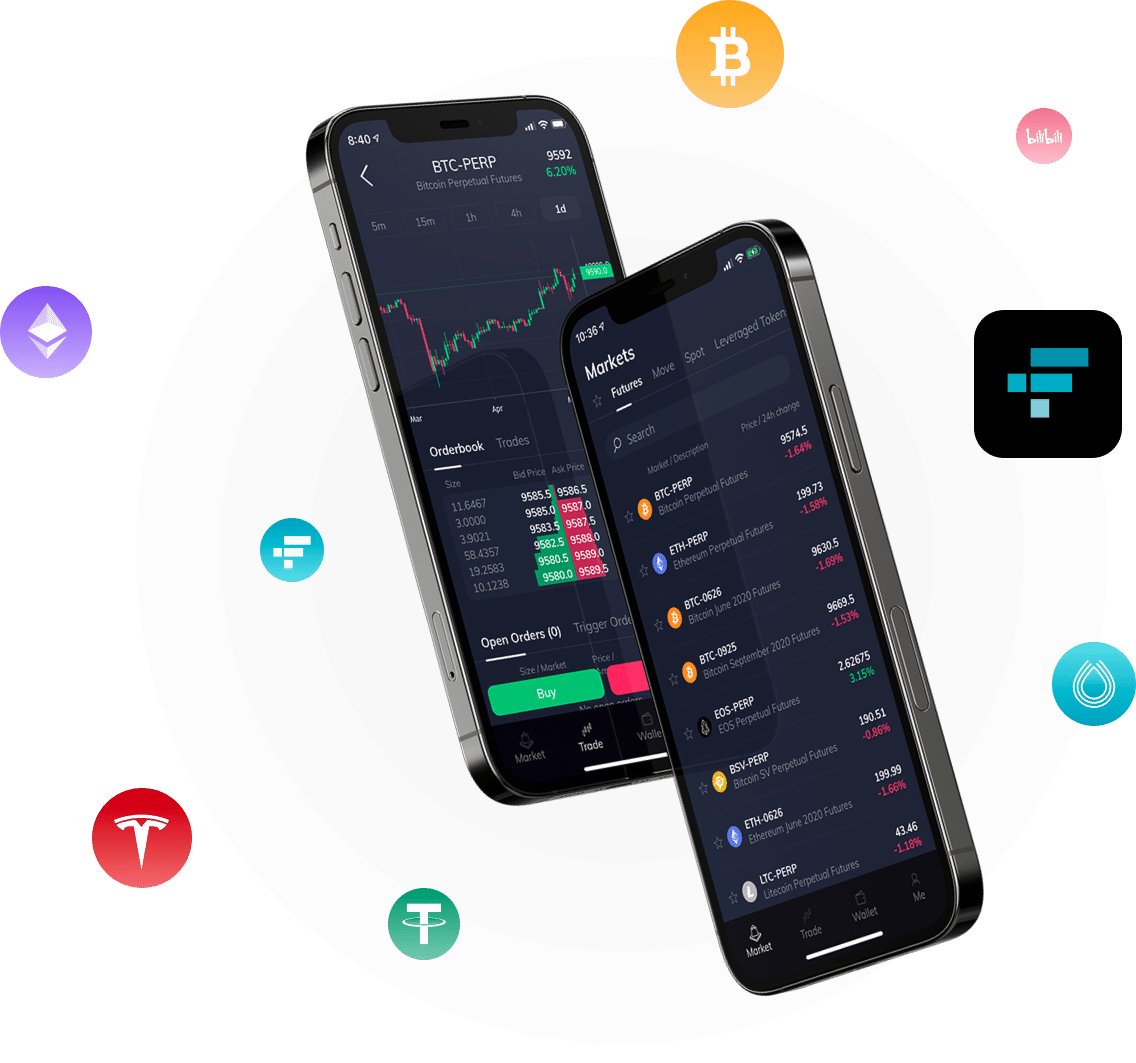

FTX: The Best Crypto Exchange Overall

So, what makes FTX the best crypto exchange overall? It’s in the top 3 of the largest exchange by trading volume, but definitely top one by investing opportunities and tokens available. The platform is built by a team of experienced folk who’ve worked for some of the top Wall Street trading firms and other Silicon Valley tech giants. The brand name also speaks for itself: no more American Airlines Arena in Miami! It is the age of crypto and the time of FTX Arena.

FTX has a wide selection of coins to trade in numerous derivatives like futures, spot, options, to even unique ‘volatility tokens’ and prediction markets. The FTT token is another distinct feature of FTX.

Aside from increasing liquidity and trading activity on the platform, clients receive certain exclusive benefits and consider this token an investment like any other cryptocurrency.

Key features:

- Offers some of the highest selection in crypto markets

- FTX.US exchange exclusively for US residents

- Licensed by the Securities Commission of the Bahamas

- No starting balance

- Supports USD, EUR, GBP, AUD, HKD, SGD, ZAR, and CAD

- Futures, spot, leveraged tokens, options, volatility, and prediction markets provided

- OTC trading offered

- 1:101 maximum leverage on futures; 1:3 maximum leverage on ERC20 tokens

- Tradable tokenized shares of MSFT, TSLA, GOOGL, AMZN

- Mobile app available for Android and iOS

- No deposit/withdrawal charges for most coins

Funding methods: Crypto, Bank Wire (more funding options for FTX.US)

Number of cryptocurrencies: 312

Pros:

- A gigantic range of derivatives offered, including tokenized stocks trading

- Processes some of the highest trading volume for crypto exchanges

- Supports 8 different fiat currencies

- Own utility token (FTT)

Cons:

- No live chat or phone support

- Still a relatively new exchange

- Not beginner-friendly

Bitstamp: The Best Crypto Exchange For US Customers

Over 4 million clients worldwide, ranging from beginner to intermediate, call Bitstamp their exchange of choice. The corporation was founded in 2011, making it one of the earliest known examples of a crypto exchange.

As you would expect during that time, Bitstamp started offering Bitcoin but has understandably expanded its selection to 54, including other coins like Ethereum, Polygon, Cardano, and more. These are paired with USD, EUR, and GBP fiat currencies to give a total of roughly 138 markets.

Trading is conducted on the TradingView platform using a browser or Android/iOS mobile app. Each trade incurs a maximum fee of 0.5%, depending on your 30-day trading volume. Bitstamp also offers the opportunity to stake (albeit a pretty limited choice) ETH and ALGO and earn around 5% yearly interest.

While Bitstamp doesn’t have an expansive list of coins compared to the likes of Binance, it remains an excellent crypto exchange overall for your more casual investor.

Key features:

- Licensed by Luxembourg’s CSSF

- Has offices in Slovenia, Luxembourg, London, New York, and Singapore

- Offers bespoke services to institutional clients

- Max. 0.5% trading fee

- $/£/€ 10 starting balance (0.002 BTC for BTC markets; 0.002 ETH for ETH pairs)

- Zero fees for crypto deposits

- Charts powered by TradingView

- Trading performed via web interface and Android/iOS mobile app

- Staking offered for Ethereum (4.94% APR) and Algorand (5% APR)

- 24/7 phone and email customer service

Funding methods: Crypto, Bank Wire (more funding options for FTX.US), Credit/Debit Card, ACH (for the US), SEPA (for the EU), Faster Payments (for the UK)

Number of cryptocurrencies: 54

Pros:

- One of the oldest exchanges globally

- 24/7 phone and email customer service

- Provides 54 coins

- Works with TradingView

- Mobile app provided

- Supports USD, EUR, and GBP markets

- Inexpensive starting balance

Cons:

- No wallet provided

- Restricted selection of coins for staking

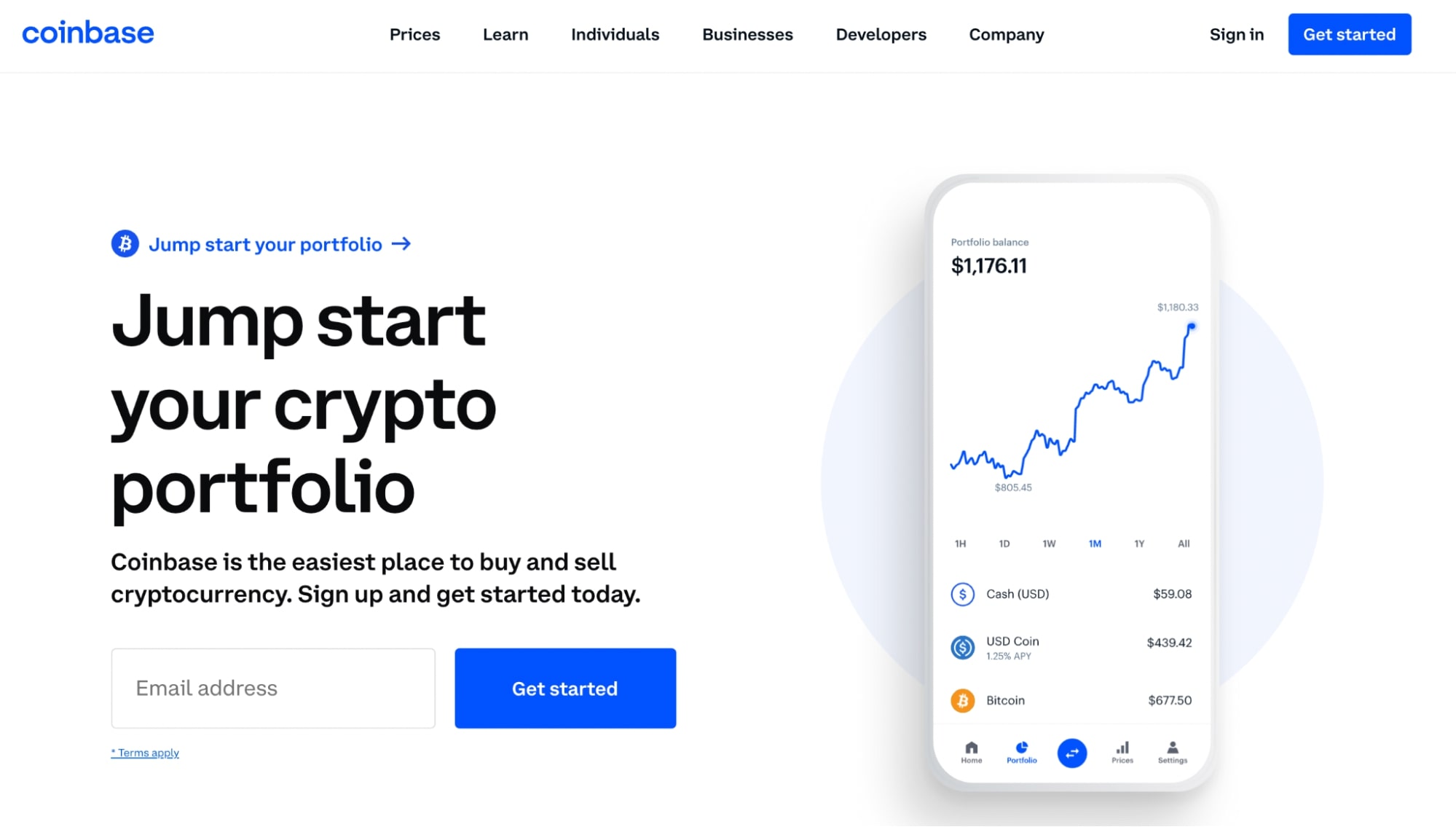

Coinbase: One Of The Most Popular Crypto Exchanges

When people mention the word ‘crypto exchange,’ Coinbase is usually mentioned among the top 3. This brand is one of the most popular in its niche, having existed since 2012. US customers particularly favor Coinbase as it’s a regulated exchange.

However, Coinbase’s reach is international as the brand services millions of clients. Although Coinbase is not feature-rich, it’s an exchange prioritizing reputation, deep liquidity, a wide selection of cryptocurrencies, and accessible customer support.

Key features:

- 126+ cryptocurrencies

- In-built wallet

- Maker fees 0-0.50%; taker fees 0.04-0.50%

- Staking available

- Coinbase Card Visa® Card with spending rewards

- Borrowing using Bitcoin collateral

- Bespoke business services

- Email and phone customer support

Funding methods: Debit/Credit Cards, PayPal, ACH, Bank Wire

Number of cryptocurrencies: 126+

Pros:

- Listed on the NASDAQ as a publicly-traded company

- Been in existence since 2012

- 8.6 score presently on CoinMarketCap

- One of the largest crypto exchanges in trading volume

- Wide choice of markets available

- Offers an in-built wallet

- Users can deposit in USD, EUR, and GBP

Cons:

- Known for having fees on the high end

- Clients from certain countries can only partake in crypto-to-crypto trading

- No margin trading provided

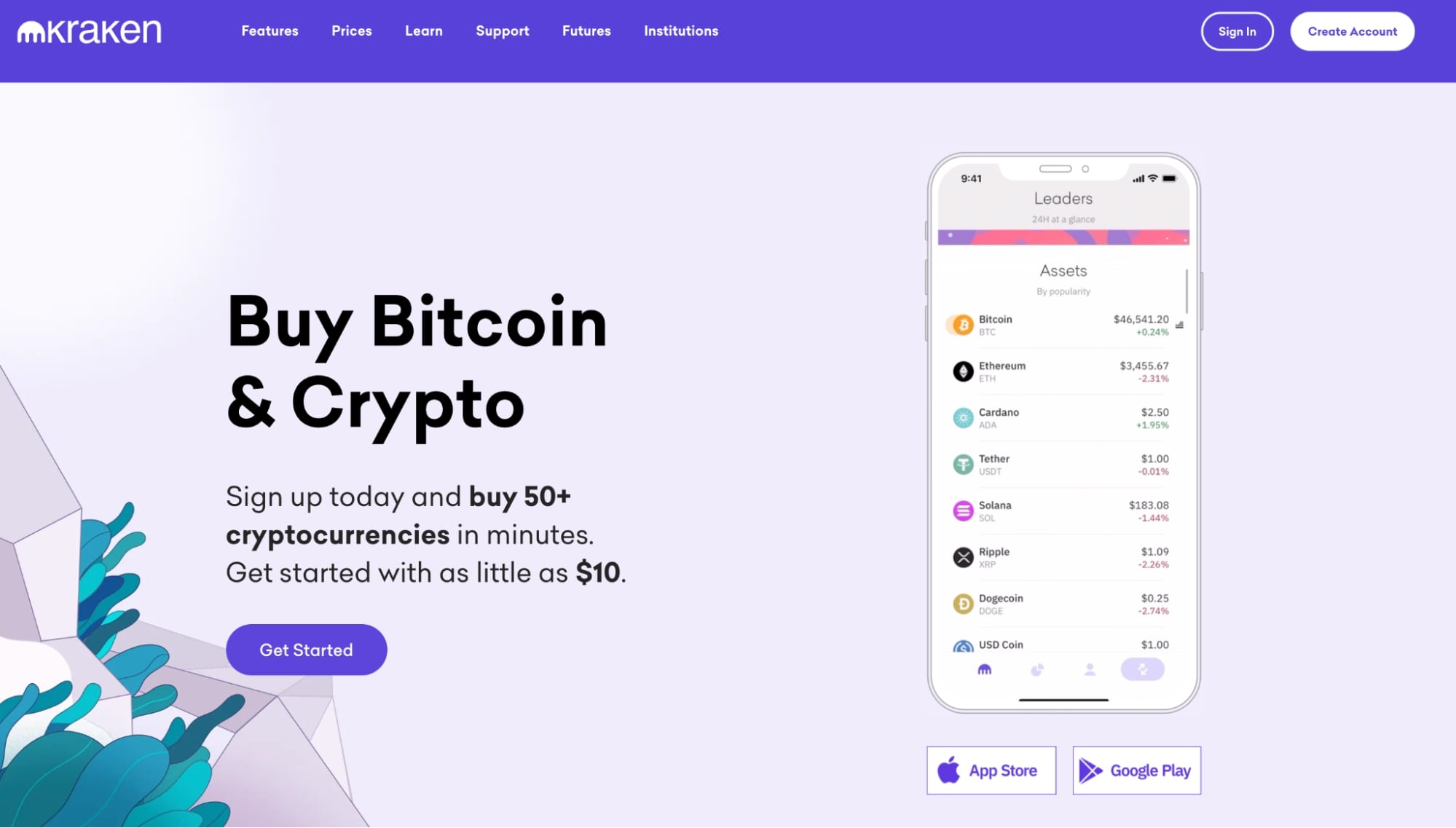

Kraken: Best For Wide Market Selection

Kraken is another big-name US-based crypto exchange founded in 2013. The service excels in supporting several fiat currencies, namely USD, GBP, EUR, CHF, AUD, CAD, and JPY.

Kraken has an extensive choice of the most popular cryptocurrencies. Overall, the exchange provides a mixed bag of spot/leveraged trading and staking services, but nothing too overwhelming to understand.

Key features:

- 100+ coins available

- Maker and taker fees 0-0.20%

- 24/7 customer support

- $1 minimum deposit

- Staking

- Margin trading

- Indices and futures markets provided

- Numerous funding choices available

- Institutional exclusive services

Funding methods: Debit/Credit Card, Bank Wire, Crypto

Number of cryptocurrencies: 100+

Pros:

- Founded in 2011

- 24/7 customer service

- 8.0 score presently on CoinMarketCap

- Available in most countries

- Sizeable selection of coins and markets

- Reasonable trading volumes

- Offers margin and futures trading on specific markets

Cons:

- No wallet offered

- Some geographical restrictions on card deposits

- Restricts most known third-party payment processors like PayPal, Skrill, etc.

Binance: Best For Providing A Broad Range Of Services

Despite only starting in 2017, Binance has made a name as probably the best platform to buy cryptocurrency. Binance has consistently been the biggest crypto exchange in trading volume within a relatively short amount of years.

Binance is a prestigious name in the industry. Hence, it boasts some of the broadest selection in cryptocurrencies. The brand isn’t well-suited for newbies as the platform is packed with a diverse array of services like simple buying/selling, derivatives trading, lending, staking, token-launching, etc.

Key features:

- 400+ coins available

- Provides basic, classic, advanced, margin, OTC, and P2P trading

- Binance Coin (BNB) offers discounts and incentives

- Maker and taker fees of 0%-0.10%

- Derivatives trading on options and futures

- Binance VISA card

- Crypto loans

- Liquidity farming

- Staking

- Launchpad

- Bespoke institutional services

Funding methods: Debit/Credit Card, Bank Wire, Cash Balance, Crypto

Number of cryptocurrencies: 400+

Pros:

- Has been the world’s largest crypto exchange for several years

- 9.9 score currently on CoinMarketCap

- Provides numerous DeFi services

- One of the lowest maker-taker fees in the industry

- Offers one of the widest selections of coins

- Derivatives trading on margin, futures, and options are available

- Provides wallet service through Trust

Cons:

- Not beginner-friendly

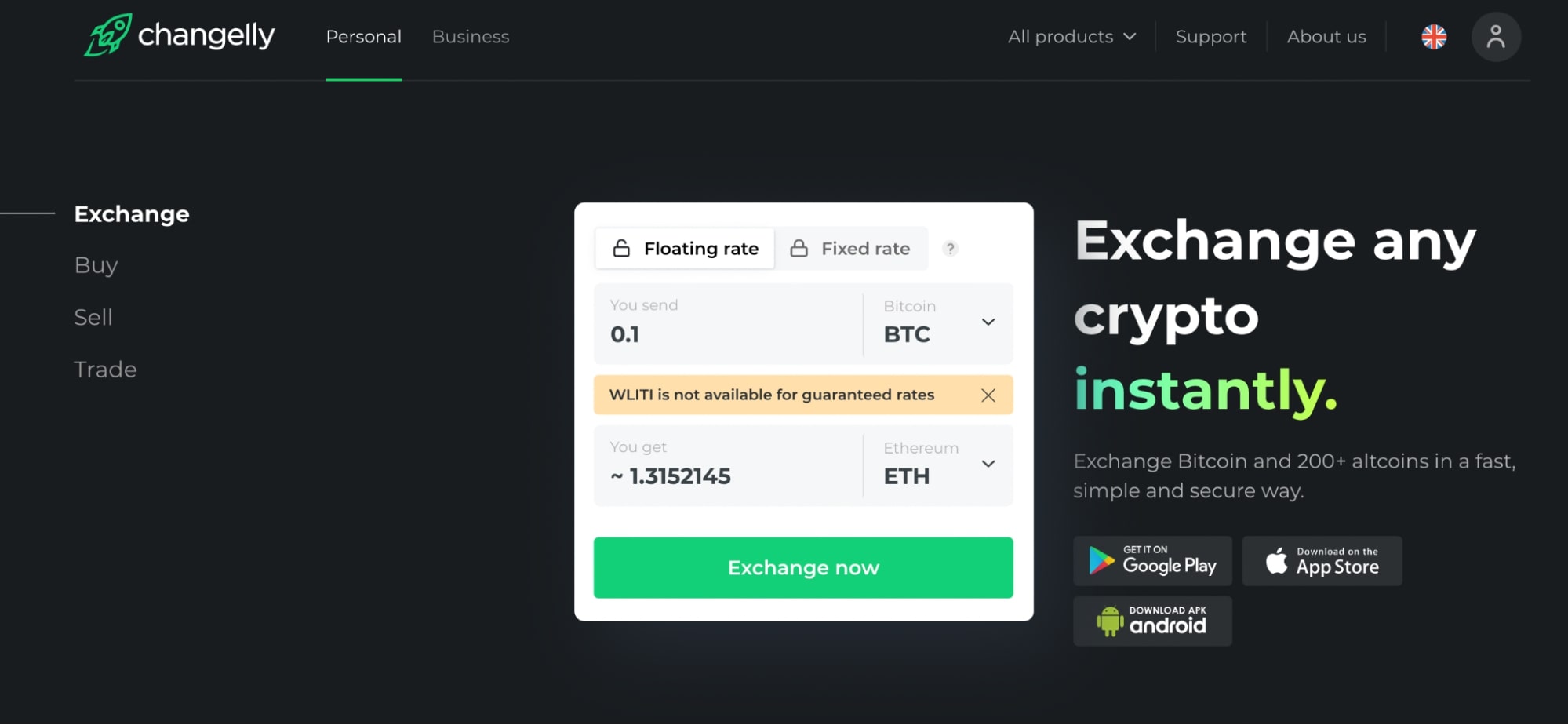

Changelly: Best For Beginners

While the best crypto exchanges provide a bunch of services, Changelly is stripped-down, making it particularly suitable for beginners looking to exchange Bitcoin and more than 200 altcoins quickly and securely.

Changelly is based in Prague, Czech Republic, and was founded in 2015. For traders looking for a more sophisticated experience on margin, you can use Changelly PRO with the exchange’s proprietary trading terminal.

Key features:

- +200 cryptocurrencies available

- Multi-currency and multi-wallet support

- 24/7 customer service

- Margin and futures trading provided

- Maker and taker fees of 0%-0.10%

Funding methods: Debit/Credit Card, Bank Wire, Crypto

Number of cryptocurrencies: 100+

Pros:

- Offers an extensive range of fiat-to-crypto trading

- Simple to use

- Reasonable trading fees

- Supports numerous wallets

Cons:

- Not many other non trading-related services

KuCoin: Best For Margin And Futures Trading

KuCoin is a Singapore-based crypto exchange established in 2017. The company claims one out of every four crypto users trades with KuCoin, a testament to their industry dominance.

KuCoin processes the fifth-highest number of cryptocurrency transactions, according to CoinMarketCap. The exchange is essentially an all-in-one crypto trading, derivatives, and earning platform with an extensive selection of services to satisfy the sophisticated investor.

KuCoin is especially impressive in its selection of margin and futures trading services. Moreover, with KCS, the exchange’s native utility token, customers can receive daily dividends, discounts, lower withdrawal fees, offers, rewards, and exclusive promotions.

Key features:

- 500+ coins available

- Maker and taker fees of 0%-0.10%

- Margin and futures trading

- Crypto lending

- Staking

- Trading Bot

- Mining pool

- KCS utility token for discounts and other incentives

- In-built wallet

Funding methods: Debit/Credit Card, Bank Wire, PayPal, Interac e-Transfer

Number of cryptocurrencies: 500+

Pros:

- In the top 5 of the largest exchanges in trading volume

- 7.7 score presently on CoinMarketCap

- Impressive selection of cryptocurrencies

- Provides crypto lending and staking

- Has utility token offering numerous incentives

- Margin and futures trading offered

- Live chat offered

Cons:

- Not beginner-friendly

- Higher fees for fiat-crypto trades

Gemini: Best For Security

Gemini is regarded as one of the safest crypto exchanges and is one of the best places to buy crypto for US customers. The brand is a product of the famous American billionaire Winklevoss twins. Gemini is particularly revered for employing institutional-grade security and, to date, has never been hacked.

Gemini offers a carefully-selected mixture of cryptocurrencies and provides a user-friendly interface for trading. While not feature-packed, Gemini has its own self-hosted wallet, stablecoin (Gemini dollar), and a lending program for users to earn interest.

Key features:

- 65+ coins available

- Maker fees of 0-0.10%; taker fees of 0%-0.35%

- Gemini Earn

- Gemini Wallet

- Gemini Credit Card (the US only)

- Industry-leading security

- Unique services for institutions

Funding methods: Debit/Credit Card, Bank Wire, ACH, Crypto

Number of cryptocurrencies: 65+

Pros:

- Well-recognized for offering the best security

- Provides wallet

- Reasonable funding/withdrawal costs

- Crypto lending offered

- NFT platform available (Nifty Gateway)

- Has its own stablecoin

Cons:

- Not the widest choice of coins compared to the rest

- No margin trading

- Only email support is offered

- Restricted to operating in many countries

Crypto.com: Best For Utility Token Providing The Most Incentives

Crypto.com is one of the fastest-growing exchanges with over 10 million users. Founded in 2016 in Hong Kong, the brand presently ranks 10th on CoinMarketCap for the largest crypto exchange by trading volume.

Its native utility token, CRO, has been skyrocketing, increasing by 1200% over the past year to be presently the 13th most traded coin. Overall, Crypto.com is an all-in-one platform for all things crypto-related in payments, trading, and other financial services.

Key features:

- 200+ coins available

- Maker fees of 0-0.10%; taker fees of 0%-0.16%

- NFT marketplace available

- Margin trading

- Crypto.com VISA card

- Crypto.com Earn (yield farming)

- Crypto.com Credit (crypto lending)

- Crypto.com blockchain

- DeFi swapping

- In-built wallet

- CRO utility token offers discounts and various incentives

Funding methods: Debit/Credit Card, Bank Wire, Crypto

Number of cryptocurrencies: 200+

Pros:

- One of the fastest-growing exchanges over the past year

- Live chat offered

- Provides many services aside from trading

- Has its own NFT marketplace

- Reasonable trading costs

- Wallet provided

- Wide selection of cryptocurrencies

Cons:

- Trading fee discounts may be confusing to understand

CEX.IO: Top Crypto Exchange Offering A Wide Selection Of Payment Methods

Founded in 2013, CEX.IO is a regulated multi-functional crypto exchange from the UK which now serves over 4 million customers in nearly all parts of the world. The brand’s mission is to provide a gateway into an open financial system.

To date, CEX.IO claims zero customer funds have been lost since their inception, largely due to their strong security involving solid DDoS attack protection, full data encryption, cold storage, and compliance with PCI DSS standards.

One distinct benefit of CEX.IO is the exchange provides numerous payment methods ranging from VISA/Mastercard to several bank transfer options.

Key features:

- 100+ coins available

- Maker fees of 0-0.16%; taker fees of 0.1%-0.25%

- FCA-regulated

- Multiple payment methods

- Margin trading

- Staking

- Crypto lending

- In-built wallet

- CEX.IO debit card (the UK only)

- 24/7 customer support via email, phone, and live chat

Funding methods: Debit/Credit card, Bank Wire (SWIFT, ACH, Faster Payments), Crypto

Number of cryptocurrencies: 100+

Pros:

- One of the oldest crypto exchanges

- Offers numerous payment options

- Staking and crypto lending are available

- In-built wallet

- Regulated in a few regions

- Offices in several countries

Cons:

- Complaints about relatively high fees

- Verification restrictions on basic accounts

Best crypto exchange: verdict

Deciding on the best place to buy crypto depends on your preferences and experience. Based on our verdict, Binance, CEX.IO, KuCoin, and Crypto.com may be suitable for seasoned investors seeking more services than just exchanging.

Changelly is targeted towards newbies and, hence, has far fewer offerings. Kraken, Coinbase, and Gemini are also relatively stripped-down and preferable for beginners/intermediates and US customers in particular.

Nonetheless, when using any crypto-related service, you should have prior knowledge about the risks involved and trade or invest with caution.

Comments