Blockchain first came on the scene in 2009 as the distributed ledger for Bitcoin transactions. In other words, it is the enabling technology for the world’s most popular crypto. Blockchain is primarily discussed in the context of crypto, but this technology can help solve wide-ranging problems in business and the broader economy.

It offers data security, transparency, the authenticity of transactions, and quick processing times to help companies reduce risk and cut costs. Because of these valuable characteristics, blockchain is seen as a revolutionary technology that can power future applications.

Here are three high-quality stocks to buy that benefit from blockchain technology.

What are blockchain stocks?

These stocks are shares in those companies — typically businesses that operate crypto exchanges, invest in cryptos themselves, or create computer equipment used to mine cryptos such as Bitcoin.

Cryptos are not traded on Wall Street in the same way stocks are. Still, several publicly traded companies are deeply tied to the world of crypto or other digital assets.

Any individual stock carries its risks — and crypto stocks may also be vulnerable to potential downturns in the volatile crypto markets. However, crypto stocks may be worth considering for investors who are comfortable with stocks and want some exposure to digital assets.

How to buy blockchain stocks?

Some of the best blockchain stocks you will find below. You need to have an account with an online brokerage platform to buy them. When choosing the best stocks to invest in, you should conduct detailed research.

Top 3 blockchain stocks to buy in 2022

Bitcoin is a digital currency that uses blockchain technology, but it’s not the only player in the game. If you want to get in on the blockchain action, here are the three stocks you should look at.

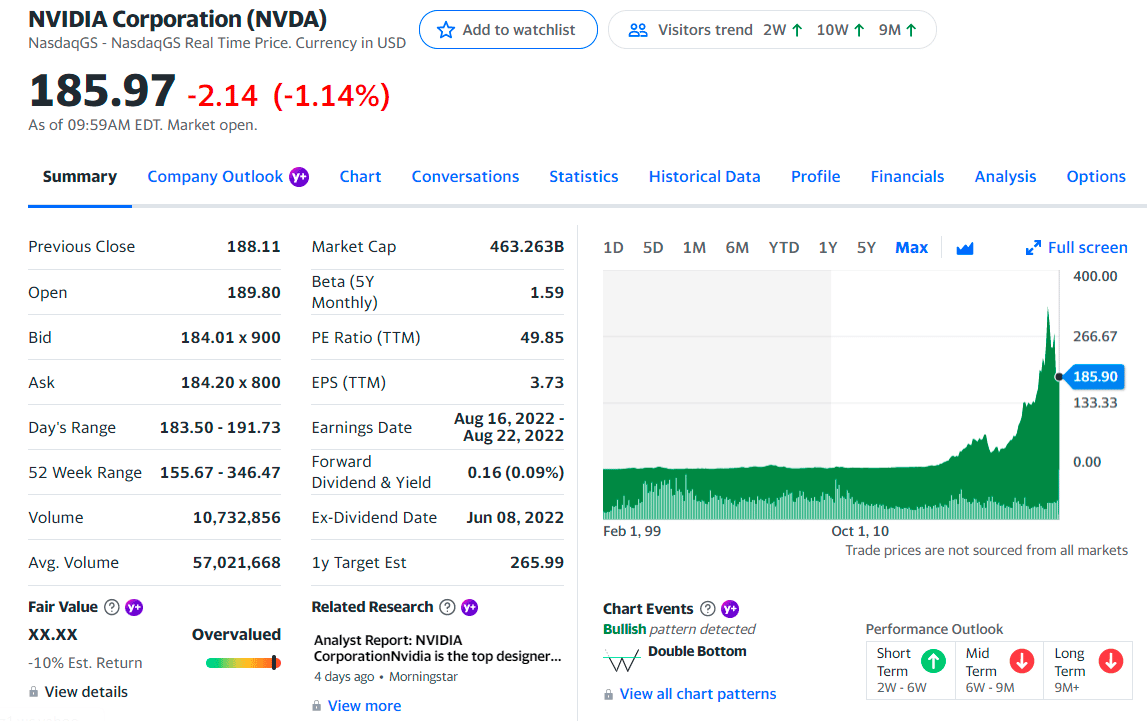

No. 1. Nvidia Corp. (NVDA)

Price: $185.97

EPS: 3.73

Market cap: $463.26B

NVDA summary

While the graphics chip supply was interrupted by the pandemic, demand for chips continues to increase, and Nvidia is at the center of its production and sales. Nvidia designs and produces high-end graphics cards and processing chips for personal computers, servers, and supercomputers. Nvidia also produces specialized chips explicitly designed for crypto mining, which gives the company additional blockchain exposure.

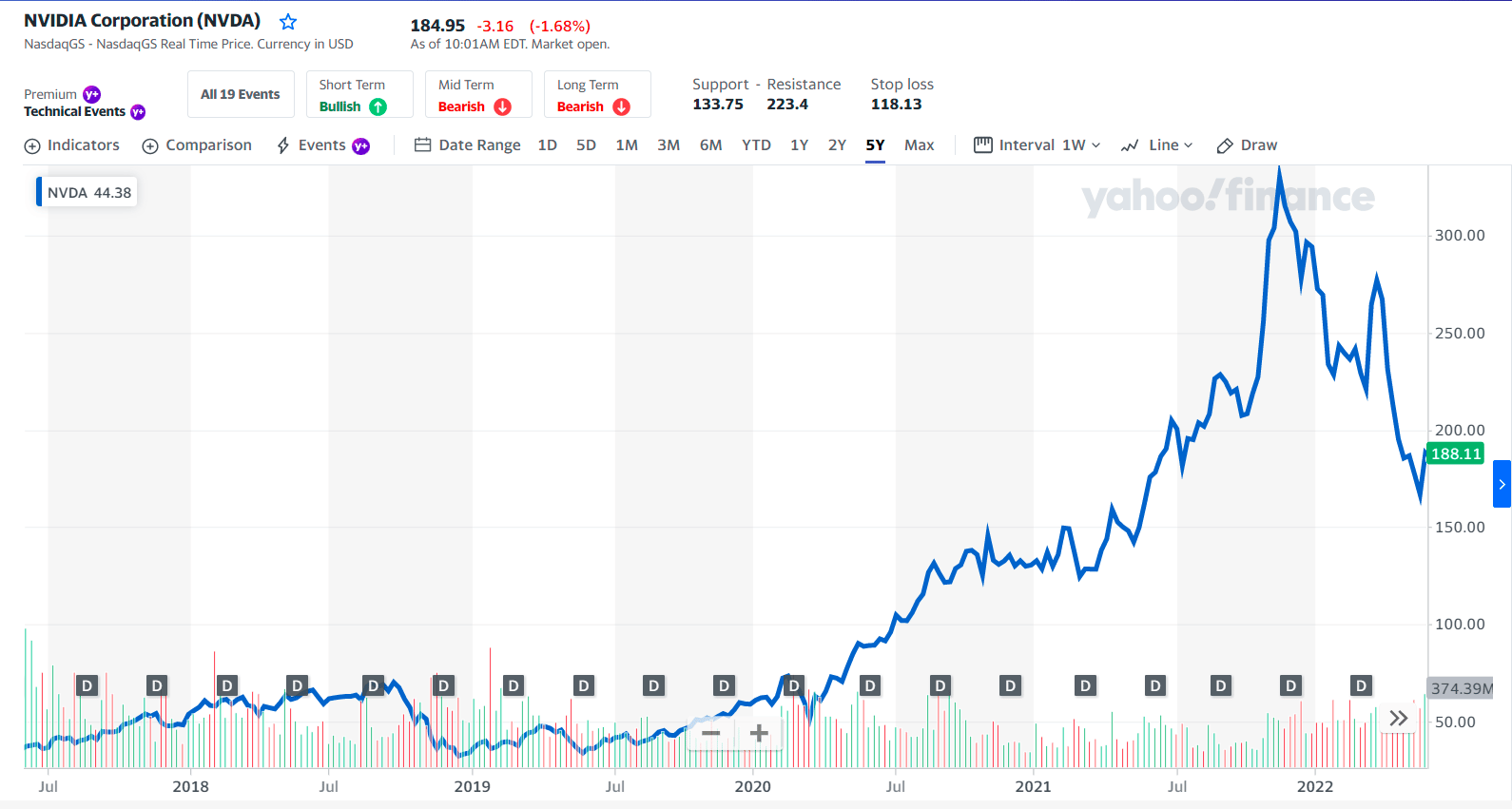

NVDA price chart

Crypto miners use graphics processing units, or GPUs, to help facilitate the calculations that validate transactions on the blockchain in the crypto mining process. The chip giant is also set to benefit from the growing Metaverse market, as GPUs will play an essential role in the devices that power the Metaverse.

The first holdings:

- Vanguard Group, Inc. — 6.81%

- Blackrock Inc. — 6.21%

- FMR, LLC — 4.98%

NVDA price prediction

According to stock analysts, the average 12-month stock price forecast for NVIDIA stock is $332.99, which predicts an increase of 77.02%. The lowest target is $161.6, and the highest is $420. On average, analysts rate stock as a buy.

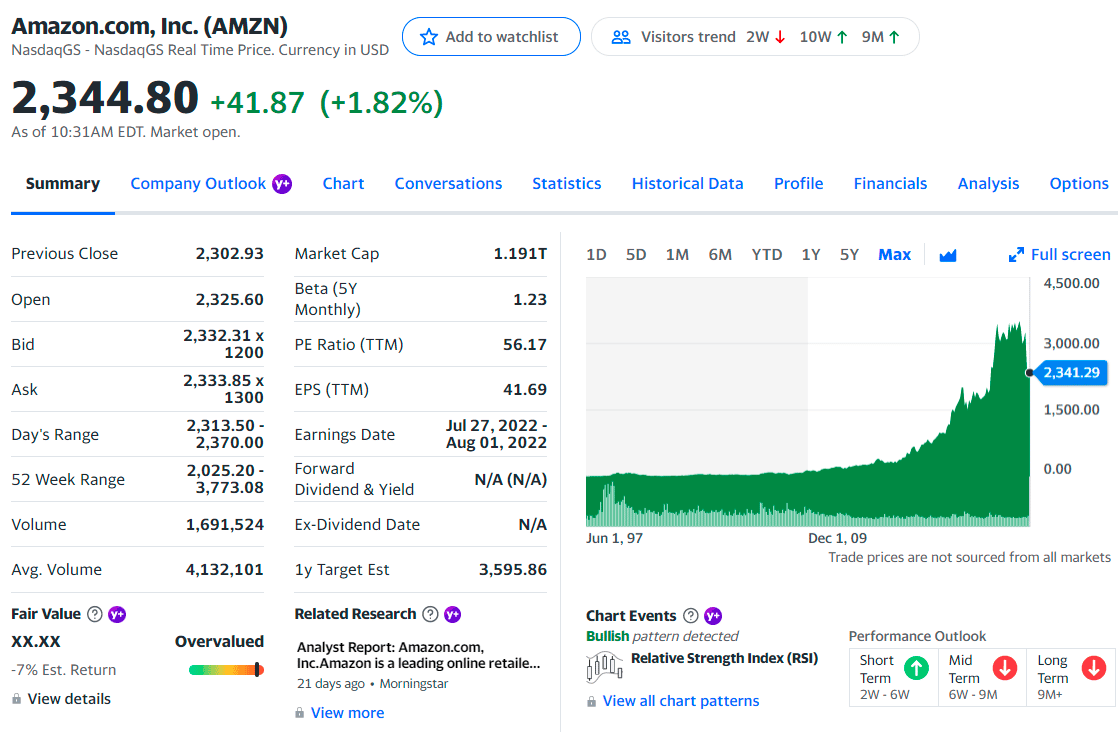

No. 2. Amazon (AMZN)

Price: $2,344.40

EPS: 41.69

Market cap: 1.191T

AMZN summary

It is not only the biggest retail site on the planet, but it also hosts the largest cloud-based service. Right now, you can indirectly use Bitcoin to pay for Amazon goods by using Bitcoin to purchase prepaid Amazon gift cards.

There’s also some indication Amazon plans to launch its crypto project with Mexico as the pilot country. It would allow customers to convert money into digital currency and then spend it on any services or goods Amazon provides.

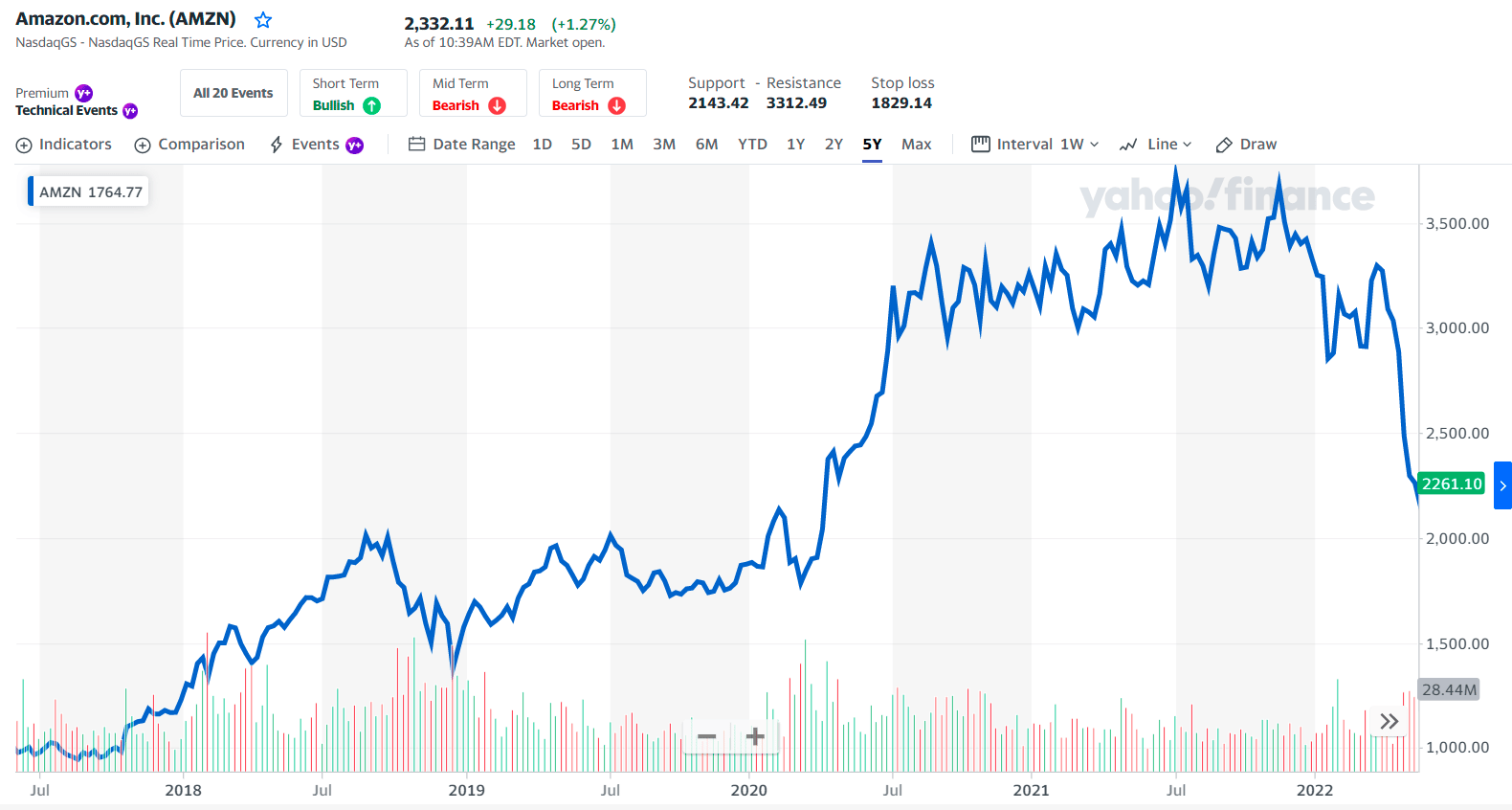

AMZN price chart

The first three holdings:

- Vanguard Group, Inc. — 6.68%

- Blackrock Inc. — 5.73%

- J.W. Cole Advisors, Inc. — 3.56%

AMZN price prediction

The stock lies in the middle of a vast and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 28.60% during the next three months and, with a 90% probability, hold a price between $1449.62 and $1936.20 at the end of these three months. Note that if the stock price stays at current levels or higher, our prediction target will start to change positively over the next few days as the conditions for the current predictions will be broken.

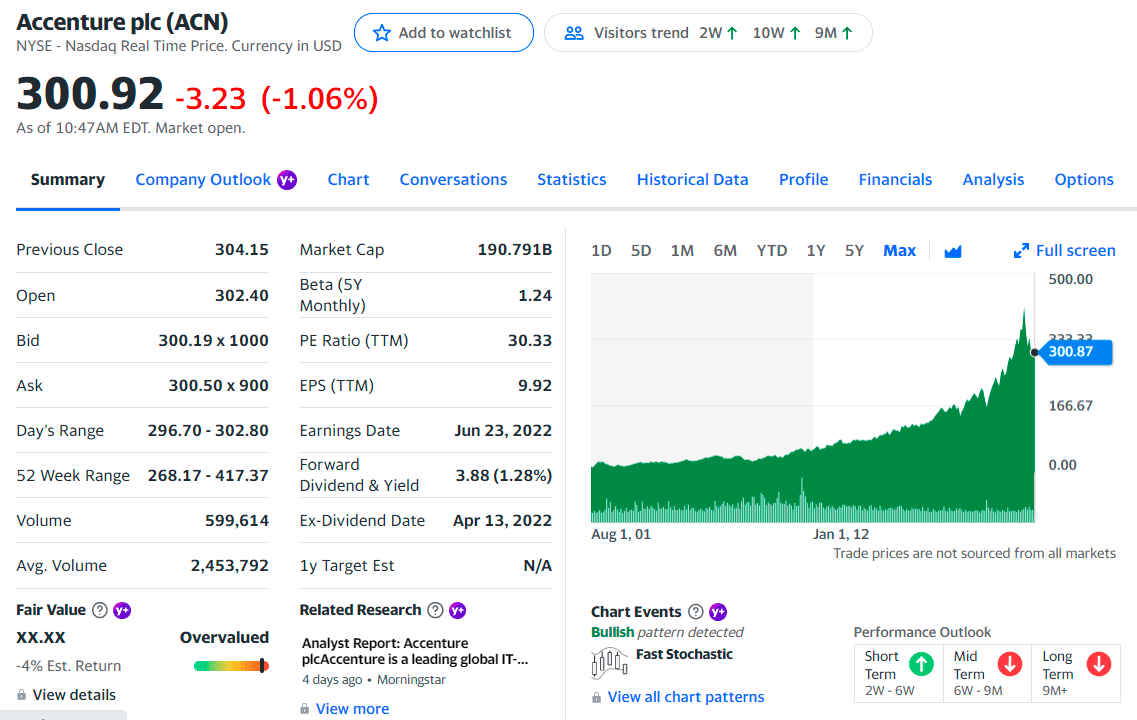

No. 3. Accenture PLC (ACN)

Price: $300.92

EPS: $9.92

Market cap: 190.79B

ACN summary

Accenture provides consulting technology and other services for businesses. Accenture’s blockchain services help customers apply and integrate the technology into their business models. The company’s fiscal first- and second-quarter results for 2022 showed revenue up 27% and 24%, respectively, year over year.

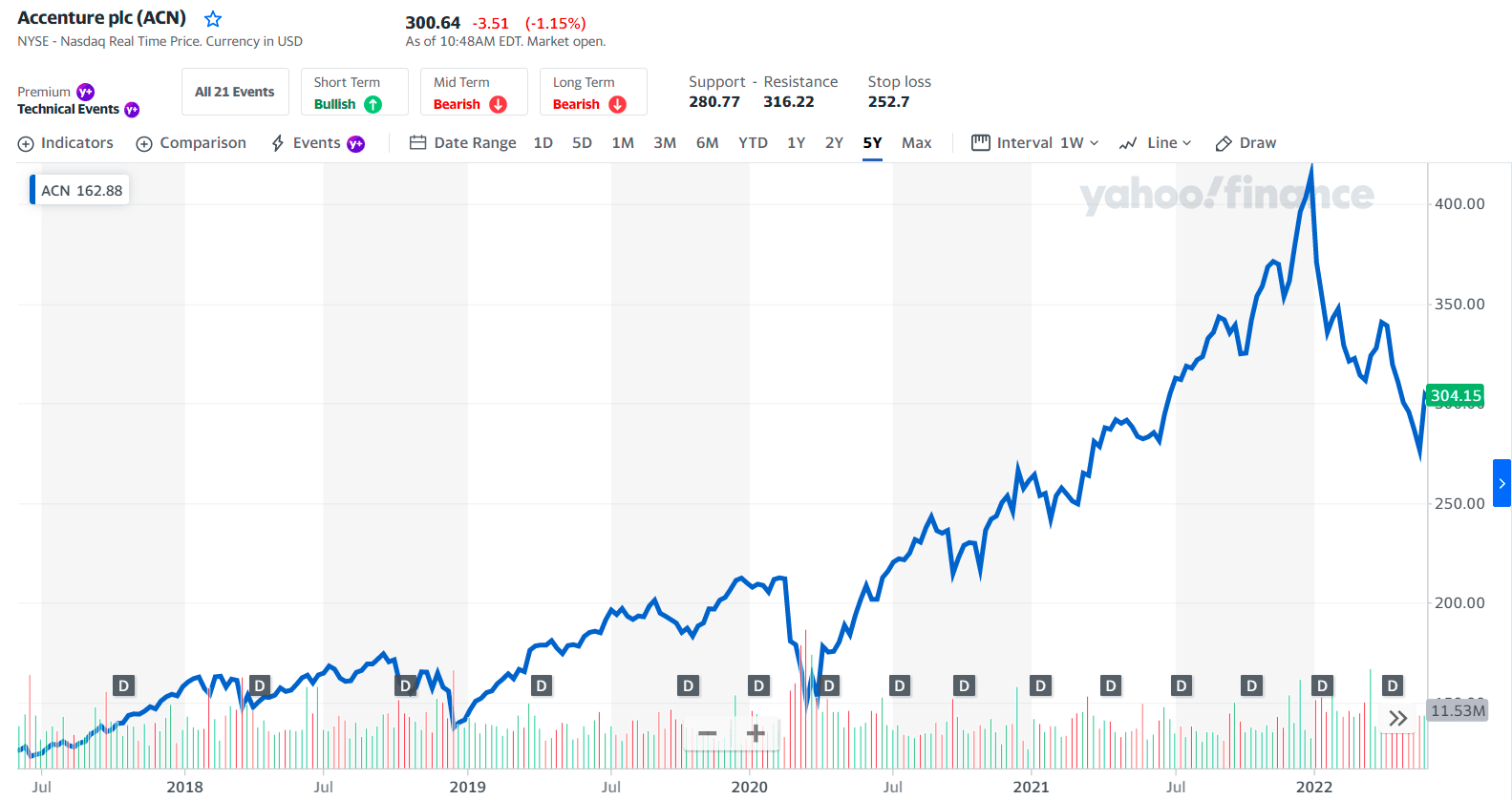

ACN price chart

In March, Accenture raised its expectation for the fiscal year 2022 revenue growth to between 24% and 26%. As the world becomes more reliant on virtual services, Accenture is poised to help companies make that transition.

The first three holdings:

- Vanguard Group, Inc. — 8.55%

- Blackrock Inc. — 7.13%

- Massachusetts Financial Services Co. — 2.65%

ACN price prediction

The stock lies in the middle of a wide and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 11.39% during the next three months and, with a 90% probability, hold a price between $238.98 and $283.27 at the end of these three months.

Note that if the stock price stays at current levels or higher, our prediction target will start to change positively over the next few days as the conditions for the current predictions will be broken.

Final thoughts

These are some of the best blockchain and crypto stocks you should consider buying While there are undoubtedly other investing methods in blockchain businesses, such as ICOs, STOs, and others, many of these methods are still unregulated in most markets.

Comments