Shares of the e-commerce giant Amazon cost more than $3,000 for a single share, but they were under $20 when the dot-com bubble burst in the early 2000s. The bottom line is that even companies that grow to be massive, like Amazon, usually start much more minor.

While history doesn’t repeat, it often rhymes. There are probably many potential “Amazons” out there, trading at meager prices.

Below are three companies that we are currently excited about, and here’s the kicker: you can have them for less than $20 per share, which is affordable for most people.

What are stocks under $20?

Stocks under $20 offer investors and traders a lower-cost alternative to more expensive assets. Despite the misperception that lower-priced stocks carry more risk, the risk profile of many assets under $20 compares favorably with stocks trading at much higher prices, as does the opportunity for profiting from investing in them.

In addition, well-established stocks under $20 often pay dividends, which is ideal for income-minded investors. Some of such stocks even have listed options, giving you additional avenues of income if you wish to sell covered call options.

How to buy stocks under $20?

You’ll first need a brokerage account to buy stocks, which you can set up in about 15 minutes. Then, once you’ve added money to the account, you can follow the steps below to find, select and invest in individual companies.

Here are five steps to help you buy your first stock:

Step 1. Select an online stockbroker

Step 2. Research the stocks you want to buy

Step 3. Decide how many shares to buy

Step 4. Choose your stock order type

Step 5. Optimize your stock portfolio

Top 3 stocks under $20 to buy in 2022

Companies with a share price under $20 may receive consistently high buy ratings from analysts. It is worth keeping in mind that investing in such companies requires a longer-term outlook for the stock price to reflect its true value. Some of these might even be priced so low because of several issues that lead to the inability to survive on the market.

Here are the top three stocks under $20 to trade right now. We’ve also shortlisted them to provide a better insight into their business performance.

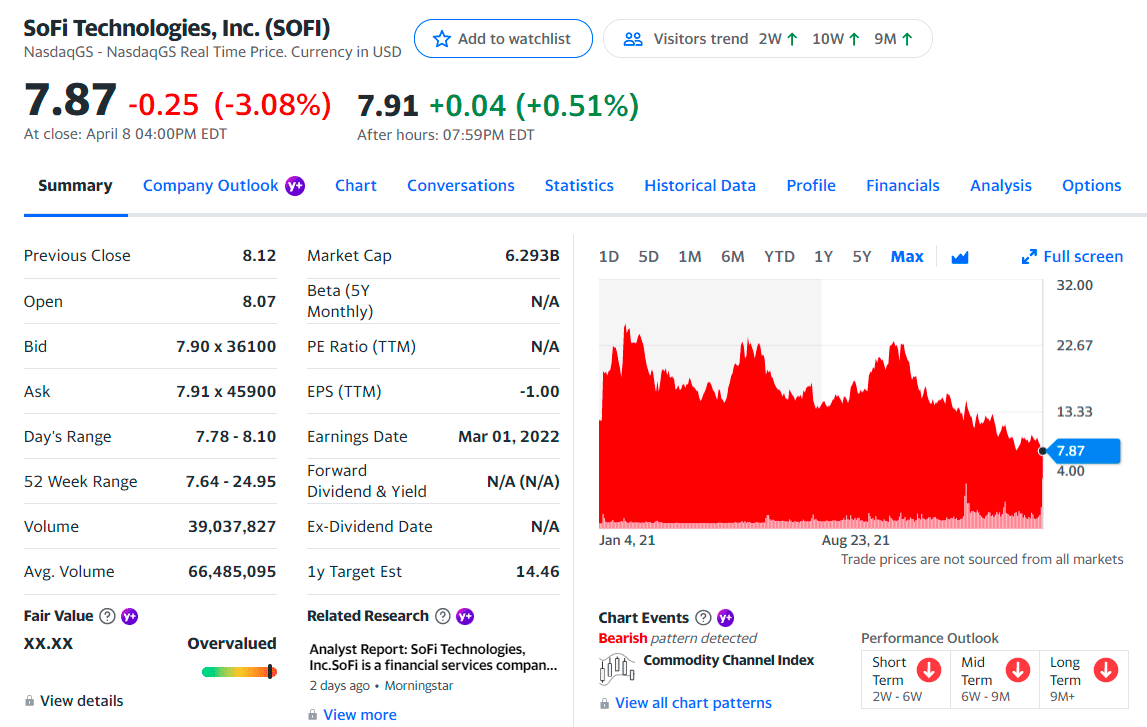

No. 1. SOFI Technologies, Inc. (SOFI)

Price: $7.87

EPS: $-1.00

Market cap: $6.29B

SOFI summary

The company was founded in 2011 and is headquartered in San Francisco, CA. SOFI is an online financial services firm with an app that offers loans, mortgages, banking services, investments, personal finance tools, and direct deposits, among other services.

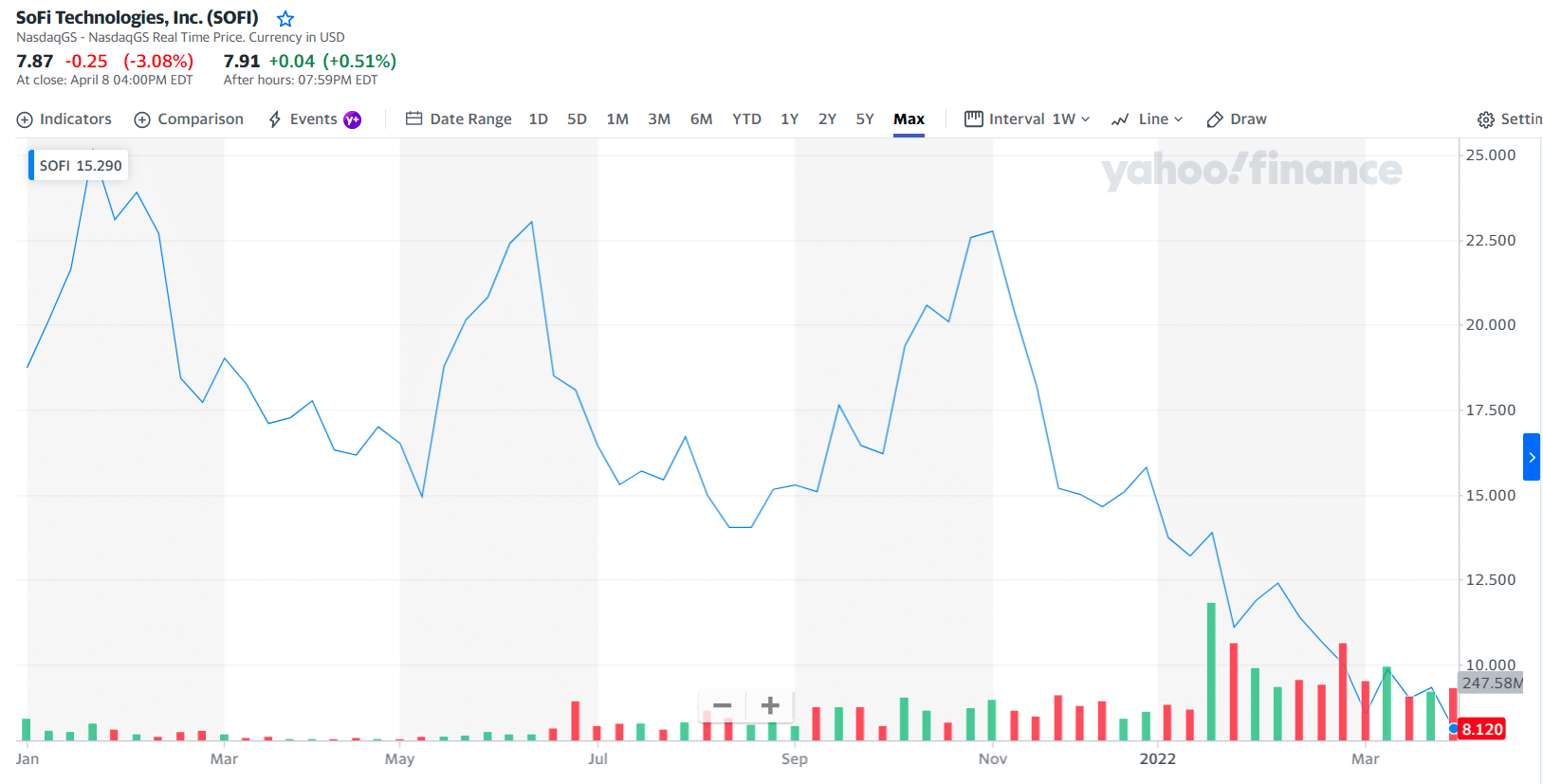

Since early November, the company’s shares have been down 41% year-to-date and roughly 61%. It currently trades under $7 per share and was struck by the correction of overvalued growth stocks.

Fintech went public early in 2021 and is still not profitable. But there is a lot to like about SoFiʻs potential. It has been overgrowing, setting records for new members/users added and products used in the fourth quarter, along with a 67% year-over-year increase in revenue.

SOFI price chart

The other thing that sets SoFi apart is its banking-as-a-service business, which it acquired when it bought Galileo in 2020 and bolstered just this month with the acquisition of Technisys. This business helps other companies build out their own digital banking business.

The combination of Technisys’ platform with Galileo will support multiple products through application programming interfaces, including checking, savings, deposits, lending, and credit cards. It will help SoFi meet the expanding needs of its current partners and reach new ones. SoFi has the lofty goal of becoming the Amazon Web Services of fintech with its one-stop-shop financial services platform.

The first three holdings:

- Amazon Inc. — 4.83%

- Palantir Technologies Inc. — 4.28%

- Microsoft Corp. — 4.27%

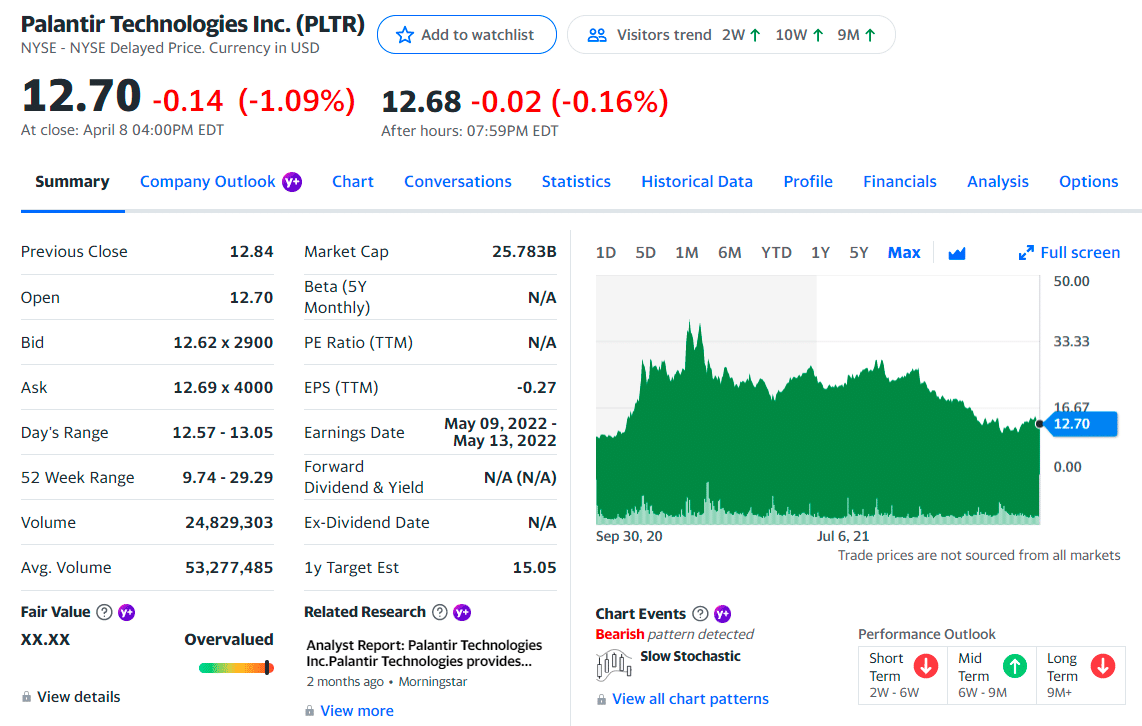

No. 2. Palantir Technologies (PLTR)

Price: $12.70

EPS: $-0.27

Market cap: 25.78B

PLTR summary

Palantir Technologies, Inc. is a holding company that develops data integration and software solutions. It was founded by Stephen Cohen, Nathan Dale Gettings, Joseph Lonsdale, Alexander C. Karp, and Peter Andreas Thiel in 2003 and is headquartered in Denver, CO.

Palantir started in the early 2000s, first gaining traction with the United States government. It has expanded into the private sector to work with companies, but the government remains Palantir’s largest customer, contributing 58% of revenue in 2021. A variety of agencies in the government use Palantir, including Homeland Security, Defense, and more.

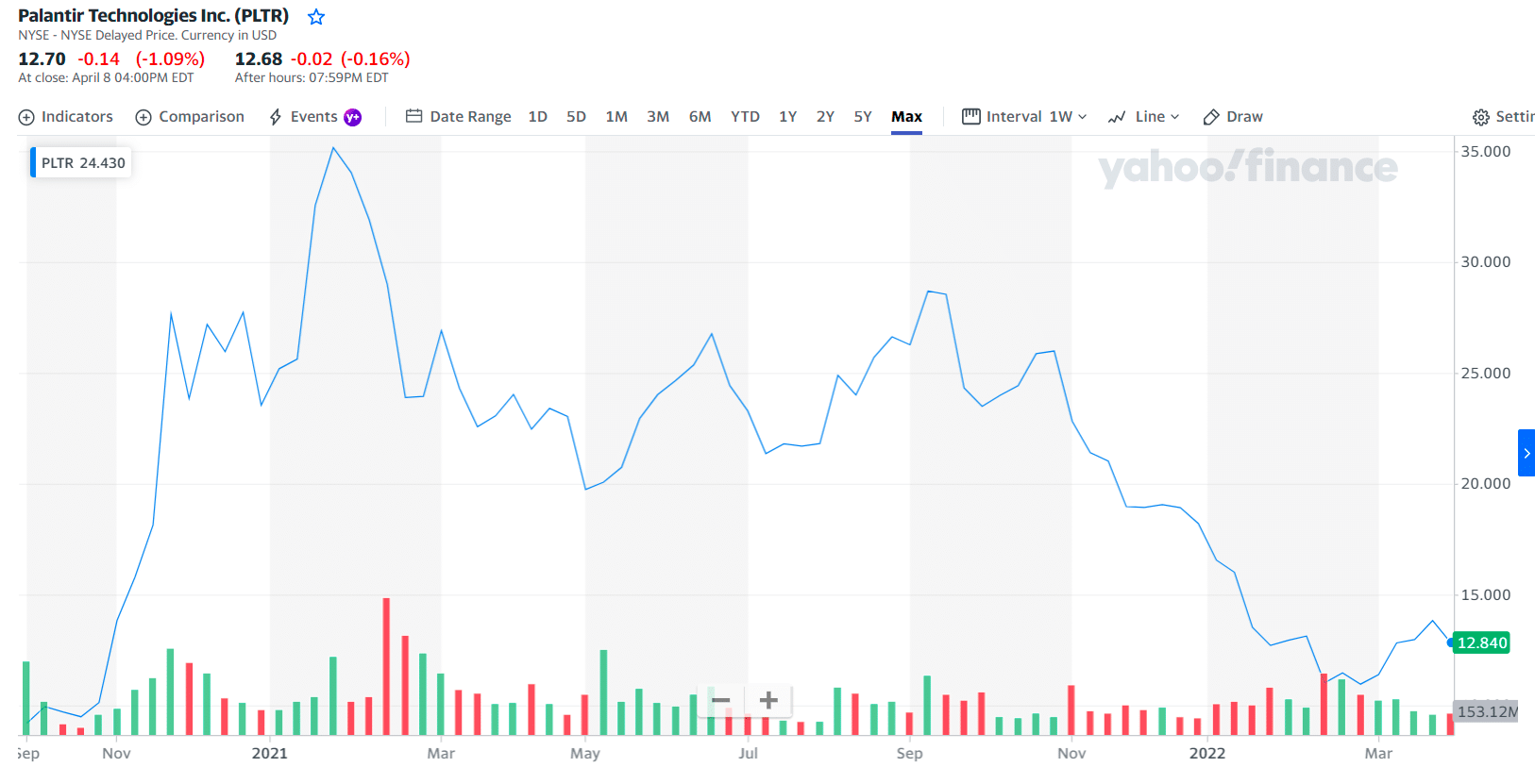

PLTR price chart

Even though revenue from commercial accounts grew just 31% in 2021 compared to government revenue’s 47% increase, the number of Palantir’s commercial clients tripled during the year. This could lead to solid revenue growth down the road because the company has a multi-phase selling process that generates revenue once its software becomes mission-critical for its customers.

The first three holdings:

- The Vanguard Group, Inc. — 6.43%

- BlackRock Fund Advisors — 3.40%

- ARK Investment Management LLC — 1.83%

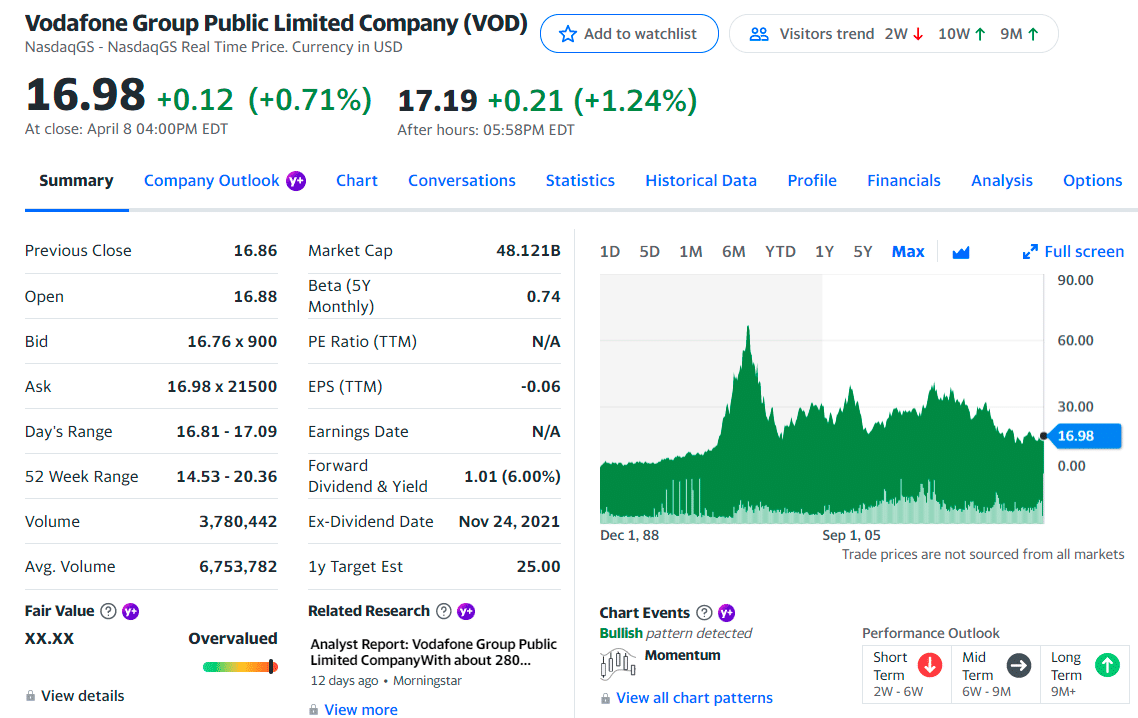

No. 3. Vodafone (VOD)

Price: $16.98

EPS: $-0.06

Market cap: 48.12B

VOD summary

UK mobile operator Vodafone has performed underwhelmingly in the stock market of late. It is due to its subpar performance in the past couple of years and its mounting debt load.

However, Vodafone’s recent positive results, appealing stock price, and solid dividend profile make it a great long-term bet.

The company recently reported better-than-expected numbers during its first half. The telecom giant has raised its earnings guidance from 15 billion euros to 15.2 billion euros in 2022. Moreover, it increased its free cash flow target by 100 million euros.

It also boasts healthy dividend yields of nearly 6.8% with close to 90% payout. If it can lower its debt burden and work on its operational effectiveness, VOD stock will be in for a significant turnaround recently.

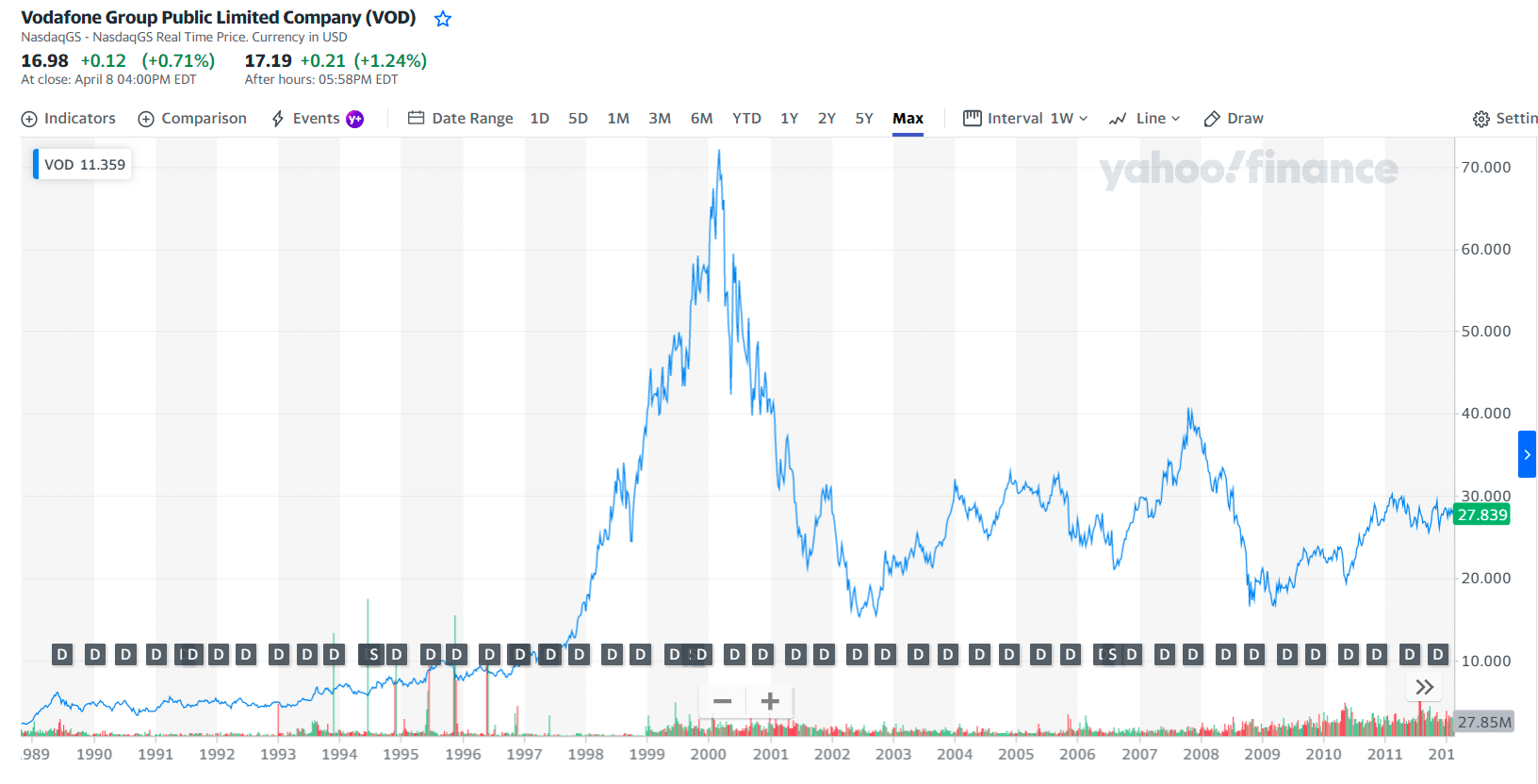

VOD price chart

The first three holdings:

- Telecom Italia S.p.A. ADR — 1.53%

- Millicom International Cellular SA — 1.31%

- Orange ADR — 0.67%

Final thoughts

Buying stocks under $20 is a great way to get your portfolio started. While these stocks may be affordable, they can still offer the potential for future growth.

This is especially true for businesses that are snowballing and expanding to new markets. While these are still cheap stocks, they have broken out of the “penny stock” range. It’s always prudent to keep an eye out for growing stocks around this price point. Buying these stocks when they’re still affordable can sometimes result in huge gains later if the company’s growth pans out.

Comments