The gaming industry within the Consumer Discretionary and Communications sectors has outperformed the broader market over the 2021 year. Thus, combined revenue from traditional casino gaming, sports betting and iGaming in the US reached $48.3 billion in the first 11 months of the 2021 year. That shattered the industry’s full-year record in 2019, before the start of the Covid-19 pandemic.

Interest in gaming and eSports has been soaring, especially with more people staying at home nowadays finding in-house entertainment. Moreover, the negative historical stereotype surrounding video gamers is dissipating, as eSports has emerged as a lucrative career option for the best of the best.

Market participants looking to capitalize on the growth of casino and gambling companies may wish to seek exchange-traded funds. ETFs, provide access to a basket of stocks, increasing portfolio diversity and minimizing risk.

What are gaming ETFs?

Gaming funds invest in companies that generate the majority of their revenue from the gaming industry, including casinos, gambling, eSports, gaming hardware and software, and graphics.

The gaming ETFs below have varying scopes of exposure to eSports, video games, and their supporting technology.

How to buy gaming ETFs?

Depending on how the funds in question are structured, there are some examples of entertainment ETFs holding up better than the broader market, but there are also examples of funds in this category that are getting drubbed.

Before buying shares in a gaming ETF, you need to sign up with a broker.

№ 1. Global X Video Games & Esports ETF (HERO)

HERO ETF summary

This fund was launched in late 2019 and has already amassed close to $1 billion in assets. It provides exposure to companies involved in the development or publication of video games, streaming and distribution, operation of eSports leagues, and production of video game hardware, including augmented and VR. The fund screens for liquidity but does not have geographic constraints and is thus globally diversified.

The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts and Global Depositary Receipts based on the securities in the underlying index.

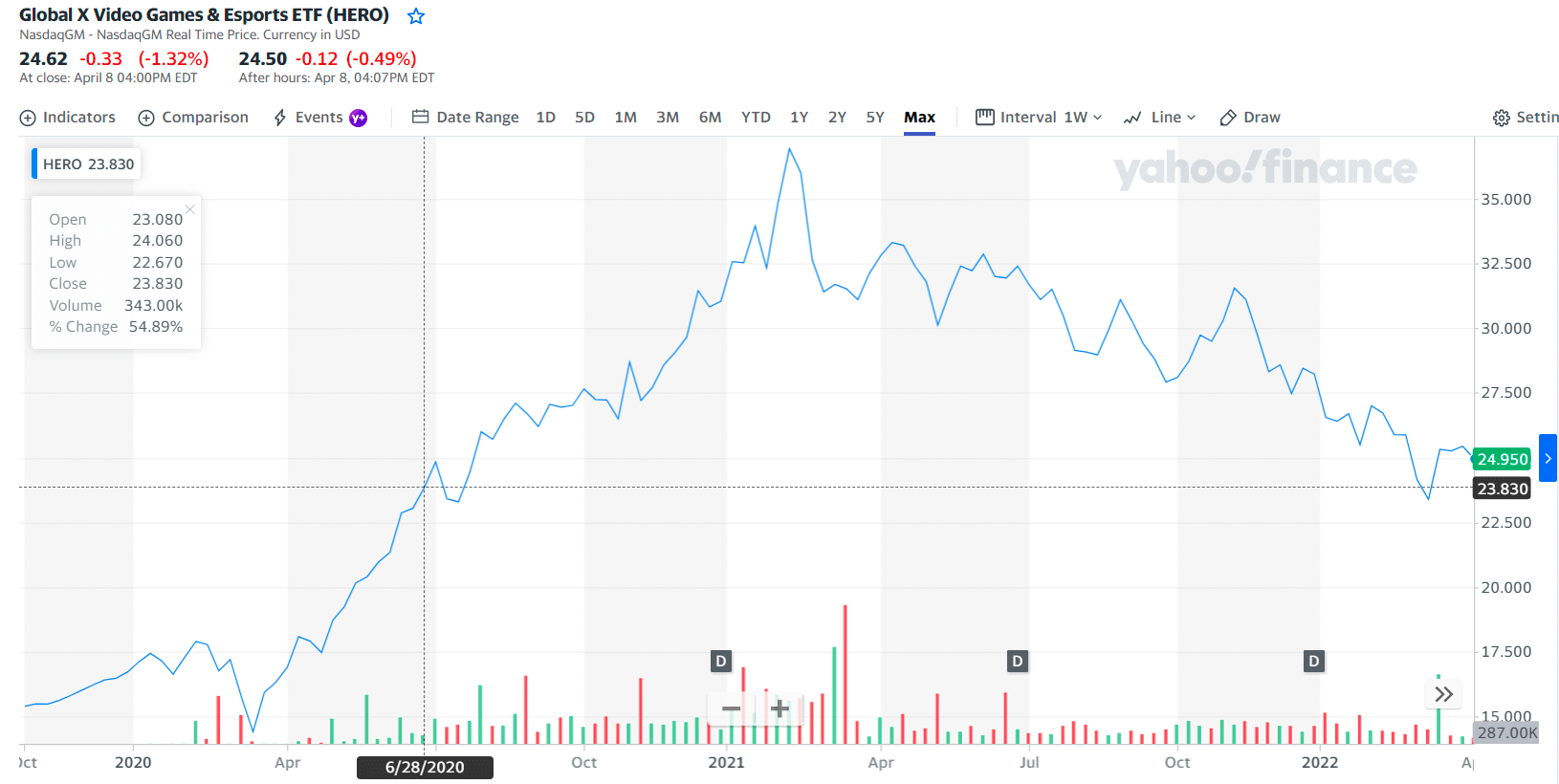

HERO price chart

HERO caps the weight of any individual holding to avoid concentration. Notable top ten holdings include Activision Blizzard, NVIDIA, Electronic Arts, Nintendo, and Zynga. It has 40 holdings and an expense ratio of 0.50%.

The first three holdings with their asset percentage are:

- Activision Blizzard Inc. — 7.98%

- Nintendo Co Ltd — 7.27%

- Nexon Co Ltd — 6.60%

№ 2. VanEk Video Gaming and eSports ETF (ESPO)

ESPO ETF summary

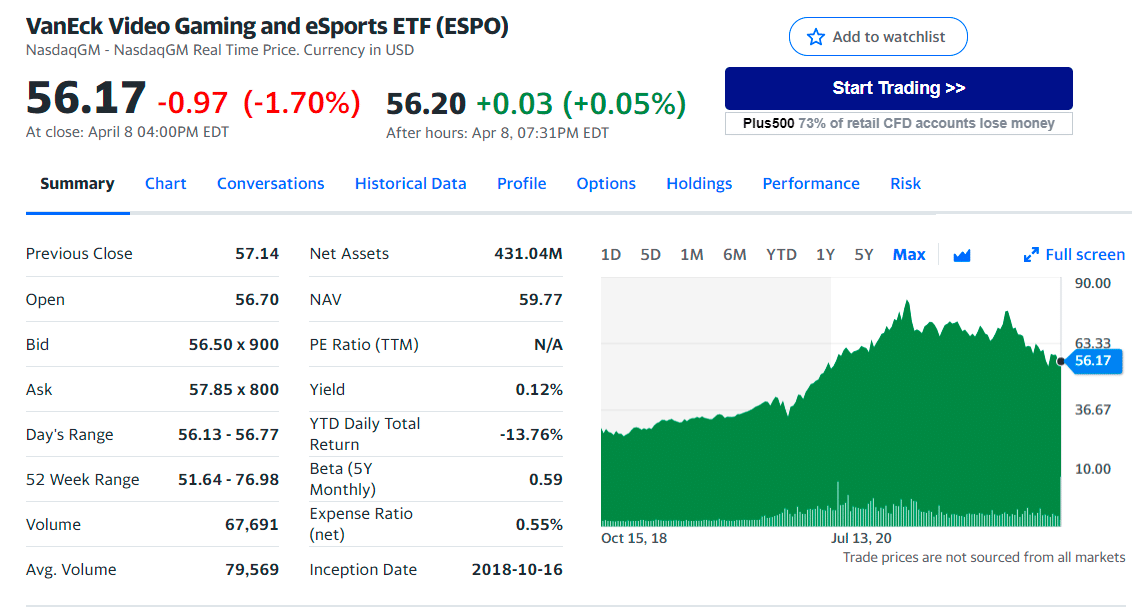

It was the first to launch a gaming ETF and now enjoys the benefits of moving first. It is the largest gaming fund on the market. ESPO pegs the competitive video gaming audience to be around 500 million people and expects eSports revenue to continue to grow considering the young and affluent customer base.

VanEck’s primary holdings are Nvidia and AMD, two of the premier gaming-related companies, thanks to their graphics and computing technologies.

Nvidia and AMD’s chips are essential for the graphics that bring video games to life. Also, their products enable data centers and cloud computing – two technologies that will be increasingly relied on in the rise of cloud gaming.

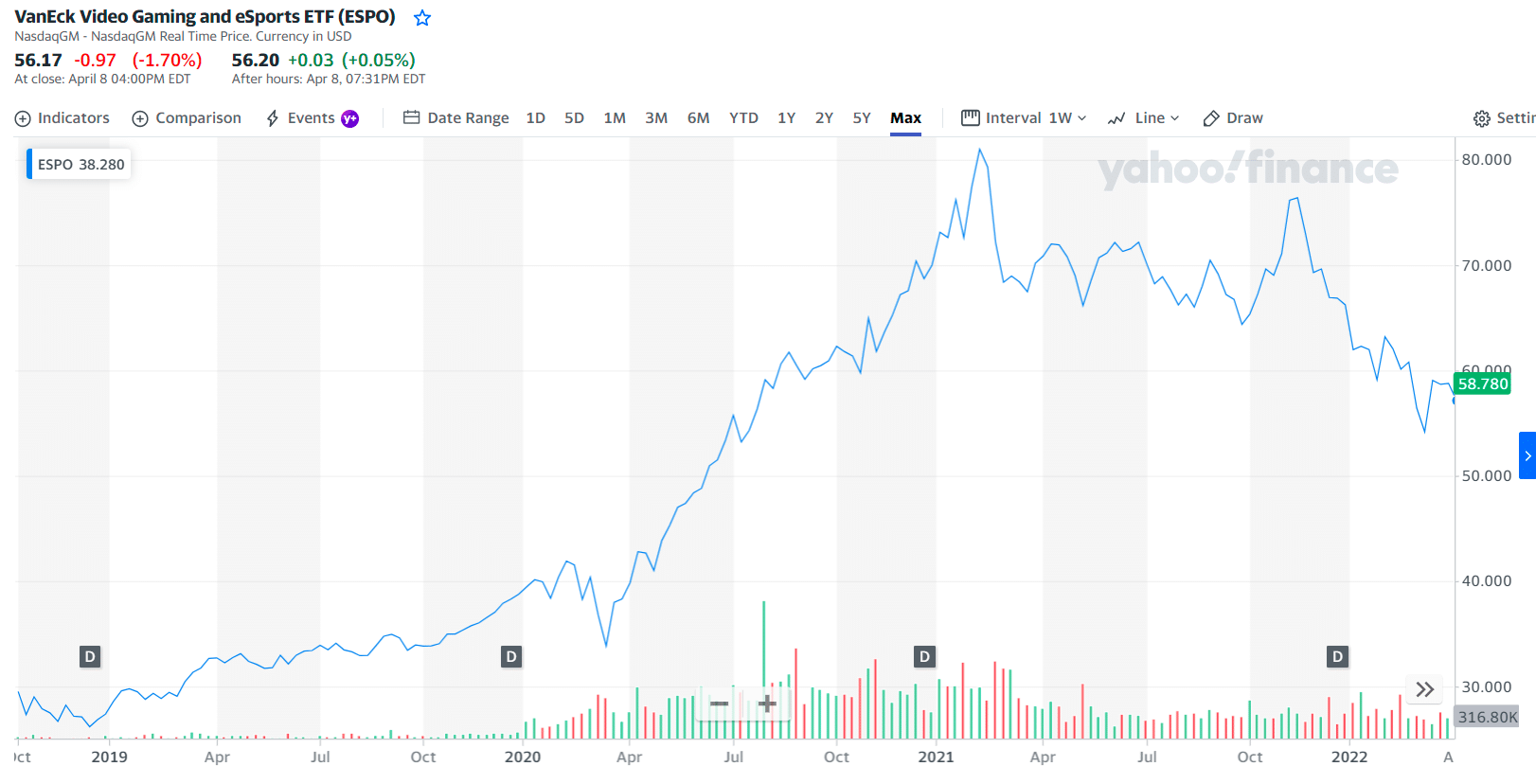

ESPO price chart

ESPO has healthy geographical diversity across its holdings, with 47% of net assets in US companies, 17% in Japan, 16% in China, and 10% in Taiwan. It consists of 26 constituents, with its top ten holdings commanding 65% of the fund’s total assets.

The first three holdings with their asset percentage are:

- Tencent Holdings Ltd. — 8.10%

- Activision Blizzard Inc — 7.73%

- Nintendo Co. Ltd. — 7.31%

№ 3. Roundhill Sports Betting & iGaming ETF (BETZ)

BETZ ETF summary

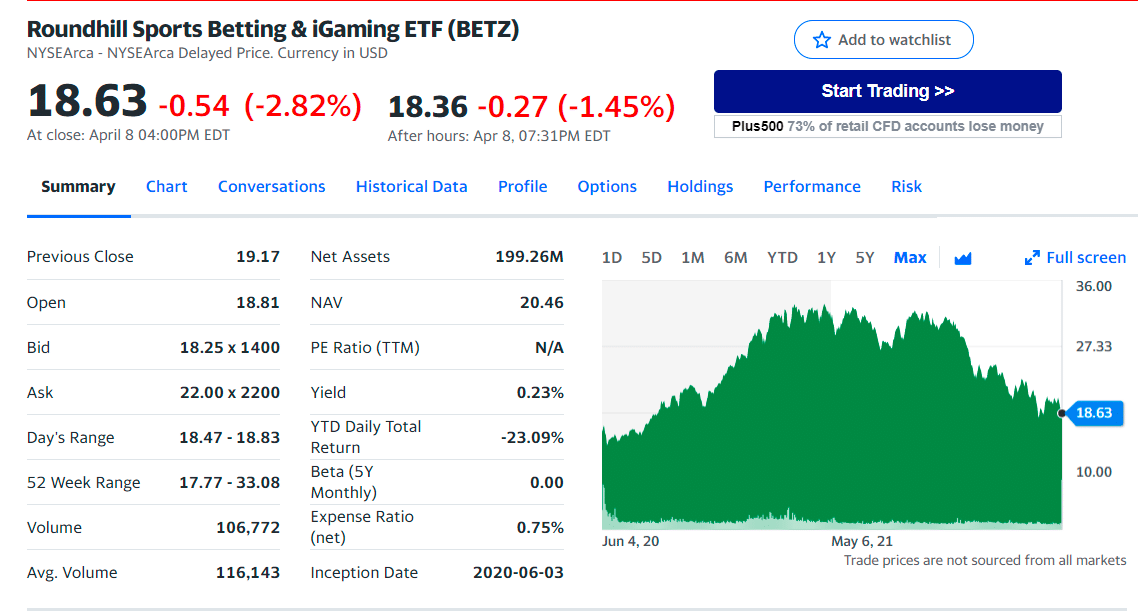

BETZ is the second ETF by RoundHill investments and the first fund to offer global passive exposure to companies in the sports betting and iGaming industry. One of the largest funds dedicated to gambling out there, this fund from minor asset manager Roundhill Investments commands about $438 million in assets and holds 40 leaders in in-person casinos and online gambling platforms.

These include overseas companies like Entain, a UK-based operator of European sportsbooks and online poker portals, and domestic stocks like PENN, which offers racetracks and casinos across the US.

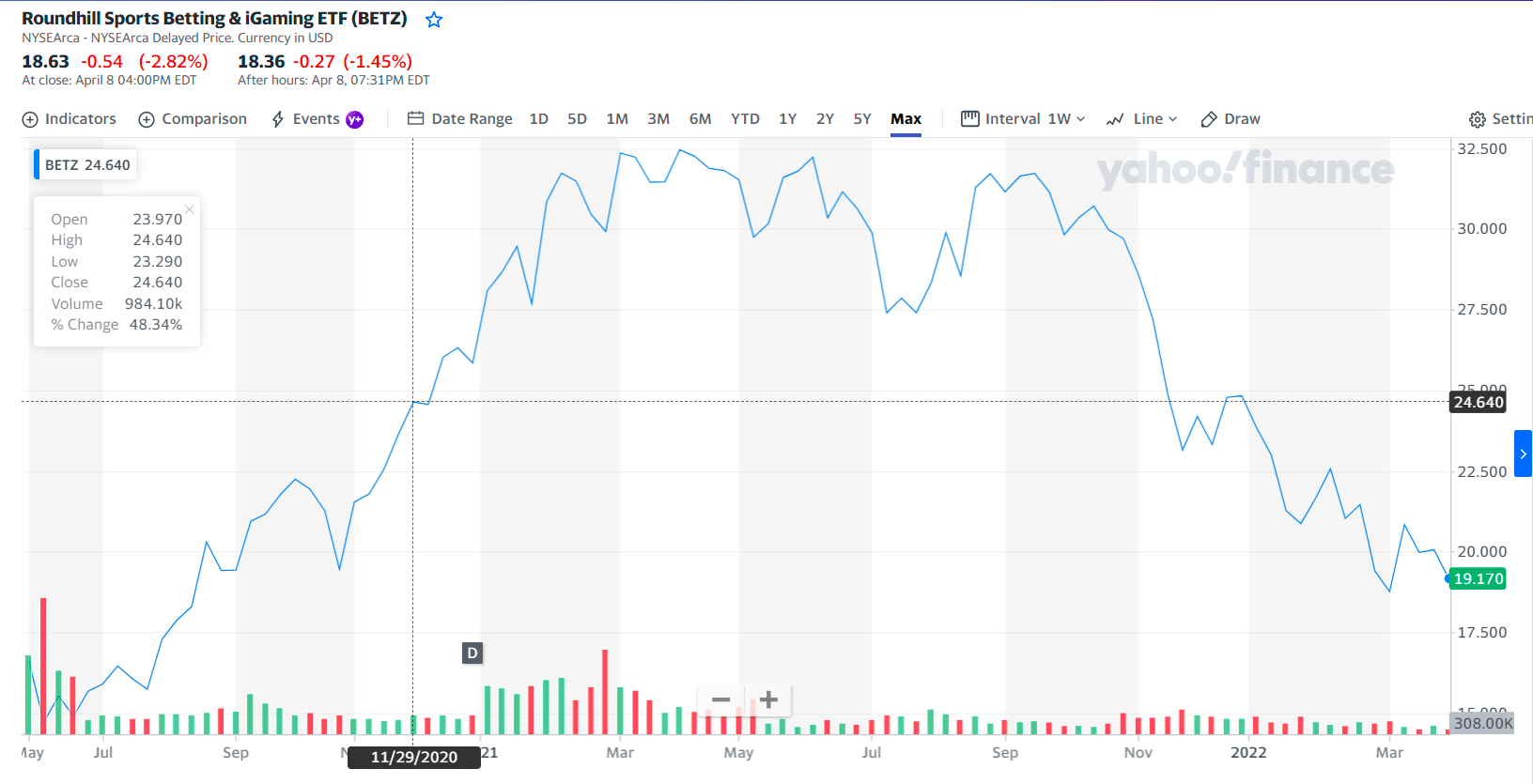

BETZ price chart

If you want a direct play on the return of casino traffic and the rise of online gambling, this is one of the best ways without picking individual stocks.

The first three holdings with their asset percentage are:

- Tabcorp Holdings L — 4.26%

- Betsson AB — 4.23%

- Flutter Entertainm — 4.21%

№ 4. Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD)

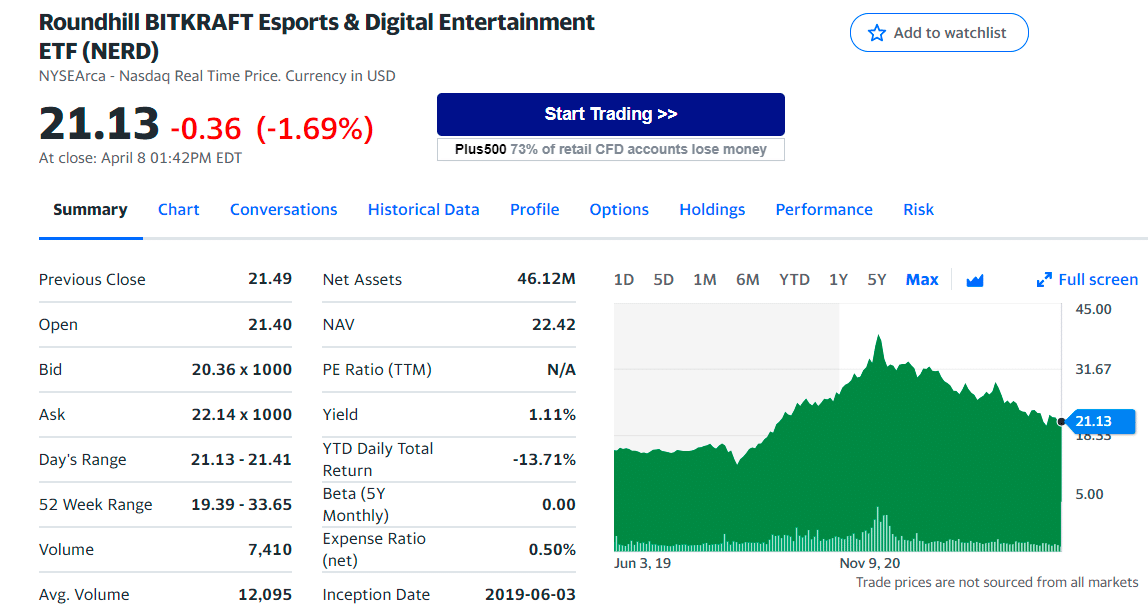

NERD ETF summary

It was launched in mid-2019 but only has about $100 million in assets despite its being cheaper than others on this list with a fee of 0.25%. Similar to HERO and ESPO, this fund holds companies involved in eSports or related business activities, including video game publishing, development, streaming, leagues and tournaments, and gaming hardware and technology.

It is one of six targeted, pure-play exposure funds offered by Roundhill Investments. The firm also has ETFs for the Metaverse, pro sports, streaming, and sports betting.

NERD provides access to the growing infrastructure around the gaming industry as much as it invests in more traditional gaming-related companies.

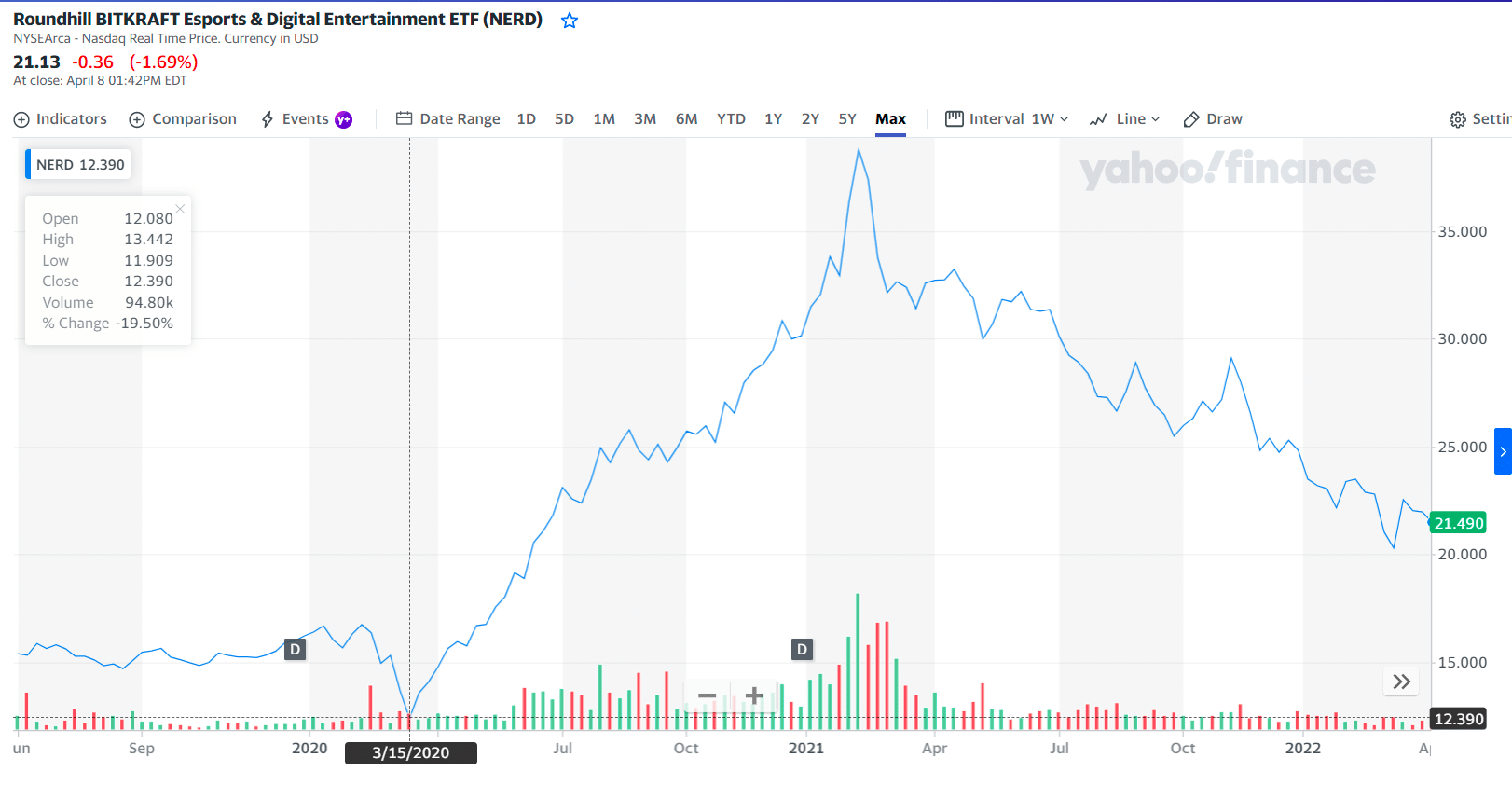

NERD price chart

It is a good example of the Roundhill team’s long-term time horizon and attention to second-order bets on a rising trend. The fund uses an equal weighting methodology and has one of the lowest fees in this space at 0.45%. This fund is roughly equally weighted and has 31 holdings.

The first three holdings with their asset percentage are:

- Modern Times Group (MTG.B) — 7.23%

- Activision Blizzard (ATVI) — 6.53%

- Corsair Gaming (CRSR) — 4.88%

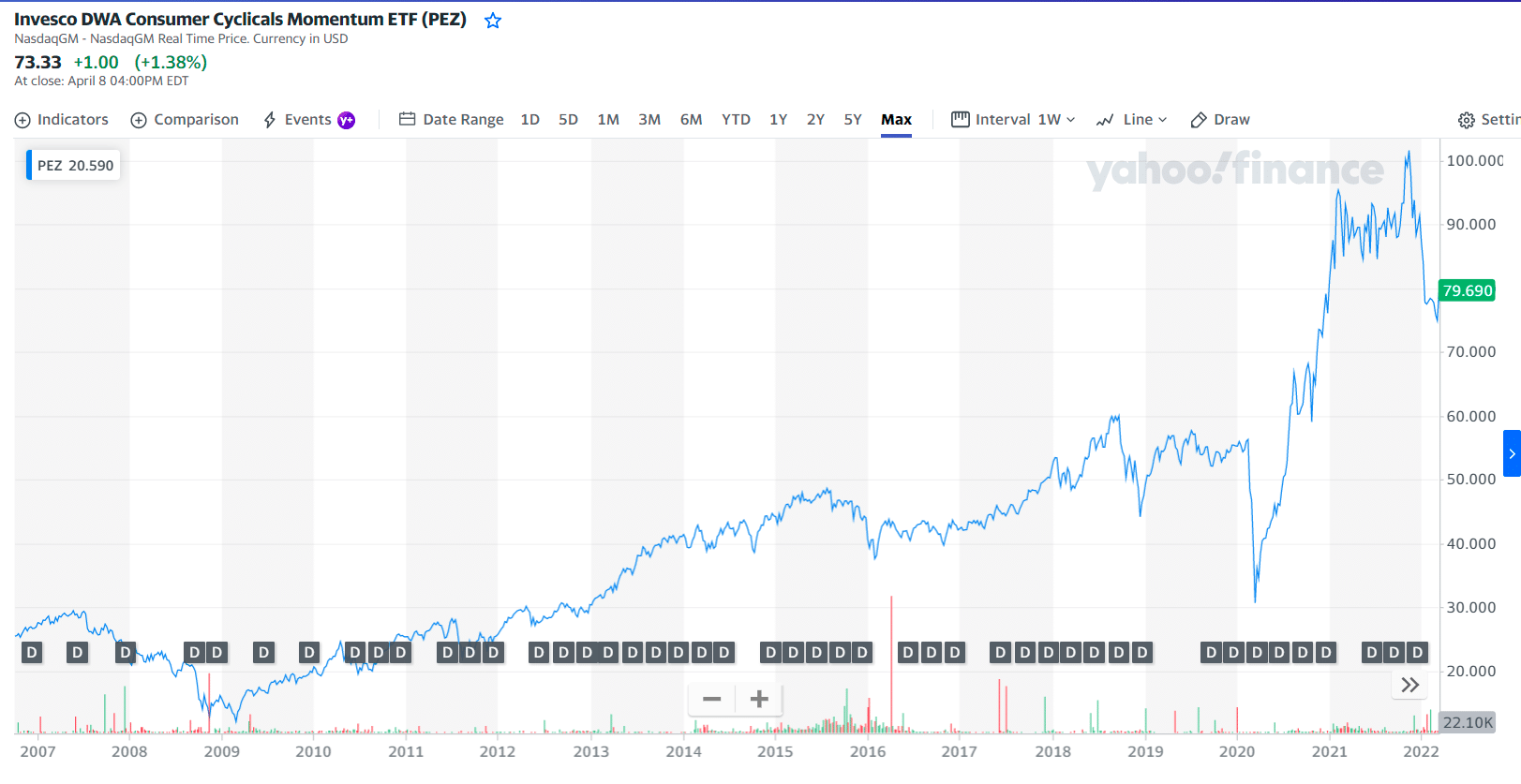

№ 5. Invesco DWA Consumer Cyclicals Momentum ETF (PEZ)

PEZ ETF summary

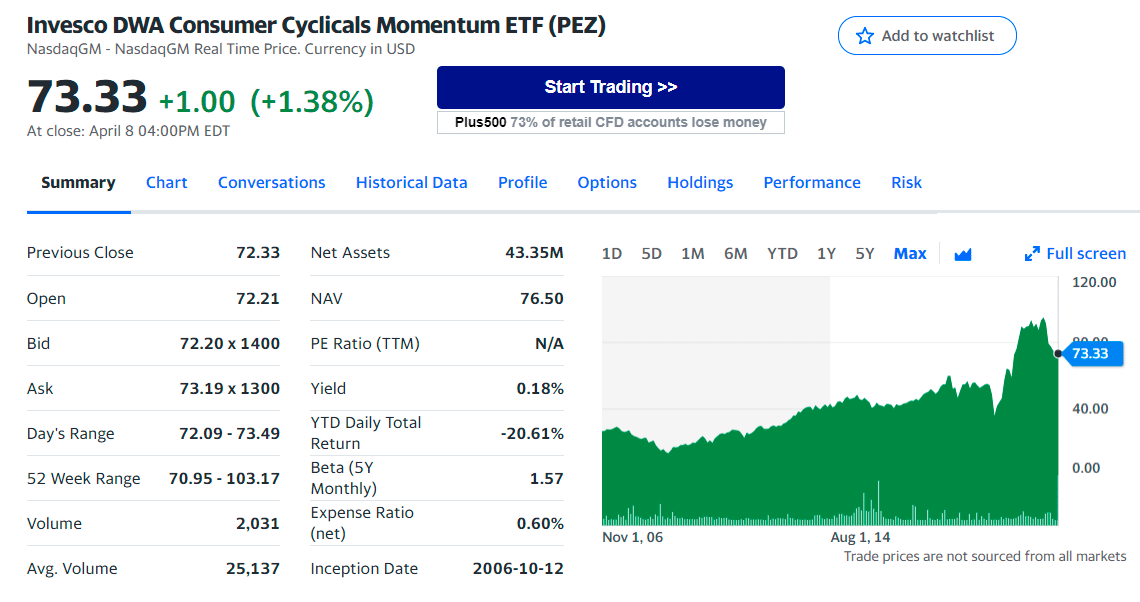

This $115 million consumer-oriented fund is a great way to gain broad exposure to an increase in spending and tourism and take a stake in some top gambling stocks in the process. The fund has jumped by nearly 20% since the beginning of the year. It comes with an expense ratio of 0.6%.

The fund follows a Dorsey-Wright relative strength index that selects and weights US consumer cyclical stocks by price momentum.

PEZ price chart

The fund seeks investment results that correspond generally to the price and yield of an equity index called the Dynamic Consumer Discretionary Sector Intellidex Index. The fund will usually invest at least 80% of its total assets in common stocks of consumer companies.

The first three holdings with their asset percentage are:

- O’Reilly Automotive Inc. — 5.99%

- SeaWorld Entertainment Inc. — 4.45%

- Costco Wholesale Corp. — 4.27%

Final thoughts

Buying gaming funds provides satisfactory exposure to this booming industry. In our estimation, ESPO and HERO will cover all of your bases in this sector.

Comments