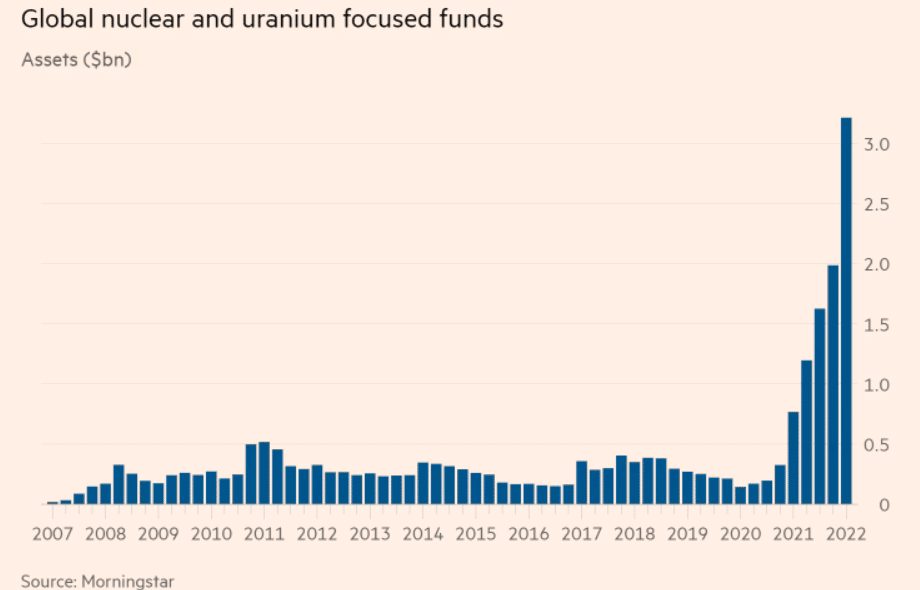

A tiny corner of the commodities market is going nuclear. Uranium prices – and therefore uranium ETFs – have reached critical mass.

Commodities, in general, have enjoyed stellar gains so far this year, thanks to the sharp economic snap-back and a related burst of fast-rising prices. Indeed, shares in commodity stocks in steel, aluminum, copper, and other hard assets outperform when inflation runs hot.

Over the past five years, a rejuvenated global search for alternative energy sources has driven most price appreciation.

Here, we explore five uranium ETFs.

What are uranium ETFs?

Uranium is a heavy metal that can be enriched and used as fuel for nuclear power plants or nuclear reactors that power naval ships and submarines. Uranium can also be used in nuclear weapons. As a financial asset, investors may gain indirect exposure to uranium through stocks of uranium miners, uranium ETFs, and clean energy ETFs.

Uranium ETFs and stocks have gained interest among the investment community. The demand for uranium and nuclear power as an alternative energy source has pushed prices for the metal higher. The uranium price has climbed more than 90% in value over the past 12 months ending March 21, 2022.

How to buy uranium ETFs?

Unlike other commodities and raw materials such as gold, silver, and crude oil, it is impossible to invest in or trade on physical uranium due to its radioactive nature.

To start trading on uranium price through shares and exchange-traded funds, follow the steps below.

Step 1. Open an account.

Step 2. Choose your product between spread bets and CFDs. Both allow you to speculate on the underlying price movements of popular instruments, and spread betting is tax-free in the UK.

Step 3. Purchase shares by placing a buy order with the stock ticker and number of shares.

Step 4. Confirm that the order was filled by checking your account summary page, which should list the fund shares and the purchase price.

Step 5. Follow news regarding the price of uranium and developments within the nuclear industry. Learn about the share market. These assets can be unpredictable, so you should learn how to trade stocks by using effective strategies.

Step 6. Use risk-management controls when opening positions.

Top five uranium ETFs to buy in 2022

Five US-based ETFs invest in nuclear energy, generally through stocks in uranium miners or utilities. One closed-end fund also buys physical uranium.

№ 1. North Shore Global Uranium Mining ETF (URNM)

URNM ETF summary

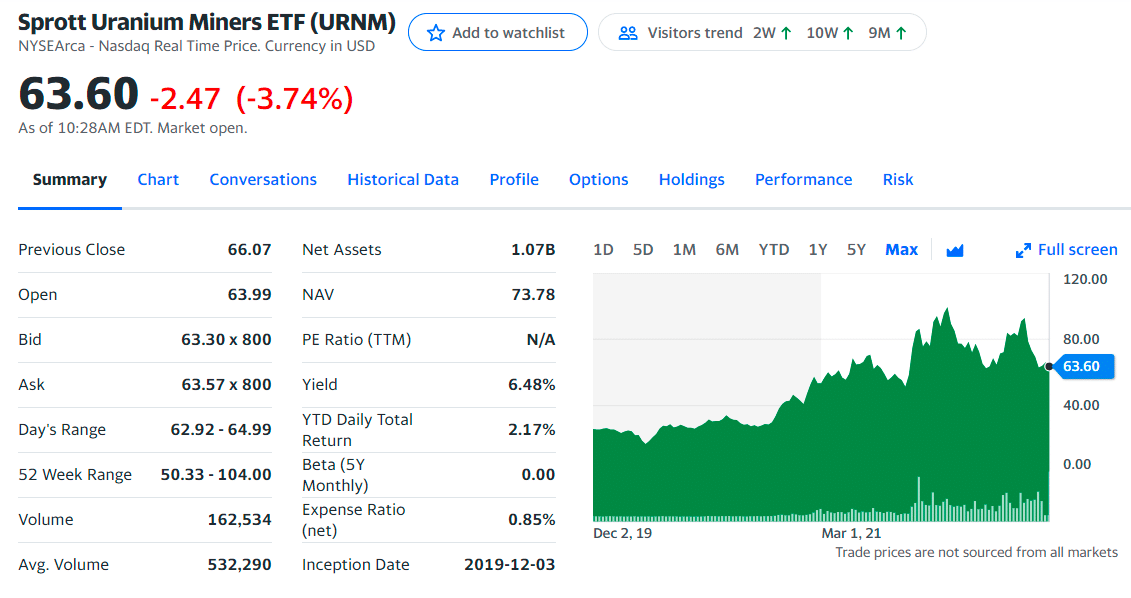

URNM, launched in 2019, has been managed by Travis Trampe since December 3, 2019, at Exchange Traded Concepts.

It seeks to passively track the performance of the North Shore Global Uranium Mining Index. It consists of a stock of companies involved in the mining, exploration, development, and production of uranium and companies that hold physical uranium or other non-mining assets. URNM performs slightly below the Global Uranium & Nuclear index while significantly outperforming the S&P 500 for the 1-year return.

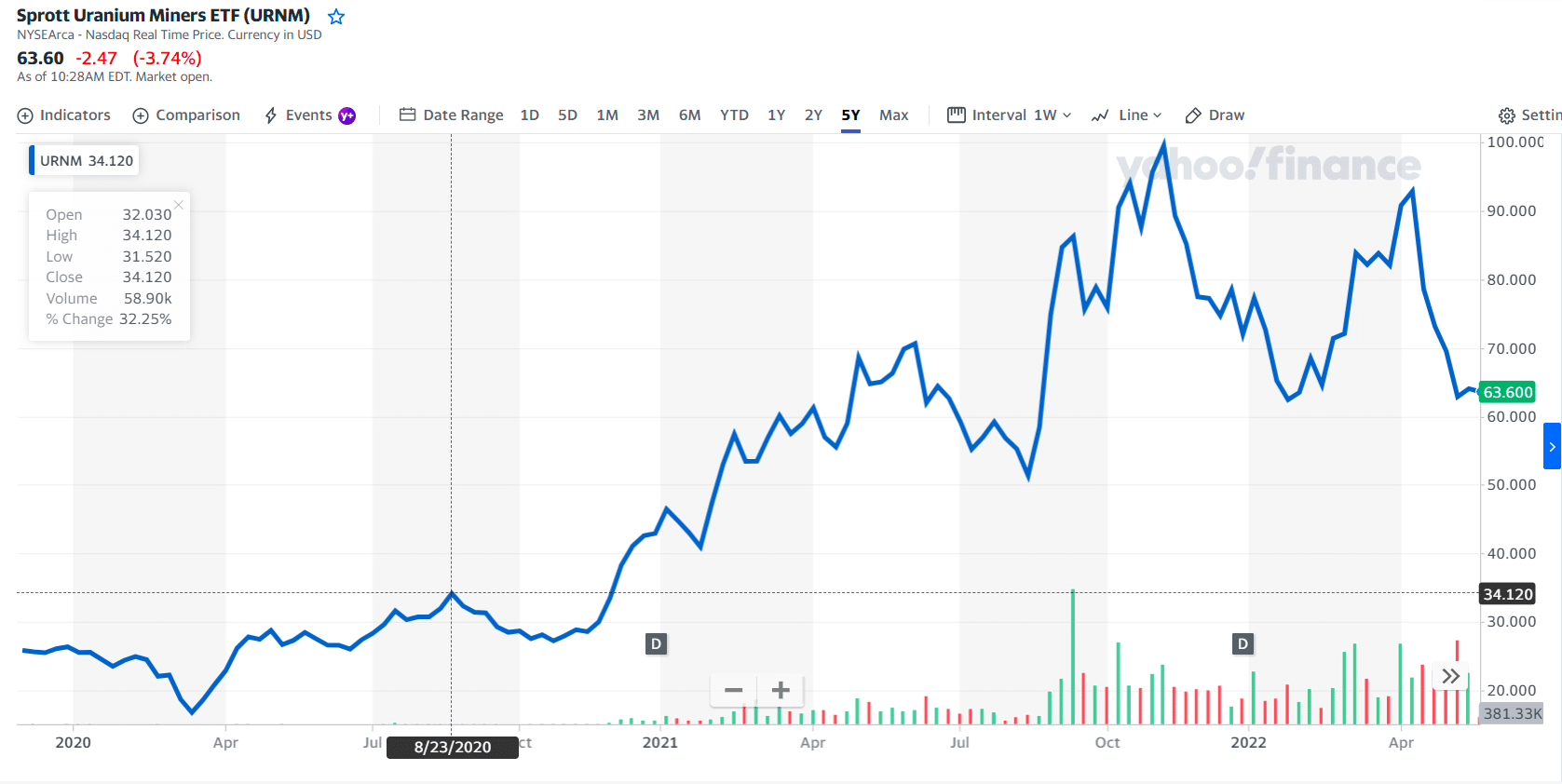

URNM price chart

URNM has an expense ratio of 0.85%, which is 72% higher than its category. Its expense ratio is high compared to funds in the Natural Resources category. The fund has returned 33.0% over the past year. Recently, in April 2022, URNM returned -11.7%.

The top three holdings with their asset percentage are:

- Cameco Corp — 18.08%

- National Atomic Co Kazatomprom JSC ADR — 12.94%

- Sprott Physical Uranium Trust Units — 9.24

№ 2. Global X Uranium ETF (URA)

URA ETF summary

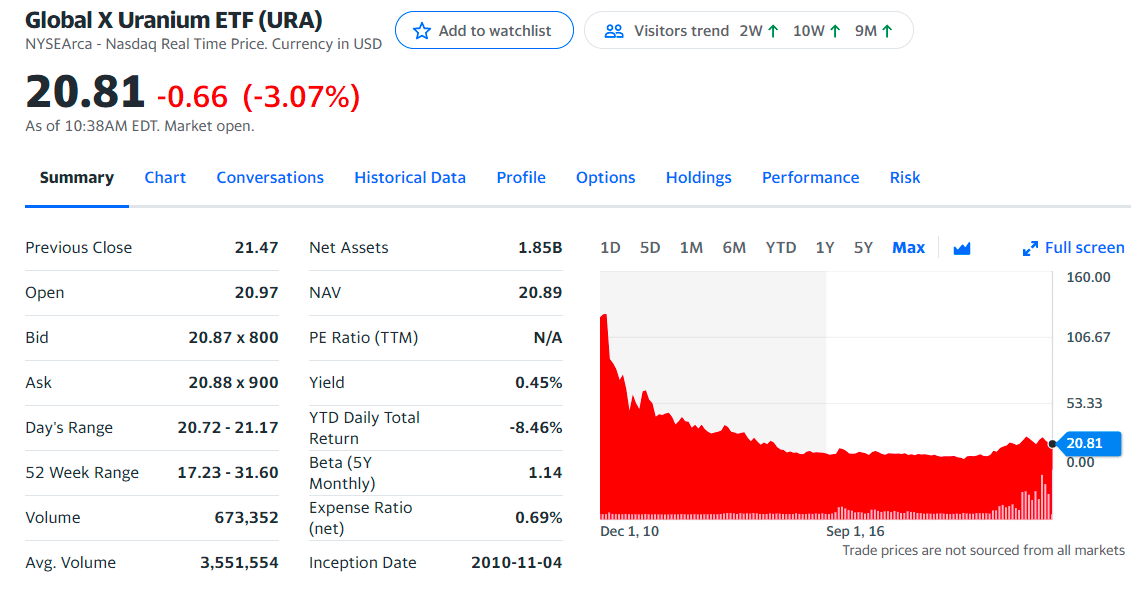

URA, launched in 2010, has been managed by Chang Kim since February 15, 2014, at Global X Funds.

This ETF seeks to provide investment results that generally correspond to the price and yield performance of the Solactive Global Uranium & Nuclear Components Total Return Index. URA provides exposure to a broad range of companies involved in uranium mining and nuclear production industries.

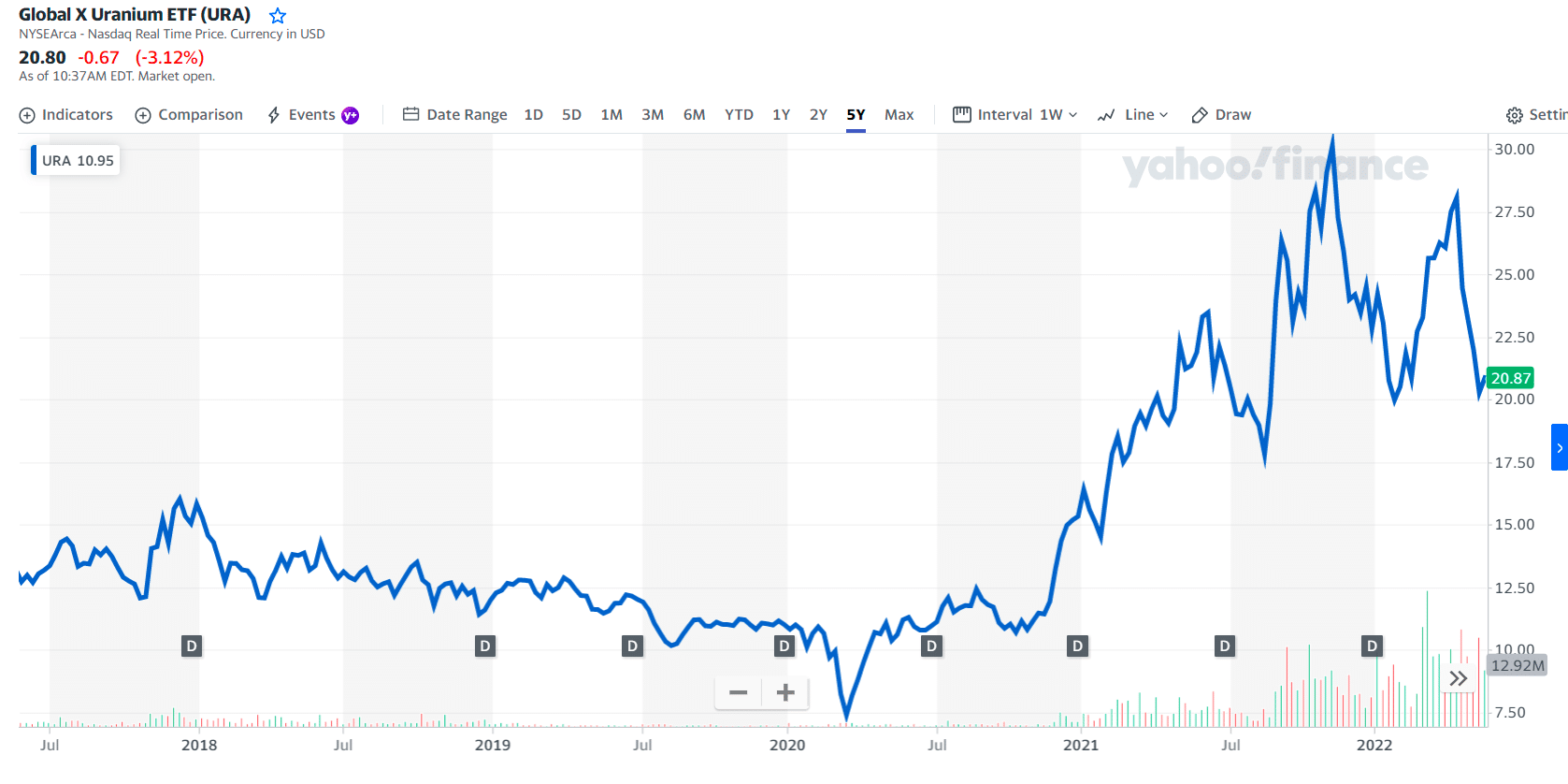

URA price chart

URA has an expense ratio of 0.69%, 39% higher than its category. The fund has returned 26.8% over the past year and 28.3% annually over the past three years, 14.8% per year over the past five years, and -5.3% per year over the past decade. In April 2022, it returned -10.3%. It has an R-squared of 34%, a beta of 1.14, and a standard deviation of 35.3%. It has a high total risk rating.

The top three holdings with their asset percentage are:

- Cameco Corp. — 23.43%

- National Atomic Co Kazatomprom JSC ADR — 22.81%

- NexGen Energy Ltd — 5.36%

№ 3. VanEck Uranium+Nuclear Energy ETF (NLR)

NLR ETF summary

NLR, launched in 2007, has been managed by Hao-Hung (Peter) Liao since August 13, 2007, at VanEck.

VanEck Uranium+Nuclear Energy ETF seeks to passively track the performance of the MVIS Global Uranium & Nuclear Energy Index. NLR provides exposure to companies involved in uranium mining and in the nuclear power industry.

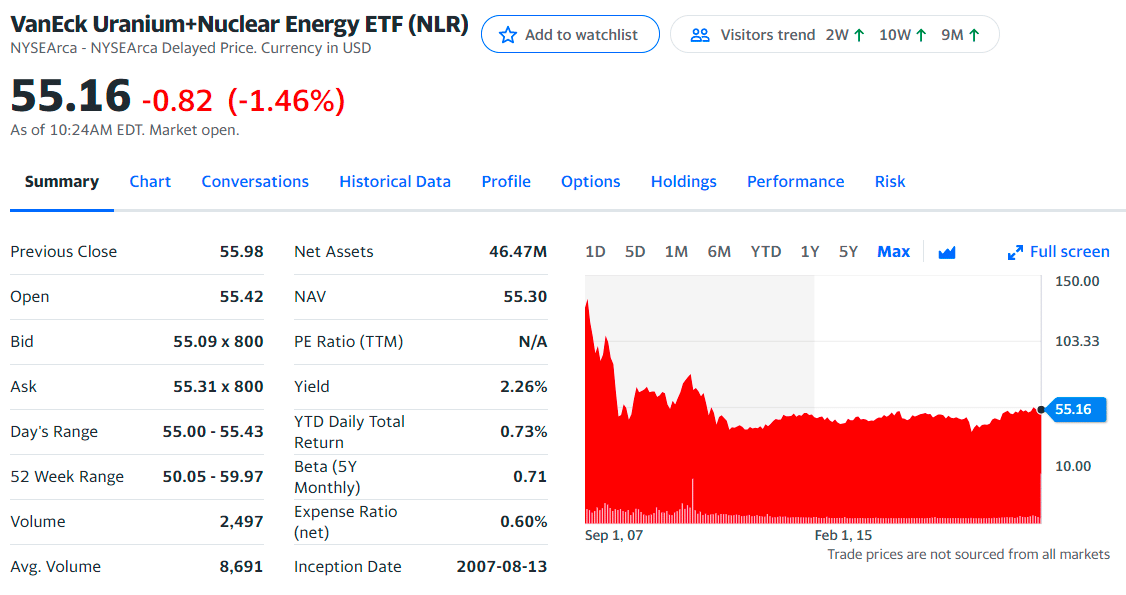

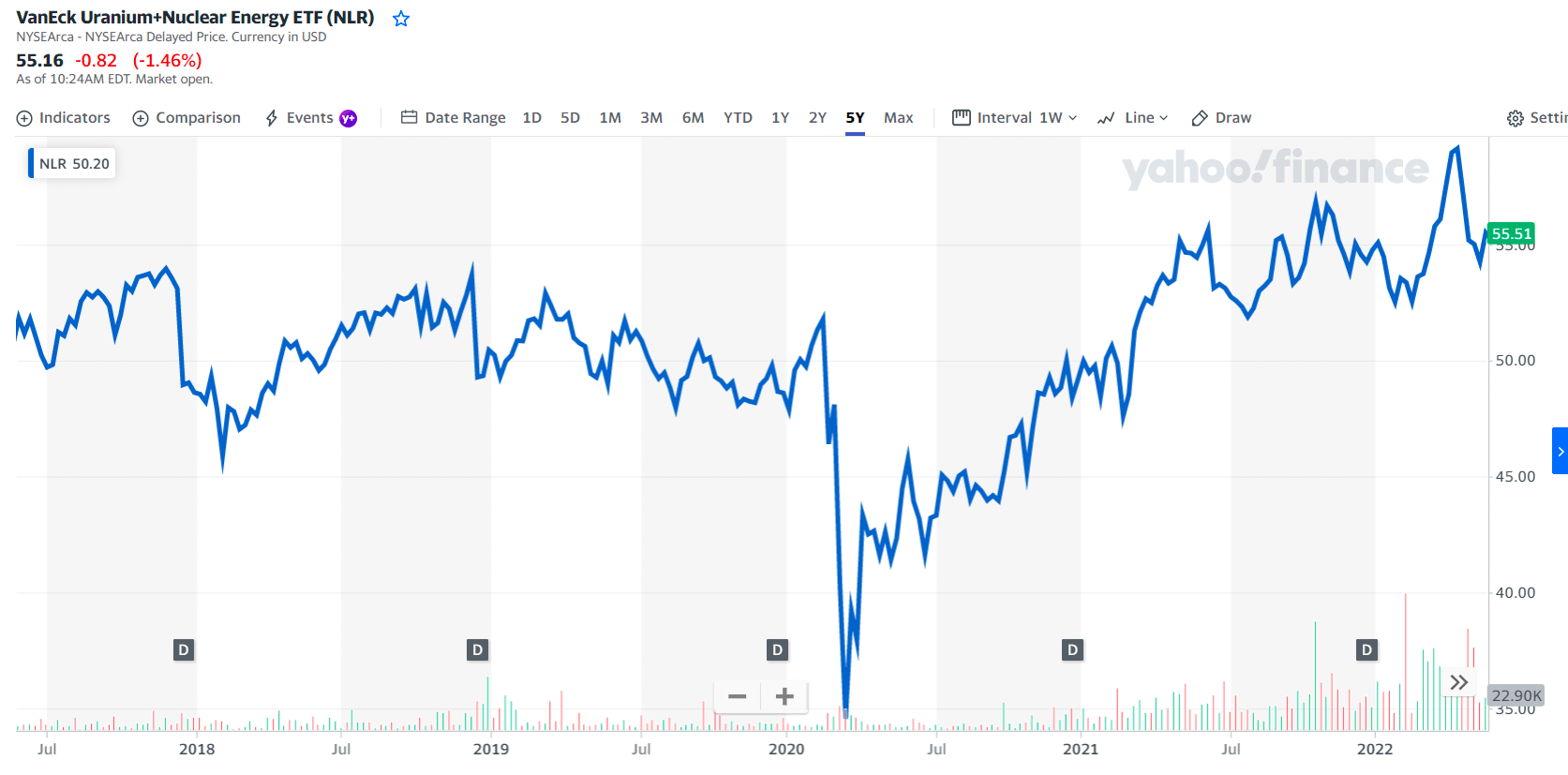

NLR price chart

Its expense ratio is above average compared to funds in the Miscellaneous Sector category. It has an expense ratio of 0.60%, which is 12% lower than its category. The fund has returned 5.2% over the past year and 4.8% annually over the past three years, 5.4% per year over the past five years, and 4.5% per year over the past decade.

In April 2022, it returned -3.2%. It has an R-squared of 60%, a beta of 0.71, and a standard deviation of 16.4%. It has a below average total risk rating.

The top three holdings with their asset percentage are:

- Duke Energy Corp. — 8.07%

- Dominion Energy Inc — 7.98%

- Exelon Corp. — 6.94%

№ 4. Sprott Physical Uranium Trust (SRUUF)

SRUUF ETF summary

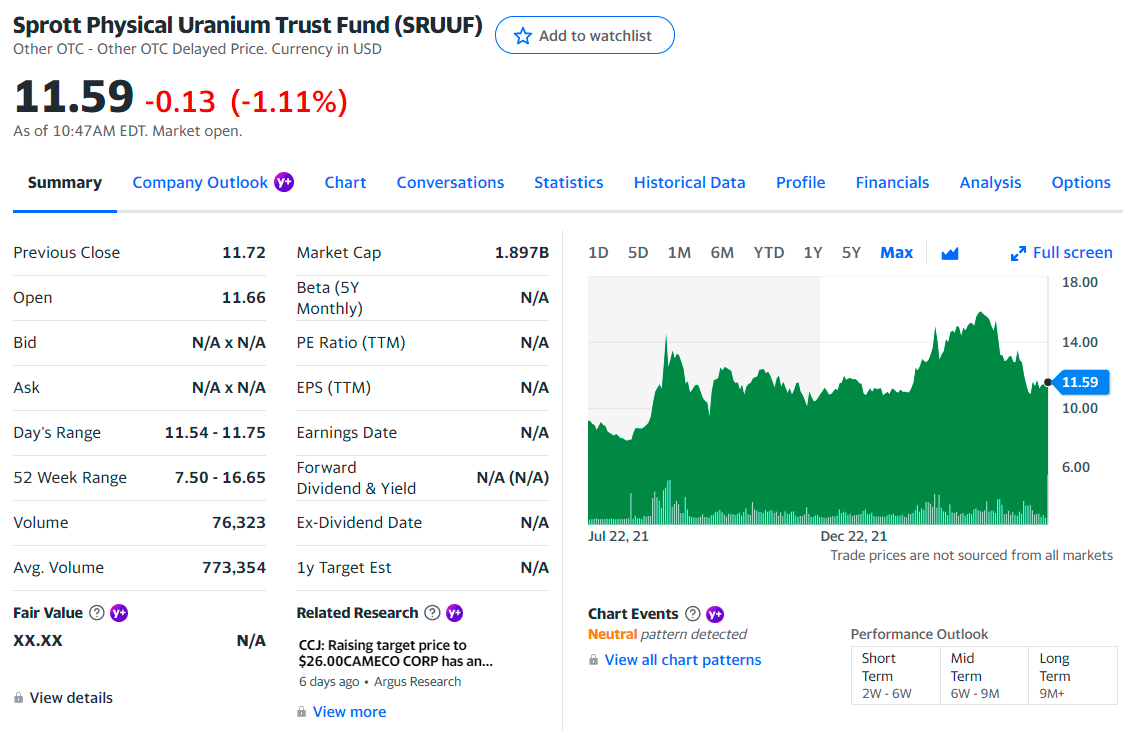

It offers a way to invest in uranium, the commodity, directly. Listed in July 2021 on the Toronto Stock Exchange, The Sprott Physical Uranium Trust is the world’s largest physical uranium fund. This is a closed-end fund you can buy through major brokers. It may also be responsible for the 2021 rally in uranium prices. The fund is up another 33% in 2022 through March.

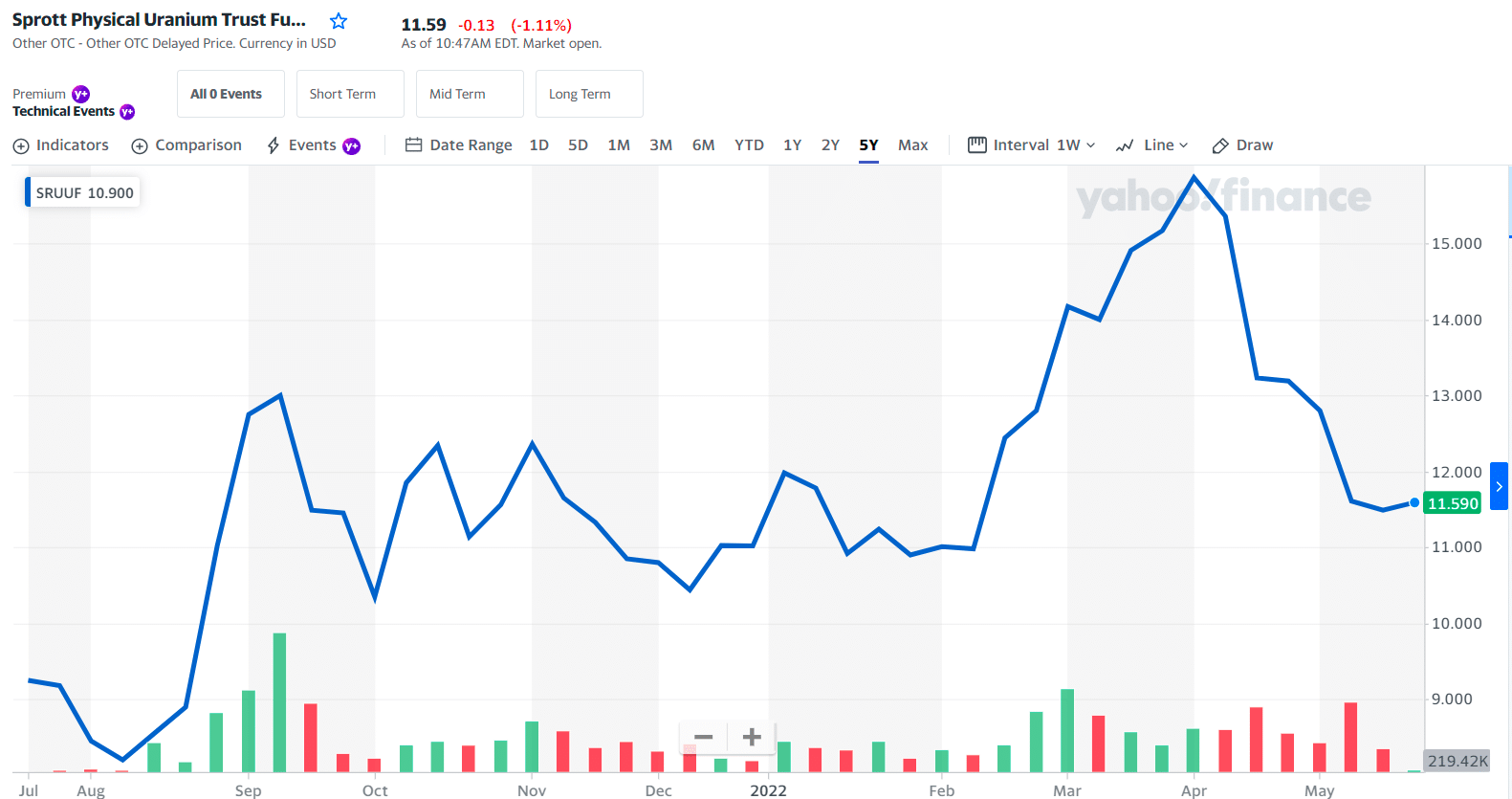

SRUUF price chart

It has $1.6 billion in assets under management, with investors parting with $35 annually as the management fee for a $10000 investment.

The top three holdings with their asset percentage are:

- Exchange Traded Concepts Tr-North Shore Global Uranium Mining ETF — 2.76%

- Advisors Inner Circle Fund II-Kopernik Global All Cap Fund — 1.42%

- Delaware Ivy Natural Resources Fund — 0.30%

№ 5. Horizons Global Uranium ETF (HURA)

HURA ETF summary

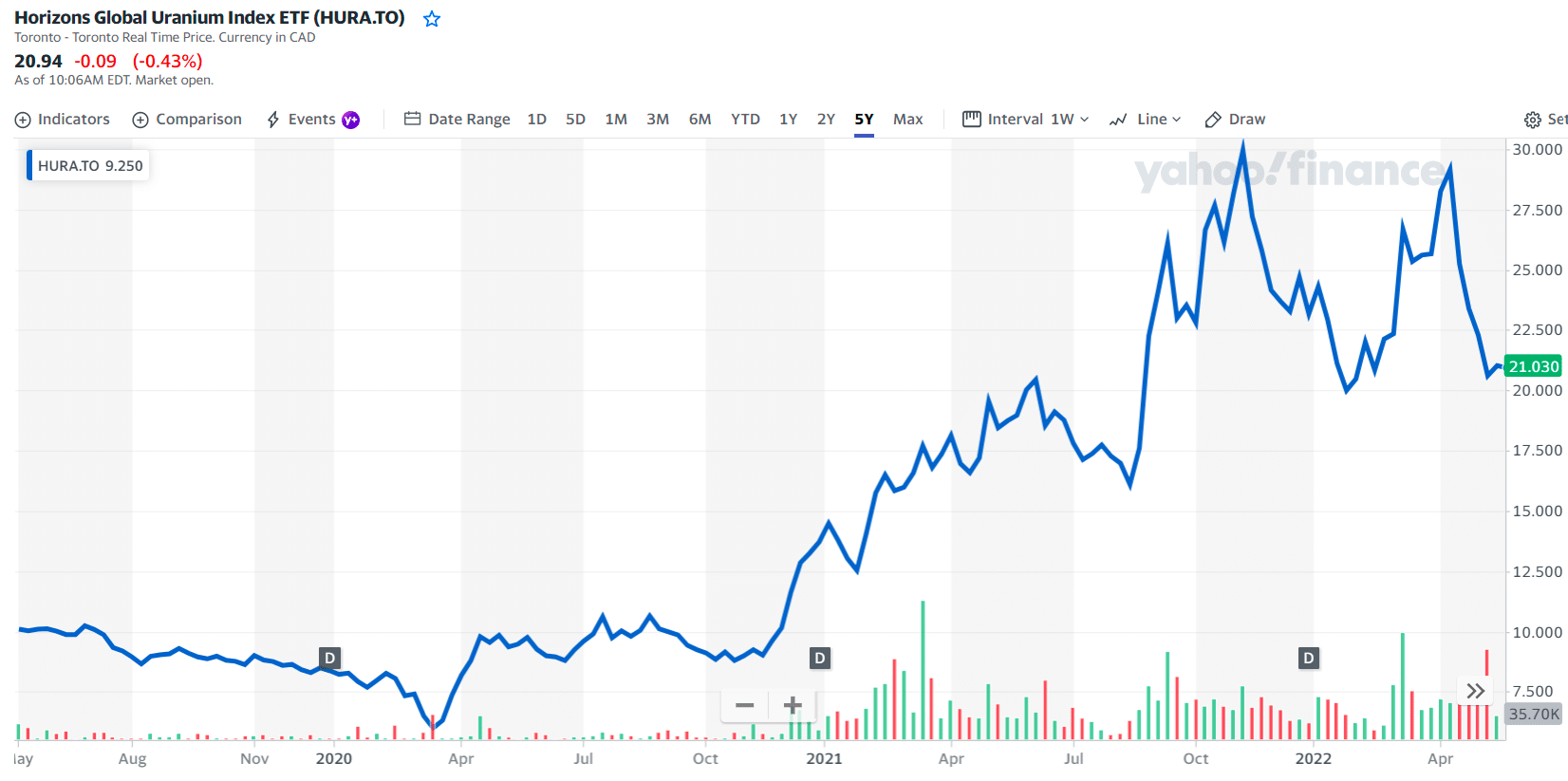

It is an exchange-traded fund listed with the Toronto Exchange. It tracks the Solactive Global Uranium Pure-Play Index. Holdings of the composite index have to be listed in exchanges of developed economies, exposing investors to their associated uranium markets.

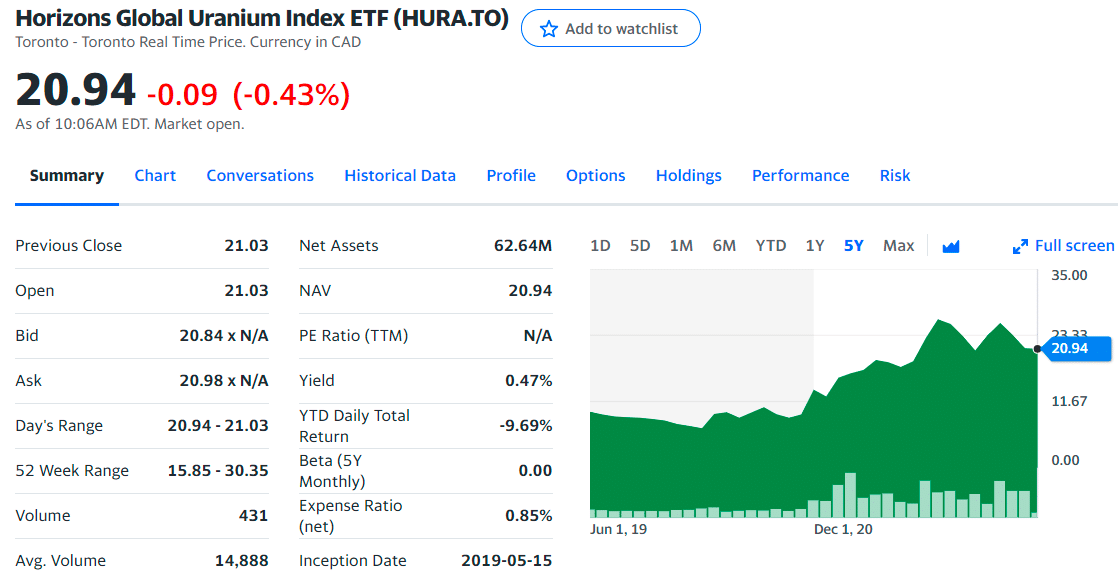

HURA price chart

It has $41.5 million in assets under management, with an expense ratio of 0.85%. With just one year in operation and a pandemic year, this fund still managed returns of 65.67%.

The first three holders with their asset percentage are:

- National Atomic Co Kazatomprom JSC ADR — 21.85%

- Cameco Corp. — 19.91%

- Uranium Participation Corp. — 10.54%

Final thoughts

Nuclear energy will likely remain controversial, but it is moving back into the spotlight. If you believe in its promise, you can invest in multiple ways.

Comments