Gold, the precious metal historically, has a stored value over the millennia. Moreover, this metal has various utilities, making sense over time to consider it as an attractive investment opportunity. Additionally, gold has been a safe haven asset historically as the price remains stable and grows during periods of market turulence.

However, technology makes our life easier and enables various opportunities to invest in this precious metal alongside traditional physical gold purchasing. This article will reveal five ways to invest in gold without holding it in 2022. You can choose any of these methods depending on several factors, such as capital size, investment duration, investment medium, return expectation, etc.

Five ways to invest in gold without holding it in 2022

The direct investment in this asset can be purchasing physical gold bars or coins. When storing physical gold bars involves many issues such as security, shipment cost, holding costs, etc. Moreover, there remains a risk of impurity when someone purchases physical gold from unauthorized sellers or opens the marketplace. However, there are several ways available to invest in this precious metal in this era of technology.

The top five ways to invest without storing physical gold are:

- Invest in gold mining stock

- Gold CFDs trading

- Invest in gold ETFs

- Silver as an alternative to gold

- Gold-backed cryptocurrencies

Invest in gold mining stock

Gold mining are those companies that extract gold from nature. The best company stocks among this list of gold mining stocks pay good dividends over a particular period. Despite the higher volatility, this sector has become an attractive investment sector. Moreover, the price of these stocks often keeps rising, ignoring the declining market of the gold, and when the price increases of this precious metal, that usually triggers the price of these stocks.

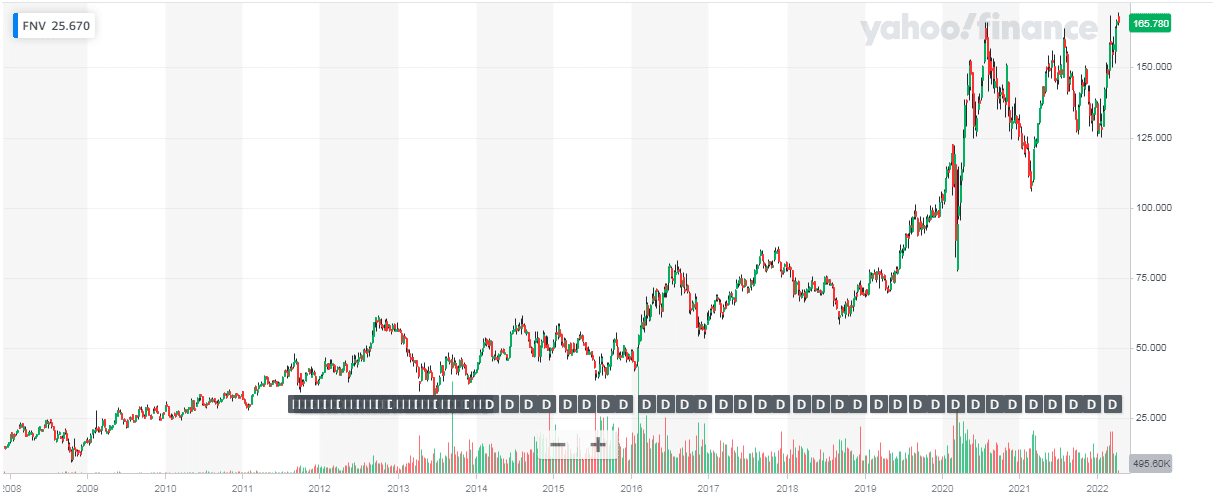

FNV price chart

On the other hand, when the mining cost of gold increases due to any fundamental reason, that also affects the gold price. For example, look at the chart above of Franco-Nevada Corporation (FNV), a famous gold mining company, showing historically smooth growth over time.

There are many mining stocks available in the marketplace. When choosing the best one, you should check key elements of that stock, including balance sheet, dividend payment, historical data, company profile, and other financial data

Gold CFDs trading

CFD trading or contract for difference is another popular approach for gold investors. This approach allows traders to have more extensive exposure to the gold market and enables practicing margin trading. Financial traders often practice CFD trading approaches for many other trading instruments.

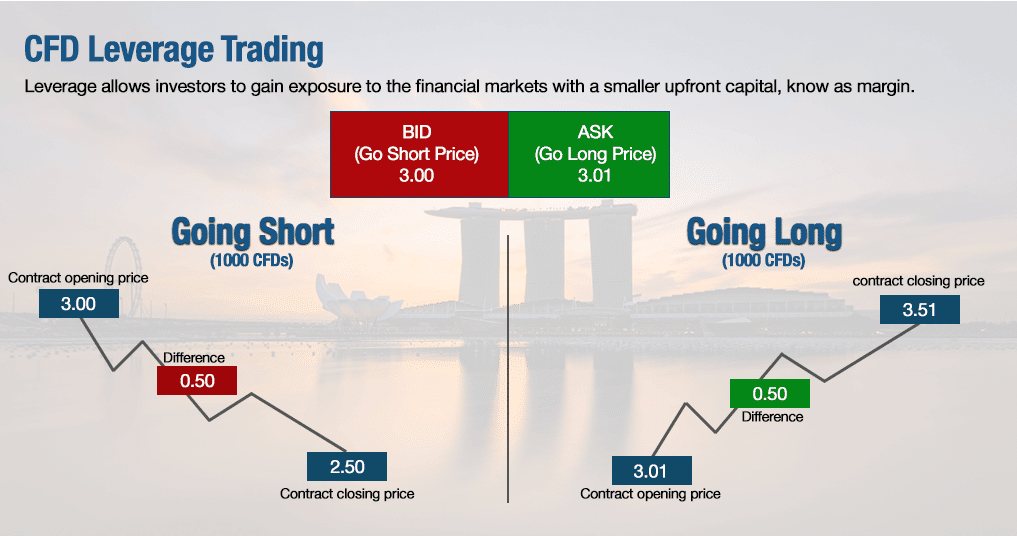

In this way, investors usually buy/sell any unit of the asset offered by financial institutions rather than buying the underlying actual product. It is typically a contract between buyer and seller, in which the buyer will pay the value difference between the current price and contract expiration price to the seller. It’s an approach to making money from the price movement of any particular asset without even owning the asset. This approach is available in many brokers for various financial instruments, including forex, stocks, futures, commodities, etc.

CFD trading concept

However, CFD trading involves magnifying profit or loss, so limit your losses by applying appropriate trade management when practicing this method.

Invest in gold ETFs

Another popular approach for gold investors is investing in assets like gold ETFs or exchange-traded funds that hold the commodity as underlying assets and make investments in futures contracts of that commodity. Investors who practice hedge trading often invest in these commodity ETFs to reduce risks on their other investment assets, such as USD. ETFs are the correct choice for investors who like diversifying portfolios.

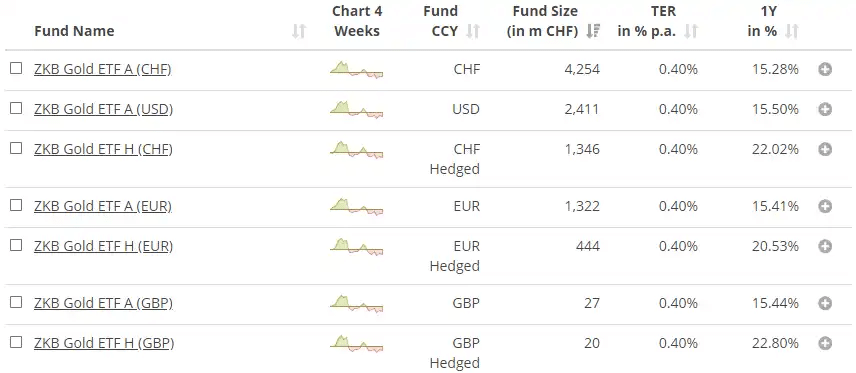

Best gold ETFs

However, this commodity ETFs can be volatile as these assets track the performance of gold, and gold price responds to demand-supply, pandemics, war, and various other fundamental and geopolitical events. You can also determine the market context of gold by following the price performances of these ETFs. The top assets of this class have billions of dollars.

Silver as an alternative to gold

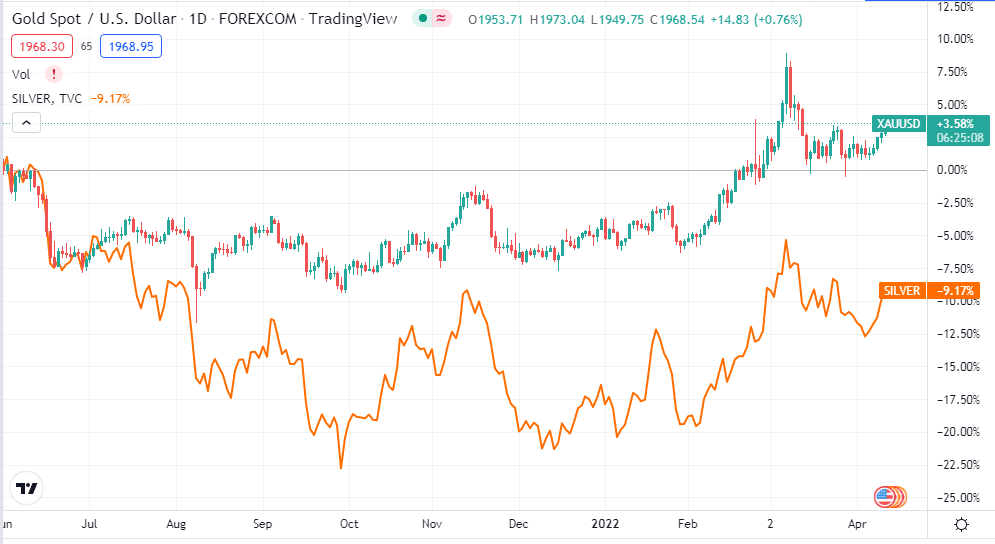

Some investors like to diversify their portfolios by investing in several correlated assets. Silver is another demandable metal, and the price of this metal often moves as the gold price moves. The difference is you can purchase a large volume of silver with the same amount of smaller units of gold. Silver is a potential investment for any investor who believes the dollar will be worthless.

Gold and silver price correlation

The price of silver was below $9 in 2008, which made a peak near $30 in 2021. Many financial analysts anticipate this metal as a potential investment as the industrial sector has a massive demand for this metal alongside many other industries. The gold-to-silver ratio is now three times higher than a hundred years ago.

Gold-backed cryptocurrencies

Technology introduces us to many digital products such as cryptocurrencies or products of blockchain technologies. This hype is going on, and the crypto market has become a marketplace of multi-billion dollars within the recent few years. There are gold-backed cryptocurrencies available in the crypto industry that track the performance of gold prices.

Thus, Digix is a Singapore based company that sells digital gold tokens (DGX) redeemable for gold in well-established Singapore vaults.

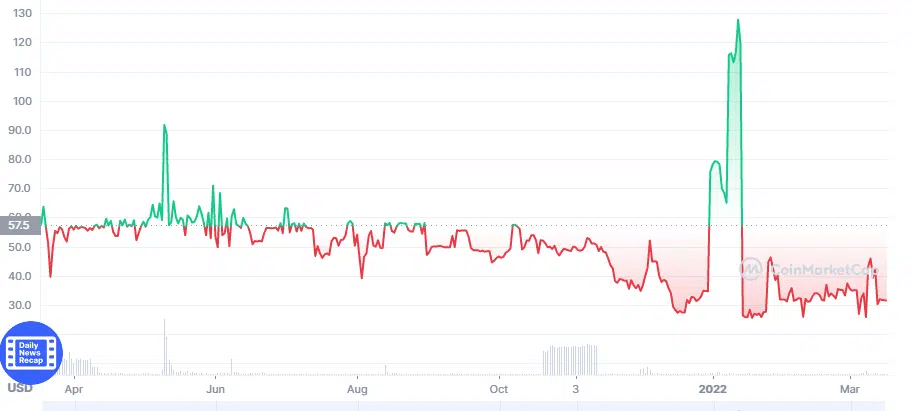

DigixGlobal price chart

Usually, each unit of these coins reflects the price of any unit of gold prices. These assets reduce many hassles that involve storing physical gold, such as transportation costs, security assurance, storing costs, etc.

Meanwhile, someone else is storing the gold for these investors, and they can sell them by using their cryptos as proof of ownership. However, cryptos are a new addition to the financial world. So it makes sense that selecting the best gold-backed cryptocurrencies requires checking on several key factors. These assets have become rapidly popular during the recent Covid-19 pandemic.

Final thought

We make this list of the best alternatives ways to invest in the precious metal gold. You can invest in any of these assets by conducting additional research and technical analysis to identify potentially profitable trading positions and participate in more profitable trades.

Comments