Valuable metals like gold and silver have long been used as a medium of exchange and choices to conventional investments instruments like stock, ETFs, and bonds.

The government having the authority to print money is a significant reason for inflation. Many investors who want to save their hard-earned money choose to invest in silver as it is still less costly than gold.

In early February 2021, traders on Reddit’s WallStreetBets forum sent silver prices spiking to an eight-year high. Back in 1979-80, a pair of billionaire brothers, the Hunts, tried to corner the global silver supply, sending its per-ounce price from $11 to nearly $50.

But is silver a good investment?

Let’s go through all the aspects of silver investing and the profits you can gain from it.

History of silver

Silver has a long and also fascinating history. Right after the barter system was no longer the medium of exchange of goods and services, the people of Turkey and Greece founded silver in 3000 B.C.

The chemical symbol of silver is Ag. Silver started to become the medium of exchange for goods and services and was considered a precious metal after gold.

Silver was then being used to mint coins and eventually in technology and medical uses due to its chemical properties. After it became popular, the generation started utilizing its worth and chose it as an asset to invest in.

What makes the silver price move?

Silver, as compared to gold, is more volatile. It may possibly not reach greater fundamental worth than gold but may increase in value. When compared to gold, silver rose 3105%, while gold was at 2328% rise between the 1970s and 1980s, according to Senior Precious Metals Analyst Jeff Clark.

Silver (Sl=F)

In the above chart, the blue price line represents silver while the green price line represents gold. In 2011 the silver prices outperformed gold.

You will see silver typically showing a price increase when there is unpredictability encircling fiat currency. Many factors affect the silver price in the global market, but the few and the most important ones are listed below.

Gold

Due to gold and silver historical relations, gold and silver are positively correlated, meaning when the gold is affected either positively or negatively, silver is affected too hence moving in the same direction.

Supply and demand

The silver price largely depends on the law of supply and demand. Nowadays, fewer industrial mining participants are getting involved in silver mining because it is less cost-effective.

At the same time, the modern demand for silver remains constant, except for the investors and traders taking part in it.

Inflation

The government can print money when they feel there is a need to do so. When they print more of it, the supplies of a currency increase, and then, there is inflation. Investors then choose to keep their money less affected by inflation and invest in silver, moving its price.

How to invest in silver?

Investing in silver is not an actual investment like gold as it does not bring in cash flow. But silver has its value in particular that makes it worth investing in.

You will see silver typically showing a price increase when there is unpredictability encircling fiat currency. Silver shows a higher profit in a bullish market, making it a great asset to invest in. Because gold is more famous and preferred by the investor at large, the small market gives an excellent opportunity for safer investment with having liquid in the market.

Typically silver investors look at silver investing as buying when the price is low and selling it when the prices are high. Investing in silver is easy, and you could do so by using different investment approaches.

Silver bullion

Any metal available in physical forms like coins and bars is called bullion. Silver coins are one of the most popularly purchased types of bullion. The fact that they’re smaller in size, they’re simple to buy in quantity and store at home.

The coins are made of 99.9% pure silver. The government has the authority to create coins worldwide. One way to profit from silver bullion is to buy it when the price is low and hold it for long until its price increases significantly.

Few famous coins that you may choose to buy are American Silver, Canadian Silver Maple, and British Silver. All the forms of bullion like coins, bars, and rounds tend to trail the spot and market prices of silver.

Silver stock

It is easy to understand and invest in it, just like investing in any other stock. Silver stocks allow you to invest without having to buy and sell physical silver. Unlike buying silver bullion, purchasing silver stock does not require you to deal with the actual commodity.

When you buy silver stock, you’re investing in a company associated directly or indirectly with the silver industry. Such association might be from companies mining silver to distributing it and making silver jewelry like silver earrings, bracelets, etc.

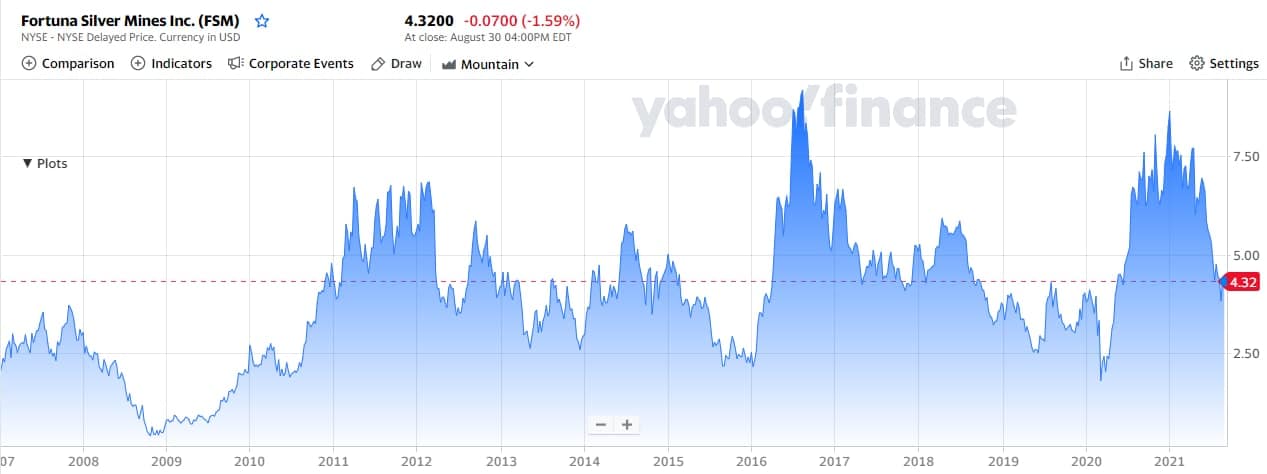

Fortuna Silver Mines Inc. chart

Fortuna Silver Mines, a Canadian mining company, is considered a high-value silver stock. They specialize in silver mining in Latin America, also operating lead, zinc, and gold mines.

Mutual funds, ETFs and ETNs

Investors must consider exchange-traded funds to diversify into silver and other metals. They are traded on a stock exchange, but they have more benefits than just stocks.

You can invest in a basket of assets with a silver ETF. Stocks, bonds, tangible commodities, and other assets are examples of these assets.

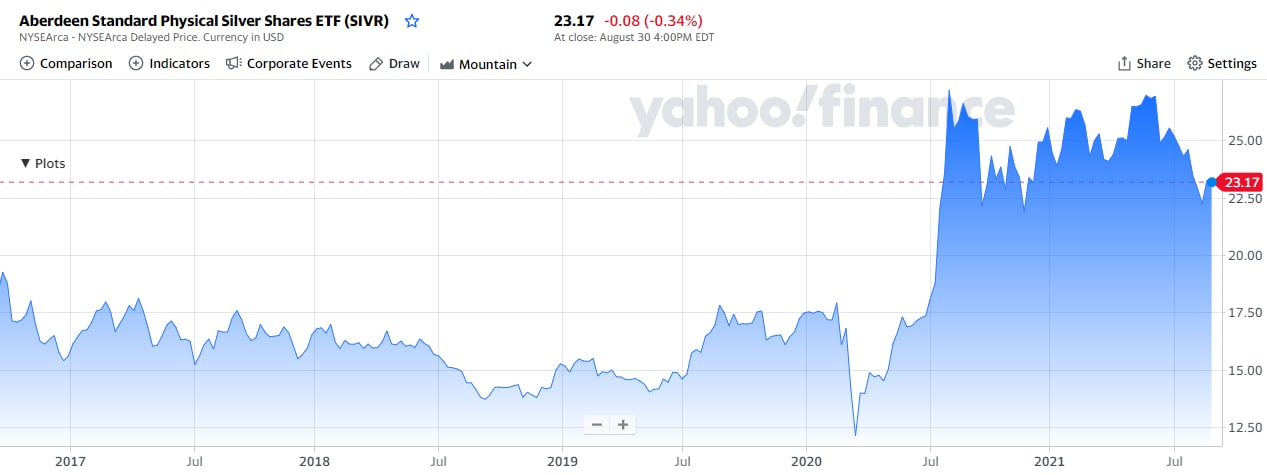

Aberdeen Standard Physical Silver Shares ETF (SIVR) chart

Aberdeen Standard Physical Silver Shares ETF is an excellent example of a silver ETF. It is structured as a grantor trust and is physically backed by silver bullion and coins held in a vault on behalf of investors. SIVR shows 51.6% 1-year trailing total returns. Standard Life Aberdeen is the issuing company of SIVR. 3-month average daily volume: 674,577

SIVR may be a valuable and safe investment during market uncertainty, but it may not be attractive as a long-term, buy-and-hold investment.

Although an ETF holds several assets, you do not have to buy and sell them all simultaneously. You can sell them in units, which allows you to expand your portfolio quickly and easily.

Pros and cons of silver investing

Before investing your hard-earned money, it is always better to look into both the positive and negative sides of the coin, in this case, silver. Let us quickly look at the pros and cons of investing in silver.

Pros |

Cons |

Silver gives an excellent opportunity for small investors to invest and profit from its price gains.

Silver is a liquid market making it suitable for investors and traders to participate and profit.

Silver is less correlated to other assets such as stock and bonds. This factor here can be an added advantage to choose silver for hedging. |

Industrial demand is a major concern for silver investing; the economic data can influence silver prices.

Industries using silver in their work process can replace silver with other cheaper metals shortly.

Silver does not give high returns like gold, stocks, and bonds. It may be good to hold it, but keeping physical silver is not practical as the world moves towards digitalization. |

Final thoughts

Investing in any form is risky, so it is always better to keep your investment low and learn about the market. Silver investment is not appropriate for everyone as major investors would choose a cash-flow high return business than silver.

Comments