Financial independence in the current world we live in is within reach. Hence, the requirement, dare to invest whichever amount you have. With $100 nowadays, you can have a diversified portfolio, unlike previously when the condition to be part of the stock markets was hundreds of thousands of dollars.

Attaining wealth growth and meeting all financial needs and goals comfortably requires more than a single income stream. By thinking about investing $100, you have made the first step towards attaining financial freedom. This guide helps highlight the investment options available for $100 with the highest potential for growth and income generation.

№ 1. Day trading

One does not necessarily have to own a certificate of shares to be part of the stock markets. For as low as $10, potential investors get exposure to the stock markets through a contract for differences while day trading.

However, this option requires a lot of market research and development of trading and money management strategies to avoid going bankrupt. Data shows that more than 75% of the day trading market participants lose all their investment. According to day trading experts, the first step to minimizing the inherent risk in this market involves having only four open deals in a trading week, especially if the trades are still negative.

Contract for differences involves speculating on the next price movement and making a tidy profit if the prediction is correct. Online brokers have made the stock markets available to everyone by having different accounts to cater to the various investment budgets:

- Standard lot-size accounts

Trade using 100,000 units

- Mini lot-size accounts

Trade using 10,000 units

- Micro lot-size account

Trade using 1000 units

- Nano lot-size account

Trade using 100 units

Lot sizes are the unit of measure for trading transactions. The more the budget, the more ideal it is to trade using larger lot sizes and vice versa. For example, the ideal trading accounts for a $100 investment budget are a nano-size account and the micro lot-size account.

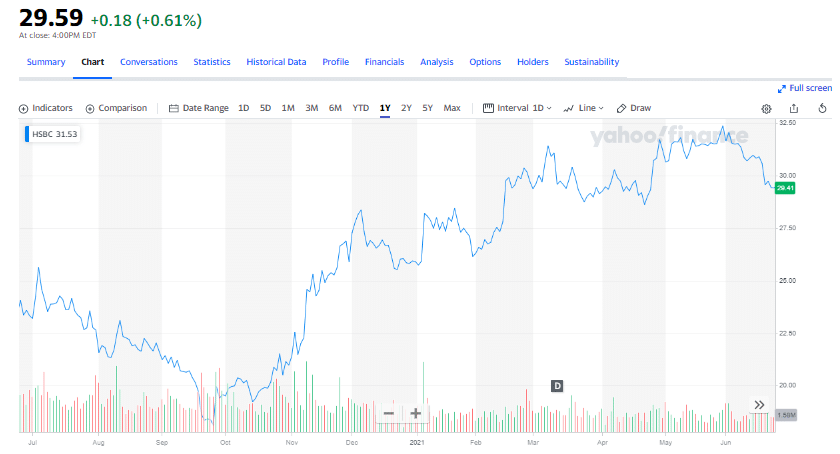

For example, post-pandemic organizations are looking for financing to resume capacity normalcy as fast as possible. Financial institutions are therefore in pole position to grow post coronavirus pandemic. Via CFDs, staking just $20 of the $100 investment budget on HSBC holding going long, a leading global financial institution, on the 24th, would have resulted in $5.2 profit. Its stocks had a bullish rally on the day from $29.42 to $29.68. It is a return on investment of 26% in a single trading day.

№ 2. Fractional investing

Many of the most lucrative stock equities in terms of growth and dividends are outside the $100 investment budget. The beauty of necessity is that it truly is the mother of all inventions, hence the growth of fractional investing.

Online investment brokers seem to be hell-bent on ensuring no one has an excuse for not investing. You can buy a fraction of interest equity in their offering and enjoy the same returns and growth as investors holding actual certificates of shares. The lowest stock unit so far available is 1/1000000. And it doesn’t end with stocks only. Fractional investing extends to all the investment assets.

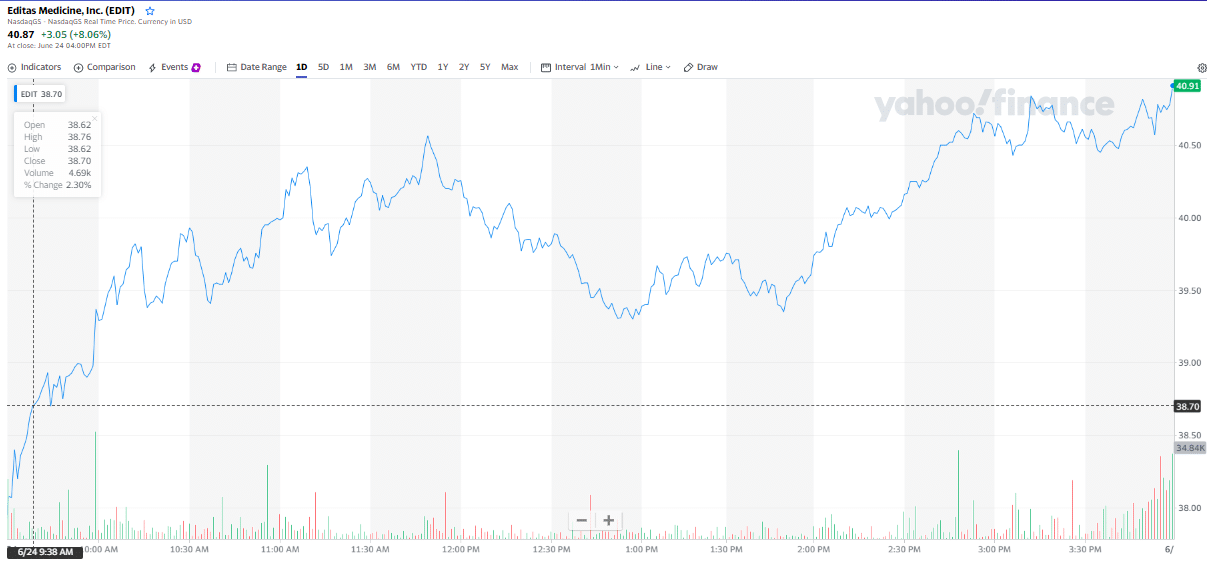

For example, Editas Medicine, one of the best speculative growth stocks of 2021, is currently trading at $40 at the time of writing. With $100, this amounts to only two shares. However, a $100 budget gets you a piece of Editas Medicine for 10$, Amazon Inc. for $20, Tesla for $10, among others, through fractional investing.

It is simply a way of building an investment portfolio within your budget while enjoying all the benefits in the investment world for a fraction of the cost. Therefore, $100 with fraction investing builds you a stock portfolio of choice to meet the desired investment objectives.

№ 3. Relatively cheap high-yield ETFs

The popularity of exchange-traded funds is attributable to their:

- Relatively lower cost

- Lower risk as an investment asset

- Consistent returns

Except for fractional investing, it is next to impossible to have a diversified stock portfolio with $100.

However, exchange-traded funds are a pool of investment assets tracking the performance of a particular index. A stock ETF, therefore, comprises different equity stocks and tracks a specific equity index. In addition, a high-yield ETF consists of stocks known to pay high dividends regularly. Thus, by investing $100 in a high-yield, low-cost stock ETF, an investor gets instant diversification and exposure to the stock market and a chance at regular and high dividend payouts.

As the economy resumes normalcy post-pandemic, all organizations in the different industries are scaling operations to deal with the rising consumer demands. Screening and investing in ETFs trading at less than $100 gives you instant exposure to a diversified stock portfolio. In addition, concentrating on high-yield ETFs results in regular income in the form of dividends, which will have the $100 grow tenfold if reinvested wisely.

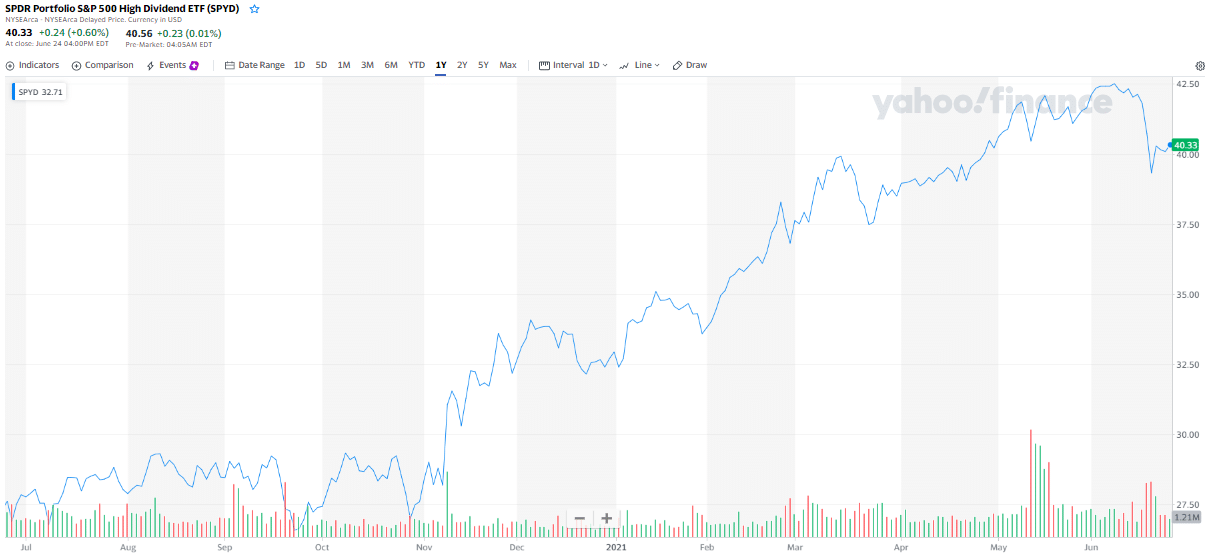

For example, the Standard and Poor’s 500 index comprises the best 500 equities across the US economic divide. Likewise, investing in the SPYD, SPDR Portfolio S&P 500 High Dividend ETF exposes an investor to 80 of the best dividend-paying companies from a list of the top 500 companies, making up the US domestic economy.

The SPYD had a yield of 4.95% in 2020. Therefore, investing $100 would translate to a $4.95 dividend. In 2021, the year-to-date return of this ETF currently stands at 25.59%. With its low expense ratio of 0.07%, it would cost only $0.07 to invest the $100.

Comments