Some scientists believe that we’re in biotechnology’s “golden age.” The biotech sector is presenting exciting opportunities for investors.

Many of the best biotech companies have robust drug candidate pipelines and winning drugs already on the market. The Covid-19 pandemic has also created massive opportunities for biotechnology companies to develop treatments and vaccines for the virus.

The biotech sector has grown exponentially since the pandemic and is expected to be worth $2.4 trillion by 2028 – one reason investors are keen to know what the hottest biotech stocks are.

What are biotech stocks?

Biotech stocks are among this latter group, as many of these innovative companies are burning cash as they research the next generation of potential cures. But as the old saying goes, be greedy when others are fearful – and before the rest of Wall Street piles in to drive a significant rebound.

Each of these companies in the list of biotech stocks above has a certain specialism within the biotech sector. Some focus on developing drugs for specific conditions such as Alzheimer’s, and others focus on producing vaccines for certain infectious diseases like Covid-19 to treat the coronavirus.

Let’s find out more about the best biotech stocks to invest in this year.

How to buy biotech stocks?

- Select an online stockbroker.

- Research the stocks you want to buy.

- Decide how many shares to buy.

- Choose your stock order type.

- Optimize your stock portfolio.

Top three crypto biotech stocks to buy in 2022

These are a few biotech companies to watch closely.

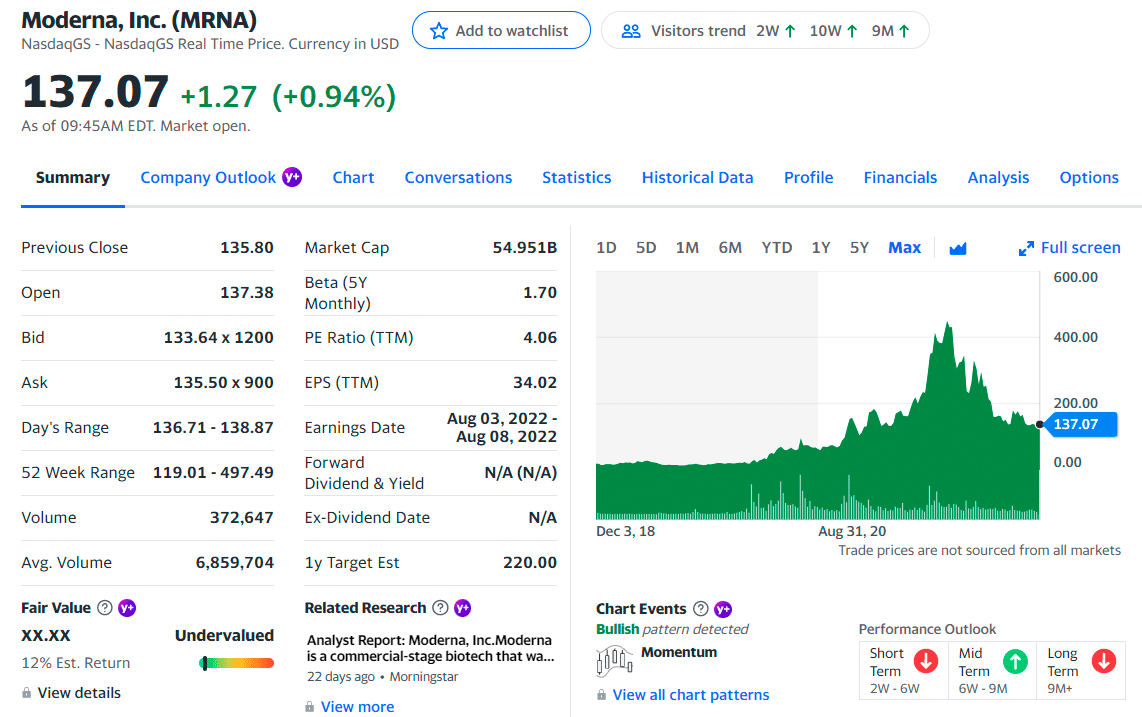

No. 1. Moderna (MRNA)

Price: $137.07

EPS: 34.02

Market cap: $54.95B

MRNA summary

It is a relatively new biotech company that went public in December 2018. The company specializes in developing medicines based on messenger ribonucleic acid (mRNA) technology. Its market cap of $60 billion.

Currently, Moderna has a strong pipeline of therapies using mRNA technology. This includes cancer vaccines, intratumoral immunology, regenerative therapeutics, and antibody vaccines.

Last year, Moderna produced revenues of $18.5 billion, creating a net income of $12 billion. While most of this was from the Covid-19 vaccine, the biotech company has several vaccine candidates in the pipeline that could add to the bottom line as the need for the Covid-19 vaccine dissipates.

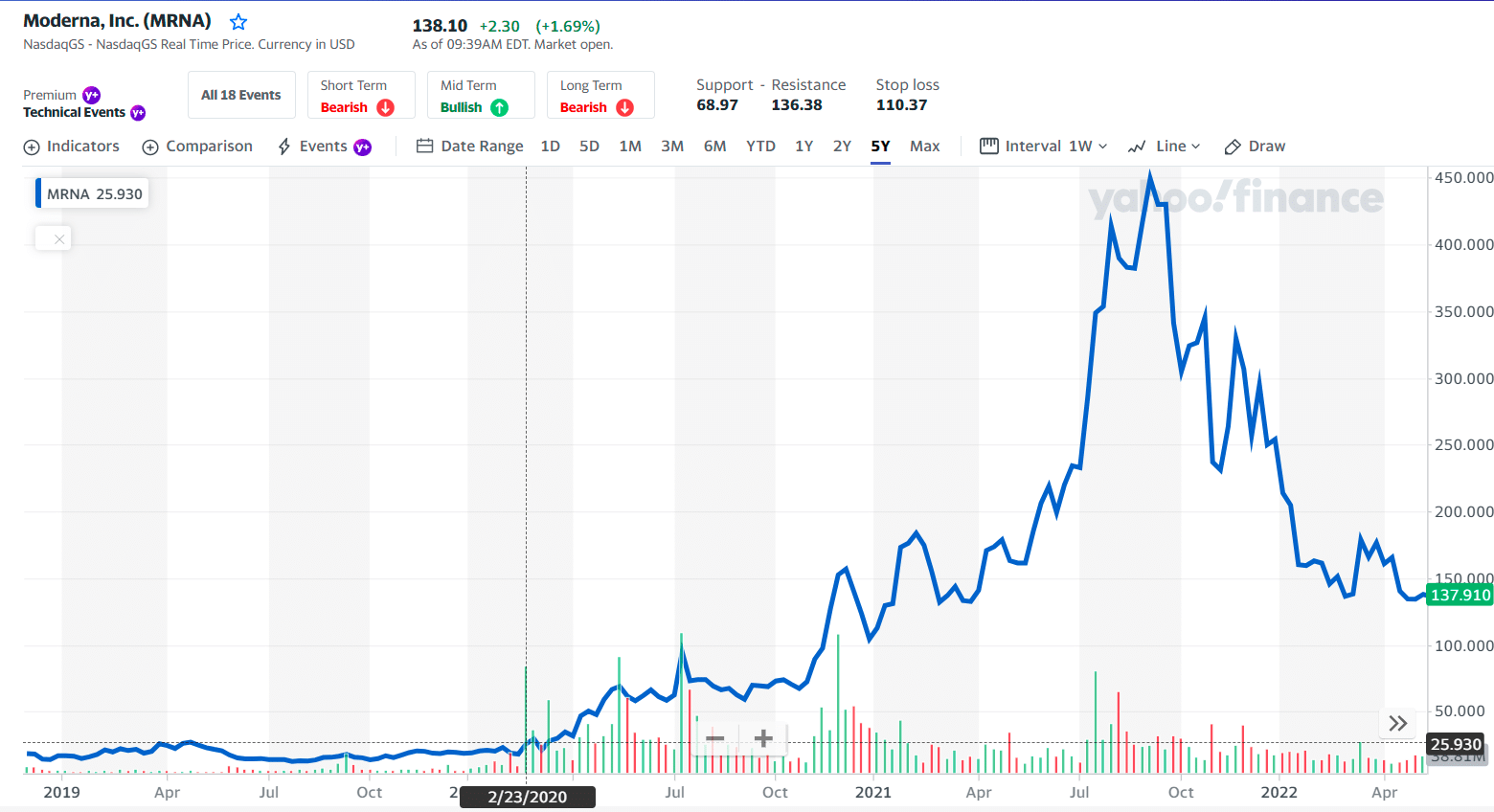

MRNA price chart

Since its IPO in December 2018, the stock rocketed more than 3,200% higher to an all-time high of $497.49 in August 2021. The stock is now down nearly 70%, providing an attractive long-term opportunity for patient investors.

The first three holdings:

- Baillie Gifford and Company — 11.47%

- Blackrock Inc. — 7.21%

- Vanguard Group, Inc. — 6.80%

MRNA price prediction

The stock lies in the middle of a vast and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -12.41% during the next three months. With a 90% probability, hold a price between $91.49 and $147.99 at the end of these three months.

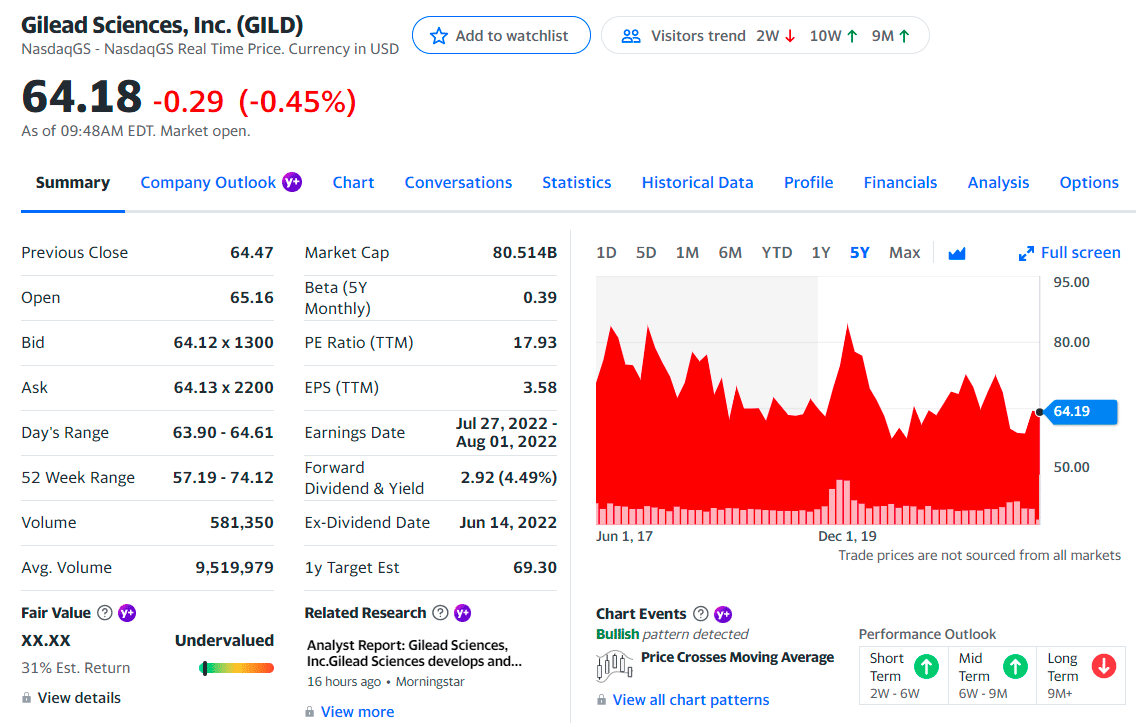

No. 2. Gilead Sciences (GILD)

Price: $64.18

EPS: 3.58

Market cap: 80.51B

GILD summary

It is another leader in the biotech sector with a market cap of $78 billion. The American-based company focuses on researching and developing antiviral drugs used to treat HIV/AIDS, hepatitis B, hepatitis C, and influenza.

In March 2019, Daniel O’Day took over as CEO and turned the company around after a long period of falling sales. It evolved from a biotech company to a pharmaceutical company by acquiring several healthcare entities.

The company has revenues of around $27 billion a year, producing a net income of about $6 billion a year. Gilead’s stock price also makes a current annual dividend yield of 4.66%. This is very high for most dividend companies, especially biotech companies that usually reinvest their profits for growth rather than pay them out in dividends to shareholders.

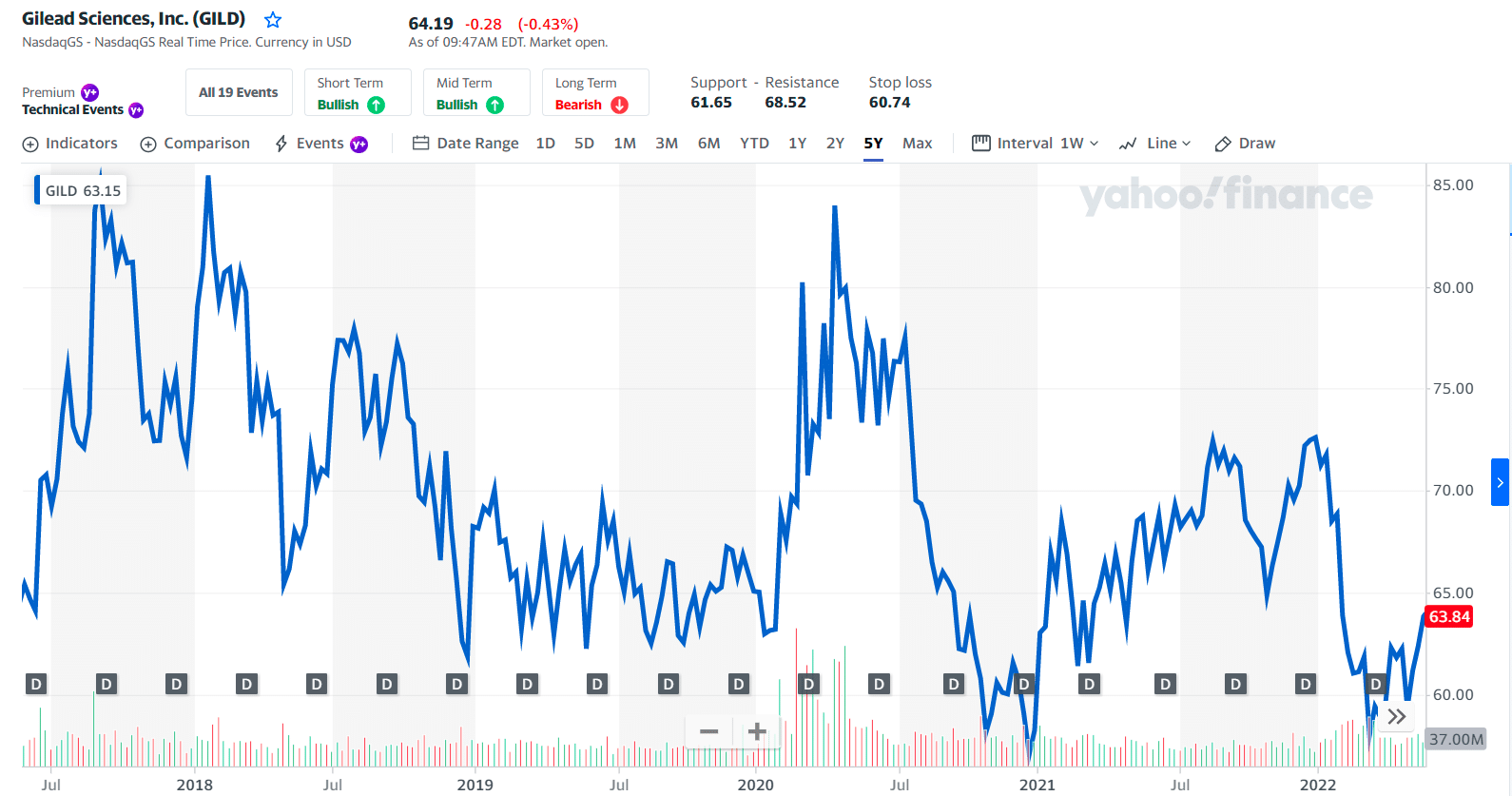

GILD price chart

The stock price performed well from 2010 to 2015 when it recorded an all-time high of $123.37 in June 2015. Since then, the stock price has fallen around 50%, providing a good dividend yield and one of the cheapest biotech stocks to buy.

The first three holdings:

- Blackrock Inc. — 9.70%

- Vanguard Group, Inc. — 8.42%

- State Street Corporation — 4.62%

GILD price prediction

The stock lies in the upper part of a weak rising trend in the short term, and this may typically pose a perfect selling opportunity for the short-term trader as a reaction back towards the lower part of the trend can be expected.

Given the current short-term trend, the stock is expected to rise 7.16% during the next three months. A break-up at the top trend line at $65.08 will indicate a more robust rising rate. With a 90% probability, hold a price between $65.02 and $69.74 at the end of these three months.

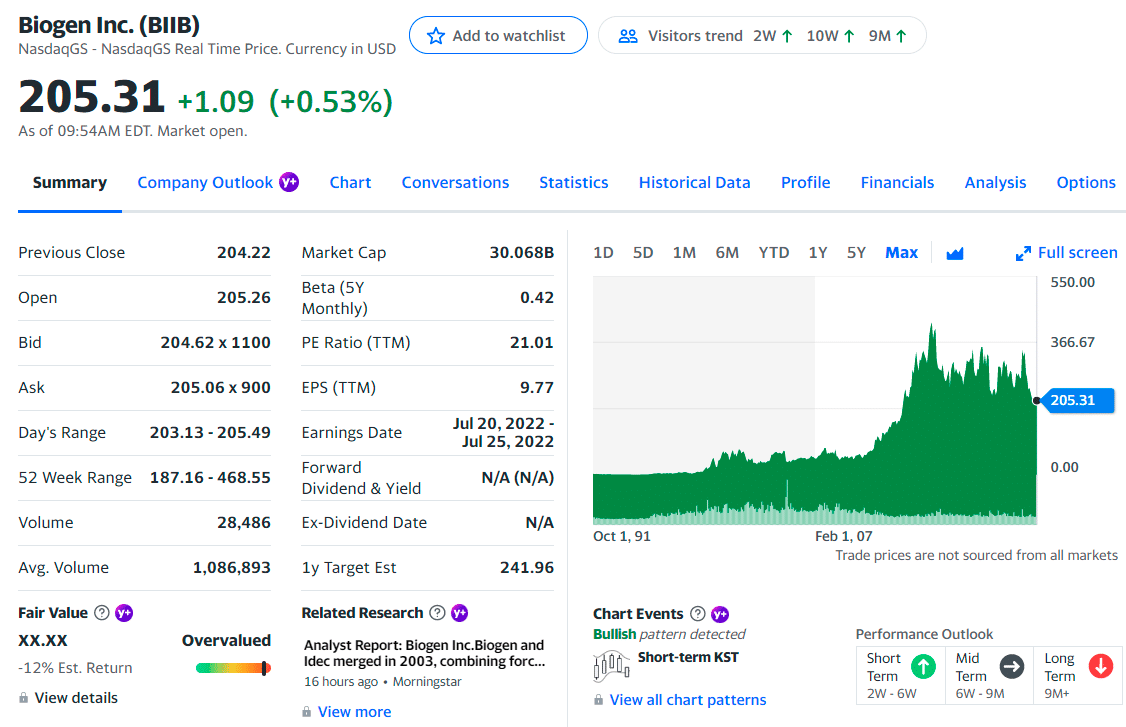

No. 3. Biogen (BIIB)

Price: $205.31

EPS: 9.77

Market cap: 30.06B

BIIB summary

It is an American multinational biotech company with a market cap of roughly $31 billion. The company focuses on discovering, developing, and delivering treatments for neurodegenerative diseases such as Alzheimer’s, Parkinson’s, multiple sclerosis, etc.

Biogen has revenues of around $10 billion a year, which provides a net income of roughly $1.7 billion a year. The company does not pay any dividends.

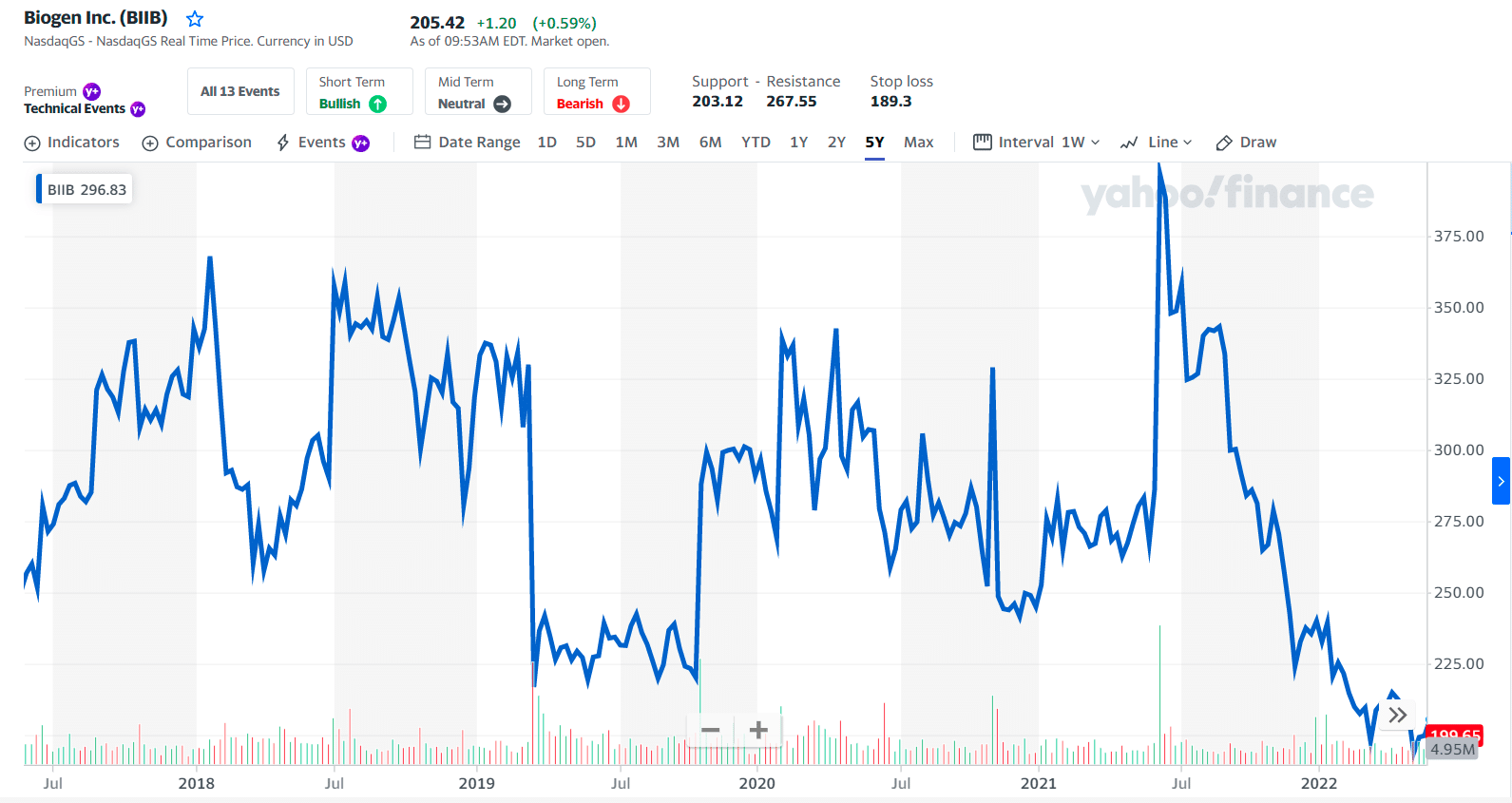

BIIB price chart

From 2008 to 2017 Biogen’s stock price rocketed more than 1,100% higher to create an all-time high of $442.29 in March 2015. Since then, the stock price has traded between $442.29 and $215.53.

The first three holdings:

- Primecap Management Company — 10.81%

- Vanguard Group, Inc. — 9.64%

- State Street Corporation — 4.92%

BIIB price prediction

The stock lies in the middle of a wide, falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 3.56% during the next three months. With a 90% probability, hold a price between $179.23 and $211.68 at the end of these three months.

Final thoughts

The whole sector has been left behind as other kinds of companies have soared. Will 2022 be our year? No one knows for sure. But careful analysis and prudent stock selection will always increase your odds of seeing clearly into your crystal ball.

Comments