The golf industry is one of the more underrated places to look for investment opportunities at this time, especially given the sport’s continued growth.

According to Statista, revenue from golf courses and country clubs is projected to reach approximately $24.6 billion in the US by 2024, which means there will certainly be companies that flourish.

There are plenty of reasons to believe why this trend might continue:

- Golf clubs are not cheap.

- Golf is a widespread business sport. 2022 will present the perfect opportunity for new golfers to show off their skills to business partners.

- The next few months are slated with massive golf tournaments.

It’s also important to consider that golf is a sport played by people of all ages, which means these types of products can be sold to almost anyone.

What are golf stocks?

Golf stocks include companies that design, develop, manufacture and distribute golf products. The golf club segment collects and sells golf bags, gloves, travel equipment, and headwear, including golf shoes and apparel.

How to buy golf stocks?

Some of the best golf stocks you will find below. You need to have an account with an online brokerage platform to buy them. When choosing the best stocks to invest in, you should conduct detailed research.

Top 3 golf stocks to buy in 2022

Below are some golf stocks that have some room to grow.

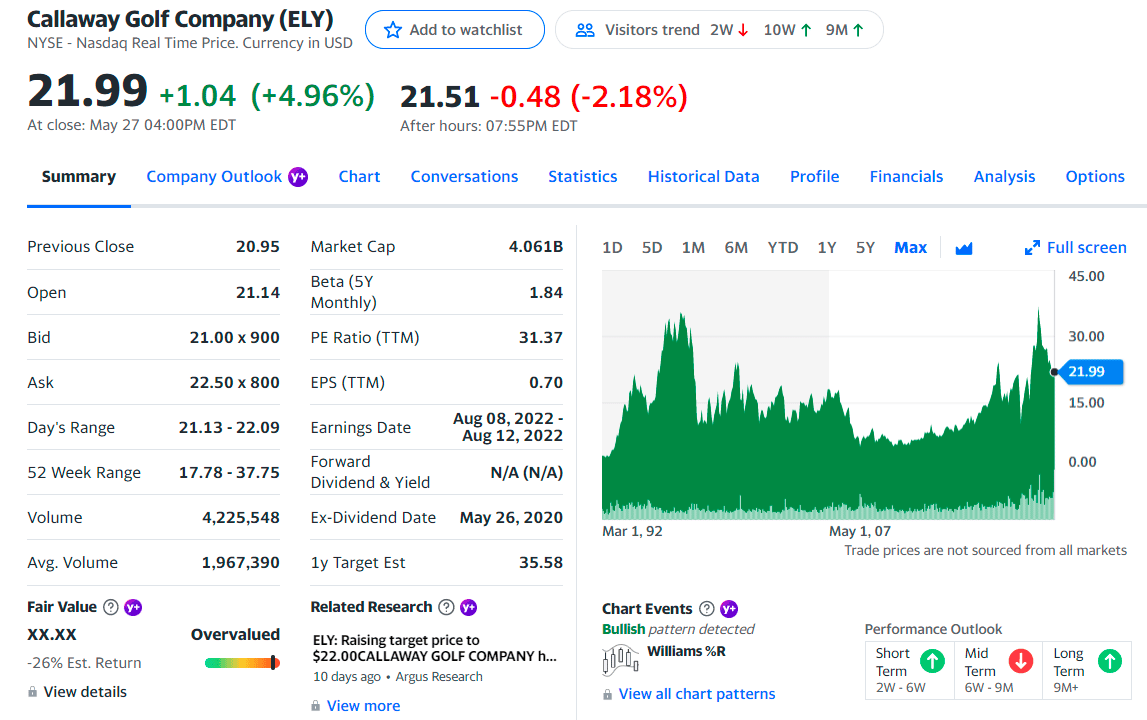

No. 1. Callaway Golf (ELY)

Price: $21.99

EPS: 0.70

Market cap: $4.06B

ELY summary

It is the dominant player in the golf industry. Callaway is a global provider of sports equipment, including clubs, balls, bags, gloves, and apparel.

One area of growth is a golf club and ball sales, said Callaway Chief Executive Chip Brewer, while the company’s apparel brands remained “resilient” in the wake of the economic downturn.

ELY stock is up 173% since the pandemic lows but off 27% YTD. Callaway’s acquisition of TopGolf last year contributed 35% of net revenue, even controlling for only a partial-year contribution.

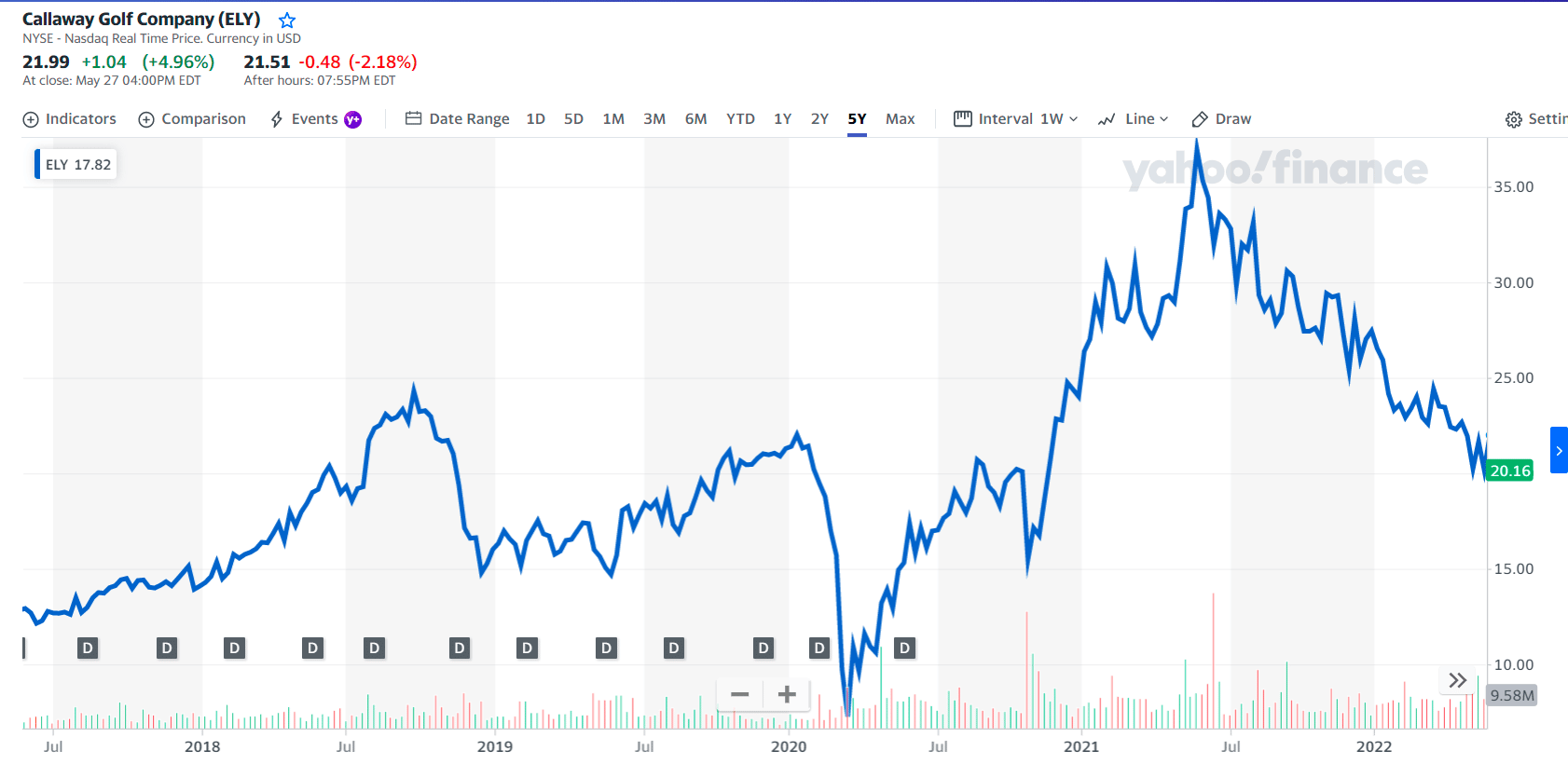

ELY price chart

The first holdings:

- Providence Equity Partners L.l.c. — 11.46%

- Blackrock Inc. — 7.01%

- Vanguard Group, Inc. — 6.73%

ELY price prediction

The stock lies in the upper part of a vast and falling trend in the short term, and this may typically pose a perfect selling opportunity for the short-term trader as a reaction back towards the lower part of the trend can be expected. A break up at the top trend line at $22.52 will indicate a slower falling rate but may be the first sign of a trend shift.

Given the current short-term trend, the stock is expected to fall -by 14.47% during the next three months and, with a 90% probability, hold a price between $14.69 and $19.26 at the end of these three months.

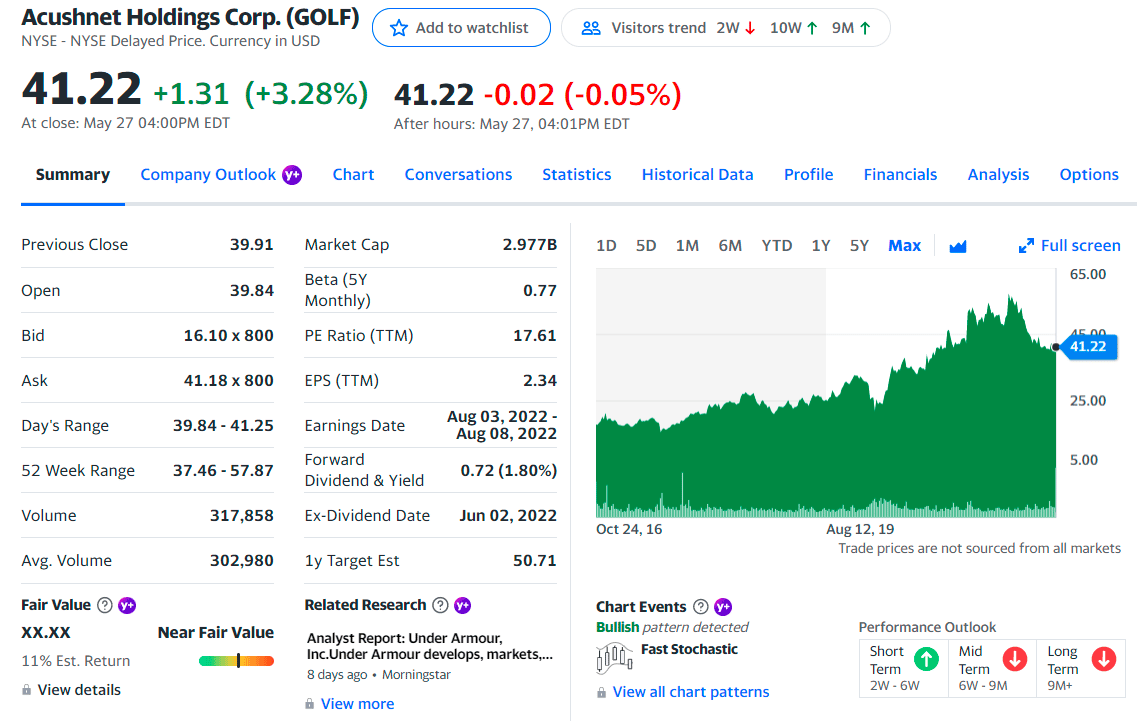

No. 2. Acushnet Holdings (GOLF)

Price: $41.22

EPS: 2.34

Market cap: 2.97B

GOLF summary

One thing to note is that Acushnet has done an excellent job managing its supply chain. CEO David Maher expects the company’s supply-side environment to clear up later in the year. He told analysts in 2020 that “the game and business of golf have been incredibly resilient over the past few months.”

In addition, Acushnet currently trades at a P/E ratio of just 17.61. This golf stock could be poised for a very strong year-end with all these factors in mind.

Acushnet’s stock is down 23% in 2022 but up 103% over the past five years.

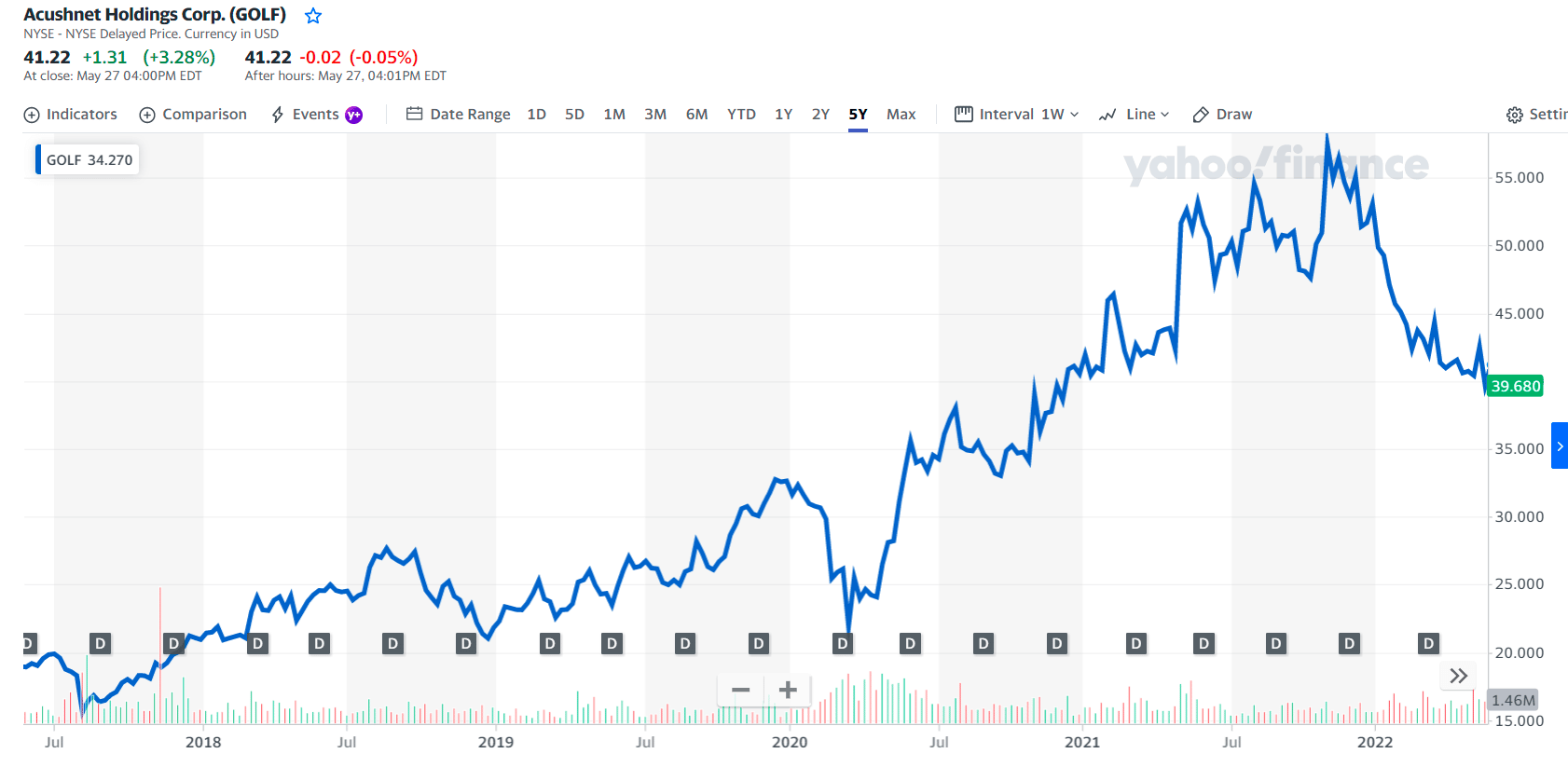

GOLF price chart

The company owns Titleist and FootJoy, another golf stock that indicated a big turnaround. The company said that demand for golf balls had been solid, indicating a pickup in rounds played.

The first three holdings:

- Kayne Anderson Rudnick Investment Management LLC — 11.16%

- Vanguard Group, Inc. — 4.33%

- Blackrock Inc. — 3.31%

GOLF price prediction

The stock lies in the middle of a wide and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 6.74% during the next three months and, with a 90% probability, hold a price between $35.29 and $39.71 at the end of these three months.

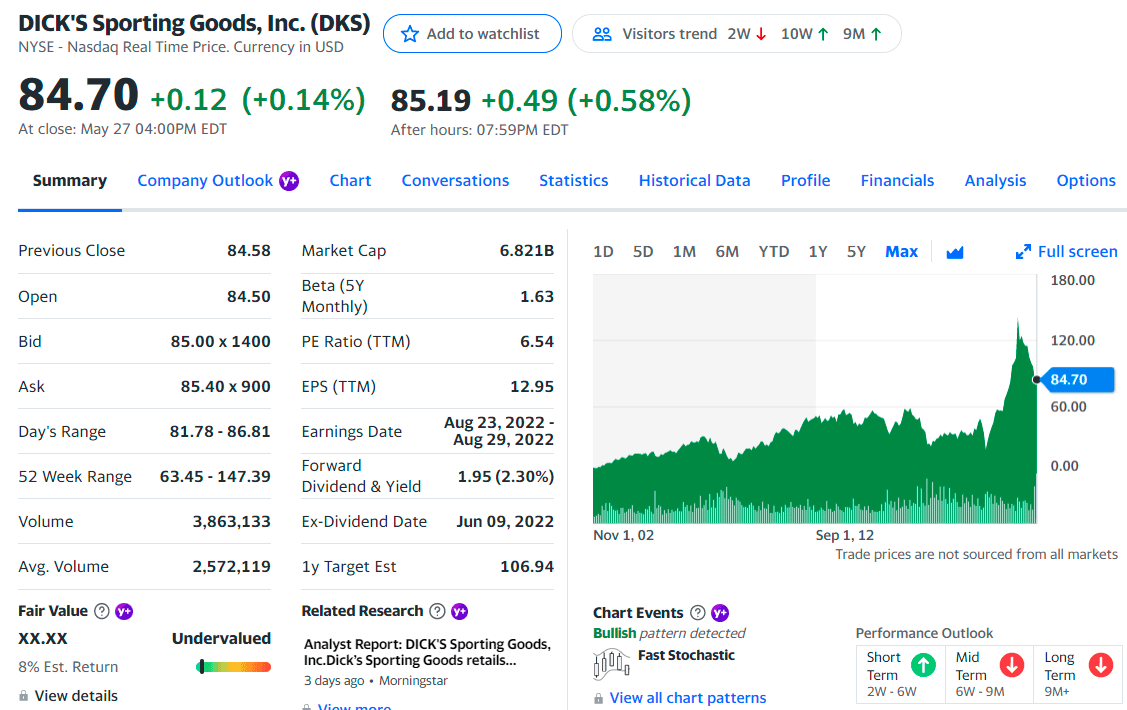

No. 3. Dick’s Sporting Goods (DKS)

Price: $84.70

EPS: $12.95

Market cap: 6.82B

DKS summary

The famous American sports goods retail company was founded in 1948. It was founded by Dick Stack at 18 and is now probably one of the biggest retailers that sell golf equipment and clothing in the US. The big name in sports brands is headquartered in Pennsylvania, United States.

You might think it’s a little unfair to label Dick’s Sporting Goods as one of the top golf stocks. After all, tons of retailers sell golf equipment. What about Walmart or Amazon? However, Dick’s Sporting Goods specializes in, well, sporting goods.

Dick’s currently owns 8% of the sporting goods retailer’s market, up from 7% in 2019. Dick’s attributed this gain in market share partly to a surge in sales of golf products.

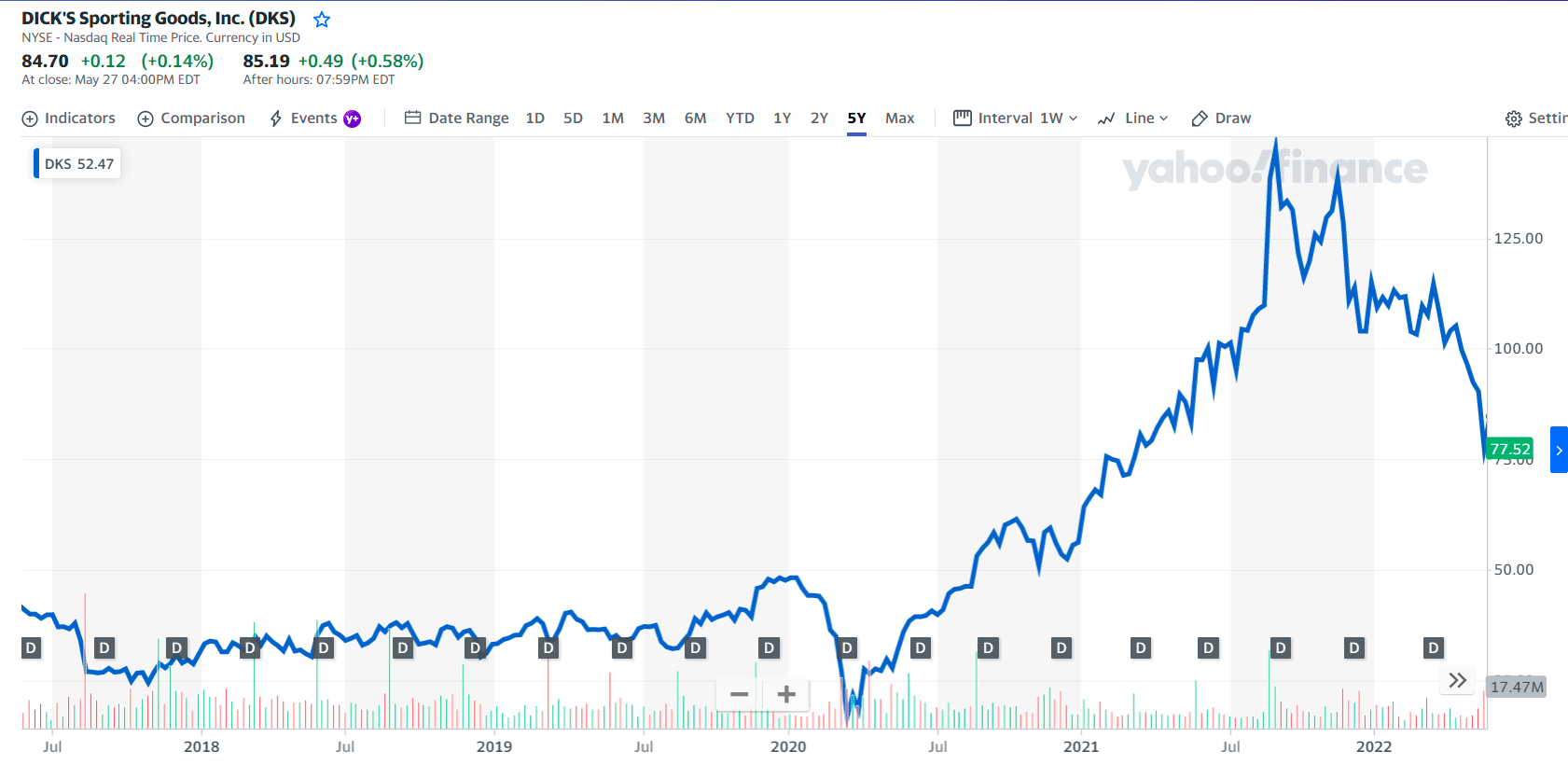

DKS price chart

The first three holdings:

- FMR, LLC — 16.28%

- Blackrock Inc. — 10.09%

- Vanguard Group, Inc. — 9.14%

DKS price prediction

The stock lies in the middle of an extensive and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 23.42% during the next three months and, with a 90% probability, hold a price between $53.49 and $72.88 at the end of these three months.

Final thoughts

When you think about how expensive golf equipment and apparel are and how the sport is popular in countries worldwide, investing in stocks with exposure to golf could end up being a hole-in-one opportunity.

Comments