A growing economy is crucial for copper demand as the metal is known for its excellent electrical conductivity. Copper is a material found in numerous applications such as televisions, air conditioning systems, cars, cabling systems, and more. Demand for this commodity is expected to double in 2030.

Due to the big copper demand in the transportation sector, investors are looking to capitalize on this interest. If you are one of these investors, make sure you do research. Investing in commodities is quite different from buying bonds and traditional stocks. The price of commodities such as copper moves due to various market drivers.

Let’s learn about the factors that affect the price of this asset, how to invest in it, and some other important info.

History of copper

The only metal known to man for around 5,000 years is copper, which has been in use for a long time before the discovery of gold. The man began using copper more than 10,000 years ago. The oldest record of copper being used in the application is the discovery of a pendant made of copper in a place now known as northern Iraq. Carbon dating traced the pendant as far back as 8,700 BC.

Copper has played an important role in industries for thousands of years and even today. Because of its widespread use, this commodity is widely traded. Industries around the world use vast amounts of copper. Thus, the asset seems to reflect the condition of the global market and is touted as the metal of the future.

What makes the price of a copper move?

Making sense of copper and the global economy

This commodity price is heavily affected by the condition of the economy. On the other hand, you can look at copper prices to understand the health of an economy. If the price is going up, it indicates a healthy economy. If the price is going down, it suggests a declining economy.

Many factors affect the price of copper. We listed and covered three aspects below:

- USD

Copper is pegged against US dollars, similar to most other globally traded commodities. If the USD declines in value, for example, concerning another currency, the buyer will pay less in his local currency to purchase a certain volume of this asset.

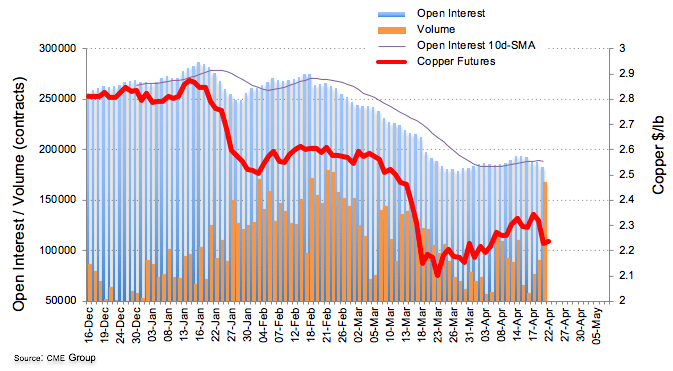

- Oil price

Refining copper requires a lot of energy. If the oil price goes up, the processing of copper becomes costly, resulting in a price increase.

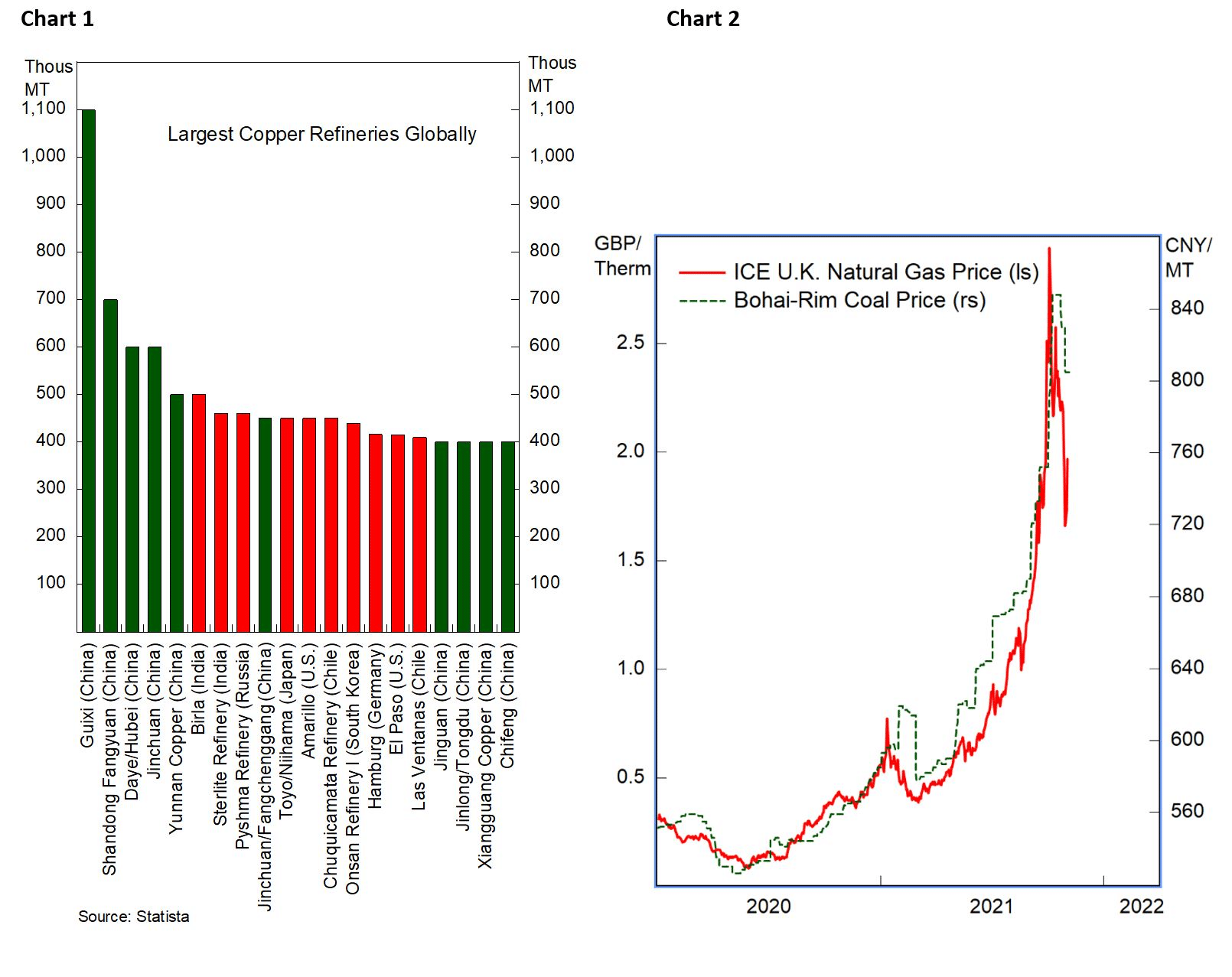

- Copper mine supply

This commodity price is affected by the available supply of copper ores, mining cost, and ore quality. Unexpected natural and man-made events can cause copper price hikes. These include bad weather, earthquakes, political turmoil, worker strikes, etc.

How to invest in this commodity directly?

One way to invest in copper is to buy copper and store it in its physical forms, such as copper coins and bullion bars. While not as direct as the previous options, you can also purchase copper futures.

- Bullion bars

Similar to silver and gold, you can buy copper bullion bars from metal dealers.

- Copper coins

Storing copper coins is more convenient than bullion bars. You can get smaller sizes of copper coins and copper rounds from independent dealers.

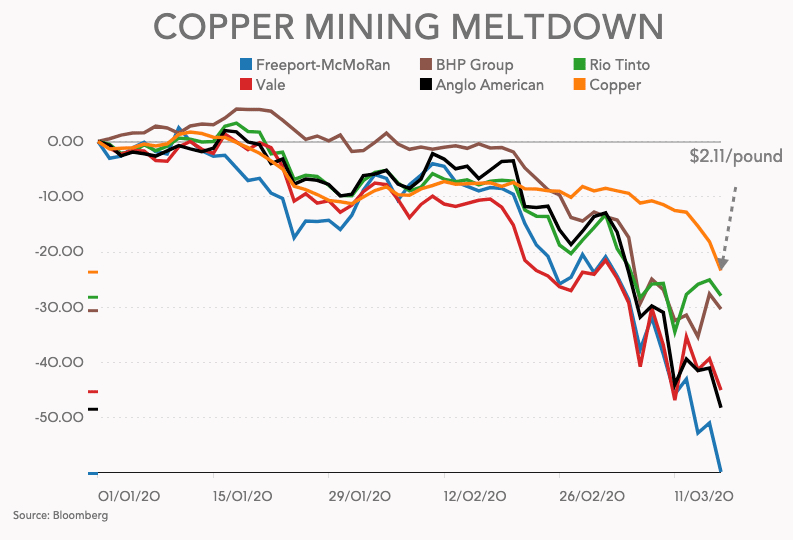

- Copper futures

You can buy copper futures through contracts. A futures contract involves buying or selling a specific amount of the commodity at later expiry date. As a contract holder, you can either close the position ahead of contract expiration or roll it over with a new contract.

Copper futures

How to invest in this commodity indirectly?

Indirect copper investing means you will not get the asset in its physical form. You will invest in entities that operate in the copper industry.

- Mining stocks

There are plenty of mining companies in the stock market, so you have a lot of options to get involved in equity investing.

Copper price meltdown sinks mining stocks

- ETFs

Another great option is copper ETFs, which allow you to spread your risk among multiple stocks. Some ETFs may include holdings that focus on copper mining, futures, or physical copper.

- Mutual funds

An alternative to ETFs is mutual funds. You can buy mutual funds that contain a basket of companies operating in the copper sector. Some mutual funds focusing on natural resources cover stocks engaged in mining.

- Options

These assets allow you to bet on the future direction of an asset. You can buy stock options or ETF options that engage in the copper business when you take this route.

Upsides and downsides of investing in copper

Before you think about investing your money, it is a good policy to consider the positive and negative aspects of an investment, in this case, copper. Let us look into the upsides and downsides of this commodity investing in this section.

Upsides of investing in copper

- There are many ways to get exposure to the copper market. Copper is the third most popular commodity after gold and silver. When you decide to get involved in copper, you have many ways to invest.

- Because of the multifarious applications of copper in many sectors, you can use it as a hedge when the economy is strengthening. This way, you can limit the effect of inflation on the value of your other investments vulnerable to this phenomenon.

Downsides of investing in copper

- As a widely used metal in industries, copper demand may drastically decline in times of economic turmoil.

- When you invest in ETFs or mutual funds, you might get little engagement to the copper sector compared to other stocks in the portfolio.

- When you buy copper in its physical form, you might incur additional costs related to insurance, storage, etc.

- It is a volatile investment asset, and you can see it oscillate wildly in a short time frame. Apart from being controversial, copper mining is also an expensive venture. Governments might implement regulatory control if the mining activity threatens the health and safety of workers or harshly affects the environment.

Final thoughts

As discussed in the previous sections, you have plenty of options for investing. You can invest in physical copper, stocks, futures, ETFs, options, or mutual funds.

The copper mining industry is generally a risky investment, whatever the world’s condition. A safer alternative would be investing in copper stocks that operate outside of mining. Because of the inherent risk, limiting your exposure to the copper sector is a good idea.

Comments