There is a wide array of investment assets available, from stocks, ETFs, index funds, mutual funds to bonds. And choosing the best is a difficult task for any stakeholder. Bonds seem to be a safe investment option since it generates a consistent income over a long term, and they are not as volatile as stocks.

Understanding bonds is a mystery to many new investors, but you will discover it’s a cleverly constructed investment asset if you read further on. Let’s learn how they work, why they are worth investing in, and the risks associated with bond purchases.

What are bonds?

They are loans that corporations or government institutions require to bring in their capital for projects or other expenditures. The entity that needs the money issues bonds to potential stakeholders to acquire.

The bond carries interest payable to the investor for the duration of the loan; this interest is the yield that investors receive for the period of the bond. Once the bond reaches its payback term, the bond issuer must repay the primary amount to investors.

How do bonds work?

Let’s illustrate how bonds work with a practical example. A company, ABC Holdings, is researching methods to reduce plastic waste. ABC holdings lack the funding for the research and have issued corporate bonds to raise funds.

The cost of the research project is $100 000. To obtain the funds, ABC Holdings will sell bonds on the secondary market through a broker. Each bond is worth $1000 has an interest rate of 6%; ABC holdings pay interest to stakeholders for the length of the bond.

After five years, the investors sell the bonds back to the company and receive the invested cash component. This way, ABC Holdings can start their research project, and the investors receive yields for the duration of the bond.

What to consider when investing in bonds?

We explained in a pretty simple way how bonds work. However, it is not as forthright as that. There are few things to consider before investing.

- How to invest in bonds?

- When is the best time to invest in bonds?

How to invest in bonds?

To answer this question, we explain the different types and how to purchase bonds.

- Government bonds

The government issues bonds as a means to raise funds to cover their expenditures. These are similar to T-bonds, the main difference being the term of the bonds. The period of government bonds is more than one year, and T-bonds can mature within a year.

- Treasury bonds (T-bonds)

The Treasury’s job is to ensure the government has sufficient funding to cover its expenses. One way of raising money is to issue bonds to investors, and these are commonly called T-bonds.

- Municipal bonds

These are bonds issued by the municipality to fund infrastructure works like schools, new roads, hospitals, etc.

- Corporate bonds

These are bonds issued by corporations to secure new projects, purchase new equipment, pay dividends to their shareholders, or buy back shares.

- High yield bonds

The company that issues the bond, in this case, has a poor credit rating, and these are high-risk entities as the risk is that they can default on payments. Therefore, the interest or yield on these bonds is more significant than regular bonds since they want to attract more investors.

- Callable bonds

These are bonds that mature earlier, and the issuer can redeem them by settling their debt earlier.

Venture capital firms, brokers, and issuing government entities give you access to purchase bonds. You can either buy new-issue bonds or on the secondary market.

New issue bonds are a bit harder to access for individual investors as you need to buy them from a bank or broker. Having a relationship with the bank or brokerage gives you better chances of access to purchase.

Procurement of government bonds is possible directly from the Treasury; these bonds are issued in increments and are usually on auction a few times a year.

When is the best time to buy bonds?

Before buying, it’s better to consider the current state of the economy. If the economy is stabilizing, interest rates will increase. Therefore, investors will sell off their bonds and either purchase bonds with better interest rates or diversify into other assets like stocks or ETFs.

The notion is to buy bonds when the economy is struggling since they are a stable income and interest rates tend to be lower, eliminating the competition.

Investors buy bonds during economic instability because protecting the capital of these loans is a priority for investors. They would instead buy bonds at lower interest rates and receive fixed income than invest in riskier assets.

However, it’s not as cut and dry since inflation can significantly affect bond yields. For example, during the 2008 recession, the Federal Reserve (Fed) executed the Quantitative Easing policy, which is simply increasing liquidity. But this liquidity occurred over four to five years, thereby keeping inflation under control. Therefore, it was an excellent time to buy bonds.

The other scenario was the recent Covid-19 pandemic, and the Fed took the same approach; however, the speed at which they raised liquidity was in one year. And this increased inflation-causing investors to avoid buying bonds as the yields were lower.

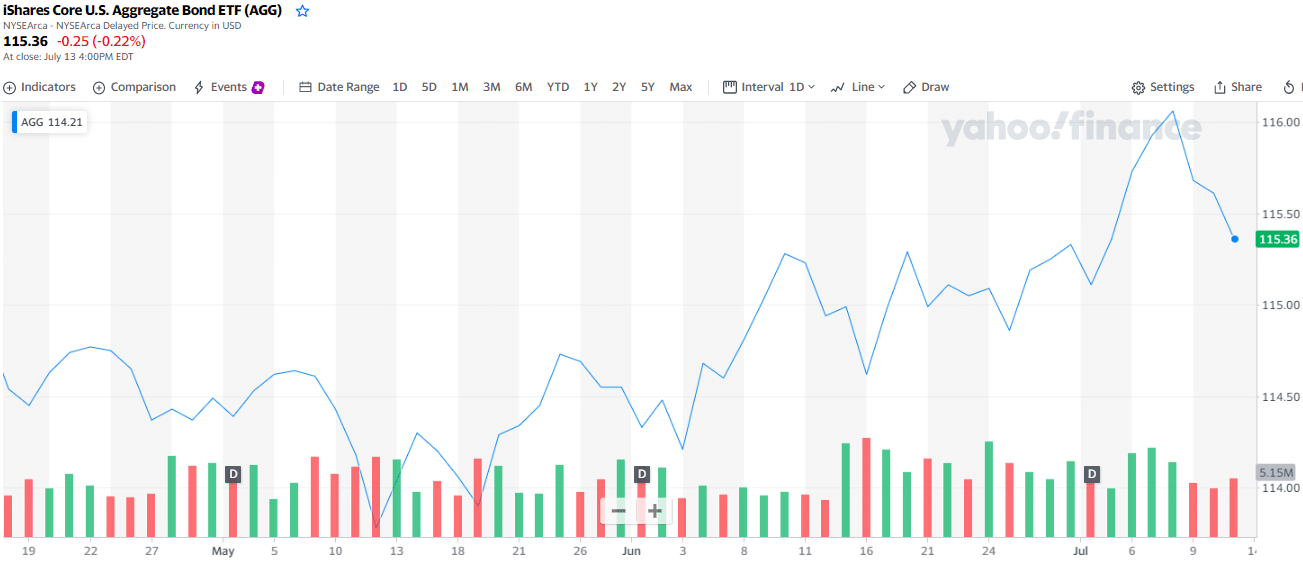

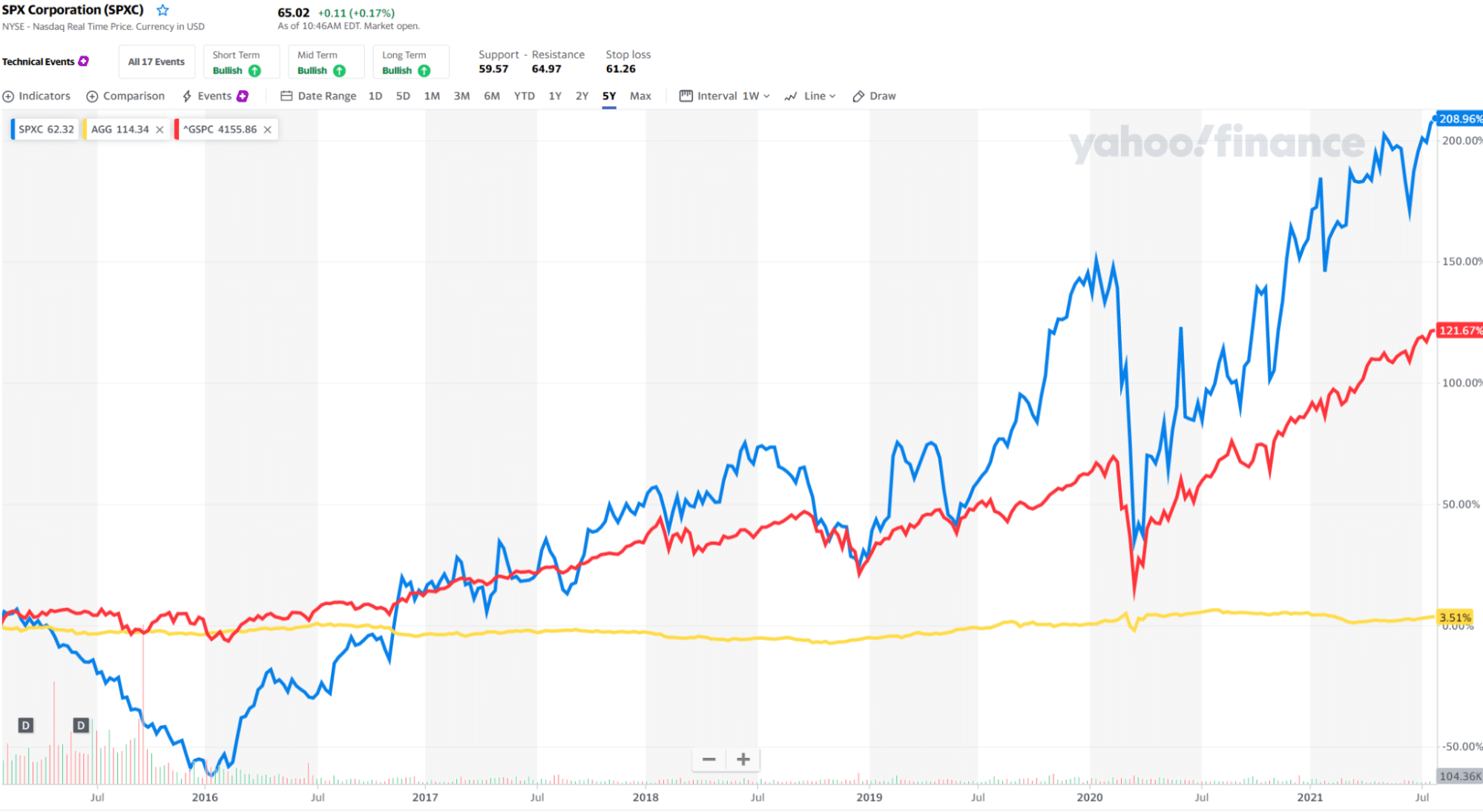

Let’s look at comparing the performance of Vanguard Long Term Bond ETF and iShares Core US Aggregate Bond ETF vs. the S&P 500 Index. The S&P 500 has been outperforming both funds since 2016, but noticeable is the consistency of both funds’ performance.

Some significant risks should be under consideration to new investors before acquiring bonds.

- Creditworthiness

Entities with poor credit ratings are a risk since they can default on payments, and in worse cases, if they liquidate before the term of the bond, investors are at risk of not receiving their principal amount. Therefore, assessing the issuer’s creditworthiness is critical, and you have to be mindful of the dangers before investing.

These bonds reward higher yields because of the amplified risk, making them appealing to investors.

- High-interest rates

Bond issuers pay a fixed interest rate; therefore, when interest rates increase, the yield on the bonds decreases. There exists an inverse correlation between interest rates and bond yields.

- High inflation

When you purchase bonds below the rate of inflation, and it increases in the future, it will reduce the purchasing power of the bonds. And it will facilitate your yield on your bond.

Final thoughts

From the surface, buying bonds seems safe and a less complicated process. However, considering the current economic state due to the pandemic, investors should consider how they spend their money.

Oversight of the risks that we highlighted can lead to significant losses to investors. Nevertheless, making an informed decision, bonds can be a safe investment as they generate a consistent income, especially to investors who are close to retirement; and a plus is that you can diversify your portfolio by balancing the returns across multiple assets.

Comments