The Covid-19 crisis caused troubles and disruptions in the operations of nearly all financial entities. Due to the severity of the crisis and its potential consequences, a response was necessary.

Amid the economic crisis prompted by the coronavirus, the world’s major central banks urged lenders not to pay dividends to their shareholders. They also strongly advised against purchases of banks’ shares, which can also benefit the stockholders.

The rationale behind it was that the banks, by holding on to cash, will be better equipped to weather any sudden shocks that could arise during uncertain times, such as the crisis we are experiencing right now. In this article, let us see if this dividend shift change matters and if yes, then how?

What changed?

The Federal Reserve announced that the national banks are now allowed to resume buyback of shares in the first quarter of 2021. These buybacks of shares can be done by following specific rules. The Fed also said that the dividends would continue to be limited. The total bank’s dividends and share buybacks in the first quarter cannot exceed the average quarterly profit from the four most recent quarters.

Now the one reason that could have triggered Fed’s to take this decision would be — recovery. Or hopes of healing, to be exact. As the vaccination process against Covid-19 is picking up pace worldwide, more and more world economies and their central banks are starting to feel better about the future.

That’s why both the United States Federal Reserve and the European Central Bank announced that the pandemic-era limitations would soon be lifted or at least eased. Many lenders across the US took advantage of the hint and hurried to change their policies accordingly. The whole scenario is giving a sense that now banks can buy back shares to pay dividends to their investors.

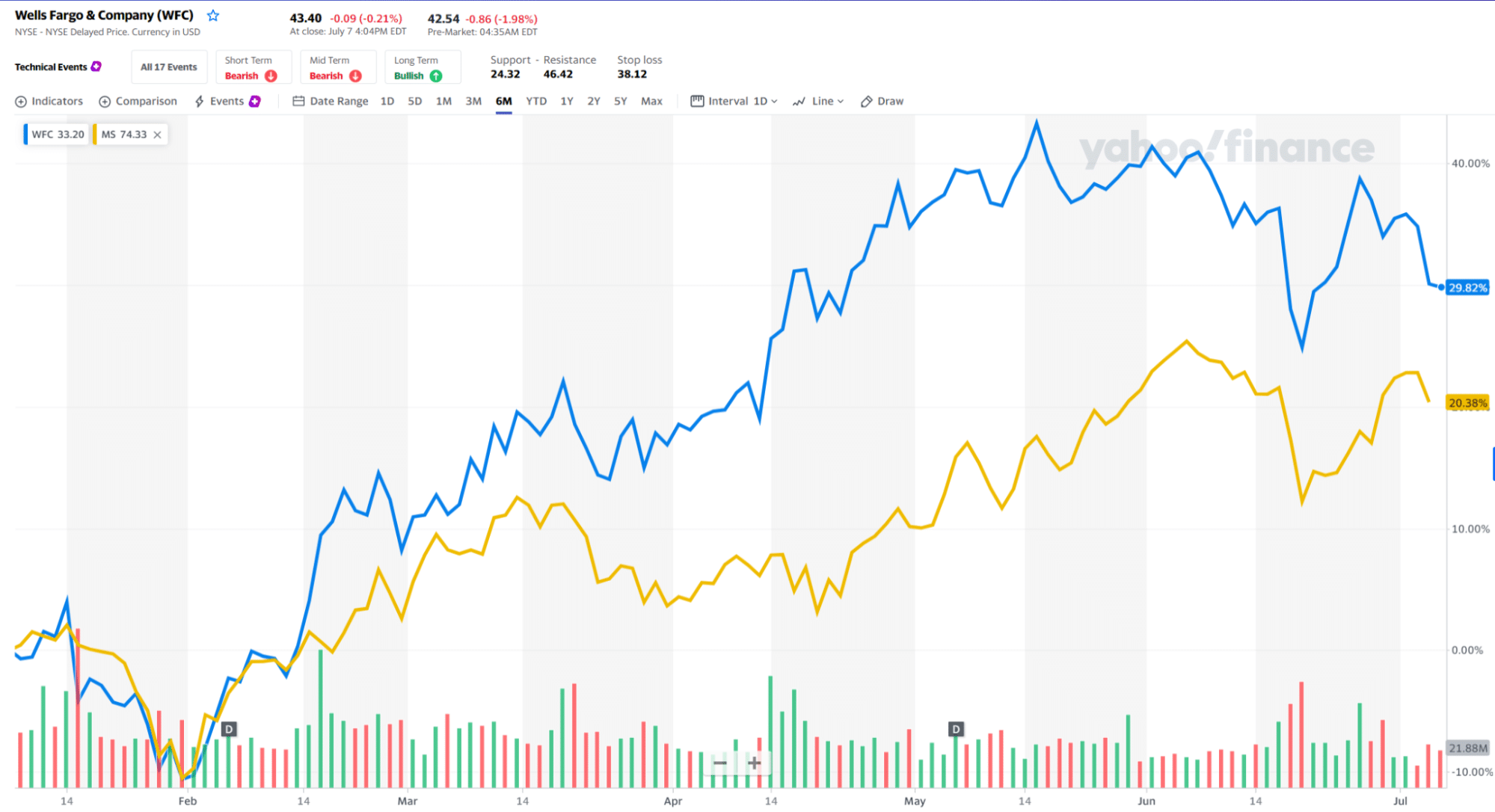

The below chart shows the comparison of dividends of the two major investment banking companies — Morgan Stanley and Wells Fargo & Company. The gold price line represents MS while WFC is by blue price line. The below chart shows the two banking companies doubled dividends and expanded their share buyback programs.

As you can see, there was a significant rise in the price shares after the Fed’s news. On the other hand, major giants like JPMorgan, Goldman Sachs, and the Bank of America, followed suit, although not to the same extreme extent.

Similarly, Wells Fargo intended to repurchase roughly $600 million worth of shares.

What does it mean for investors?

You could probably see in the news that the shares of banks rose sharply once they announced their dividend policy changes, as well as modifications of their stock buyback programs. This led many investors to still worry over the future of bank stocks. Their concerns usually stem from a similar but not quite the same situation that occurred in 2008. People remember that the banks were a sort of a culprit in the past financial crisis and tend to assume that lenders assume a similar role in the COVID-prompted turmoil.

Only, that is not the case. During the previous emergency, banks were a part of the problem. Unlike in 2008, the banks are a part of the solution to the current crisis. Compared to the previous turbulence, they also carry a much better cash buffer due to the dividend limitations.

To make things all the more appealing to the investors, the major lenders are still seemingly undervalued, especially when you keep in mind that the shares of most of them soared after the dividend-limitation recall. In light of those things, traders who want to take advantage of the upward trend might decide to buy now and wait for the stocks to rise further or sell the stake they already have to make the best of the initial uptick.

With the banks saving on capital, they are able to reward increased dividend payments; Bank of America is hiking theirs by 17% to 21% per share, the likes of JP Morgan & Chase up to $1.00 per share. And Goldman Sachs is planning to increase their dividends from $1.25 to $2.00 per share. Also, investors who held out the cuts due to the pandemic are welcoming the increased payments.

What about the risks?

While all of the above suggests that buying bank stocks is the smartest choice you can make right now, nothing is ever so simple or cut and dried.

While the economic rebound is undeniably significant in most of the world, there is no telling if an occurrence could hinder the process. The emergence of the Covid-19 Delta variant is one of the examples of what can happen if you assume that the crisis is over.

If the economic recovery were to slow down, the bank stocks would be the first to take a hit due to their exposure to most economic sectors. That’s why their future is likely to resemble that of the general economy.

Final thoughts

The news about the change of policies regarding the bank-dispersed dividends is undeniably positive. The central banks don’t just willy-nilly change their response to a crisis to see if a new approach will work. You can rest assured that both research and heated discussions backed Fed’s and ECB’s decisions.

On the other hand, you have the final say in what happens with your money, as you will be the one that faces the outcome. The decision on whether you will invest in the bank sector now has to be yours and yours alone.

Comments