Stock investing carries a risk to your capital. That is why thorough research is necessary before you decide to invest in any prospective stock. One statistic you must watch closely is float.

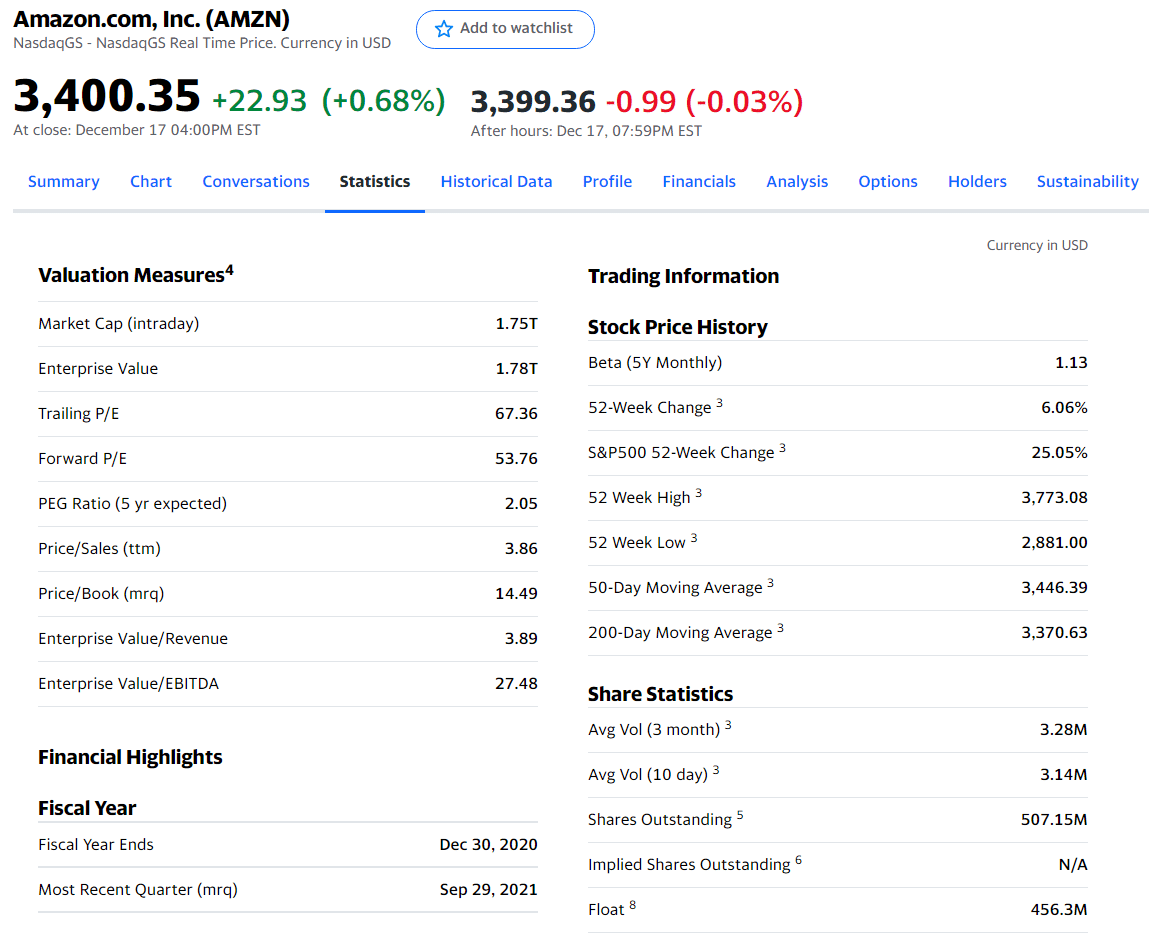

This metric is readily available from financial websites like Yahoo Finance. To get the float of Amazon stock, just visit Yahoo Finance, type AMZN in the search box, and go to the statistics tab. The current float at the time of posting is 456.3 million.

Knowing the stock float is not enough. As an investor, you have to understand its relevance in your investing decisions. A relevant concept is a high float and a low float. Things might get overwhelming as you dig more deeply.

In this article, you will encounter multiple terms related to stock float. Try to understand what they mean and use the learning in your stock investing. Over time things will make sense, and you start to enjoy the learning and investing journey.

What is a stock float?

It is the number of shares being made publicly available for investors. This figure does not cover the full amount of shares authorized by the company. The company typically keeps a portion of the shares for ownership by insiders. These are called controlled and closely held shares. The float is a figure that represents how many free shares investors can buy or sell at any given time.

Information about a stock’s float is freely available online. You can find it from financial websites like Yahoo Finance, NASDAQ, etc. If you want to compute the float yourself, the formula is simple arithmetic. Just subtract the amount of controlled and closely-held shares from the number of issued shares, and then you get what you are looking for.

What is an outstanding share?

Outstanding share refers to the full amount of shares issued to the public. These assets are outside of the company’s treasury, hence called outstanding. Be aware that there are two main types of outstanding shares:

-

Controlled shares

They are not transferable and issued to employees, management, and insiders. You cannot buy, sell, or trade such shares publicly.

-

Public shares

The company issues public shares for trading publicly. As an investor, you can buy, sell, or trade such shares anytime you like.

What is the float percentage?

It is another way of presenting the stock float. Compared to the stock float amount, the stock percentage is easier to represent the number of shares available to investors. While it does not give the actual figures, it can quickly tell the proportion of total shares being made publicly available. Using the float percentage, you can soon determine if a stock is a low float or high float.

Let us take an example stock and come up with its float percentage. Let us use Amazon stock in this example. Yahoo Finance provides the following information for Amazon as of 19 December 2021:

- Shares outstanding: 507.15 million

- Float: 456.3 million

The float percentage for this stock is 89.97 percent, meaning this stock has a high float.

Amazon stock statistics

High vs. low

Take note that the float of a stock is not a constant value. It changes from time to time and is affected by several factors. A stock float is either low or high.

High float

A stock has a high float if it makes a massive amount of shares available to the public. In the above example, Amazon has a high float because most of its shares are available for investors to own.

Low float

A stock has a low float if it opens only a small percentage of the total shares for public trading. The company has complete control over the number of shares it wants to issue to the public. If the company reserves a vast amount of shares for internal ownership and wants few investors, the float will be small. When the float is low, investors will find the stock less attractive to investors.

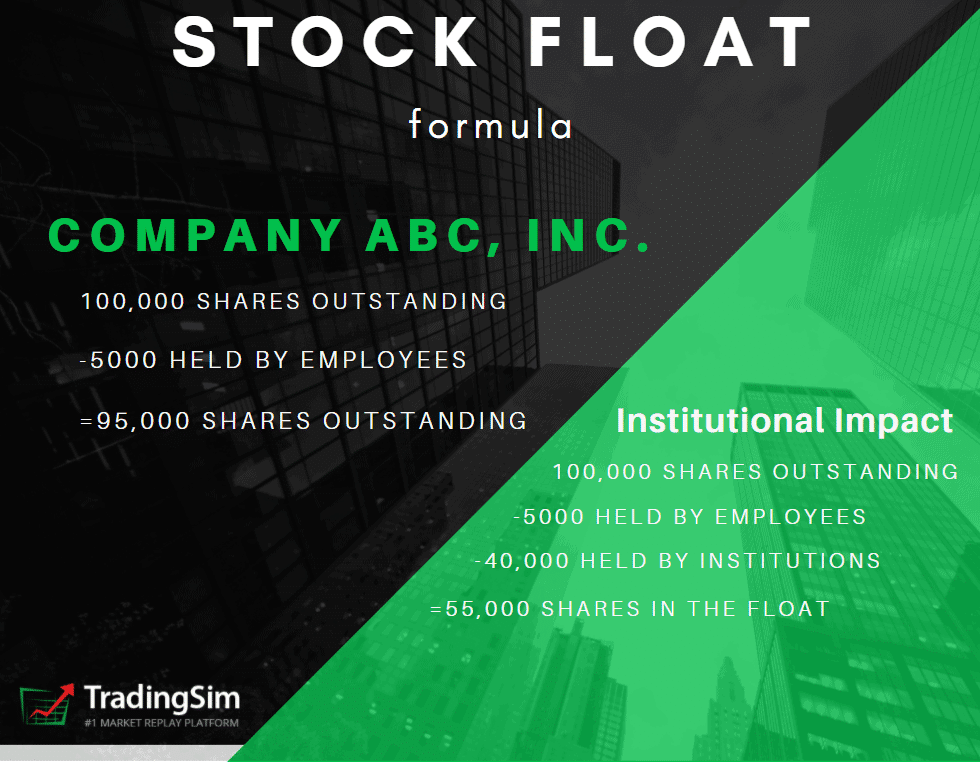

Sample float calculation

To get a good appreciation of stock float, let us consider a hypothetical scenario. Company ABC has 100,000 total shares. Out of this amount, employees hold 5,000 shares, and institutions hold 40,000 shares. Regular investors hold the rest of the shares.

Based on the above figures, the stock float is 55,000. This is the difference when you subtract the amount of shares held by institutions and insiders from the outstanding shares. This shows that even though the total amount of shares is very high, the actual amount of publicly tradable shares at a point in time may be significantly smaller.

Float calculation sample

Impact of float on stock price

Float can have a dramatic effect on volatility and stock price. Besides, supply and demand drive stock valuation. As more investors pile up shares of a particular stock, it will take a few stock purchases to push its price higher. This is why the price of new stocks goes wild during the initial public offering stage.

Investors cannot help but wonder if it can manipulate the stock price through its float. As you might have figured out from the preceding discussions, reducing the float will almost instantaneously lead to price appreciation. It might sound counterintuitive, but it is the reality. A higher float will not result in a higher price. A study confirms the truthfulness of this rhetoric. When the float is significant, the price goes down and vice versa.

Final thoughts

The term float talks about the number of shares currently available for stock investors. It does not encompass the controlled and closely held shares. This figure can help you decide whether to invest in a stock or not. If you are looking to invest long-term, high-float stocks are good options. On the other hand, you can take low-float stocks if you want to get in and out of positions quickly.

Comments