Interest rate affects investment in a big way, and organizations invest capital at one time to realize return at some point. The term investment, in this case, does not refer to funds set aside by individuals for personal gain. It is the amount of money that companies invest in producing new products and services that affect national income.

J.M. Keynes, the author of the famous book General Theory, stated that the extent of national income hinges on the extent of collective demand in the short term. Meanwhile, collective demand consists of two elements: consumption and investment. Consumption tends to remain constant; hence, income largely depends on investment demand.

When a company invests, it pours capital to bring new products to life. However, capital is only one aspect of production. To produce something, raw materials and labor go hand in hand with capital outlay.

First, let us gain a correct understanding of investment from the viewpoint of business organizations. This article will learn about the kinds of investments that companies usually make. Also, you will come to understand the influence of interest rates on investment.

The real definition of investment

When you buy stocks or bonds, you are said to have made an investment. That is what most people think of as an investment. However, when we talk about national income, this type of investment is irrelevant. Buying stocks or bonds as an individual investor result in a financial investment that has little bearing on the economy.

The type of investment that has a bearing on the economy involves asset creation. To buy shares of stocks or bonds, there should be a seller on the other end of the transaction. That is why buying and selling shares only mean that asset ownership changes hands from one person to another. The asset or security already exists at the time of purchase.

Examples of this form of investment include the erection of plants and factories, procurement of trucks and machines, etc. Let’s look at the image below. These investments lead to the creation of jobs and employment. That is the real meaning of investment from the point of view of economic development.

Example of fixed investments

Types of investment

Below are the kinds of investment that lead to nation-building:

- Residential: e.g., the building of new houses.

- Fixed: e.g., procurement of machinery, plant, equipment, building, etc.

- Inventory: i.e., the difference in products manufactured and products sold in a year.

Companies often have three types of inventory: work in progress, raw materials, and finished products ready for sale. They register finished products as sales, and production sometimes does not correspond. Meanwhile, they hold a list of work in progress and raw materials to ensure continuous production.

Factors affecting investment demand

Two things have a bearing on demand for investment. We are talking about the expected rate of return and the prevailing rate of interest. Because we can set the interest rate constant in the near term with only a minor error, we can say that investment demand is primarily a factor of the variation in the expected rate of return. The return rate gives businesses an idea about how soon they can recover their capital and start making a profit.

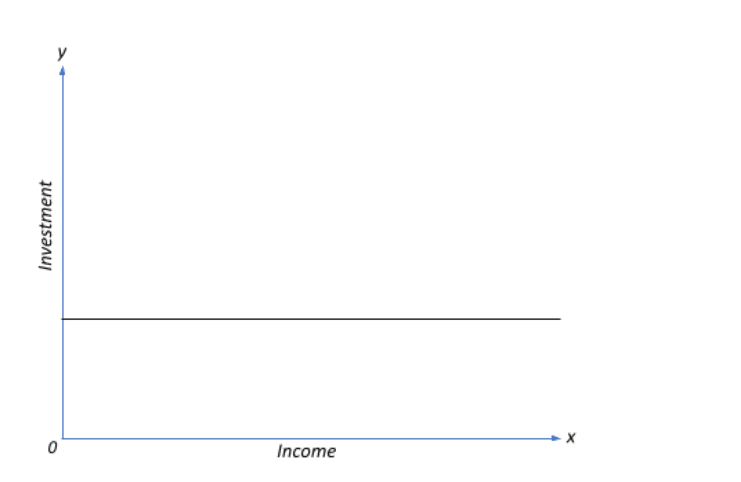

The diagram below shows that companies may invest capital one time and expect income to come in indefinitely. Return expectations are more significant because they can vary in the near term. When it happens, the investment may fluctuate. To grow the national income, governments should assuage investors that investing in the economy is safe.

Investment-income relationship

Relation of interest rate to investment

Companies look at the interest rate as the main deciding factor when considering a prospective investment. If the interest rate looks good, they are more likely to take out capital. When the rate seems terrible, they will find another opportunity or invest another day.

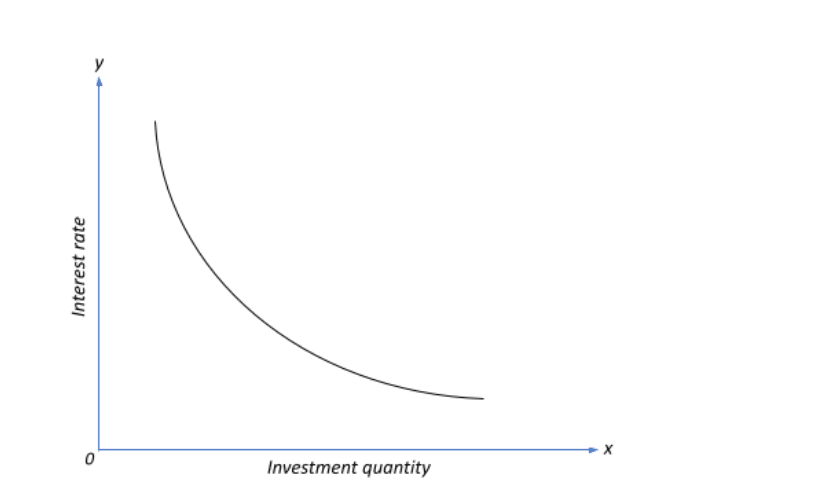

When the interest rate is high, investment quantity is low. When the interest rate is low, investment quantity is high. Let’s look at the image below. Here you see a curve line, but you will also see a straight line going down from right to left at other times. Therefore, the interest rate is negatively correlated with investment.

Investment demand curve

Interest rate vs. investment: sample scenario

Let us assume you have a small factory looking to install a solar panel system to generate energy to warm your building. From your inquiry and analysis, you found out that you would spend $10,000 in installation cost and save $1,000 yearly on electricity. Let us assume further that this system does not require maintenance after installation. Therefore, you spend money only once and enjoy the savings forever.

If you have $10,000 cash on hand and you have the option to invest in a bond, what choice will you make? Will you put money in a system that helps you save money or invest in a security that generates a return? Your choice likely depends on the prevailing interest rate.

When you allocate the funds to the solar panel installation, you make $1,000 yearly on energy savings. This equates to an ROI of 10 percent annually. Above 10 percent, you will get a bond. Meanwhile, if you use the money to buy a bond that turns in 12 percent in annual interest, the bond becomes a better investment. However, if the bond only gives an 8 percent interest, then the solar panel offers a higher revenue. If the bond yields an annual interest lower than 10 percent, you will go for the solar panel system.

Final thoughts

As discussed previously, the investment amount is inversely proportional to the interest rate.

- If the interest rate varies, the investment amount moves somewhere on the line.

- If the interest rate appreciates, investment depreciates and vice versa.

However, a few other factors influence investment amount: economic activity, investor beliefs, capacity utilization, stock amount, raw material cost, public policy, and technology change. Any variation in the above factors will affect the demand curve.

Comments