Investing is no longer just for the rich and famous and has become accessible to the mainstream public. As a result, many people choose to invest their hard-earned money long-term due to the potentially higher gains than leaving it in a savings account that gives low returns.

Mutual funds have been in existence for centuries and are a trusted form of investing, provided you conduct due diligence regarding the funds and risks involved.

We will dive into this topic to enable you, as a novice investor, to put together the right decisions regarding such funds.

What are mutual funds?

In 1774, a merchant from the Netherlands started a mutual fund, believed to be the first of its kind. He recognized the need for small investors to diversify their holdings. It became a popular option leading countries like Switzerland and the U.S.A. starting similar funds.

The oldest existing mutual fund is the Vanguard Wellington fund, established in 1929, and it was the first to include bonds and stocks.

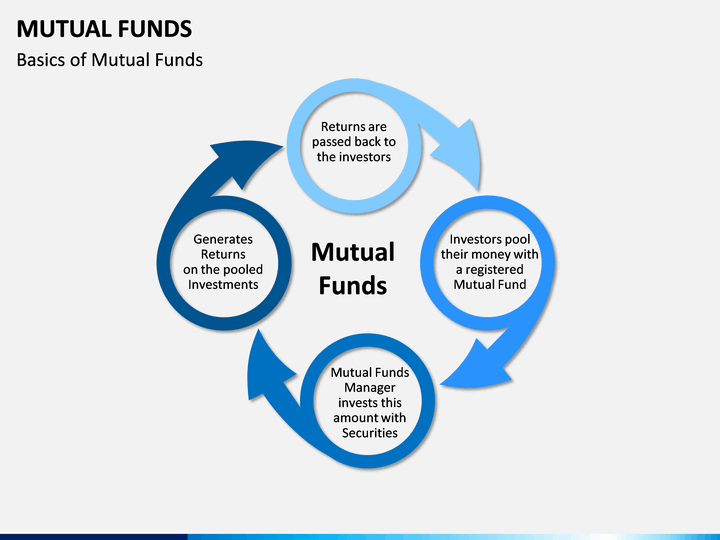

So, what exactly is a mutual fund? It is an investment put together by professional investment firms. First, the investment firm would compile a structured prospectus to include the fund’s portfolio and investment goals. Then they would use the money from the investors to purchase bonds, stocks, or other assets.

The intents of investing in such funds are:

- To benefit from diversification

- To give small investors access to professionally managed portfolios

- To enjoy the advantages of large institutional investors

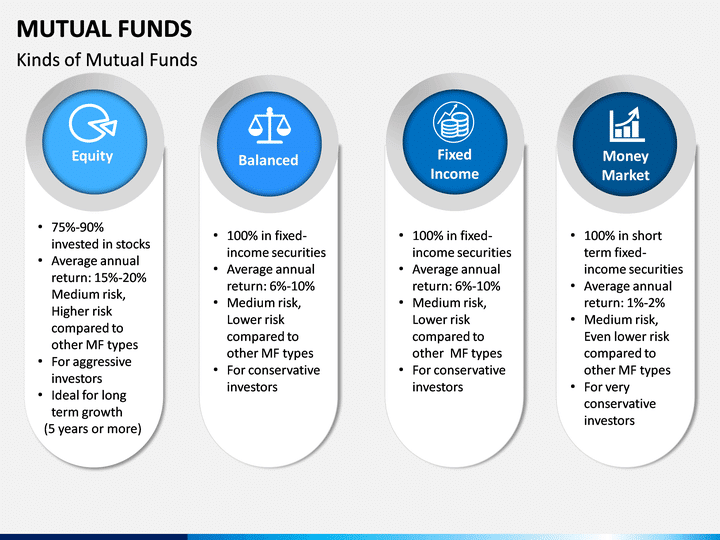

Common types of mutual funds

-

Equity funds

A collection of stocks from publicly traded companies

-

Balanced funds

These are a combination of bonds and equity funds in a specified ratio

-

Bond funds

Also known as ‘debt funds’, investing in bonds or fixed-income securities

-

Index funds

This is a collection of funds tracking the performance of indices like the S&P500 and the Dow Jones

How to choose the right mutual fund?

You will need to determine how to pick the perfect fund depending on your investment preferences. As these are long-term investments requiring a substantial amount of capital, you must make the right decision. There are countless mutual funds and bountiful investment firms to choose from, and following these guidelines would help you narrow it down.

As with any investment, whether short or long-term, you first need to determine your investment goals and risk appetite.

Questions you need to consider:

- How are you planning to spend the money? E.g., college education, property purchases, retirement, etc.

- Are you looking for long- or short-term income?

- In terms of risk, determine whether you can leave your money tied up in the fund for an extended period?

- Do you prefer a low, medium, or high-risk investment strategy?

Fund management

You will need a good investment firm to manage your portfolio, and you will have to conduct thorough research into the firm’s past performance. Fund managers should be a team of disciplined, experienced, and talented individuals.

A good indication is to regulate how much of their net worth the fund manager has invested, proving that they are confident and taking the risk along with their investors. This way, you are assured that you are not putting your money at risk solely based on their recommendations.

Added to this is the management style of the fund, active or passive management. An active fund manager or team of managers keeps track of the fund by making regular buy or sell decisions. Their goal is to outperform the market.

In contrast, a passive management style pays no attention to daily market movements and focuses on holding for the long term.

Consider fund fees

-

Expense ratios

Investing in a mutual fund carries certain costs. These fees include the salaries of the team, resources, and other office supplies. A percentage of these costs adds to your portfolio management fees, known as the expense ratio.

The aim is to have the lowest expense ratio when owning a fund because this percentage eats away at your gains and can add up to a considerable amount over time.

-

Loads

Charges that add to a mutual fund, like commissions or sales fees, are referred to as loads. Like expense ratios, these are also a percentage charged each year for the duration of the fund. And this cost can be substantial depending on how high the rate is and the length of your investment.

So, there are two options you can invest in: either a load fund or a no-load fund. The difference simply being that no-load funds do not charge load fees. If you are buying a no-load fund, your expenses will decrease, and you will have more returns; however, with ‘load funds’, a portion of your recovery has to be deducted for load charges.

-

Fund performance

When choosing a fund, you have to look at the historical performance and influence it in the future. But, as we know, when it comes to investments, past performance is not a sole guarantee that the fund will continue on that trajectory.

For example, if you’re investing in a stock for which the share price increased from $18 to $25 within a year, investors might realize it’s overbought, causing a correction, and the price will go down. So choosing a fund on this basis is risky.

A good tip is to compare the fund’s performance against other funds in the same category, usually looking back over the last ten years. For example, if you purchase such a fund focused on stocks over the medium term, you will use other medium-term stock funds as a benchmark.

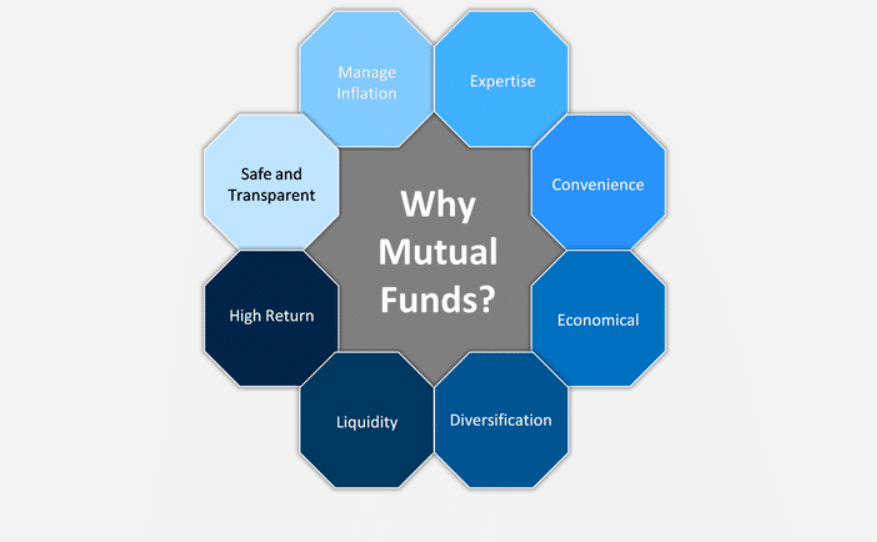

Why invest in mutual funds?

To answer this question, we have listed the pros and cons to help you weigh your options.

| Pros | Cons |

|

|

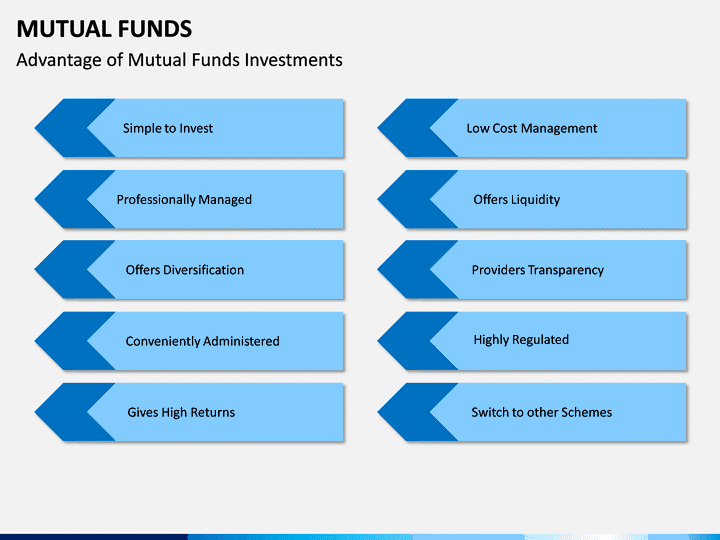

Opting to invest in mutual funds allows you to diversify because you are purchasing a bundle of different assets.

Professional fund managers are responsible for making decisions regarding your investment, and you don’t have to worry about when to buy, sell, or hold.

Mutual funds require lower fees than other types of investments; in addition, you don’t require significant capital to start investing in mutual funds.

There are multiple options available, making it a flexible choice and not trapping you in one specific investment. |

Buying into a mutual fund means you do not own the underlying stocks or bonds. Instead, you own shares in the fund itself.

You will be required to pay capital gains taxes upon selling your investment, and this amount can be high depending on how often the fund pays out capital gains.

You will spend higher fees on actively managed funds, and it can escalate depending on the number of transactions and other management fees. |

Conclusion

To conclude, investing in mutual funds seems much easier and less risky than buying shares in a company. Yes, you don’t have control over the fund, but that is why you have advisors and fund managers to look after your portfolio. Once you have thoroughly researched according to our advice, you will be able to choose the right fund that suits your goals.

Comments