Real estate investment trusts or REITs are a great way to invest in the property sector for several reasons. This type of investment involves owning a small worth of the invested amount of a property or portfolio guaranteed to pay out a particular percentage of their profits in dividend.

Millions of Americans own real estate; even though many investors seek to put their wealth in bonds and stocks, owning property may be an excellent choice to have a handy return on their capital.

The REIT has attractive investment attributes that bonds or stocks investments can’t match. Owning a property can diversify your total assets. Additionally, investing in this sector can help recover losses on other investments as it preserves the total value of your contribution.

However, the number of property ETFs is not infinite as there are only finite amounts of real estate globally, especially in specific locations. The best REIT ETFs allow investors to have a great return of total invested capital in the long term. This article will help you sort the best property funds as we listed the top 10 REIT ETFs to buy based on their equity, performance, and potentiality.

What are REIT ETFs?

These types of funds invest most of their assets in equity real estate investment trust securities and related derivatives — simply holding REITs and stocks. It is often costly to invest in properties directly, or building a diverse REIT portfolio is not always easy. In that case, such ETFs can be a starting point.

- You can invest in a diverse range of properties with low cost at this type of investment.

- You can buy and sell REIT funds like the stock traders.

The companies that create and manage funds provide information to the public that helps to sort out and invest in excellent assets. Investing in REIT funds might not allow investors to have direct control over the purchased REIT shares. Investors can study or observe the purchased REITs and the portfolio of properties that they are holding.

Top 10 Reit ETFs to buy now

Let’s see the top of property funds to invest in based on their historical performance, liquidity, and efficient team behind them.

- Vanguard Real Estate ETF (VNQ)

- Vanguard Global ex-U.S. Real Estate ETF (VNQI)

- VanEck Vectors Mortgage REIT Income ETF (MORT)

- Global X Data Center REITs & Digital Infrastructure ETF (VPN)

- iShares U.S. Real Estate ETF (IYR)

- Schwab U.S. REIT ETF (SCHH)

- iShares Residential Real Estate ETF (REZ)

- U.S. Diversified Real Estate ETF (PPTY)

- iShares Cohen & Steers REIT ETF (ICF)

- iShares Core U.S. REIT ETF (USRT)

Vanguard Real Estate ETF (VNQ)

Vanguard Real Estate ETF trades under the ticker VNQ and is one of the best funds for today. It is the largest mutual fund company and continues to absorb funds rapidly with an expense ratio of 0.12%.

The inception date of this fund is Sep 23, 2004, and it currently has 405.8 M shares. Vanguard Real Estate ETF fund offers an efficient way for investors to gain indirect exposure to real estate prices (instead of direct exposure gained through ownership of the residential property).

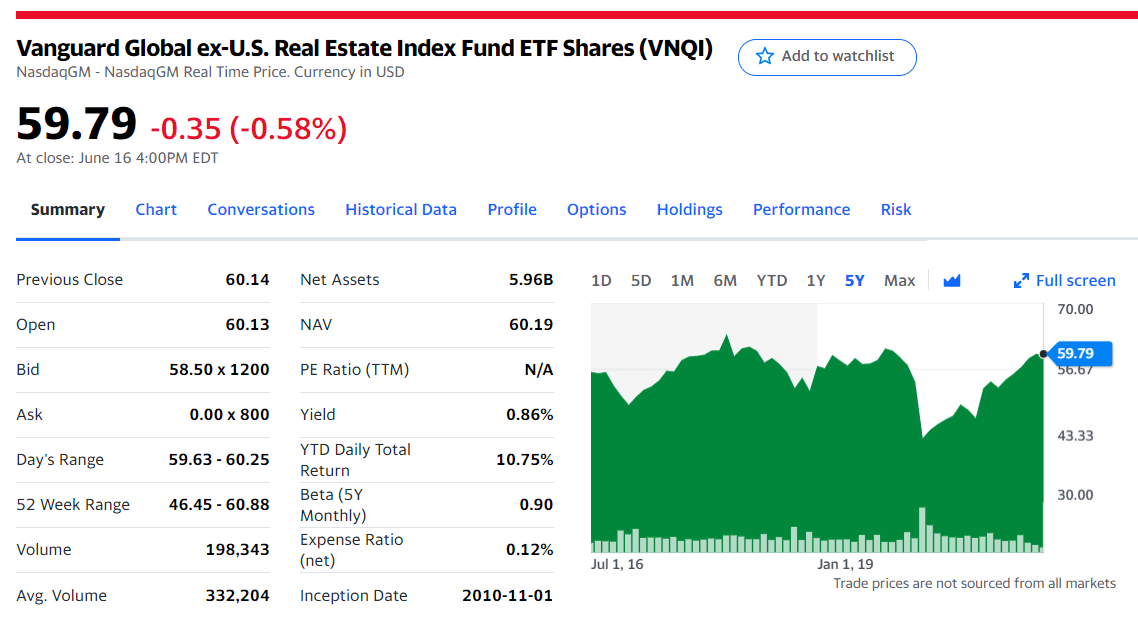

Vanguard Global ex-U.S. Real Estate ETF (VNQI)

The second on our list is Vanguard Global ex-U.S. Real Estate ETF (VNQI). The issuer of this fund is Vanguard, and the inception date is Nov 1, 2010. It could make for a solid choice for several investors who seek an excellent return in the long term with a small expense ratio of 0.12% (same as VNQ).

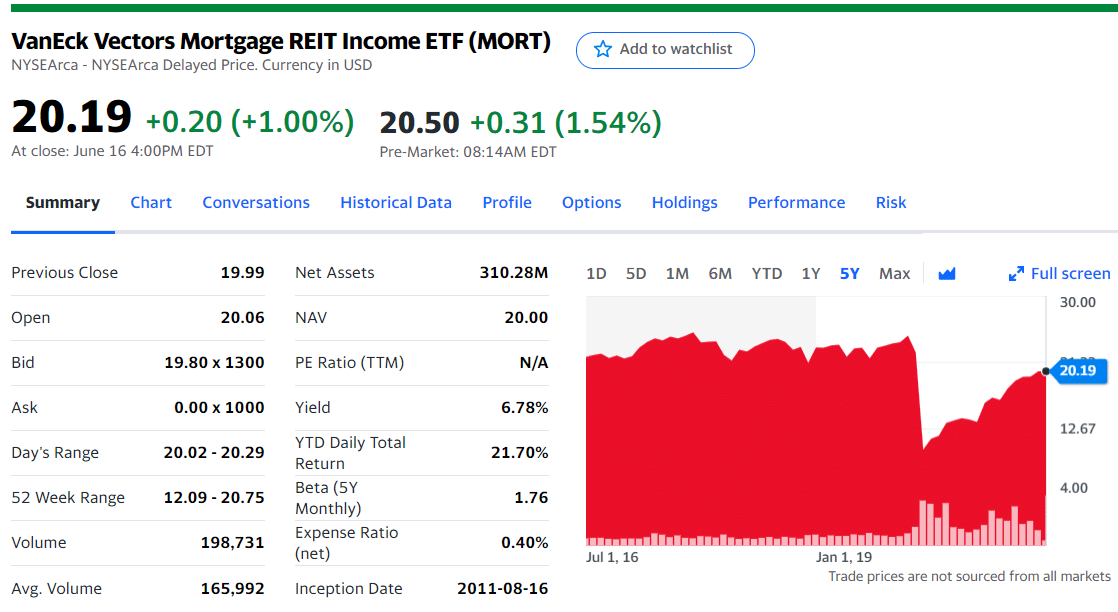

VanEck Vectors Mortgage REIT Income ETF (MORT)

The issuer of VanEck Vectors Mortgage REIT Income ETF (MORT) is VanEck under the category of property. The inception date of MORT is Aug 16, 2011, and it currently has 16.9 M shares. You can invest in both short-term and long-term strategies at this type of ETF with an expense ratio of 0.40%.

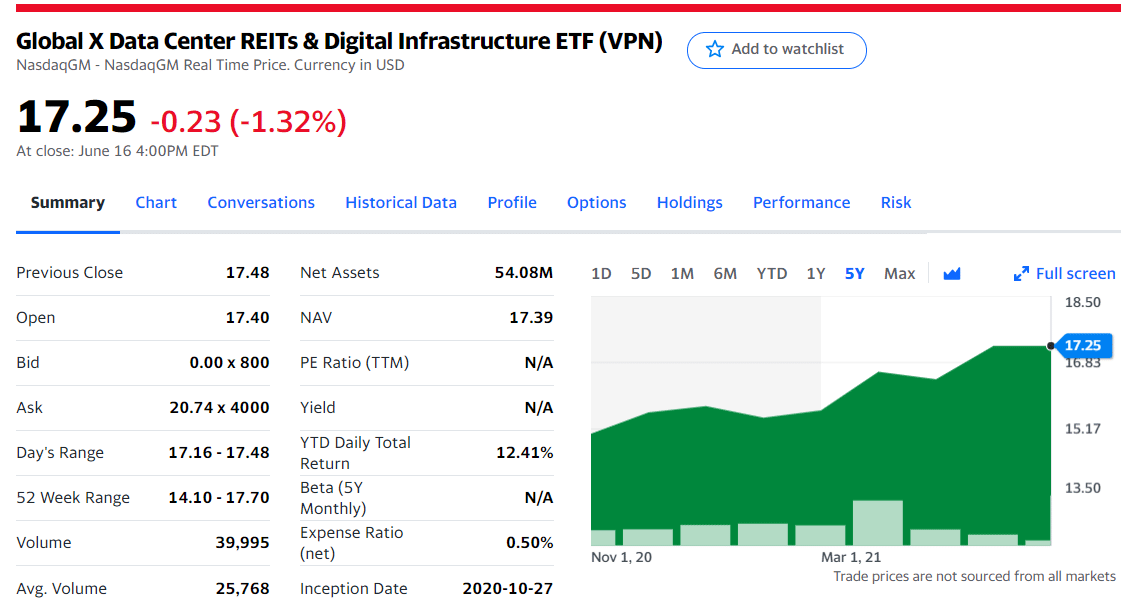

Global X Data Center REITs & Digital Infrastructure ETF (VPN)

The issuer of Global X Data Center REITs & Digital Infrastructure ETF (VPN) is Mirae Asset Global Investments Co., Ltd., under the category of Global real estate. The inception date for this fund is Oct 27, 2020. It currently has 3.3 M shares with an expense ratio of 0.50%.

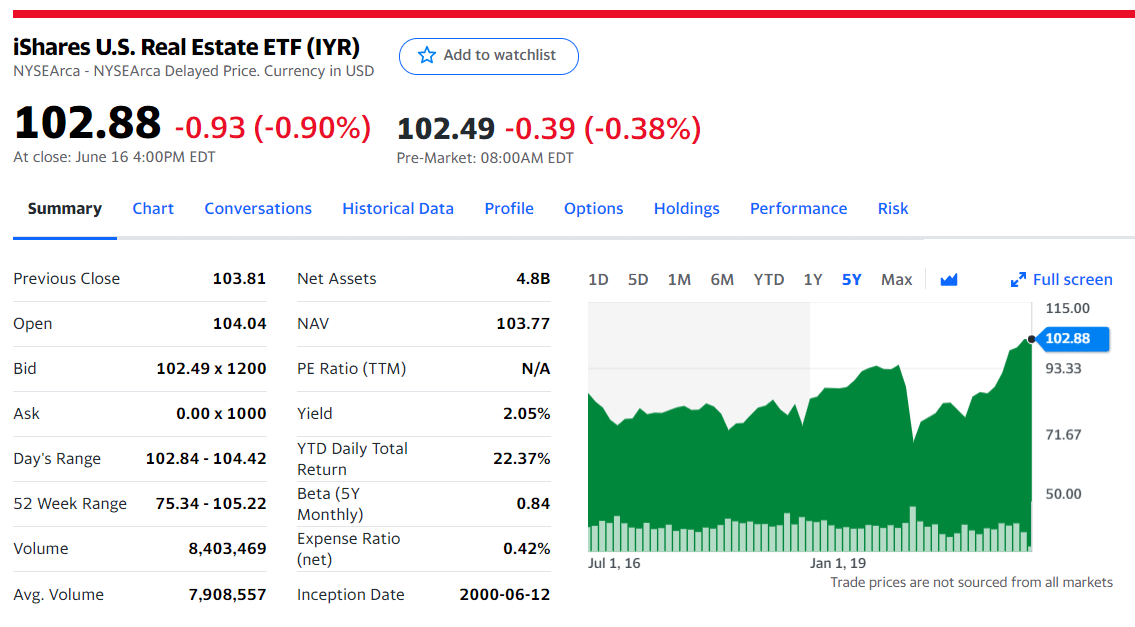

iShares U.S. Real Estate ETF (IYR)

Under the property category, the issuer of iShares U.S. Real Estate ETF (IYR) is Blackrock Financial Management. The inception date of this fund is Jun 12, 2000, which currently has 62.5M shares. The IYR follows the Dow Jones U.S. Real Estate Index with an expense ratio of 0.42%.

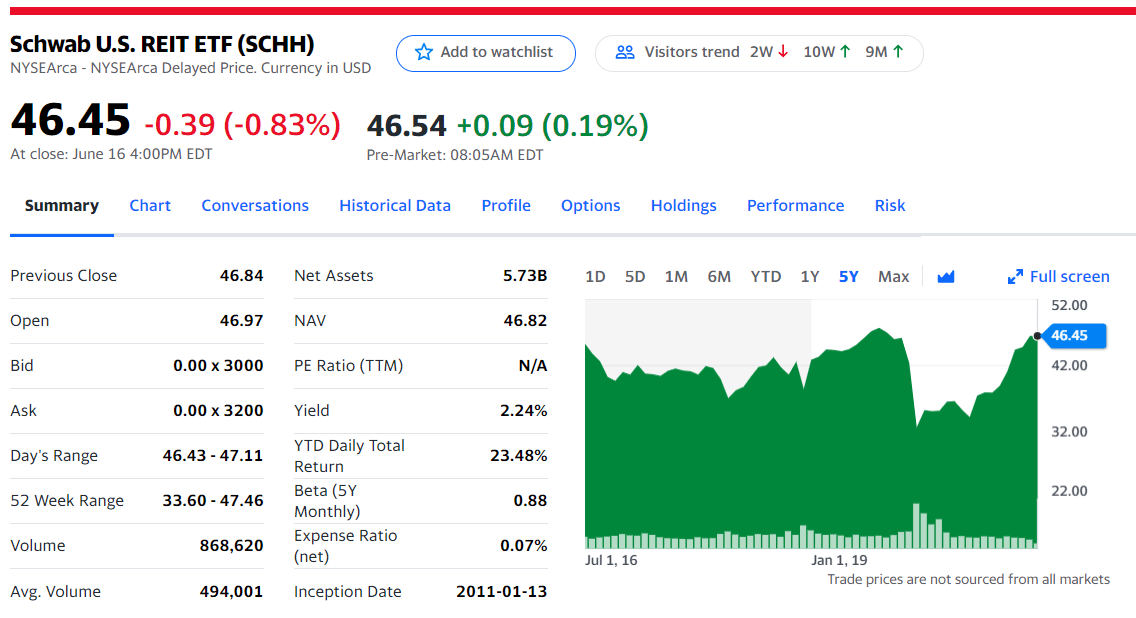

Schwab U.S. REIT ETF (SCHH)

Schwab U.S. REIT ETF (SCHH) offers exposure to the real estate category in the U.S. equity market. The inception date is Jan 13, 2011, and the issuer of this fund is Charles Schwab. It currently has 130.3 M shares with a cheaper expense ratio of 0.07%.

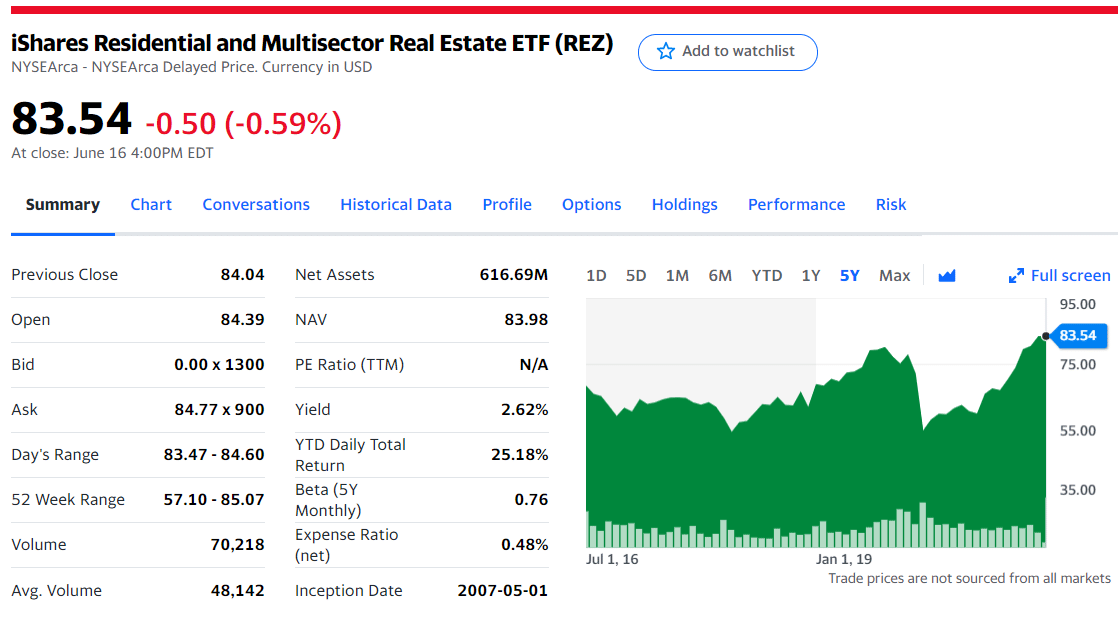

iShares Residential Real Estate ETF (REZ)

The next on our list is iShares Residential Real Estate ETF (REZ), which exposes the residential real estate, healthcare, and self-storage sectors. The inception date of this fund is May 01, 2007. It currently has 7.7 M shares with an expense ratio of 0.48%.

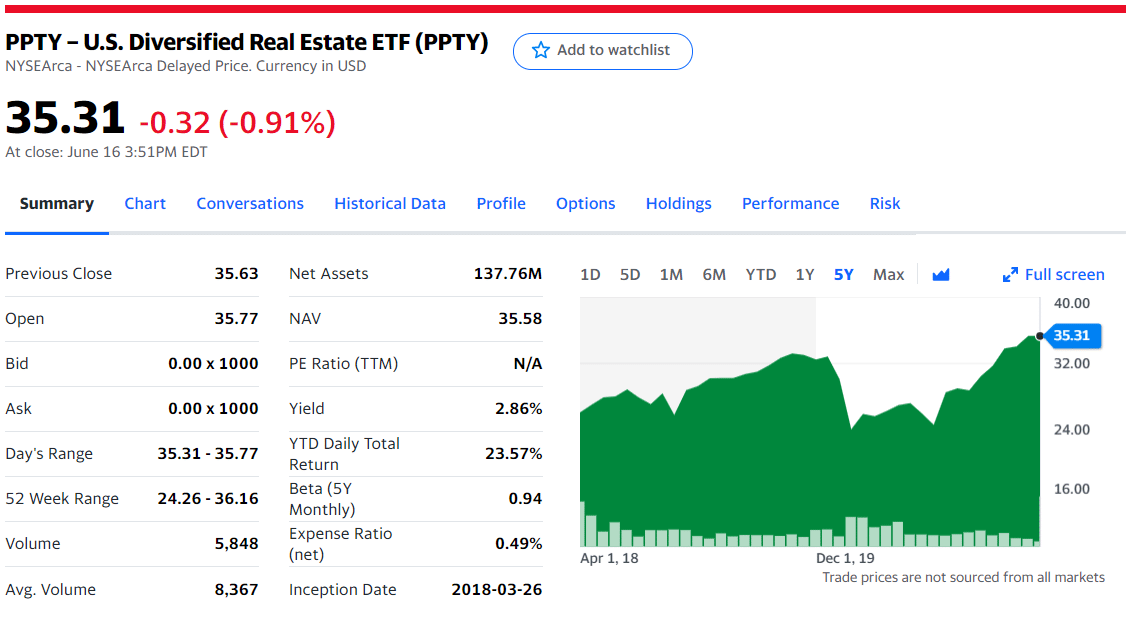

U.S. Diversified Real Estate ETF (PPTY)

The issuer of U.S. Diversified Real Estate ETF (PPTY) is Vident under the category of real estate. It currently has 4.1M shares worldwide with an expense ratio of 0.49%. The core elements of this investment are industrial, residential, and office REITs.

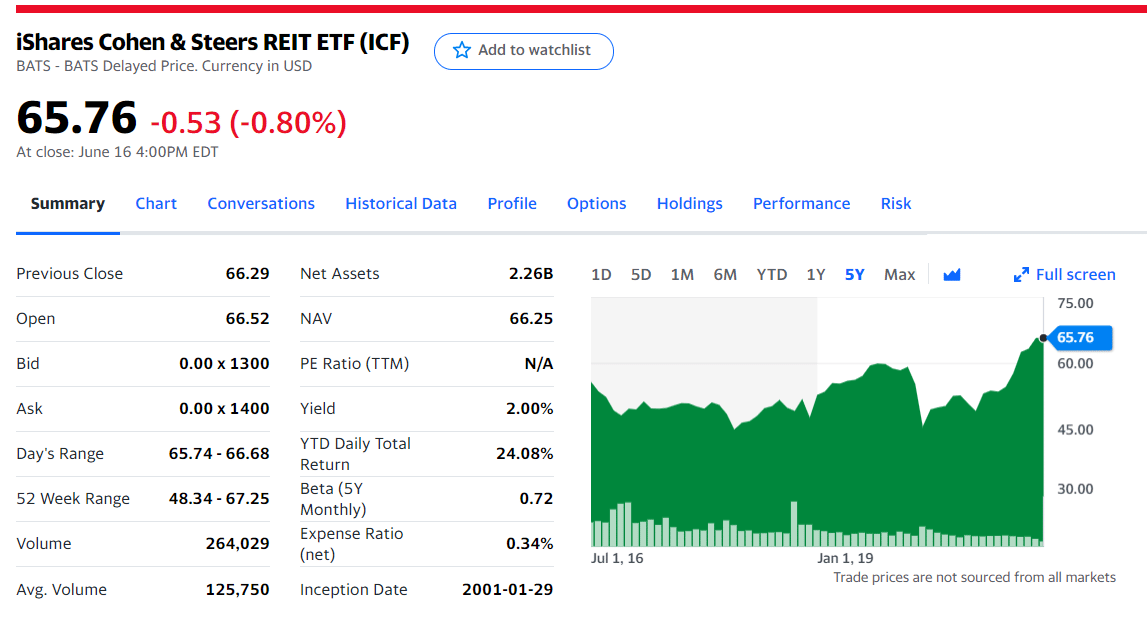

iShares Cohen & Steers REIT ETF (ICF)

The inception date of iShares Cohen & Steers REIT ETF (ICF) is Jan 29, 2001, and the issuer of this fund is Blackrock Financial Management under the category of real estate. It currently has 36.1 M sharers with an expense ratio of 0.34%. ICF follows the Cohen & Steers Realty Majors Index in the region of the U.S.

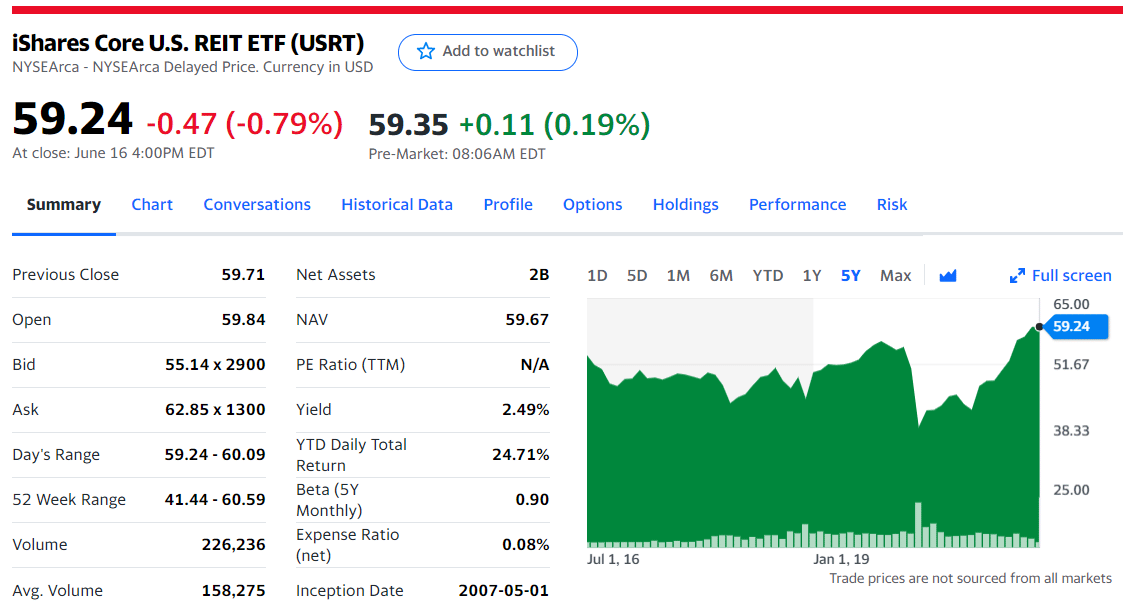

iShares Core U.S. REIT ETF (USRT)

The inception date of iShares Core U.S. REIT ETF (USRT) is May 01, 2007. The issuer of this fund is also Blackrock Financial Management under the category of real estate. It currently has 35.6 M shares with a cheaper expense ratio of 0.08%.

Conclusion

Finally, the REIT ETFs are a potential sector to invest in, but you must choose a better broker or medium or pertinent to invest your money. We suggest you always select the assets carefully before investing, check the terms of investments, and if the return on capital meets your desire.

Comments