Platinum-based ETFs are a popular choice among investors to gain the necessary exposure to the platinum metal without owning and storing the actual physical metal. After gold and silver, platinum has emerged as one of the preferred modes of investment in precious metals.

Irrespective of the inherent workings, the platinum ETFs tend to generate returns that are directly in sync with the price movement of the platinum metal as it trades on major commodity exchanges. This article provides the list of ETFs which belong to the platinum category and are available for trading.

Following is the list of all five exchange-traded funds which belong to the platinum category.

What are platinum ETFs?

Platinum may be most often noticed as an aspect of jewelry, especially rings, but it has many other uses. It’s a critical component of manufacturing and healthcare equipment, and it’s often used in the fuel cell batteries of electric vehicles.

Investors who want to get involved with platinum action without starting a futures account can turn to ETFs. When it comes to platinum ETFs, not all are created equal. This is what tempted us to make a side-by-side comparison to help investors and traders determine whether they are using the proper platinum ETF for their needs.

While there is one significant thing in common with these five funds, the differences are often overlooked. Assuming one platinum ETF is the same as another is a foolish mistake that could be costly over time.

How to buy platinum ETFs?

If you want broad exposure to the platinum industry through several stocks, you could consider funds. Thus, you can generally trade in a range of platinum-related companies or trade this industry with a single position.

The buying and selling of such shares are the same as for stock shares, placing orders through your brokerage account.

Step 1. Purchase shares by placing a buy order with the stock ticker and number of shares.

Step 2. Wait untill your order will be filled almost immediately during market hours.

Step 3. Confirm that the order was filled by checking your account summary page, which should list the fund shares and the purchase price.

Top five platinum ETFs to buy in 2022

Platinum ETFs enjoy all the benefits of ETFs. These include diversified holdings and some tax benefits compared to mutual funds. Like ETFs covering any other sector, platinum funds can also be leveraged or inverse. Here are some of the top funds.

№ 1. Physical Precious Metals Basket Shares (GLTR)

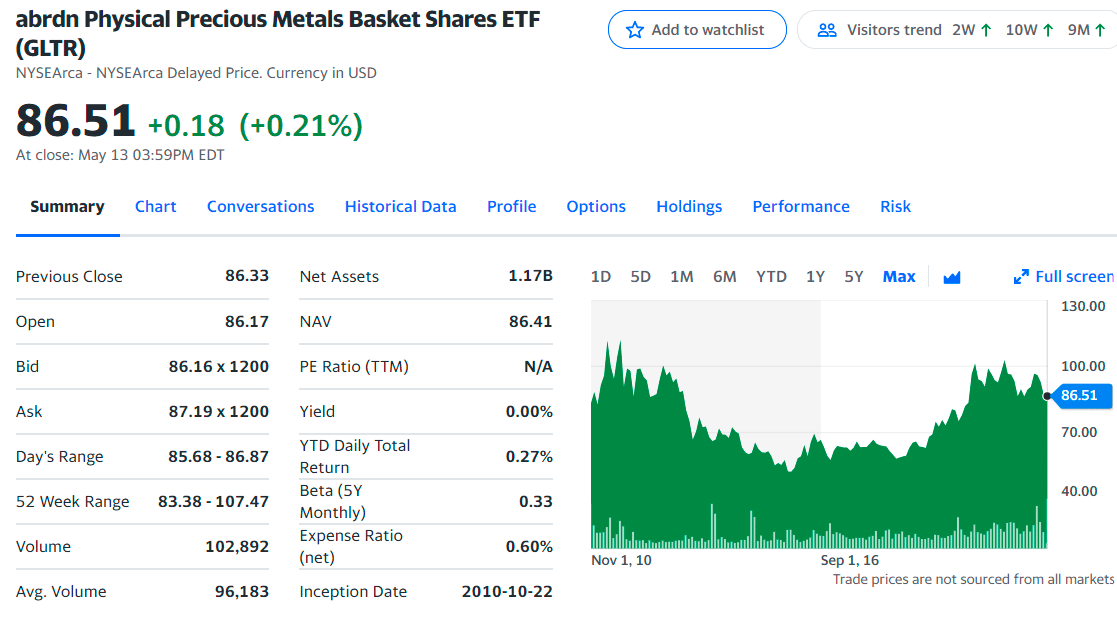

GLTR ETF summary

The fund was launched in 2010 and managed by the Management Team since October 22, 2010, at Aberdeen Standard Investments.

GLTR is the first broad basket of precious physical metals. Unlike most other products that only provide exposure to gold and silver, the fund holds physical gold, silver, platinum, and palladium. Custodied by JP Morgan Chase Bank, the gold and silver bullion are held in London, while the platinum and palladium bullion is held in London or Zurich.

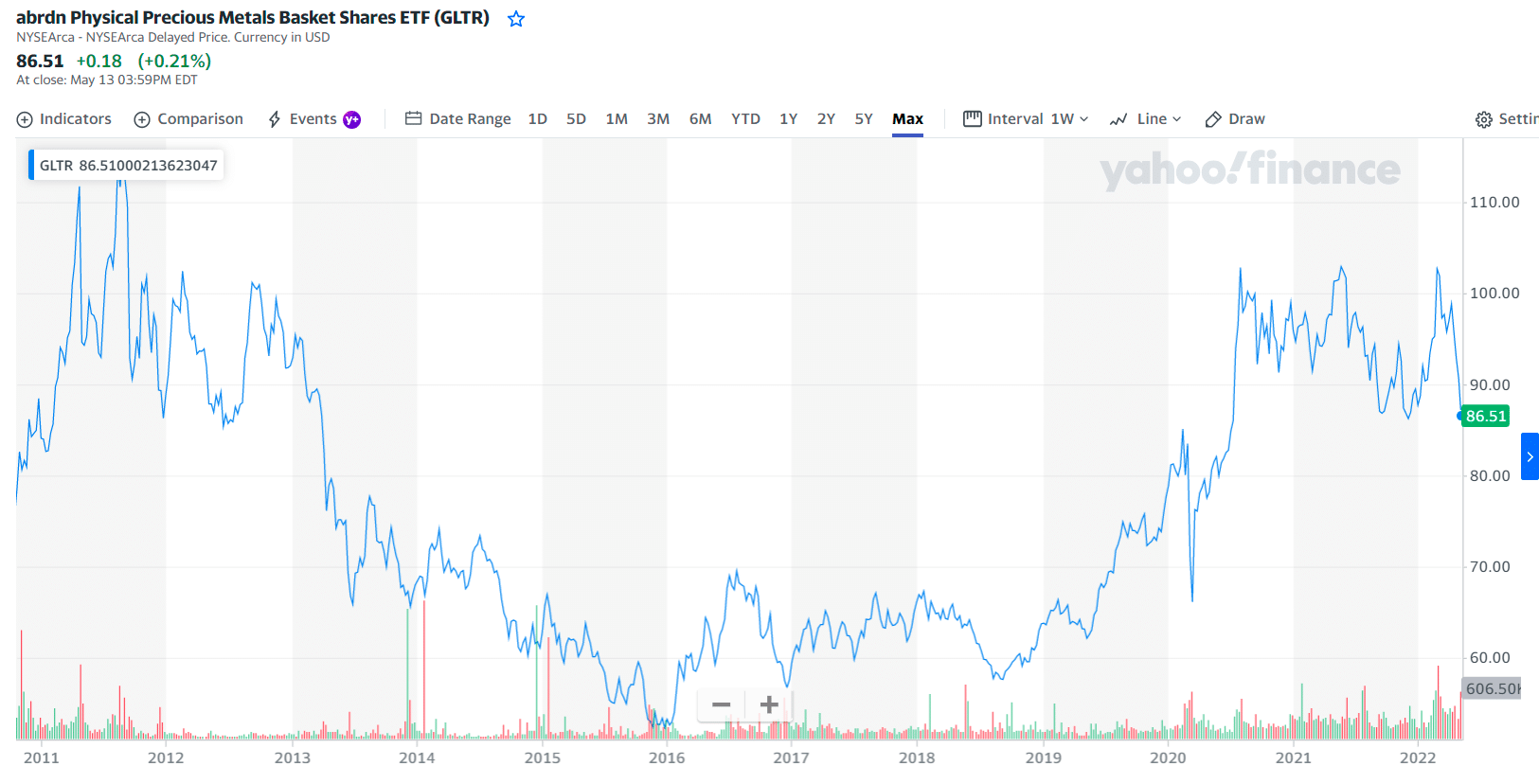

GLTR price chart

It has an expense ratio of 0.60%, which is 5% lower than its category.The fund has returned -4.0% over the past year and 14.0% annually over the past three years, 8.2% per year over the past five years, and 0.1% per year over the past decade.

GLTR has an R-squared of 10%, a beta of 0.33, and a standard deviation of 17.8%. It has a below-average total risk rating. Recently, in April 2022, GLTR returned -2.3%.

The top four holdings with their asset percentage are:

- Physical Gold BullionN/A — 52.01%

- Physical Silver BullionN/A — 27.86%

- Physical Palladium BullionN/A — 15.96%

- Physical Platinum BullionN/A — 4.16%

№ 2. Physical Platinum Shares (PPLT)

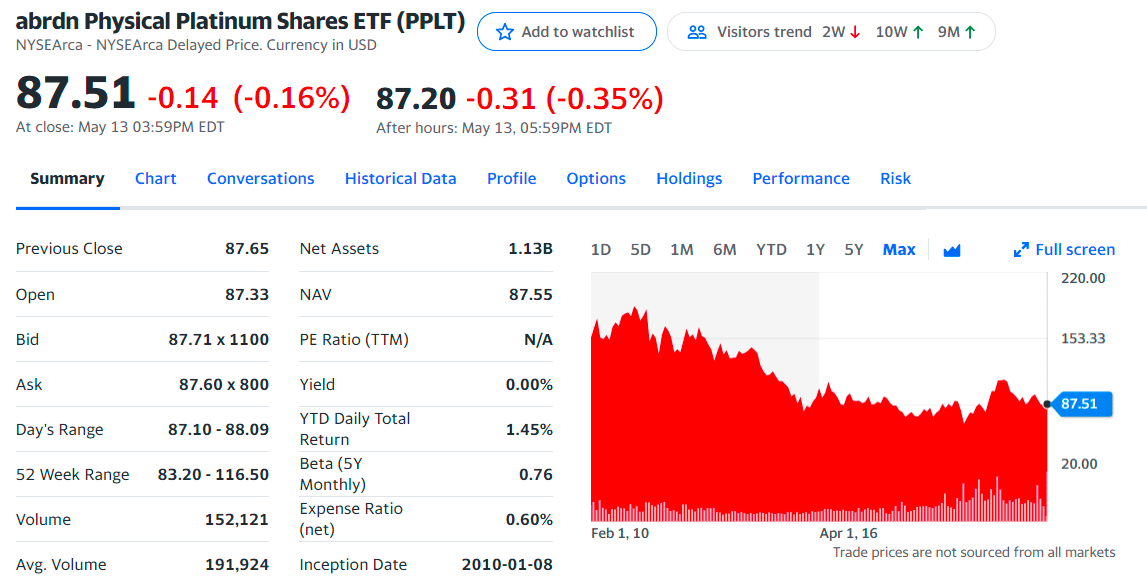

PPLT ETF summary

The investment objective of the PPLT is to reflect the performance of the price of platinum, less the expenses of the trust’s operations. The fund is designed for investors who want a cost-effective and convenient way to invest in physical platinum.

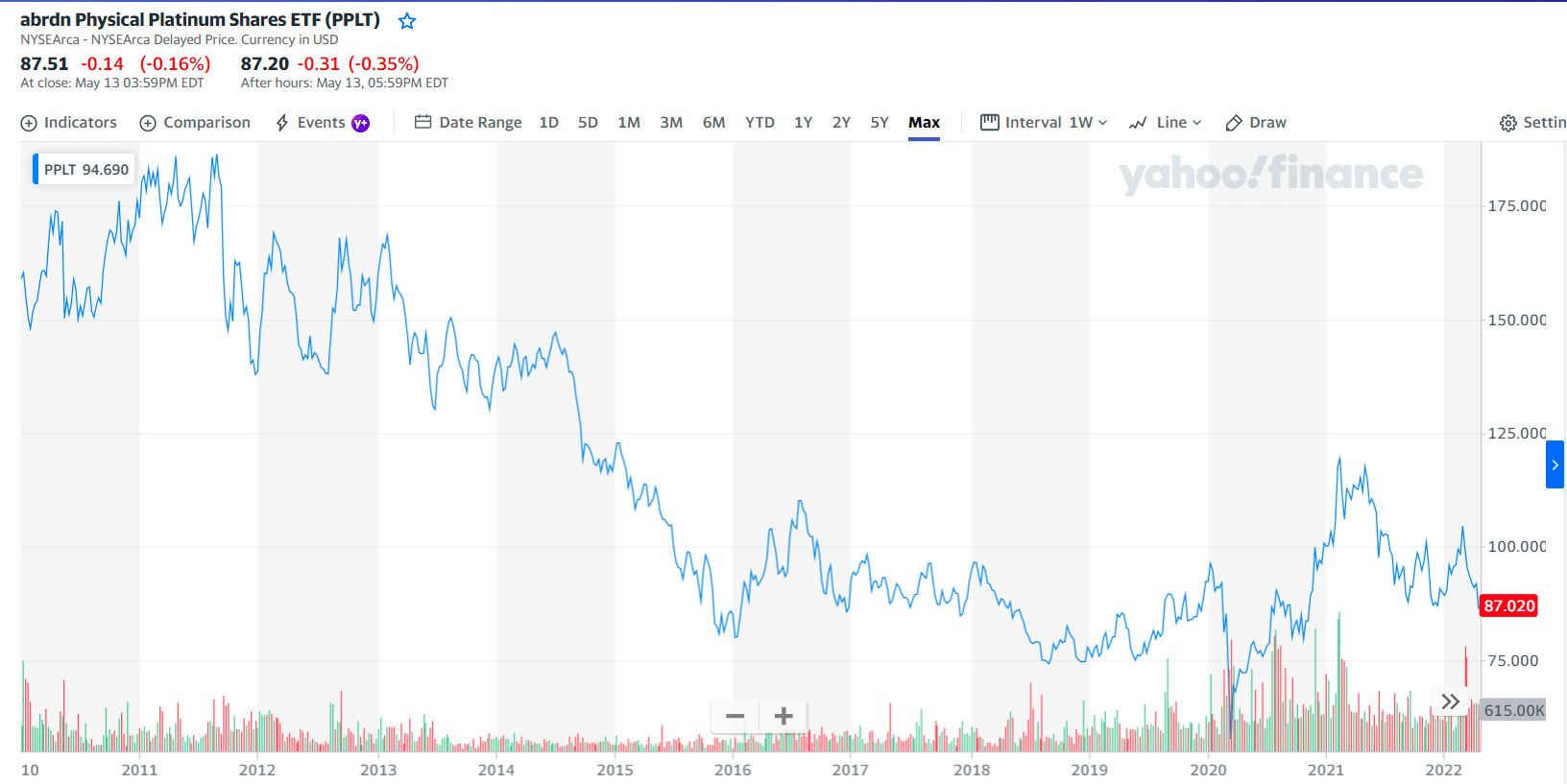

PPLT price chart

The PPLT currently has $1.13 billion in assets under management, with an expense ratio of 0.60%. Its performance is highly correlated to the automotive industry’s performance. Hence a look at its earnings in the pandemic year and year to date is negative.

However, a look at its three-year earnings shows that it has the potential for returns of +15.78%. As more and more countries call for low emission vehicles, platinum, with its rarity and the only ingredient for the necessary catalytic converters to reach zero emissions, will only become more valuable.

Top one holding (100.00% of total assets):

- Physical Platinum Bullion — 100%

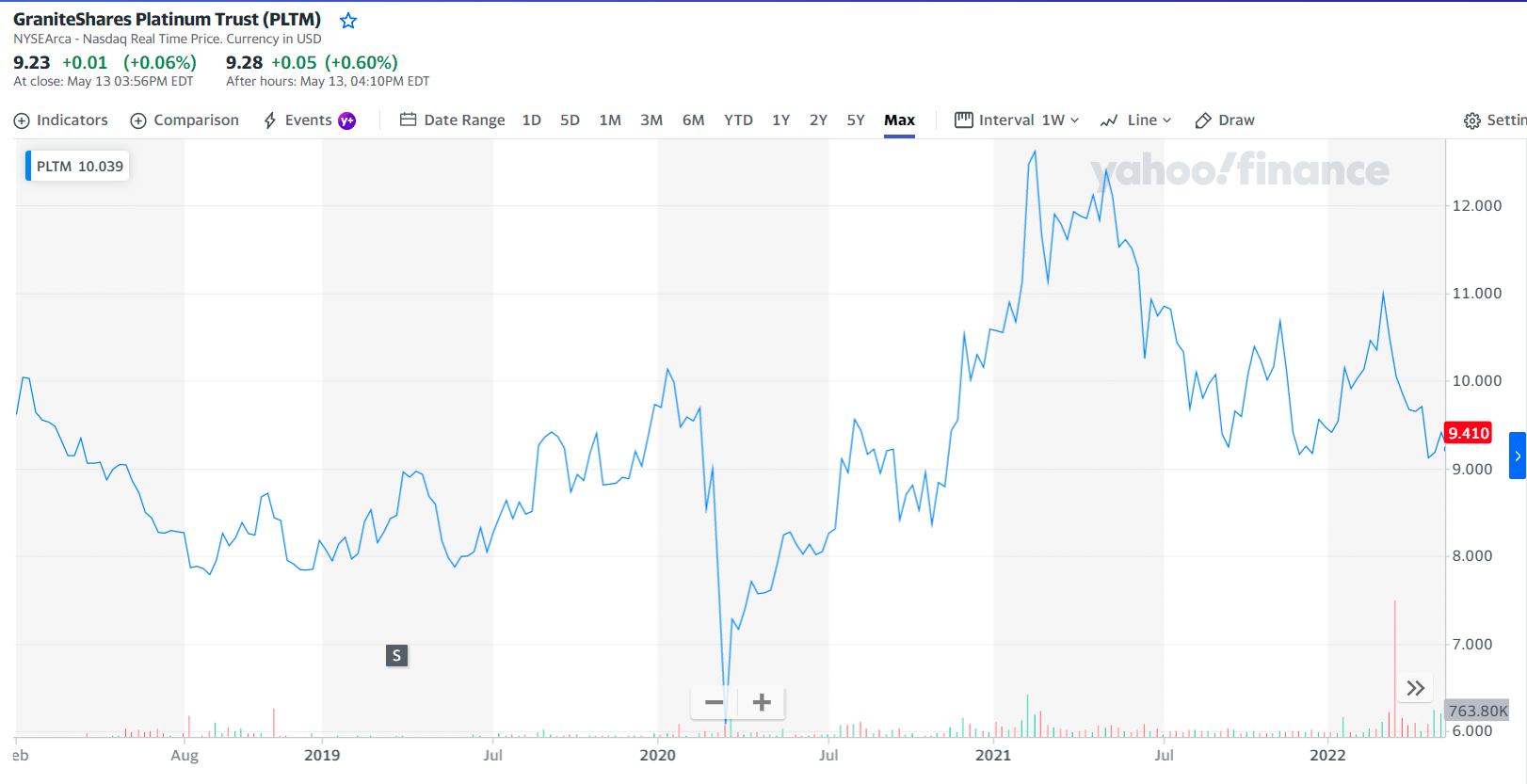

№ 3. GraniteShares Platinum Trust (PLTM)

PLTM ETF summary

The fund was launched in 2018 and managed by the Management Team since January 22, 2018, at Graniteshares.

PLTM invests directly in physical platinum stored in a London vault and custodied by ICBC Standard Bank. The grantor trust structure protects investors since trustees cannot lend the platinum bars. Since PLTM holds physical platinum bars, investors can expect the fund to track the spot platinum price closely. Moreover, the fund provides exposure identical to established competitors such as PPLT. Like all physically held precious metals funds, any long-term gains will result in noteworthy tax liabilities since PLTM is considered a collectible.

PLTM price chart

PLTM ETF, a reasonably new entrant into the platinum space, compared to the PPLT ETF, has meager assets under management, $35.19 million. However, investors part with $50 annually for every $10000 invested, cheaper than investing in the PPLT.

Its expense ratio is average compared to funds in the commodities-focused category. PLTM has an expense ratio of 0.50%, which is 20% lower than its category. The fund has returned -23.9% over the past year and 1.1% annually over the past three years. In April 2022, it returned -5.2%. The fund has an R-squared of 30%, a beta of 0.79, and a standard deviation of 24.4%. It has an above-average total risk rating.

Top one holding (100.00% of total assets):

- Physical Platinum Bullion — 100%

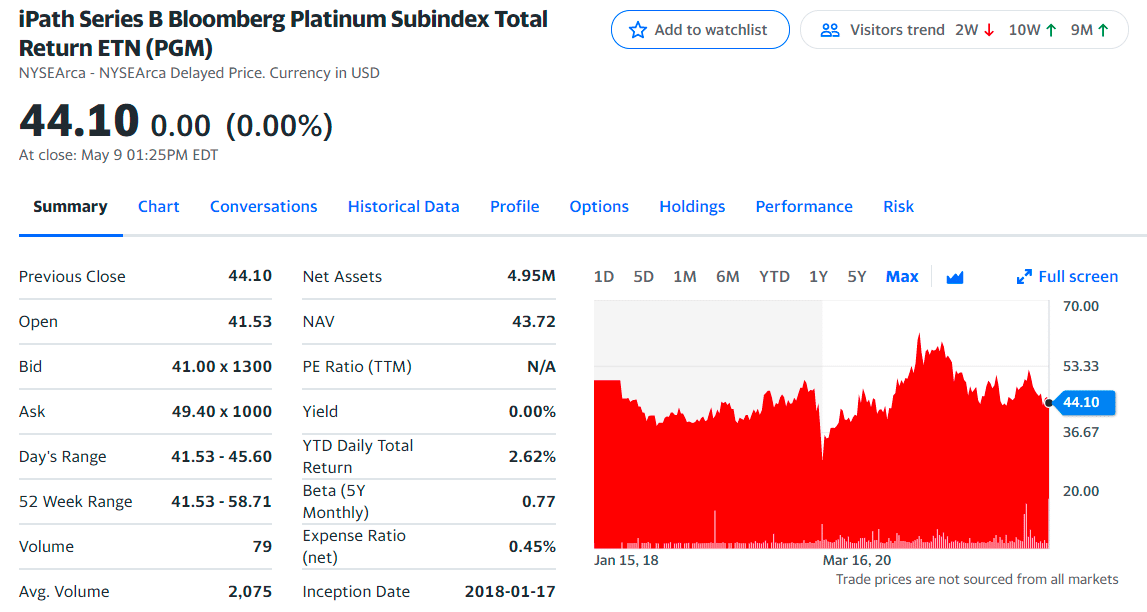

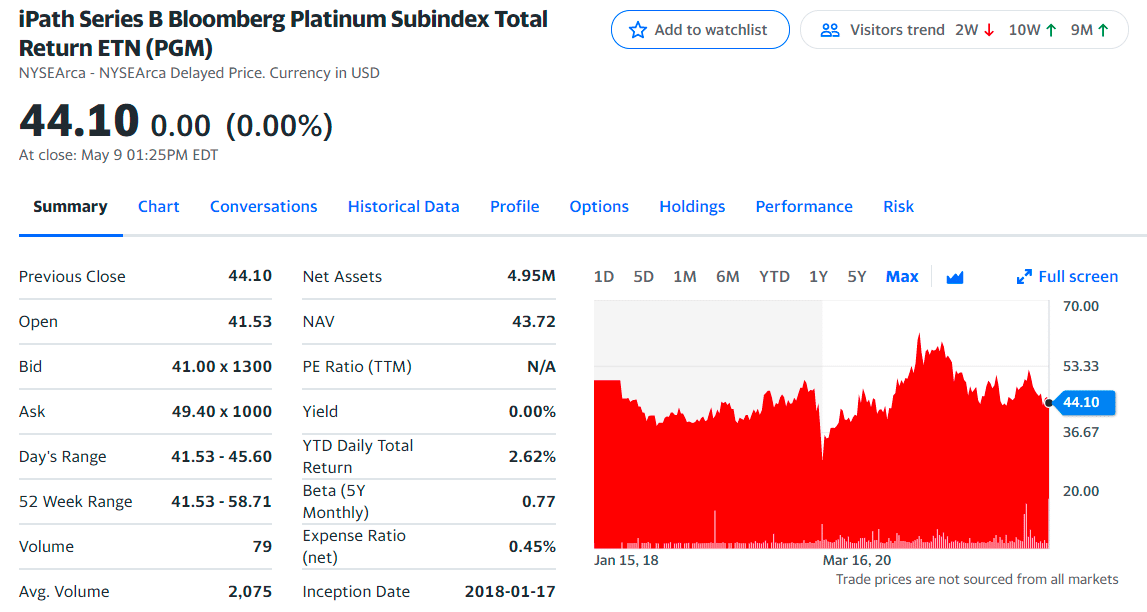

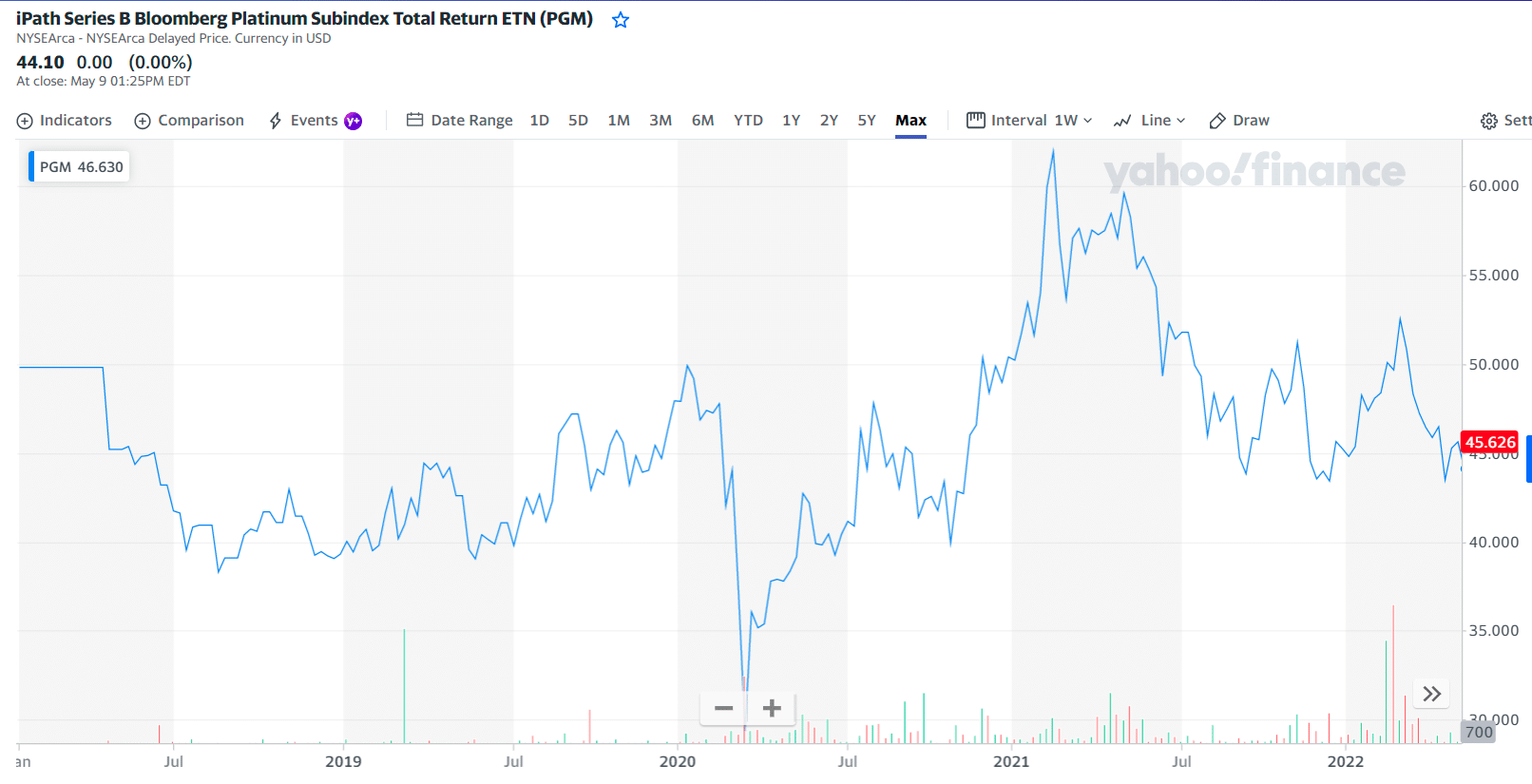

№ 4. iPath Series B Bloomberg Platinum Subindex Total Return ETN (PGM)

PGM ETF summary

PGM provides exposure to platinum by tracking a single futures contract on the metal, starting three months from maturity and held until shortly before expiration, according to a fixed schedule. This strategy produces a performance that varies significantly from spot prices. The fund was launched in 2018 and managed by Millais Investissements Funds.

PGM price chart

Its expense ratio is average compared to funds in the commodities-focused category. It has an expense ratio of 0.45%, 28% lower than its category.

The fund has returned -22.7% over the past year and 0.2% annually over the past three years. In April 2022, it returned -5.6%. PGM has an R-squared of 27%, a beta of 0.77, and a standard deviation of 24.7%. It has an above-average total risk rating.

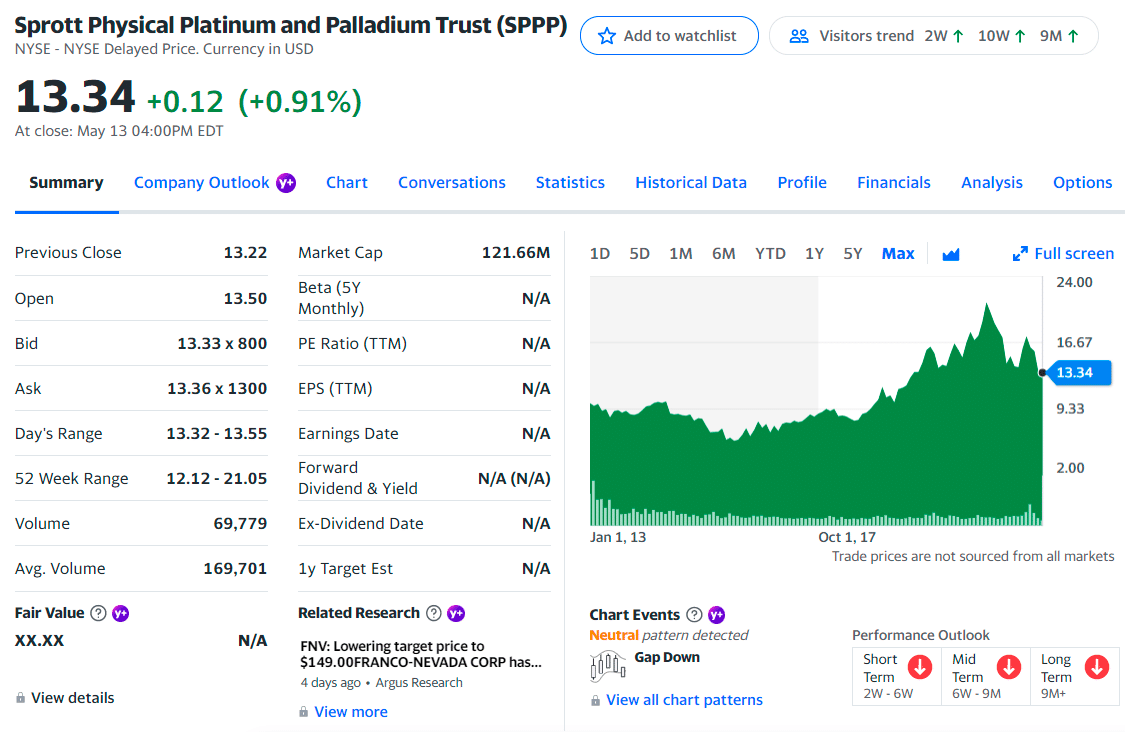

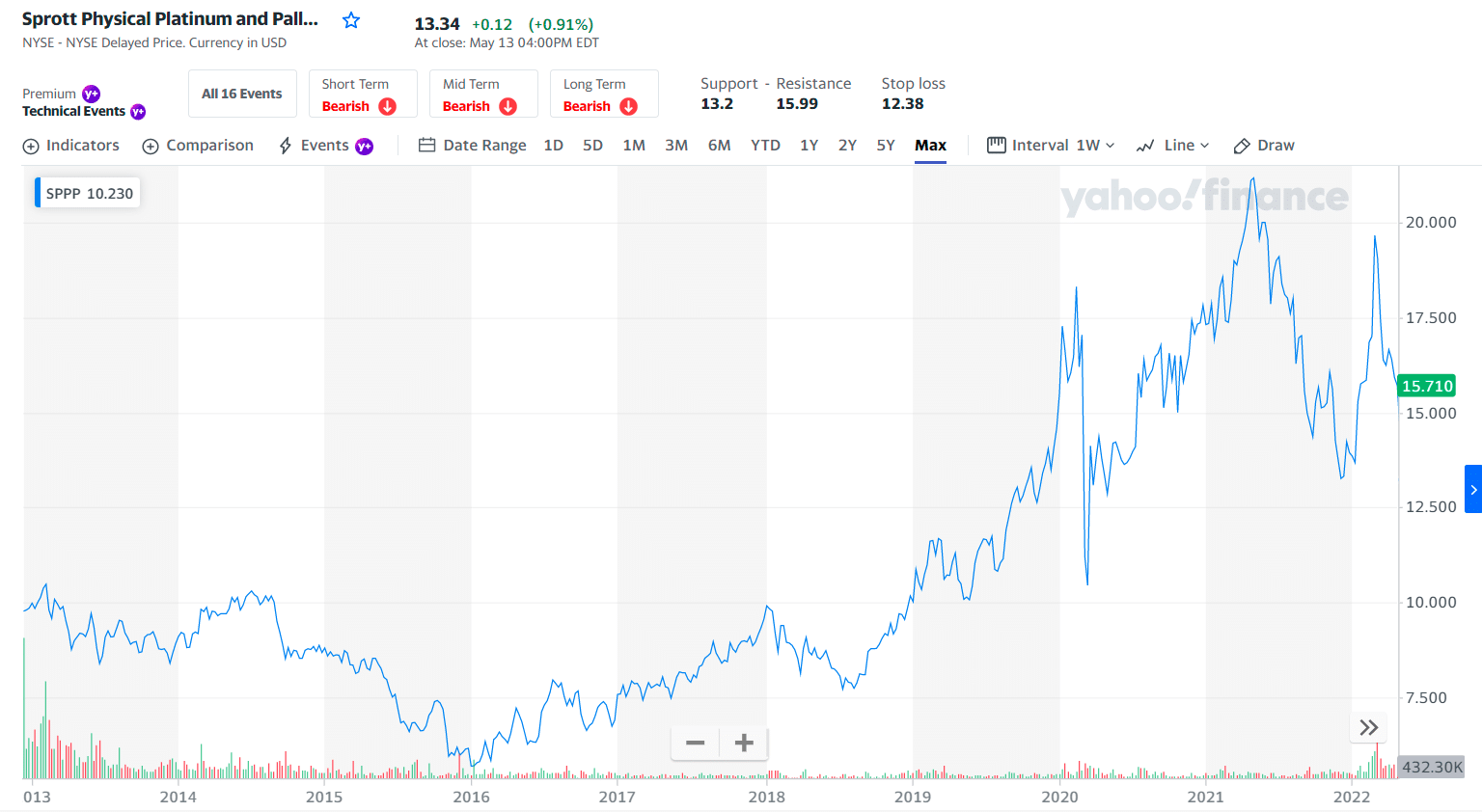

№ 5. Sprott Physical Platinum and Palladium Trust (SPPP)

SPPP ETF summary

This fund is to provide a secure, convenient, and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The trust offers several compelling advantages over traditional exchange-traded platinum and palladium funds.

SPPP price chart

The first three holders with their asset percentage are:

- Shares Held by Institutions — 12.74%

- Float Held by Institutions — 12.74%

- Shares Held by All Insider — 0.00%

Final thoughts

Rising demand for metals tends to drive up prices, providing investors with the opportunity to make money on the metals market. One broad way to invest in the thesis that metals prices will rise is through metals ETFs, an essential tool for bullish investors on the metals market.

Comments