Most financial experts, including Warren Buffett, believe the best ETF to buy for the average person saving for retirement are the large-cap funds tracking the performance of the S&P 500 or the Dow Jones. Over the very long term, it turns out that these micro-and small-cap funds to buy might deliver better returns.

Microcap ETFs generally refer to the US publicly traded companies with a market cap between $50 million and $500 million. These funds indexes target specific deciles of capitalization or exclude a fixed quantity of more extensive stocks, so the upper bound often approaches $1 billion.

Companies with less than $50 million in market cap are often labeled nano-cap stocks, although some sources will include these smaller stocks within the micro-cap classification. One of the primary benefits of using ETFs to get exposure to this market area is the single-security risk mitigation provided by the diversification achieved from owning hundreds of these assets.

What are micro cap ETFs?

They are funds more minor than small-cap. It’s somewhat of a forgotten market segment, as these assets are the most volatile, and there aren’t many products available to capture them.

First, remember the size factor – small funds tend to outperform large stocks because small assets are riskier, so investors are compensated for that risk.

Secondly, remember that factor premia get stronger as we go smaller. Factors like value and profitability pay higher premiums and are more statistically significant in smaller funds. This is why a small-cap value is usually the golden child of the market.

How to buy micro cap ETFs?

Funds work best when their underlying holdings trade inefficient, deep, and liquid markets. The micro-cap market is none of those. These assets can go for days or months without trading a single share. When they mechanically buy and sell even small share lots into a relatively illiquid market, they can affect prices.

You will need a pre-funded account with an online broker or fund platform. To buy a specific ETF, you will need to know its name or stock market ticker symbol and how much you want to buy in terms of units or total pounds invested. The entire buying process takes only minutes, but the specifics vary with different firms, so please consult your chosen broker or platform’s literature.

Top three micro cap ETFs to buy in 2022

There are only three micro-cap funds, all suboptimal and bittersweet in their way.

№ 1. iShares Micro-Cap ETF (IWC)

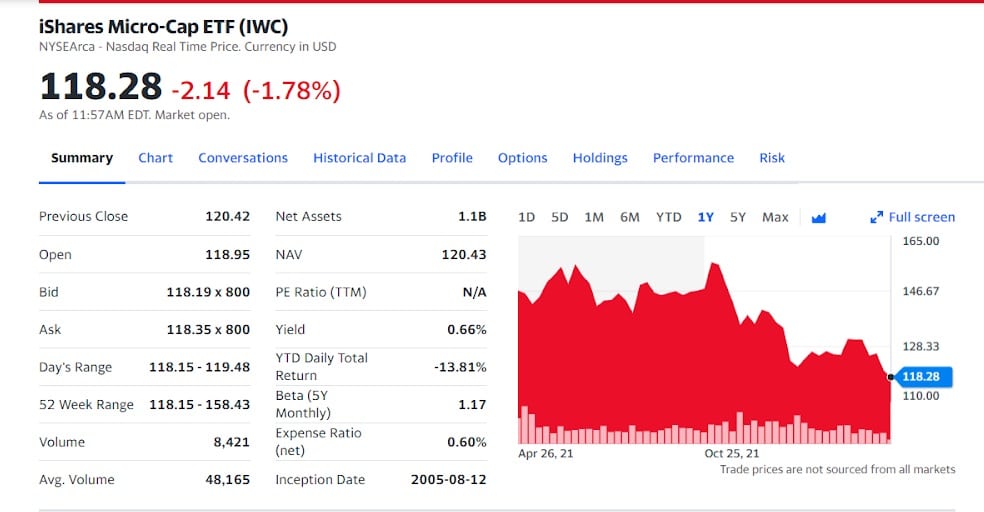

IWC summary

This fund tracks a market-cap-weighted index of US micro-cap stocks. The index selects the smallest 1000 stocks in the Russell 2000 Index. It was launched in 2005 by iShares, which doubles as its managers. The fund invests about $1.1 billion of its net assets across 1781 stock holdings, including the best small-cap, mid-cap, and large-cap funds with high net asset value. The fund has managed a 7.65% return since inception and returned 11.30% in the previous year, after-tax.

However, it skews significantly from our perspective, putting a lot of weight on companies we consider small-caps. Its beta indicates that the fund is relatively volatile compared with the broad US micro-cap market. Still, it provides decent coverage of the space overall.

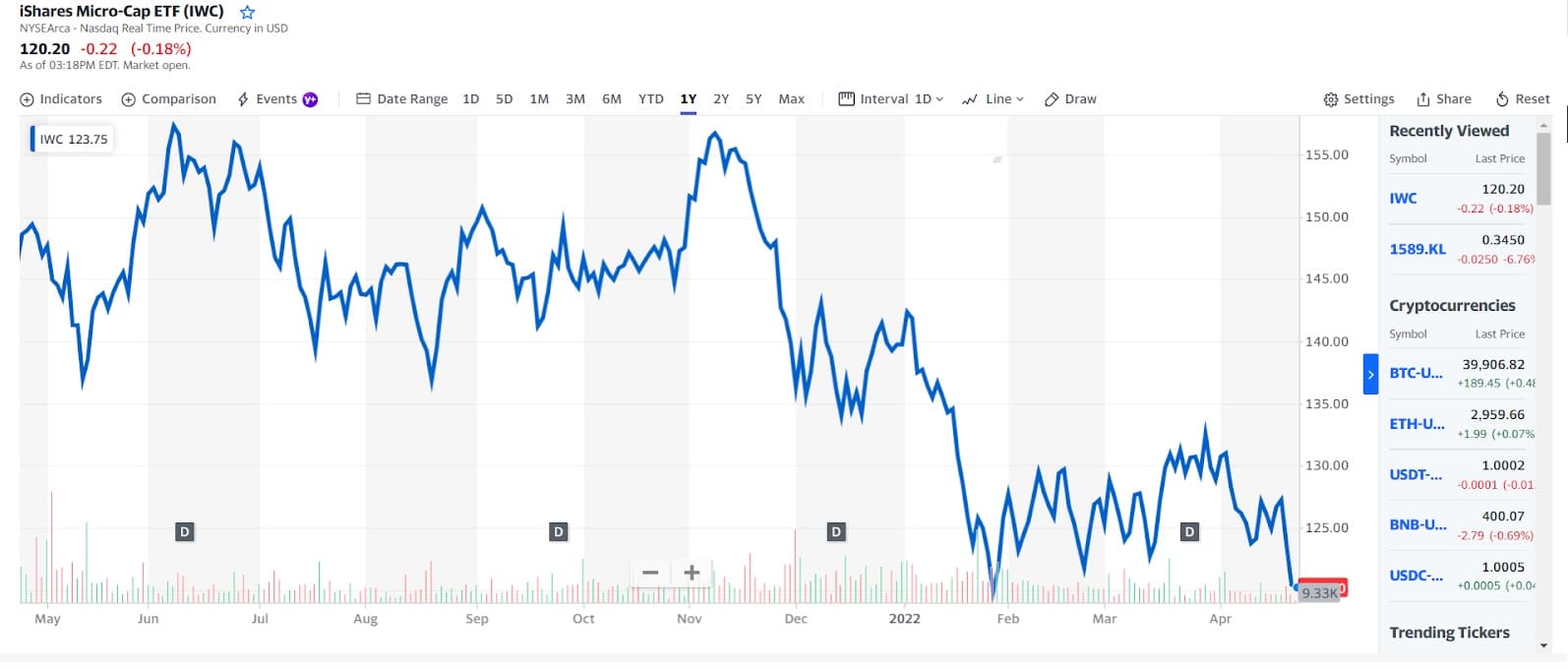

IWC price chart

Holdings costs are likely lower than the stated expense ratio, thanks to smart portfolio management that tends to recover a sizeable chunk — a solid choice for this hard-to-reach area of the market.

The first three holdings with their asset percentage are:

- Apollo Medical Holdings Inc. — 0.63%

- Protagonist Therapeutics Inc. — 0.40%

- Everi Holdings Inc. — 0.37%

№ 2. First Trust Dow Jones Select MicroCap Index Fund (FDM)

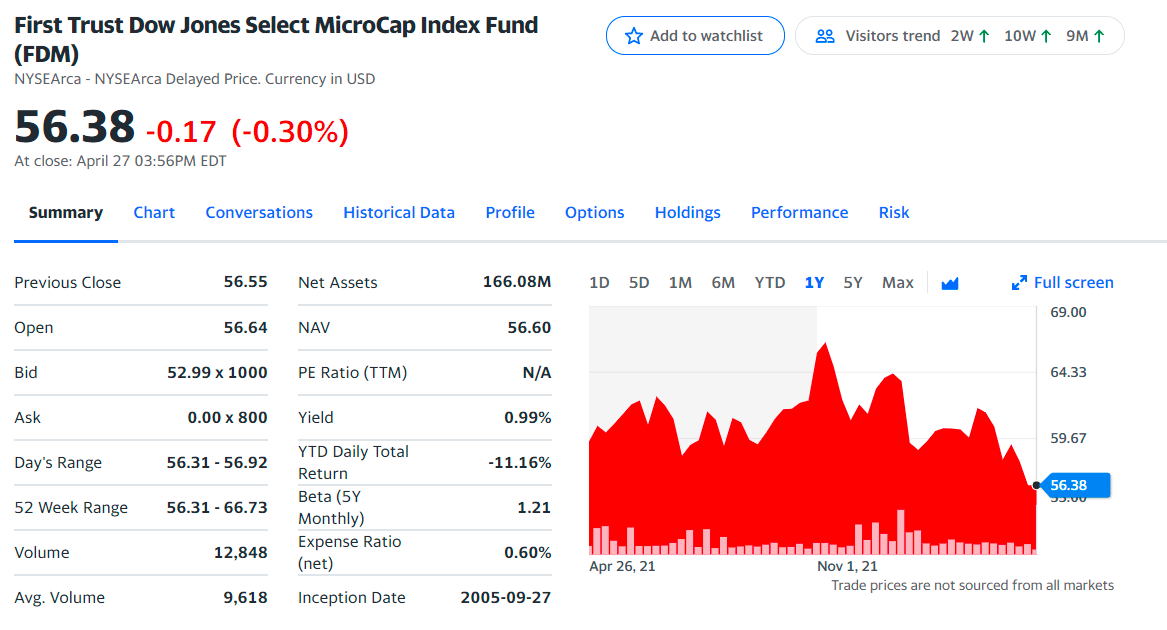

FDM summary

FDM Group Plc engages in the provision of information technology services; and it was founded by Roderick Neil Flavell in 1991 and is headquartered in London. It focuses on developing and testing information technology service management, cyber security, project management office, data services, business analysis, and AI.

The fund operates through the following geographical segments: UK and Ireland; North America; rest of Europe, Middle East, Africa; and the Asia Pacific. The fund has a comparatively greater loading on value and profitability with a similar loading on size, which means greater expected returns over the long term for FDM.

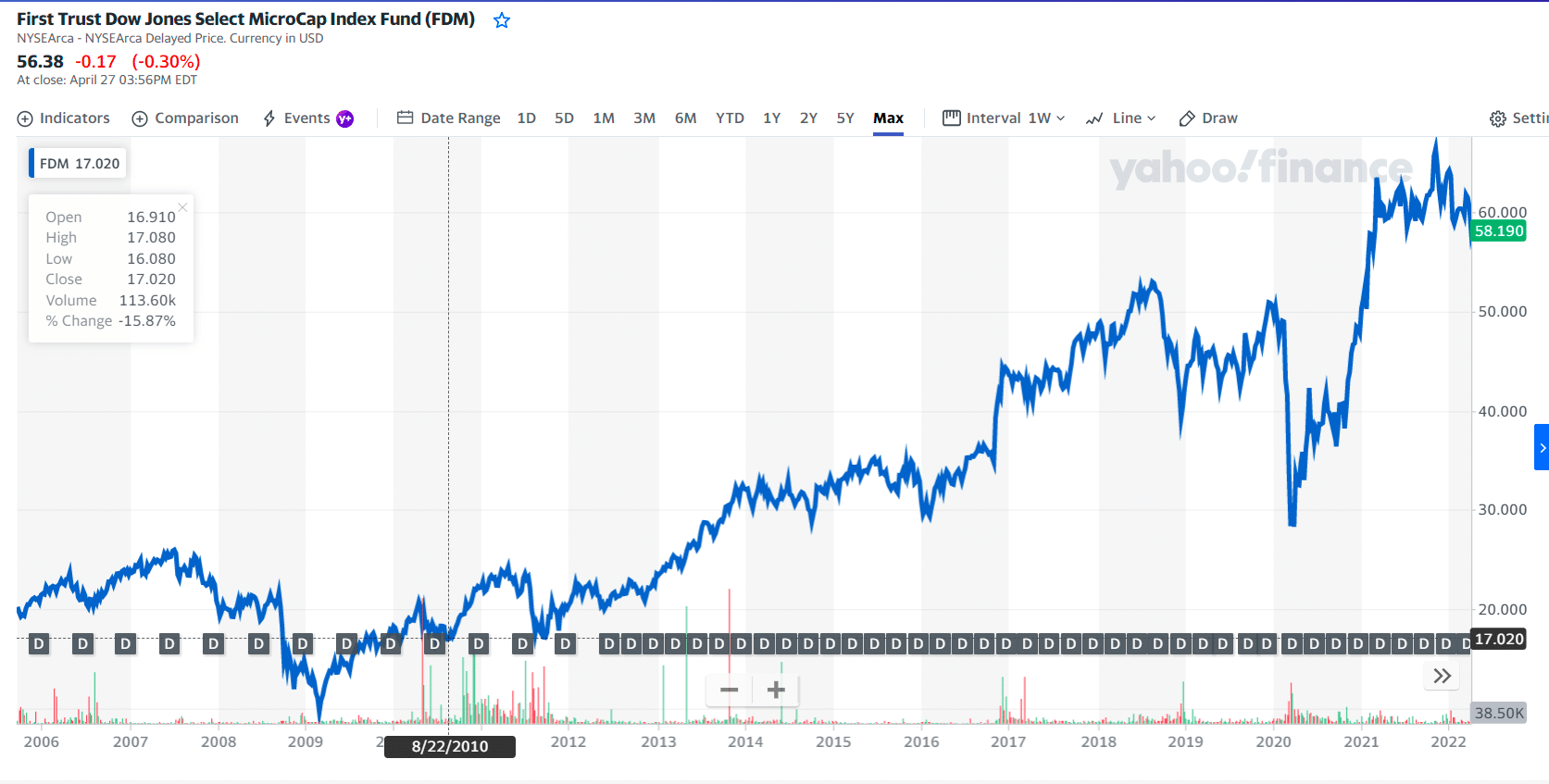

FDM price chart

It has outperformed the other two funds over its short lifespan of a little over two years but with much greater volatility and risk. It holds about 150 stocks, and its weighted average market cap is about $950 million.

The first three holdings with their asset percentage are:

- Andersons, Inc. — 1.53%

- Ingles Markets — 1.32%

- AdvanSix — 1.30%

№ 3. AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC)

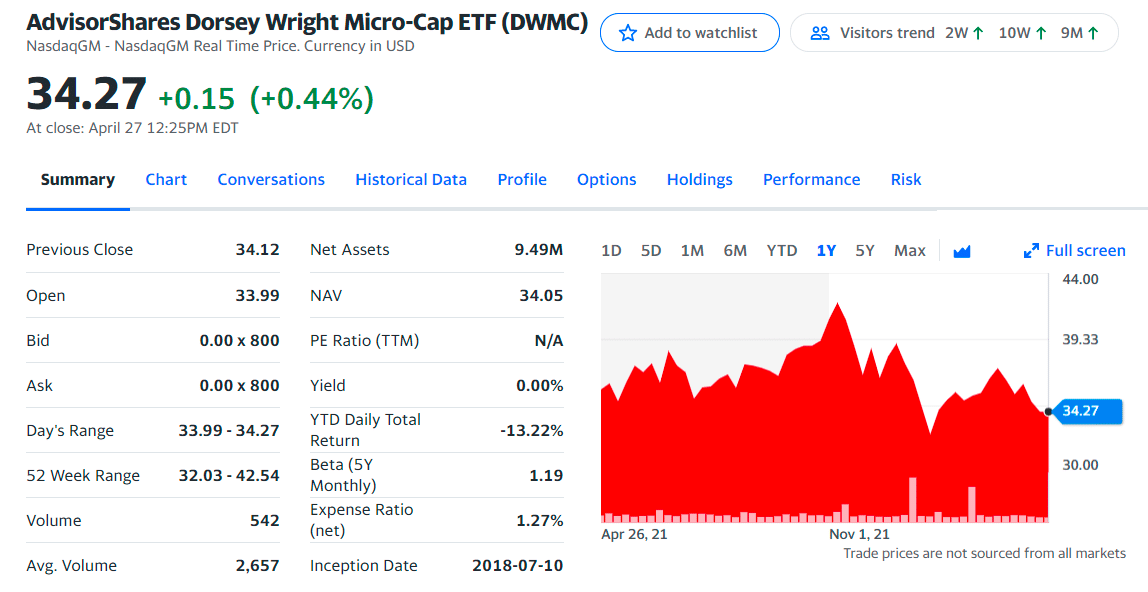

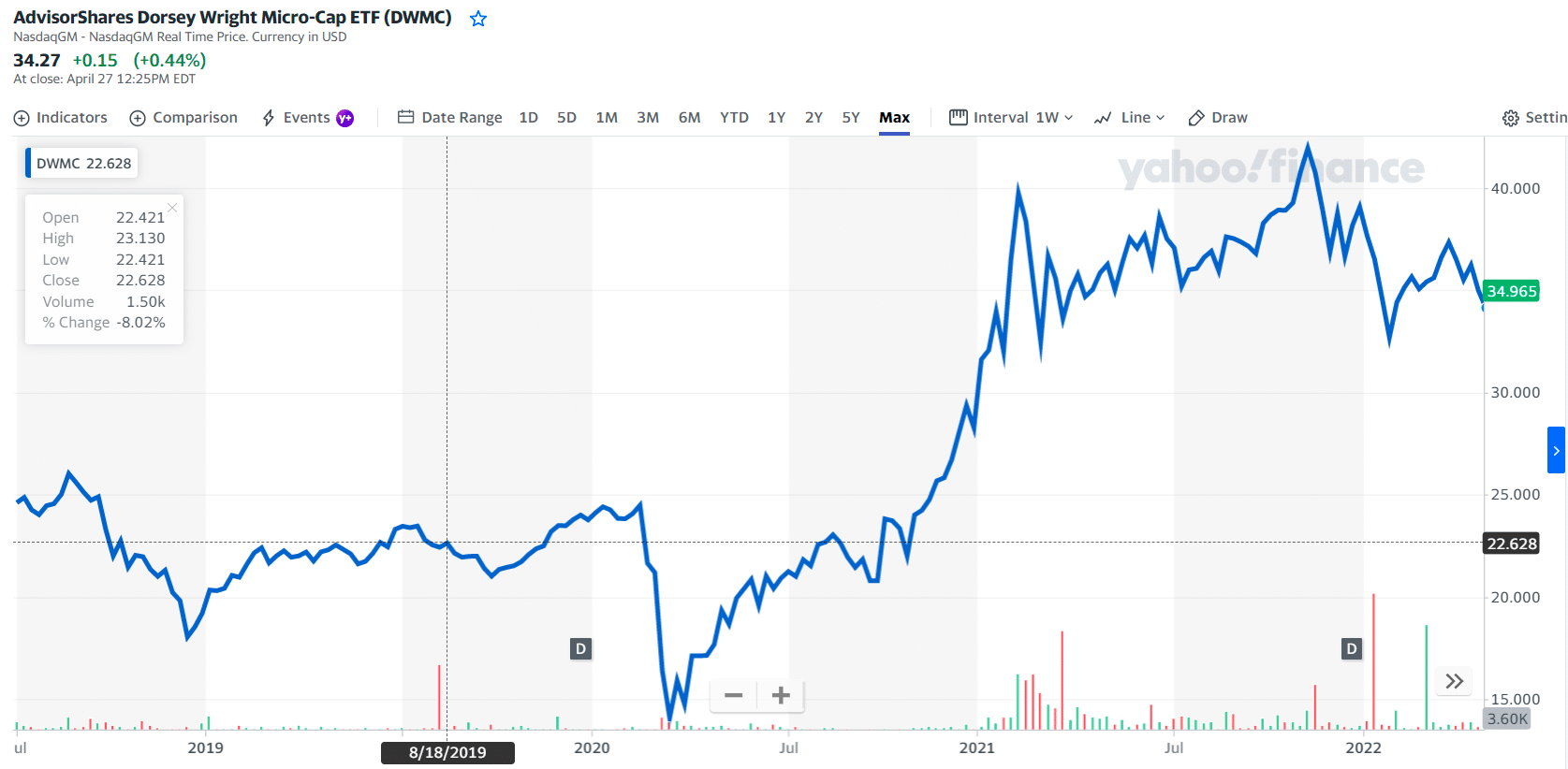

DWMC summary

Unlike the first two funds in our review, this one doesn’t care about liquidity, profitability, etc.; it’s seeking out volatile micro caps. It was created in late 2018 but hasn’t taken off at all; its AUM is only a little over $5 million. As such, it may be at risk of closure. The fund employs rule-based selection based on price momentum, so it’s not genuinely active. It increases management costs, which shows up in the fund’s high fee of 1.32%.

It has outperformed the other two funds over its short lifespan of a little over two years but with much greater volatility and risk. It holds about 150 stocks, and its weighted average market cap is about $950 million.

DWMC price chart

However, it is active in name only, as the fund follows a rules-based process to select US micro-cap stocks based on relative strength. The investment universe contains the lower half of the Russell 2000 Index by market-cap and 1,000 other micro-cap stocks. Stocks ranked in the top 50% by relative strength are included in the portfolio. Its components receive a modified equal weighting when added to the portfolio. Positions are held until their relative strength falls below the 50% threshold.

The first three holdings with their asset percentage are:

- Alpha Metallurgical Resources — 2.78%

- CVR Partners LP — 1.68%

- Danaos — 1.66%

Final thoughts

Many investors like the allure of small-cap stocks. Buying the next Apple Inc. or Amazon Inc. is every investor’s dream while still in its infancy. But investing in small-cap stocks can be difficult. Many of them aren’t covered by the Wall Street investment firms, so it’s hard to find research and opinions.

However, micro-cap funds must often include a few small and large-cap stocks in their portfolio while maintaining micro-cap dominance. And despite ETFs being a less risky channel for micro-cap stock investment, small-cap funds can be dangerous. We recommend you do your risk assessment before adding any assets to your portfolio.

Comments