When you plan to invest in stocks, you will likely encounter the term volatility in your search. Volatility is the extent of deviation from the underlying asset’s average price.

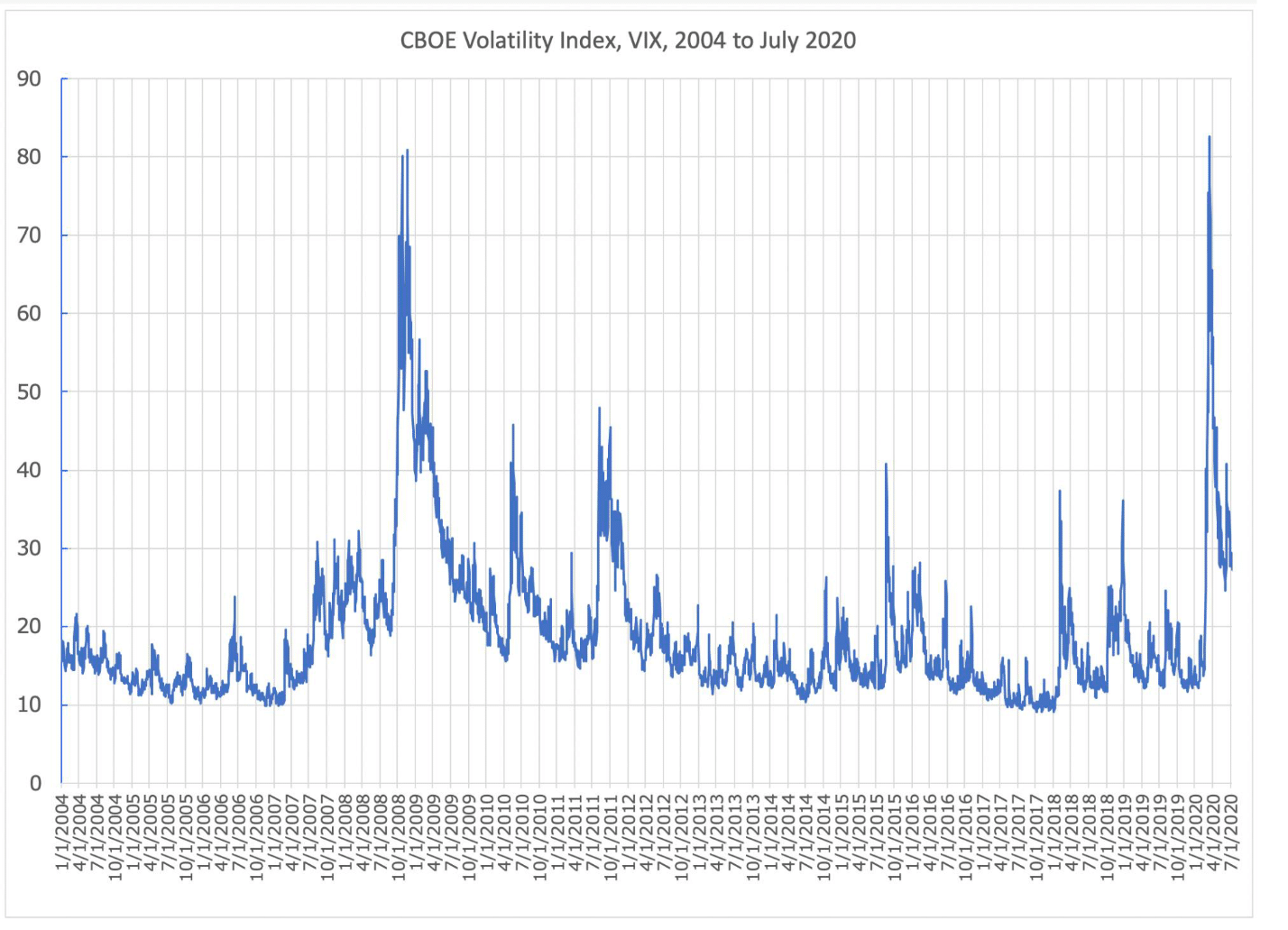

Investors look to the volatility index (VIX) for guidance to get a reliable volatility score. When they see the VIX going up, they consider the market volatile, leading to wild price fluctuations. Investors fold their hands when the VIX goes beyond 30 and wait until volatility returns to normal levels.

If you think that volatility equals risk, that is not entirely true. While volatility is used to forecast future price action, the risk is merely a perception of the potential loss. The two are not necessarily partners in crime, but they connect. You can use volatility as a factor when looking to ease investing risk.

Let us look at some volatile stocks to consider buying in 2022. Also, we will learn what volatility means, how to buy volatile stocks, one indicator you can use, and when to buy such stocks.

What are volatile stocks?

The assets which display erratic price behavior or make wild price swings up and down. You can identify them when you look at your charts. Most investors consider them high-risk investments. However, not all investors shy away from trading volatile stocks. Few come to the market in search of tremendously active stocks.

If you are an investor with a big appetite for risk, then you might love this type of stock. Of course, you cannot approach volatile stocks without preparation or a system in place. You are asking for disaster in that case. To minimize risks, you have to use a tested strategy that will allow you to exploit a moving market that will likely give hefty profits.

Volatility index

How to buy volatile stocks?

Volatile stocks tend to make sharp movements in one way or the other. To capitalize on this, you must have the patience to wait it out until you find good entries. When they appear, you must be ready and quick to take action. Naturally, volatile stocks that exhibit directional biases are better than those that move sideways. This bias is one factor you must consider when trading volatile stocks.

Without using a technical indicator, you can already tell if a stock is trending or not. Just look at the price action or market structure. Does price paint a step-up or step-down ladder formation? If so, you are seeing a market moving in one direction and moving with momentum.

One strategy to buy volatile stocks

One indicator you can use to trade volatile stocks is the Keltner channel. With this indicator, you can easily see a trending stock. Plus, it can define entries, stop losses, and take profit targets for your trades. When you attach this indicator to your chart, you will see three lines on the main chart. The middle, upper, and lower bands interact with price action. This tool works best in trending markets.

To buy a stock with the Keltner channel, identify the trend first. If the price is hugging the upper band of the channel, then the trend is up, and you should buy. Since the trend is established, wait for the price to touch the middle band. This is your entry point. Once you have taken a buy trade, put the stop loss on the lower band, and set the take profit on the upper band. Follow the same logic but in reverse for a downtrend.

Keltner channel indicator

When to buy stocks in 2022?

The stock market tends to stage a rally at the turn of the year and in the summer period. You can buy your favorite stocks during the Santa Claus rally, which happens on the last trading week of the year. You can take advantage of the January effect as well. At the start of the year, investors come back to the stock market full of hope and determination.

If you miss the January entry, you can look to the summer months for your stock investing. This period essentially coincides with the third quarter of the year. Thus, July to September 2022 is a reasonable buying period. If you want to buy and sell stocks more often as a short-term investor, you can get a good deal every month. Just buy at the middle of the month to get discount prices and then liquidate your position at the end of the month.

Top three volatile stocks to buy in 2022

Below is our pick of the top three volatile stocks to consider buying in 2022.

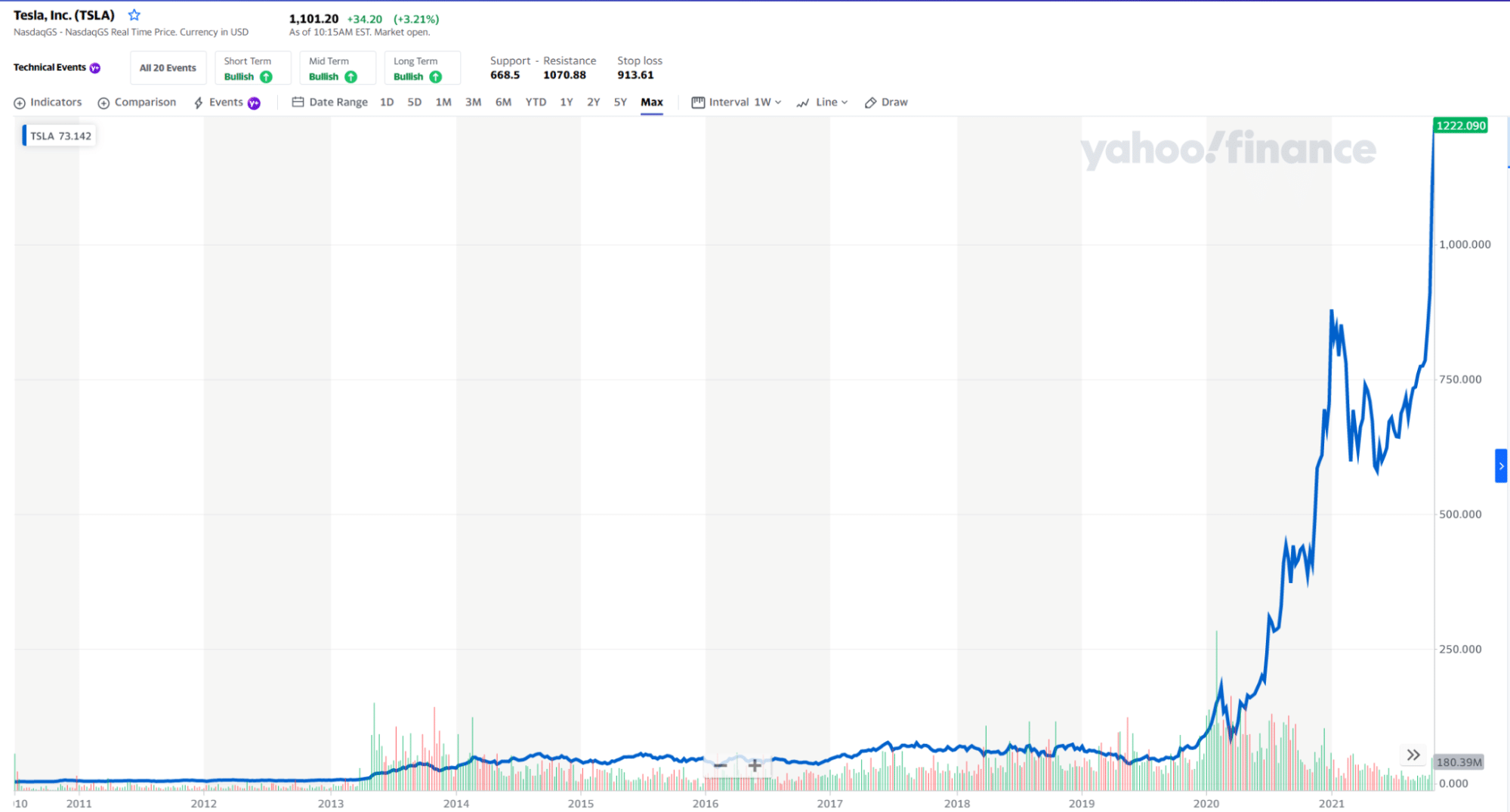

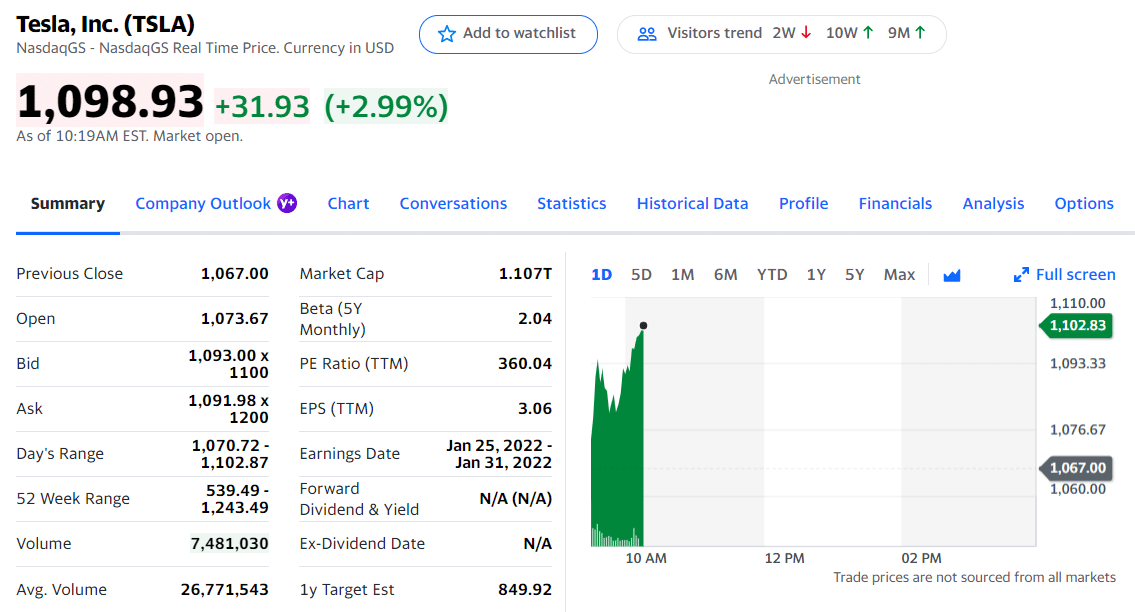

No. 1: Tesla, Inc. (TSLA)

Price: $1,101

EPS: 3.06

Market capitalization: $930.869 billion

Tesla stock price chart

Tesla manufactures and markets clean-energy devices and electric cars. It had a strong rally starting from the last few months of 2020 until April of 2021. However, this bull run faded in the wake of falling demand for electric vehicles in China. When the demand picked up, the stock began rising again.

Tesla stock summary

The company is anticipating a massive growth of its bottom line as it scales in production capacity, manufacturing becomes more efficient and done locally, and the self-driving system becomes mature.

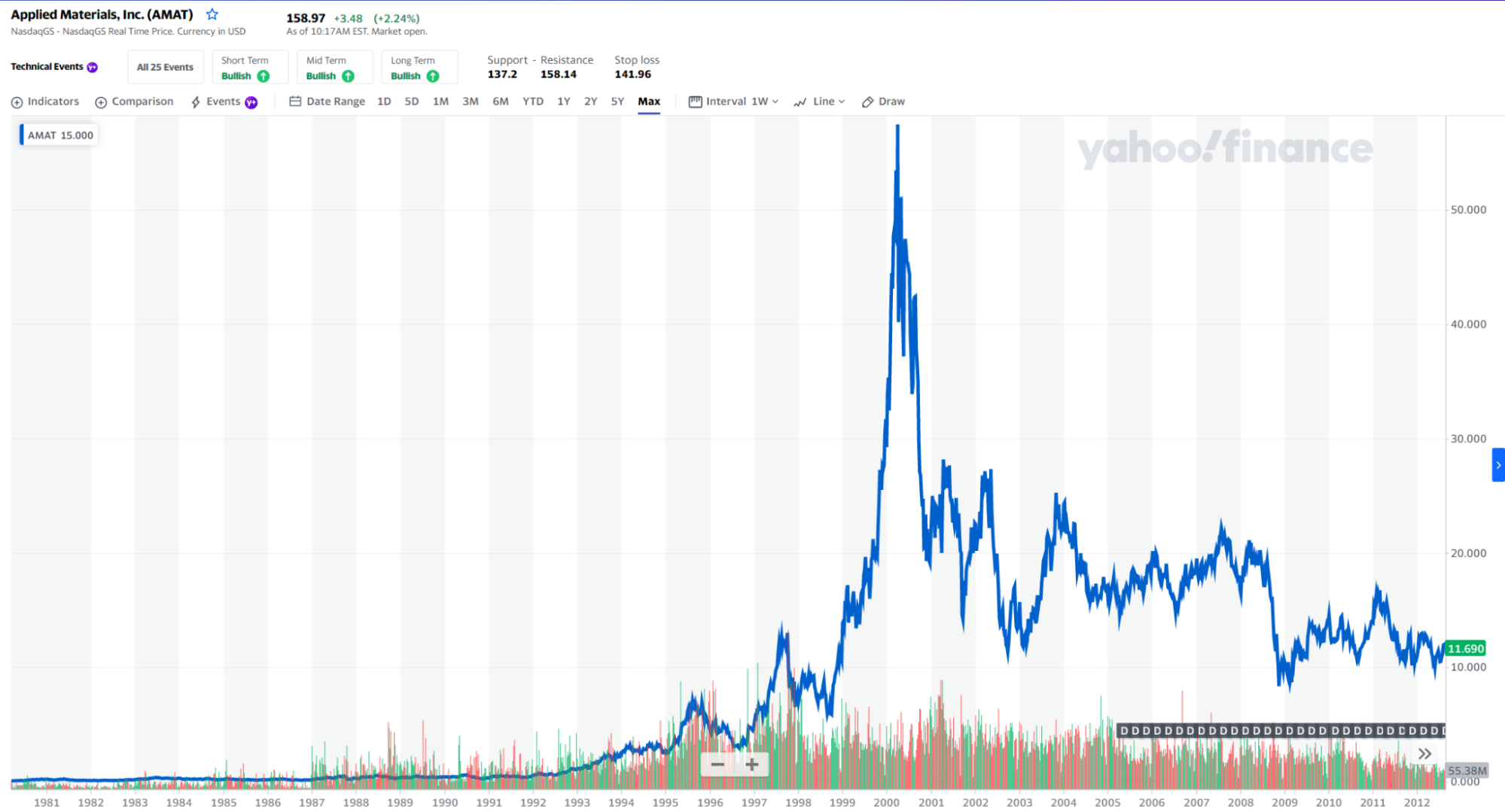

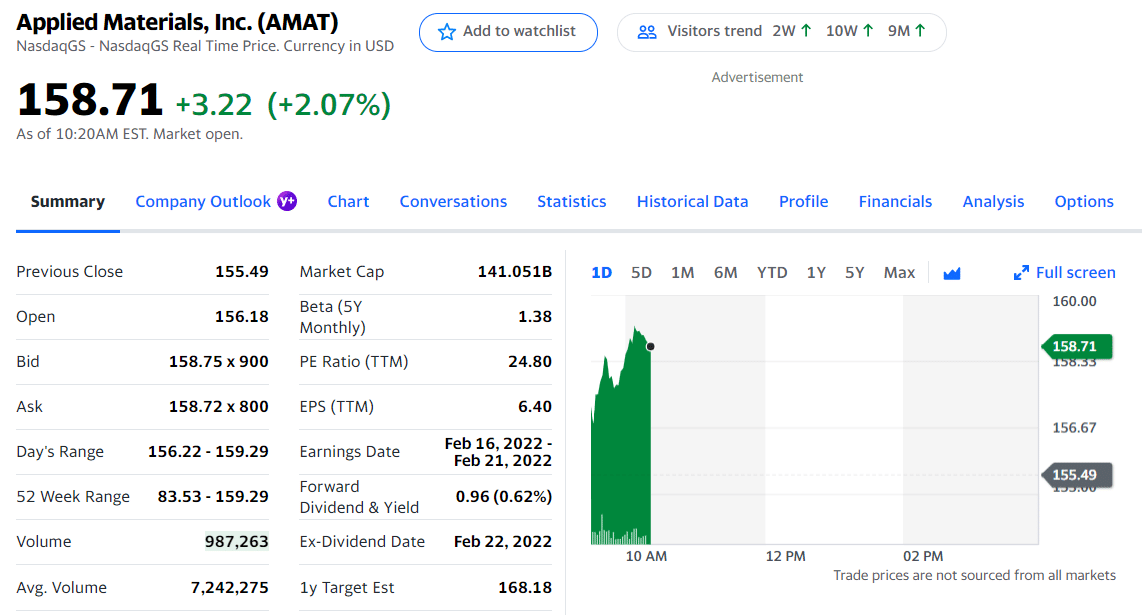

No. 2: Applied Materials (AMAT)

Price: $158.71

EPS: 6.40

Market capitalization: $132.46 billion

AMAT stock price chart

The company manufactures and markets semiconductors. On 20 May 2021, AMAT published its revenue for the second quarter, that is, $1.63 earnings per share. This value amounts to about $5.6 billion, making around 40% gain year after year.

AMAT stock summary

On 10 June 2021, AMAT gave a $0.24 quarterly dividend per share to its shareholders. Shortly after, JP Morgan stated that it plans to grow its AMAT holdings within the year.

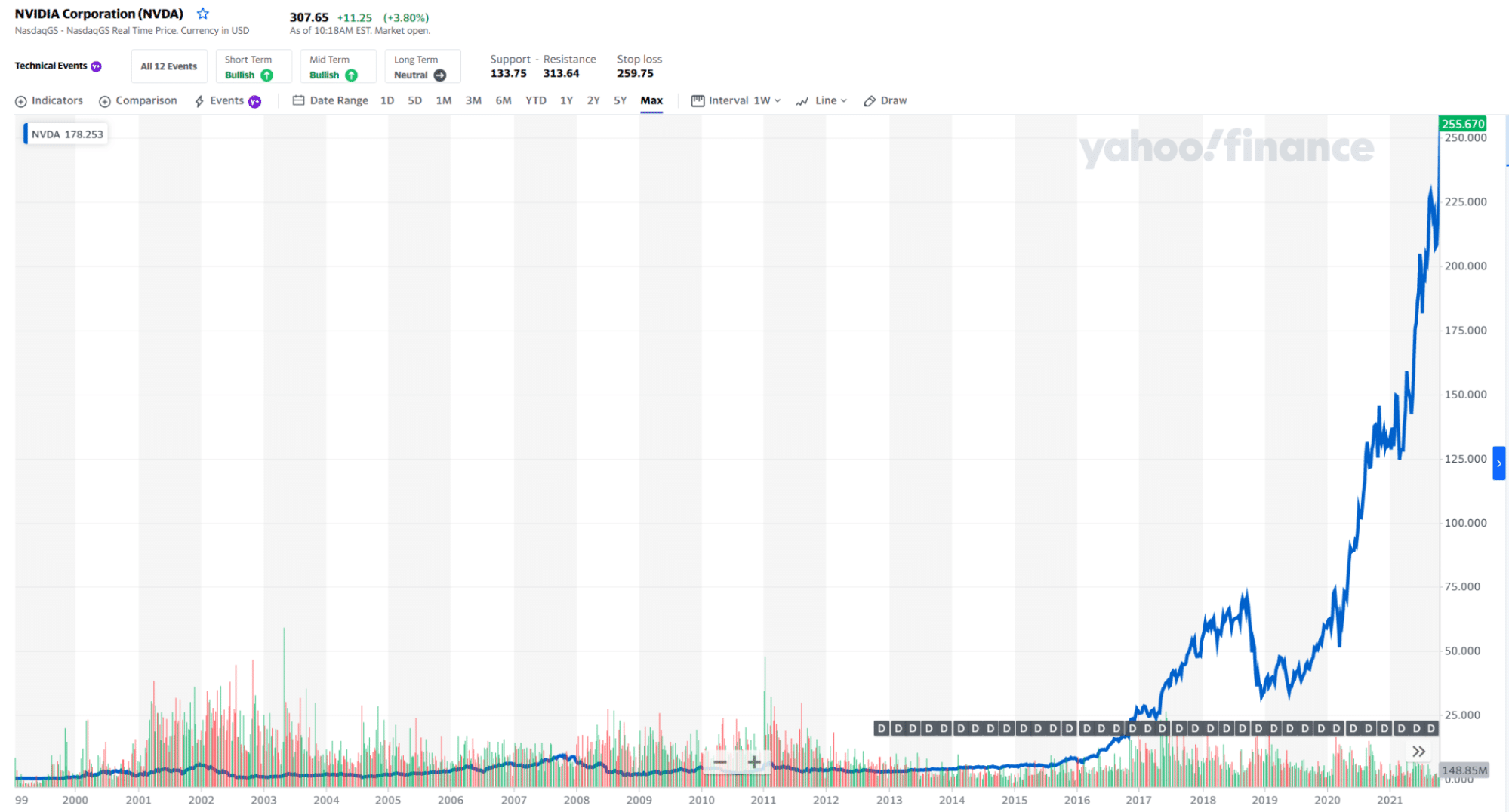

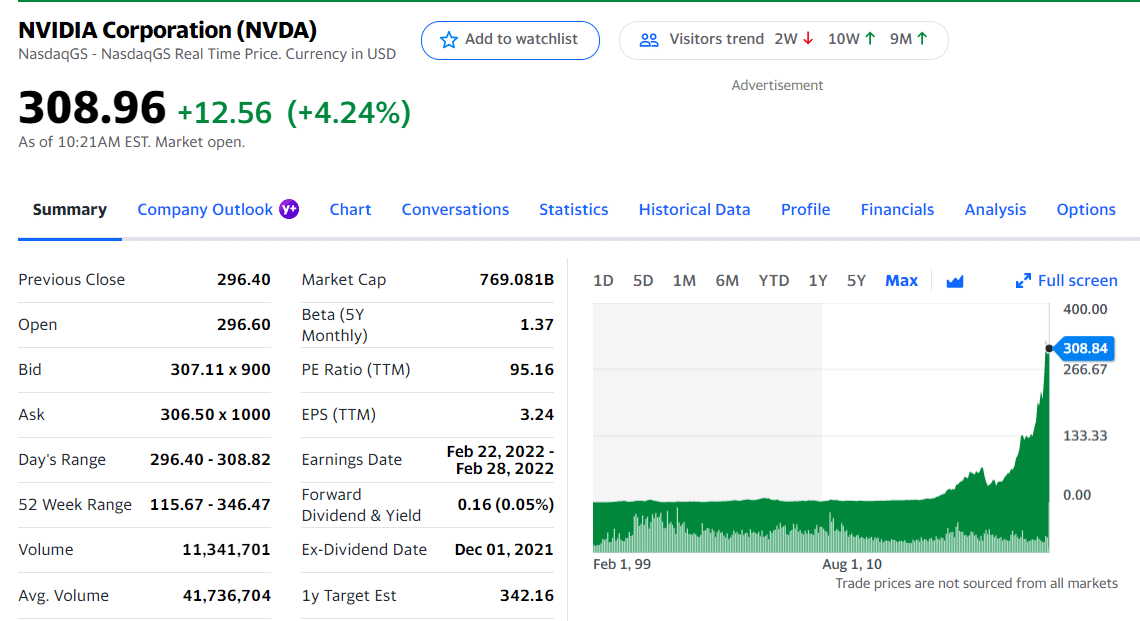

No. 3: NVIDIA Corporation (NVDA)

Price: $308.96

EPS: 3.24

Market capitalization: $707.404 billion

NVDA stock price chart

It is a visual computing company with a market cap of more than $700 billion. It published earnings of $16 billion in 2020. This revenue came as a result of the high demand for semiconductor chips. NVIDIA’s products have become in demand worldwide in recent years due to the growth of crypto mining.

NVDA stock summary

Finance website tracker Insider Monkey revealed that 80 hedge funds in its database hold NVIDIA shares amounting to $6.2 billion, which is about 28 percent ($8.6 billion) lower than the previous quarter.

Final thoughts

To succeed in stock investing, you must become a versatile investor by investing in any market environment. You cannot trade or invest in any market without volatility. While the risk is higher when buying volatile stocks, the chance for quick, hefty returns exists. Just be aware of the potential loss and find a way to limit the downside effect.

Comments