Each year there are a few trends that investors watch closely and often take off incredibly. This year it’s 5G or fifth-generation technology. With the onslaught of so many smart devices using up the Wi-Fi network, 5G is a way for the telecom sector to keep up with the demand for superior service.

While you could invest in individual companies offering this technology, that’s risky. To offset the risk, you could invest in ETFs, which are baskets of securities meant to offset the risk of a single stock.

So what is the best fund thus far? Here are our favorites.

What are 5G ETFs?

The “fifth-generation” of mobile technology, is the next significant standard for broadband cellular networks. Experts predict that these networks will eventually provide consumers with ten gigabytes per second data speeds.

An ETF is a basket of stocks that trades on the stock market like an ordinary share of stock. Unlike mutual funds, ETFs can be purchased during the trading day. The stocks included in an ETF are generally driven by a theme. For instance, a 5G ETF will hold the stocks of companies that offer 5G services.

Now you know what a 5G ETF is, let’s look at how to invest in some of them.

How to buy 5G ETFs?

Step 1

Open a trading account. The first step is to register with an online broker. Pay attention to commissions and keep an eye out for hidden fees such as interest on margins or withdrawal service fees. Take note of trading restrictions and minimum account balances as well.

Step 2

Choose the fund. Your broker’s online portal will show a list of available funds, and some platforms will allow you to narrow the list to find funds from a specific provider or with low fees.

Step 3

Execute your trade. When you’ve found the fund you want to buy, you can purchase it from your broker in the same way you do a stock.

Top five 5G ETFs to buy in 2022

The following five ETFs are among the most popular for investors, and they can help you add 5G exposure to your investment portfolio.

№ 1. Vanguard Communication Services ETF (VOX)

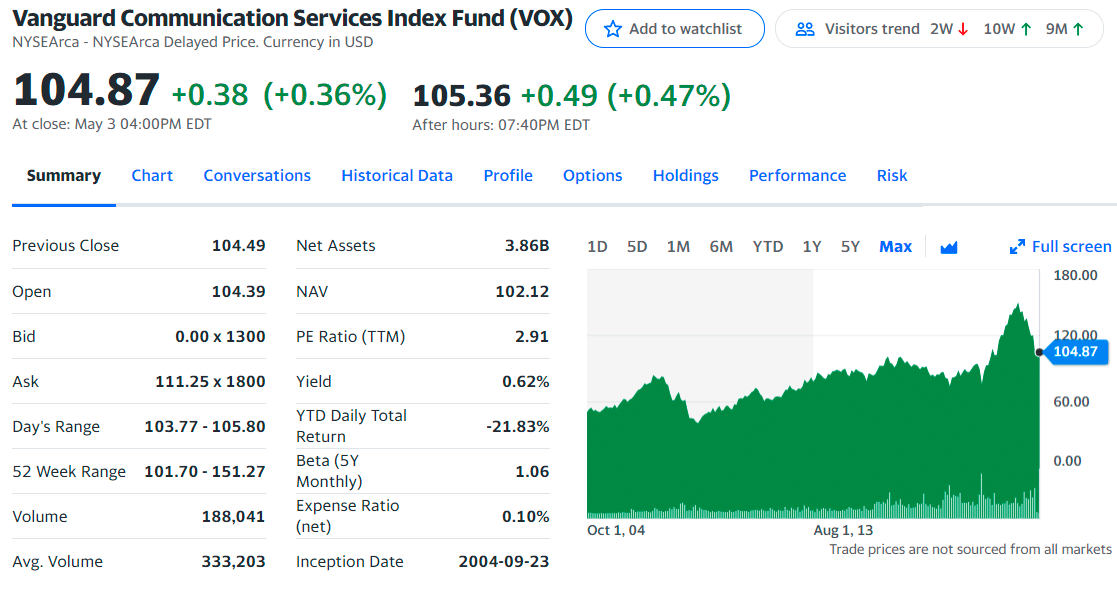

VOX ETF summary

If you are interested in this technology investing, you’ve probably heard of VOX. With over $3.16 billion in AUM, it is the largest telecom fund investing in 5G companies. The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index, which is made up of stocks of large, mid-size, and small US companies within the communication services sector, as classified under the GICS.

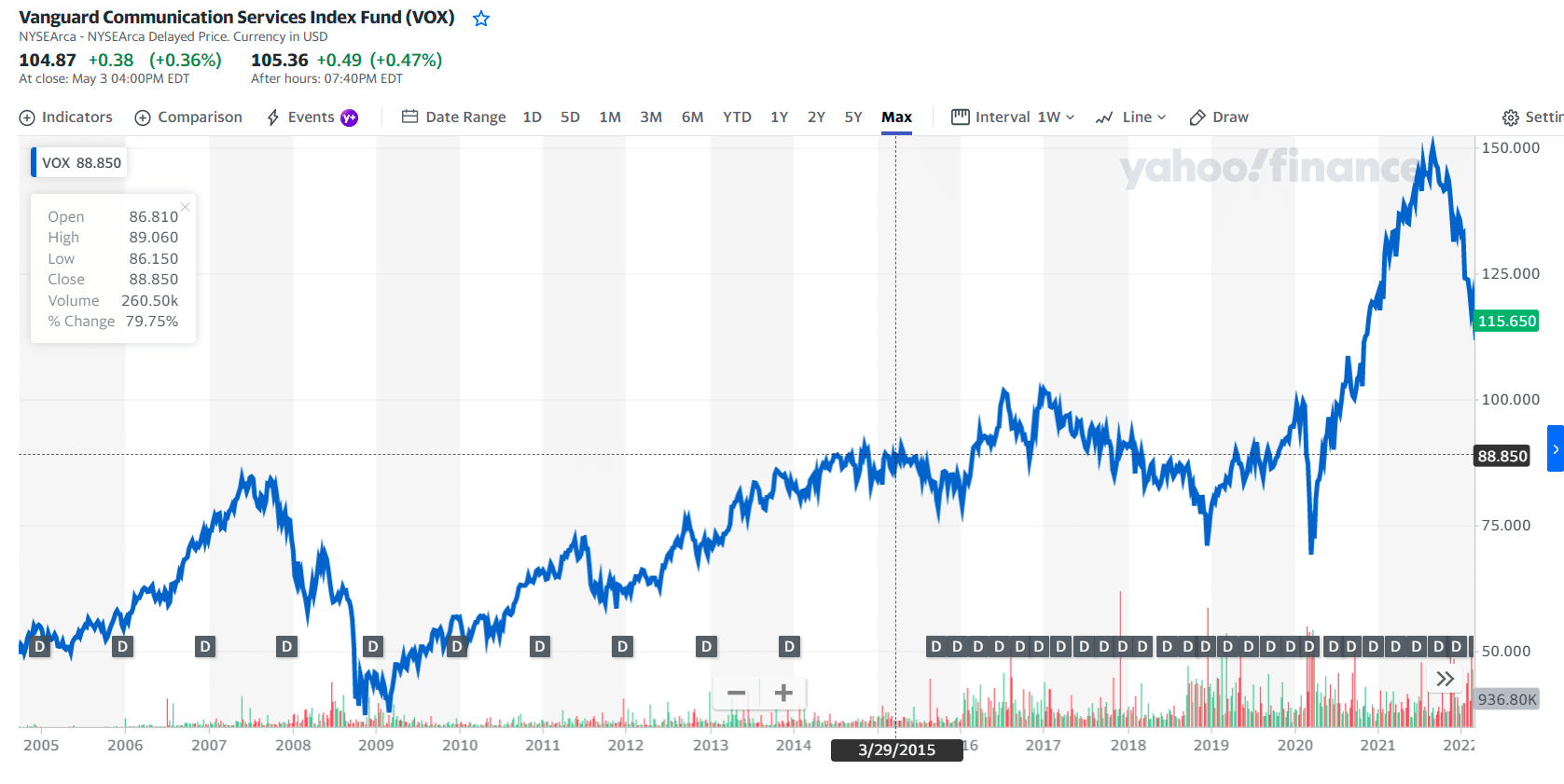

VOX price chart

Some of the company’s most extensive 5G holdings include investments in Verizon Communications, the Comcast Corporation, and AT&T. Other significant holdings include Facebook and Google’s parent company, Alphabet. With widespread investments in some of the largest tech companies in the US, this ETF can provide you with a diverse range of exposure to this market and beyond.

Its expense ratio is low compared to funds in the communications category. VOX has an expense ratio of 0.10%, which is 74% lower than its category. The fund has returned -6.8% over the past year and 13.9% annually over the past three years, 6.5% per year over the past five years, and 9.1% per year over the past decade. The fund has an R-squared of 83%, a beta of 1.06, and a standard deviation of 19.9%. It has an average total risk rating.

The first three holdings with their asset percentage are:

- Facebook Inc Class A — 16.95%

- Alphabet Inc Class C — 11.26%

- Alphabet Inc Class A — 11.22%

№ 2. iShares US Telecommunications ETF (IYZ)

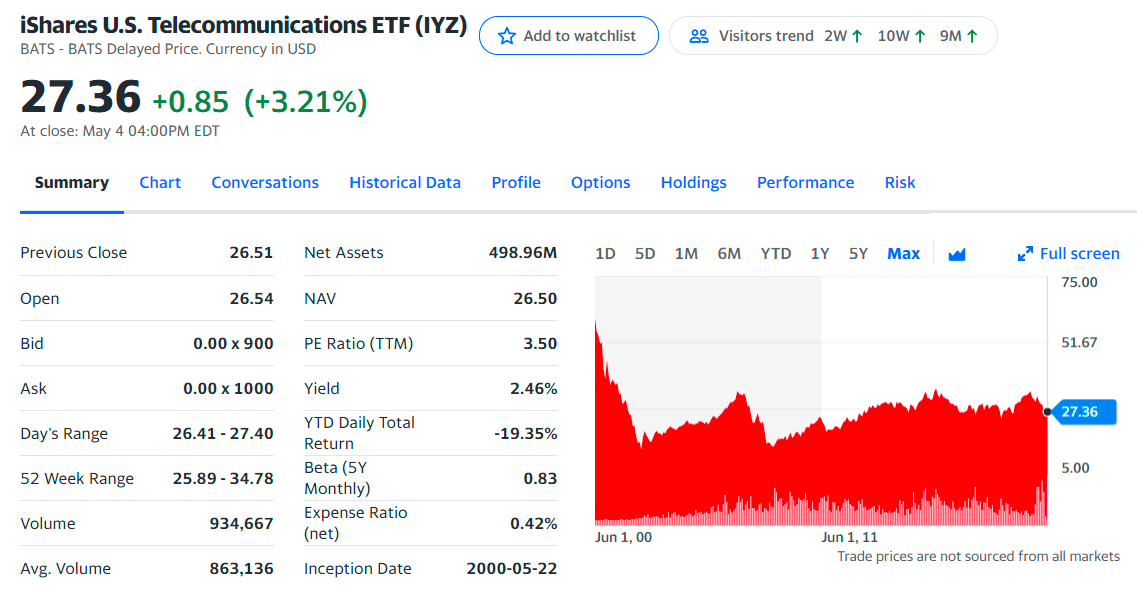

IYZ ETF summary

This smaller iShares ETF is valued at about $400 million. But unlike VOX and the prior Fidelity fund, this dedicated telecom fund cuts out the Big Tech leaders near the top of some other funds and instead goes all-in on the actual telecom service providers.

There’s risk there, too, with roughly 35% of the fund in big names such as Comcast Corp., Verizon, and AT&T. If you’re not afraid of this focused approach. The fund is the best way to play actual connectivity providers instead of secondary players.

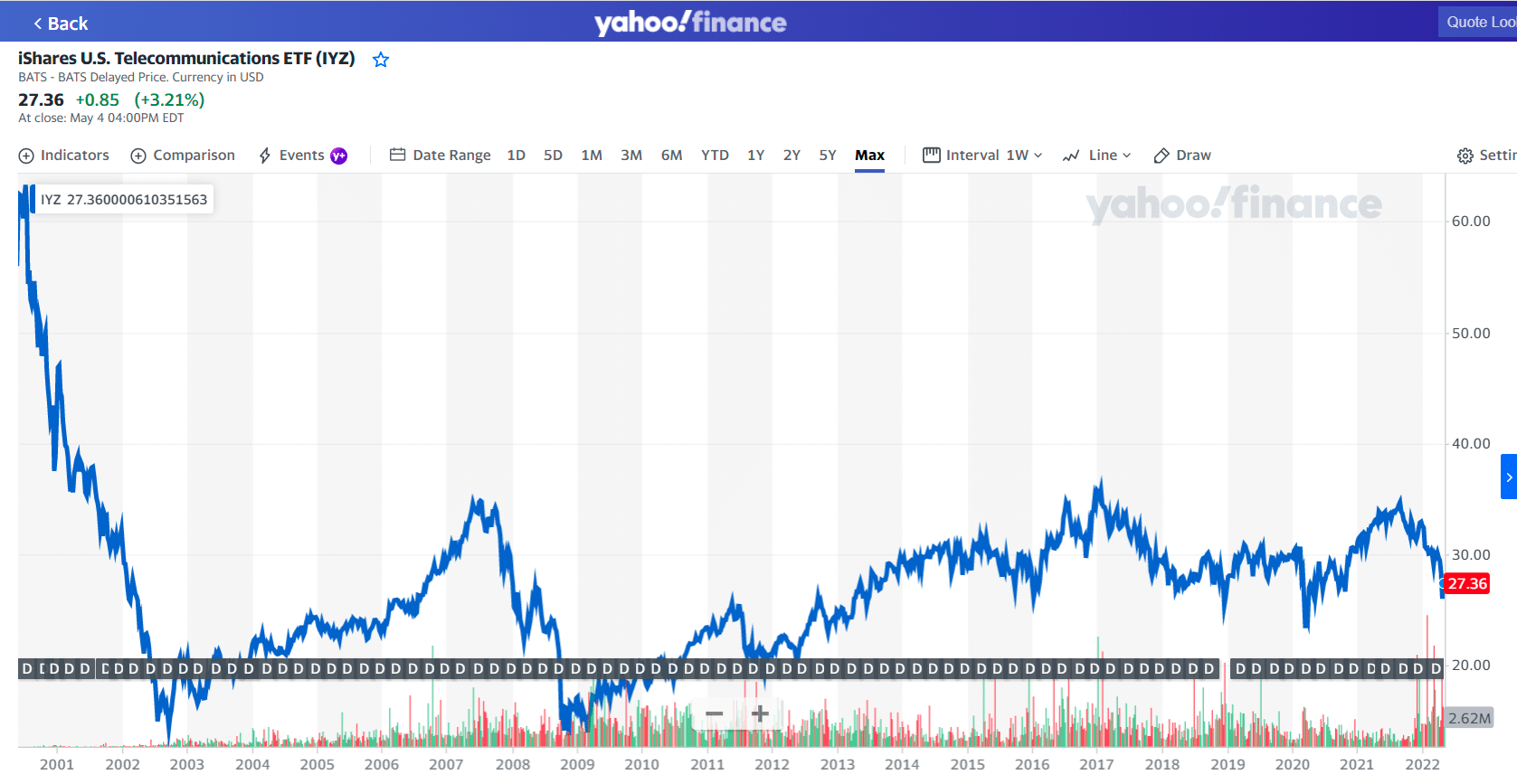

IYZ price chart

The fund is non-diversified. Its expense ratio is average compared to funds in the communications category. IYZ has an expense ratio of 0.42%, which is 11% higher than its category. The fund has returned -19.1% over the past year and -2.5% annually over the past three years, -2.8% per year over the past five years, and 4.3% per year over the past decade. It has an R-squared of 79%, a beta of 0.88, and a standard deviation of 18.0%. It has a below-average total risk rating.

The first three holdings with their asset percentage are:

- Cisco Systems Inc — 24.15%

- Verizon Communications Inc — 21.31%

- Garmin Ltd — 5.43%

№ 3. Global X Internet of Things ETF (SNSR)

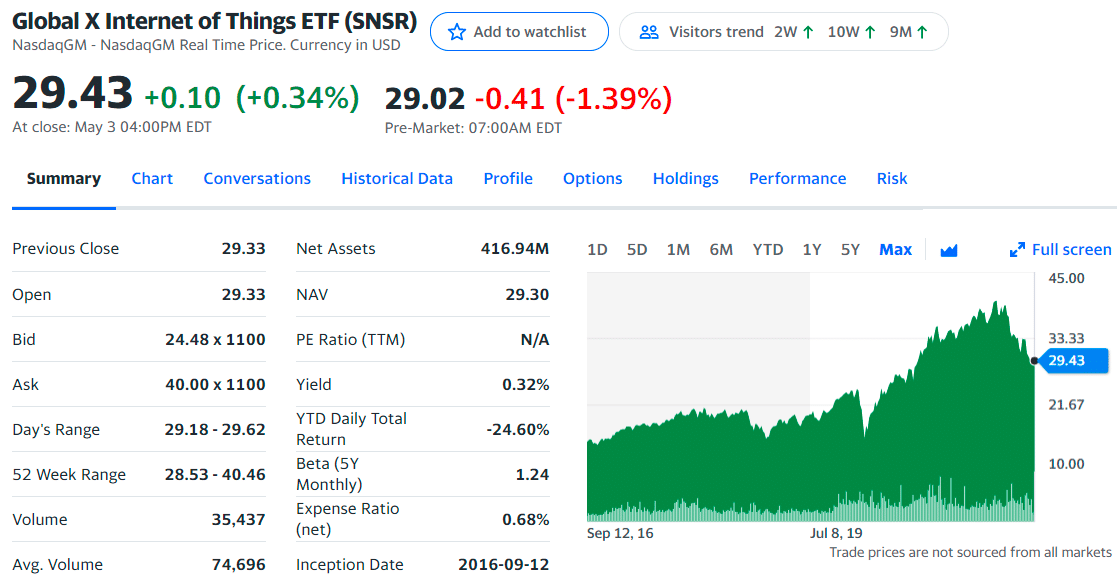

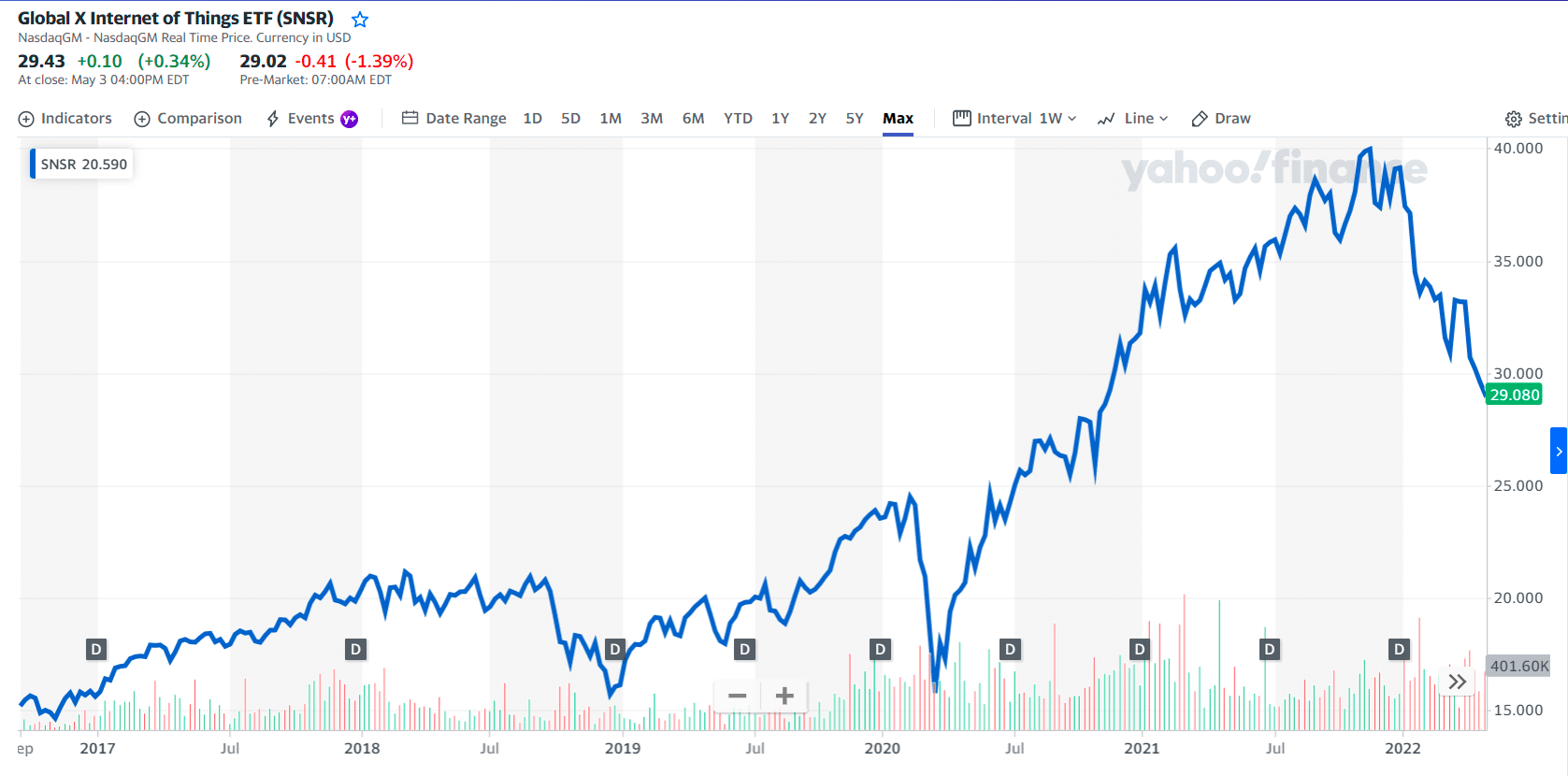

SNSR ETF summary

Another relative newcomer to the sector is the SNSR, launched in 2016. It doesn’t directly invest in the companies bringing 5G to the world. Instead, it invests in those focused on technologies that directly benefit from 5G’s rollout, companies developing IoT. The trade-off for attractive share price growth is that the annual dividend yield is 0.5%.

The fund’s portfolio of 47 stocks has more than doubled in value since its inception, partly due to some high-growth companies in the ETF’s portfolio. The largest companies are top connectivity stocks such as healthcare technologist DexCom, automotive chipmaker NXP Semiconductor, and navigation and sports device maker Garmin.

SNSR price chart

Its expense ratio is above average compared to funds in the technology category. SNSR has an expense ratio of 0.68%, which is 21% higher than its category. The fund has returned 0.8% over the past year and 22.9% annually over the past three years. The fund has an R-squared of 87%, a beta of 1.24, and a standard deviation of 23.0%. It has an above-average total risk rating.

The first three holdings with their asset percentage are:

- Skyworks Solutions Inc. — 6.36%

- Garmin Ltd — 6.28%

- STMicroelectronics NV — 5.77%

№ 4. First Trust IndXX NextG ETF (NXTG)

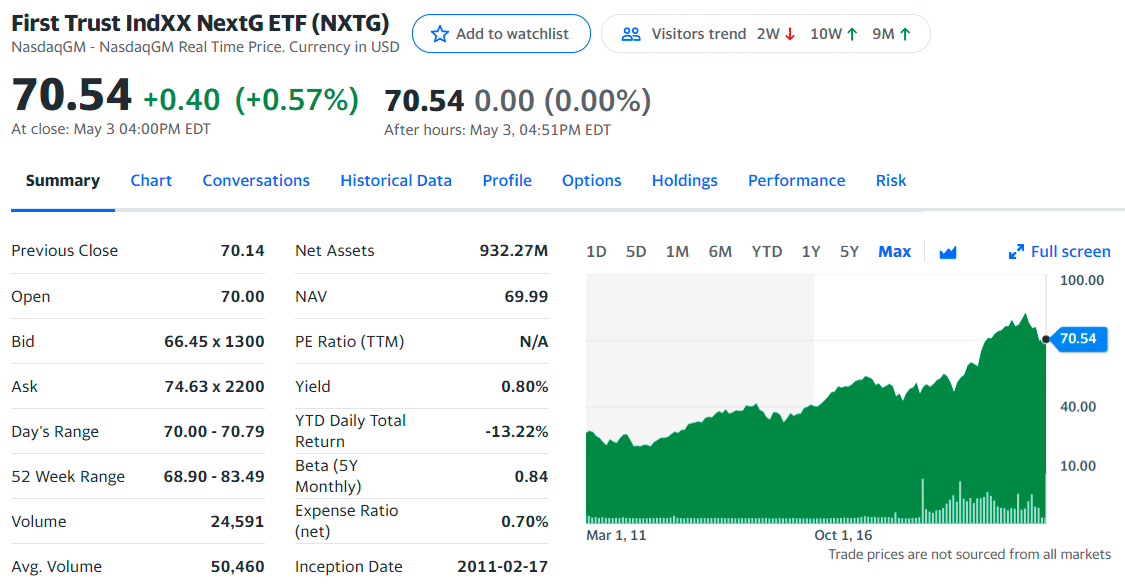

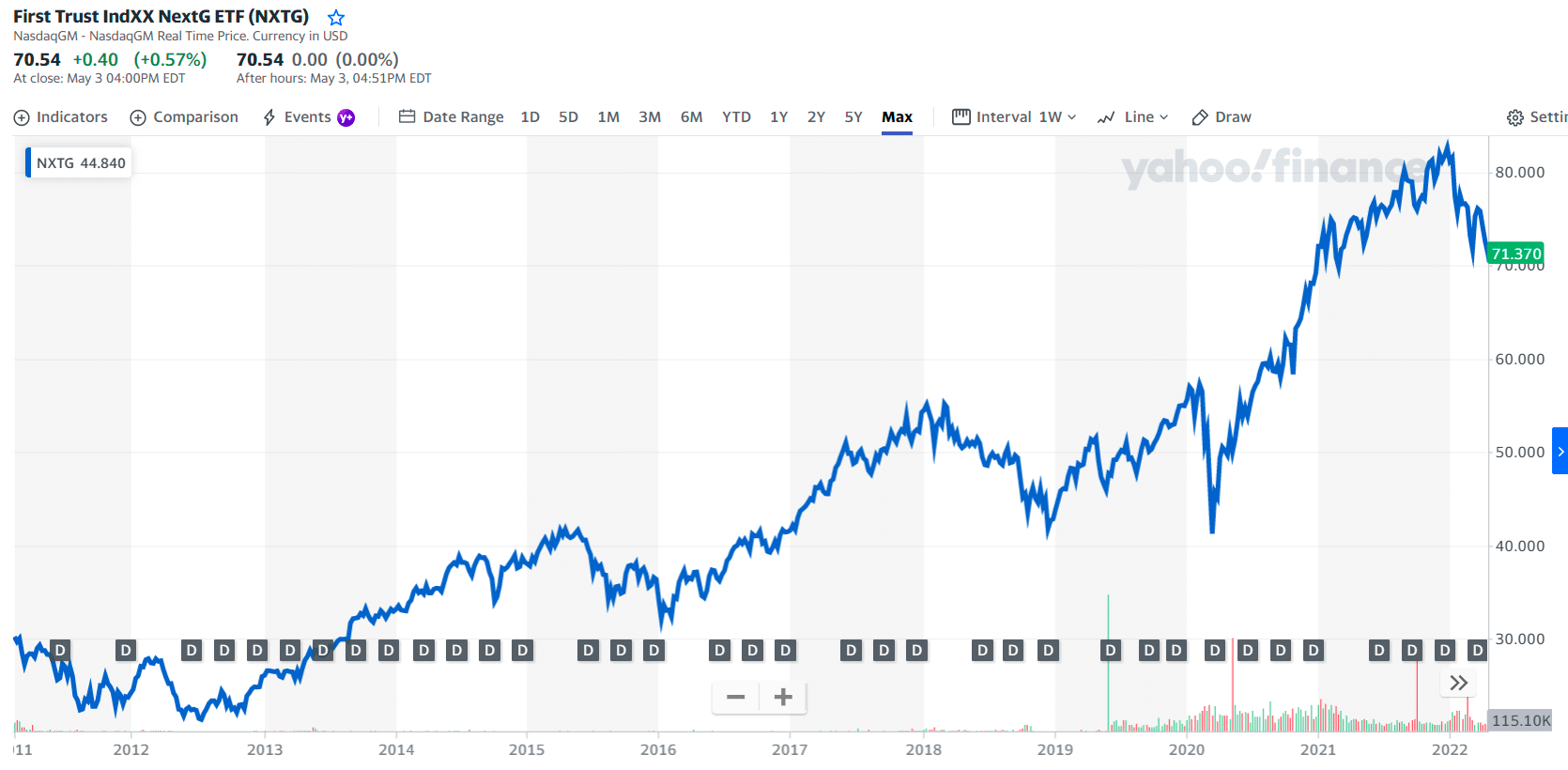

NXTG ETF summary

Buying this fund is one of the best ways to gain portfolio exposure to next-gen mobility. This is far from the largest fund on this list, with less than $1 billion in assets under management. The fund invests in the stocks of companies with market capitalizations of at least $500 million that are helping to develop and deploy the technology. This ETF is a great place to start for broad-based exposure to global 5G development.

NXTG price chart

The nearly 100 stocks that comprise this ETF’s holdings include device makers such as Apple and South Korea-based LG Electronics and semiconductor companies like AMD and Broadcom. Telecoms from around the globe, such as Europe’s Vodafone and Verizon, are also represented.

Its expense ratio is above average compared to funds in the technology category. NXTG has an expense ratio of 0.70%, which is 24% higher than its category. The fund has returned 6.4% over the past year and 17.4% annually over the past three years, 11.8% per year over the past five years, and 12.0% per year over the past decade. The fund has an R-squared of 80%, a beta of 0.84, and a standard deviation of 16.2%. It has a below-average total risk rating.

The first three holdings with their asset percentage are:

- Tech Mahindra Ltd — 1.52%

- Advanced Micro Devices Inc — 1.51%

- NVIDIA Corp. — 1.43%

№ 5. Defiance 5G Next Gen Connectivity ETF (FIVG)

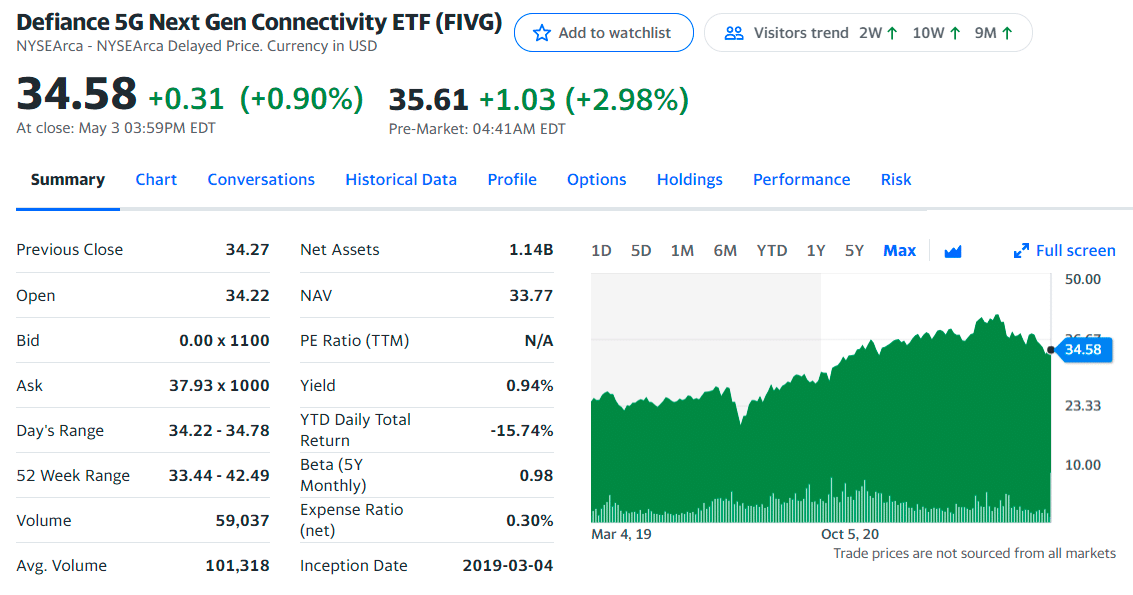

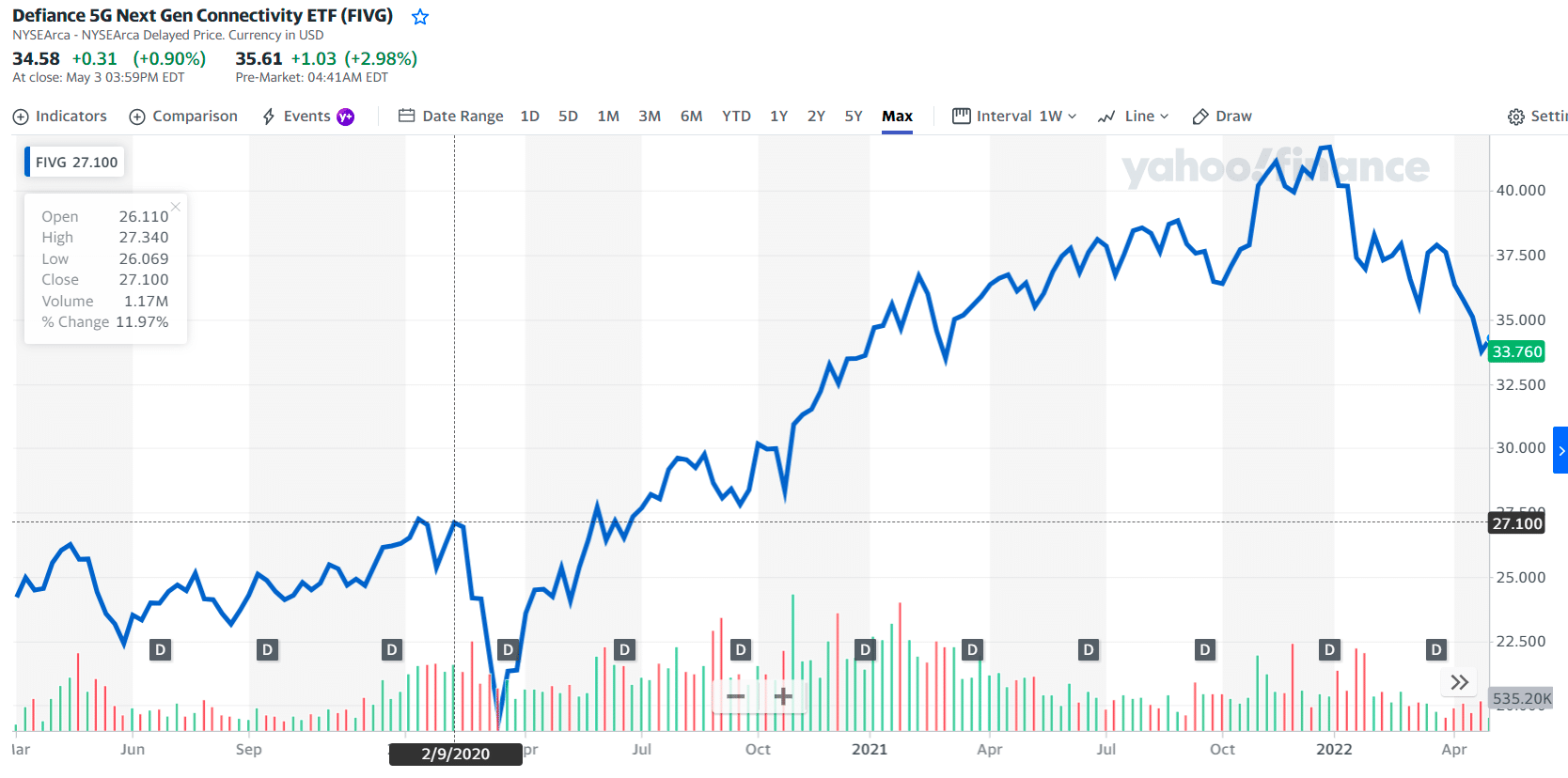

FIVG ETF summary

The fund seeks to track the total return performance of the Bluestar 5G Communications Index. The index consists of a modified market capitalization-weighted portfolio of US equity securities, depositary receipts, products, or services tied to developing a network and communication technologies.

The fund could be suitable for investors seeking companies with significant growth potential. Tech researcher IDC expects US 5G smartphone shipments to grow at an average annual rate of almost 36% through 2025.

FIVG price chart

The ETF’s portfolio includes the stocks of semiconductor companies such as Qualcomm, Skyworks Solutions, and Marvell Technology Group, which make chips for phones and other connected devices and infrastructure equipment.

Its expense ratio is below average compared to funds in the communications category. It has an expense ratio of 0.30%, which is 21% lower than its category. The fund has returned 8.2% over the past year and 16.6% annually over the past three years. The fund has an R-squared of 75%, a beta of 0.98, and a standard deviation of 19.4%. It has an average total risk rating.

The first three holdings with their asset percentage are:

- Advanced Micro Devices Inc. — 5.72%

- Qualcomm Inc. — 5.24%

- Analog Devices Inc. — 3.94%

Final thoughts

As 5G continues to expand, adding these funds to your portfolio provides you with a unique blend of exposure to developing technology and diversification. If you decide to invest in ETFs, we recommend that you know the expense ratio that comes with owning each fund.

Comments