If Tesla or Apple equities are too expensive for you, pay attention to those that cost no more than $5-10 — penny stocks. They are cheap, promise big profits and attract many traders. If you understand the rules of the game, you can make good money.

Suppose you bought 10,000 shares at 30 cents apiece, for a total of $3,000. If the stock price rises to $1, you will earn 7,000 by doubling your capital. But in reality, it is not so easy: you can be left without profit and lose money.

Let’s look at penny stocks and decide if it’s worth dealing with them.

What is a penny stock?

Penny stocks are small organizations or start-up companies not yet registered in the mainstream stock exchange.

Traditionally, they are called “stocks traded for less than $1.” But the Securities and Exchange Commission changed this to cover all stocks that trade at $5 or less.

Why would investors have an interest in such low-valued stocks? Not all penny stock companies are the next Amazon. However, they have high growth potential, albeit at high risk, and therefore of interest to investors with a high-risk tolerance.

How is a penny stock created?

Small companies usually issue shares as a means of raising capital for business development. Although the process is lengthy, issuing shares is often one of the quickest and most effective ways for a start-up company to raise money.

Like any other publicly traded share, a penny share goes through an initial public offering or IPO.

To be listed on the OTCBB, a company must first apply for registration with the SEC or indicate that the proposal can be exempted from registration. Once approved, the company can begin the process of receiving orders from investors. Finally, a company can apply to list shares on a more extensive exchange or trade on the OTC market.

Why are penny stocks risky?

Whether you are a beginner or a seasoned investor, you should never forget that penny stocks are a very risky instrument. Before deciding whether to contact this type of stock, pay attention to:

-

Operational inefficiency

The challenge of small organizations is acquiring the financial muscle to expand their operations. By offering up shares cheaply, these organizations attract risk-taking investors, who are willing to invest low-priced for massive gains. There is no guarantee that these organizations will scale up profitably. So the risk of losing all of the investment in these shares. The lean regulation and legislation of these markets also call upon investors to be highly diligent in market research to avoid their inherent dubiousness.

-

Ambiguous market regulation

Penny stocks operate in an ambiguously regulated market resulting in infrequent movement of the associated shares. The result is a difficult market to find ready buyers and sellers regularly hence low liquidity. The liquidity challenge results in market prices reflecting individual trader whims rather than actual price valuations. It also results in wide spreads, which make investing in this market costly.

-

Volatility

The cheap feature of the stocks facilitates large volume trading hence a potential for colossal intraday movement. The markets have high volatility and increased investment risk: can move in any direction rapidly.

Choosing penny stocks

Observe the following while choosing these stocks:

-

Research the market

The first cardinal rule of trading penny stocks is thorough research, which can be done individually or through reputable professional management firms. The stringent financial requirements and regulations are inapplicable to the OTC markets. As a result, the economics and fundamentals of these companies are not easily found in the public domain, making them susceptible to manipulation. Research ensures the stocks picked have real growth potential and the associated companies’ legitimacy.

-

Monitor the fundamentals

While choosing penny stocks efficiently, fundamentals are of utmost importance — their high volatility results in significant price movements driven by news. Therefore, monitoring the fundamentals and analyzing their impact ensures accurate position and investment adaptation to the resulting market turbulence.

-

Identify the hot industry early

The old investment adage still holds water for this market, “If the majority are fearful, be greedy, and when the majority are greedy, be fearful.” The change from the in-fad stock to out-of-fad stock for this market is brutal and fast. In most cases, the next move for a hot industry is always down for all the associated shares. The skill is to identify the hot industry early enough and invest in it before everyone jumps on board and ensures early exits.

- Don’t delay with the sale

One of the main advantages of penny stocks is that they can earn 20% or 30% of the invested amount in just a few days. Unfortunately, many traders get too greedy and want 1000% profit. Keep in mind that the price of your shares could be artificially inflated.

- Invest in high volume penny stocks

Buy stocks with a trading volume of at least 100,000 per day. If you are trading low-volume stocks, you may find it challenging to sell them.

Investing vs. trading in penny stocks

There are two ways of getting a piece of the penny stock pie: trade or invest in them.

Trading

This way refers to price change speculation without actually taking ownership of the shares.

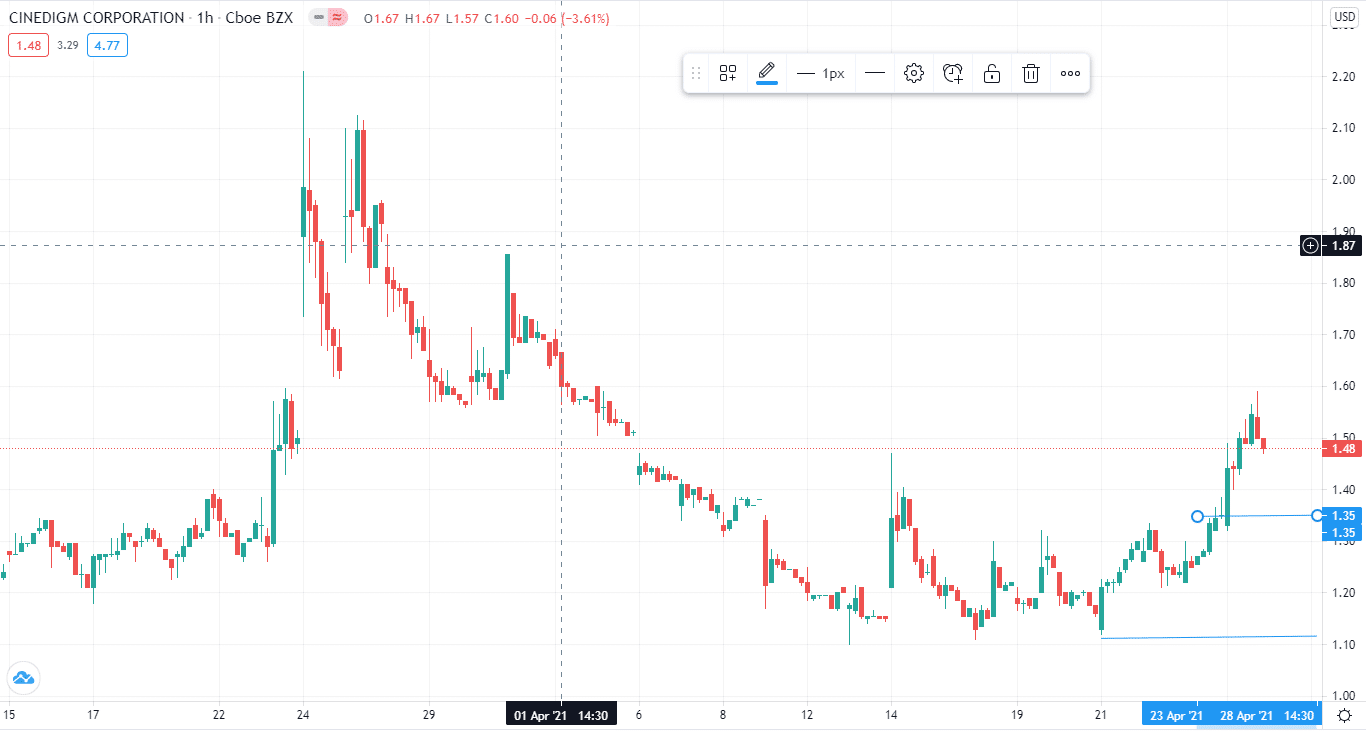

For example, through the broker platforms, a penny stock trader can speculate on whether the price of Cinedigm stock will go up from $1.1 to $1.5. If the market moves in their favor, as shown in the chart below, they profit. Suppose the market goes in the opposite direction. A trader loses out and makes losses.

Investing

This way refers to an investor having an actual stake in a company through share buying and issuance of a share certificate.

For example, an investor can buy shares worth $100 at $0.80. The organization issues such an investor with a share certificate indicating they own 125 shares. So the investor could sell the shares later when they appreciate or enjoy a percentage of the profits in terms of dividend payouts.

Summary

Every penny stock company wants you to believe that it will revolutionize the field. If you are already in this business, then avoid sentimentality, figure it out and diversify your portfolio. It would help if you were careful with penny stocks, but some strategies will minimize the risks and make good money.

Comments