Now that the pandemic has passed and many countries’ limitations lifted, many individuals seek to go on vacation. These relaxations have brought travel stocks into the spotlight. As a result, travel stocks will inevitably rise when Covid-19 limits end.

But what are some of the best travel stocks to look for in 2022? This article will get across the top three travel stocks you need to look for in 2022.

What are travel stock?

The tourism industry faced a severe hit by the Covid-19 outbreak and the resulting restrictions imposed by lockdown precautions; there is rising optimism that tourism will increase massively in 2022.

As a result, the tourism industry will eliminate Covid-related restrictions’ sway. As things are going to be correct, many investors can benefit because the tourism industry is one of the most booming industries in the world.

According to research, almost $9 trillion in GDP was contributed by the tourism industry in 2019 worldwide, and this contribution made the tourism industry one of the largest industries in the world. In 2022, investors expect that after lifting the Covid-19 restrictions, this estimate will increase to a considerable level.

How to start with a travel stock?

If you’re investing in travel stocks, be sure you grasp the different segments. Travel stocks are of four categories: airlines, hotels, bookings, and cruises. In addition, certain parts of the travel industry might also have yet to build-in recovery, giving them attractive investment opportunities.

However, the top travel and stocks retain a few characteristics, including significant brand awareness, a convenient website or application, and a devoted fan base.

Here are the top three travel stocks worth investing in 2022.

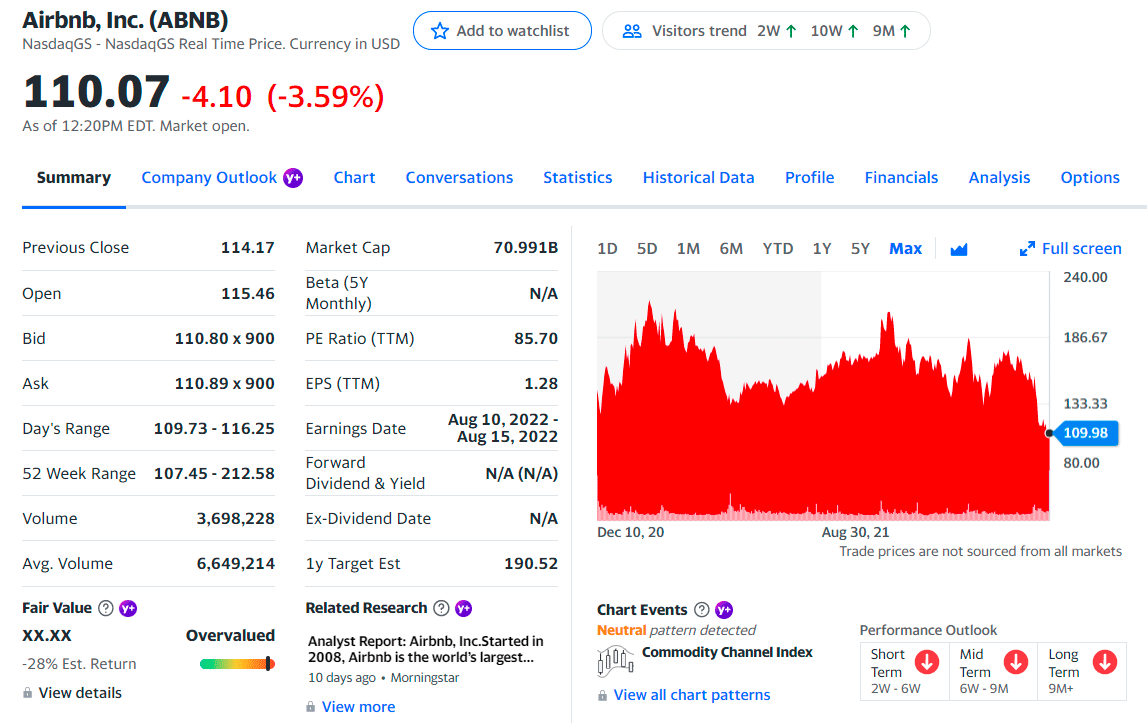

1. Airbnb (ABNB)

Price: $110.07

52-week range: $111.22-$212.58

Airbnb 1-year price change:-13.46%

ABNB summary

Airbnb is used by consumers and property managers to market shelters just like homes, huts, and flats through their websites. Many people are now earning while traveling throughout the world, and Airbnb’s goal for advancement in 2021 was lengthy contracts.

The company generated around $1.5 billion in revenue and $55 million in net income. The gain is 38% and 115% from the previous quarter. Furthermore, despite lower overall travel than before the epidemic, Airbnb has posted four straight quarters of free cash flow.

Airbnb has appeared as a prominent beneficiary of this shift in the global workplace during a pandemic. As a result, millions of individuals are now working while traveling, and extensive reservations were a substantial growth focus for Airbnb in 2021.

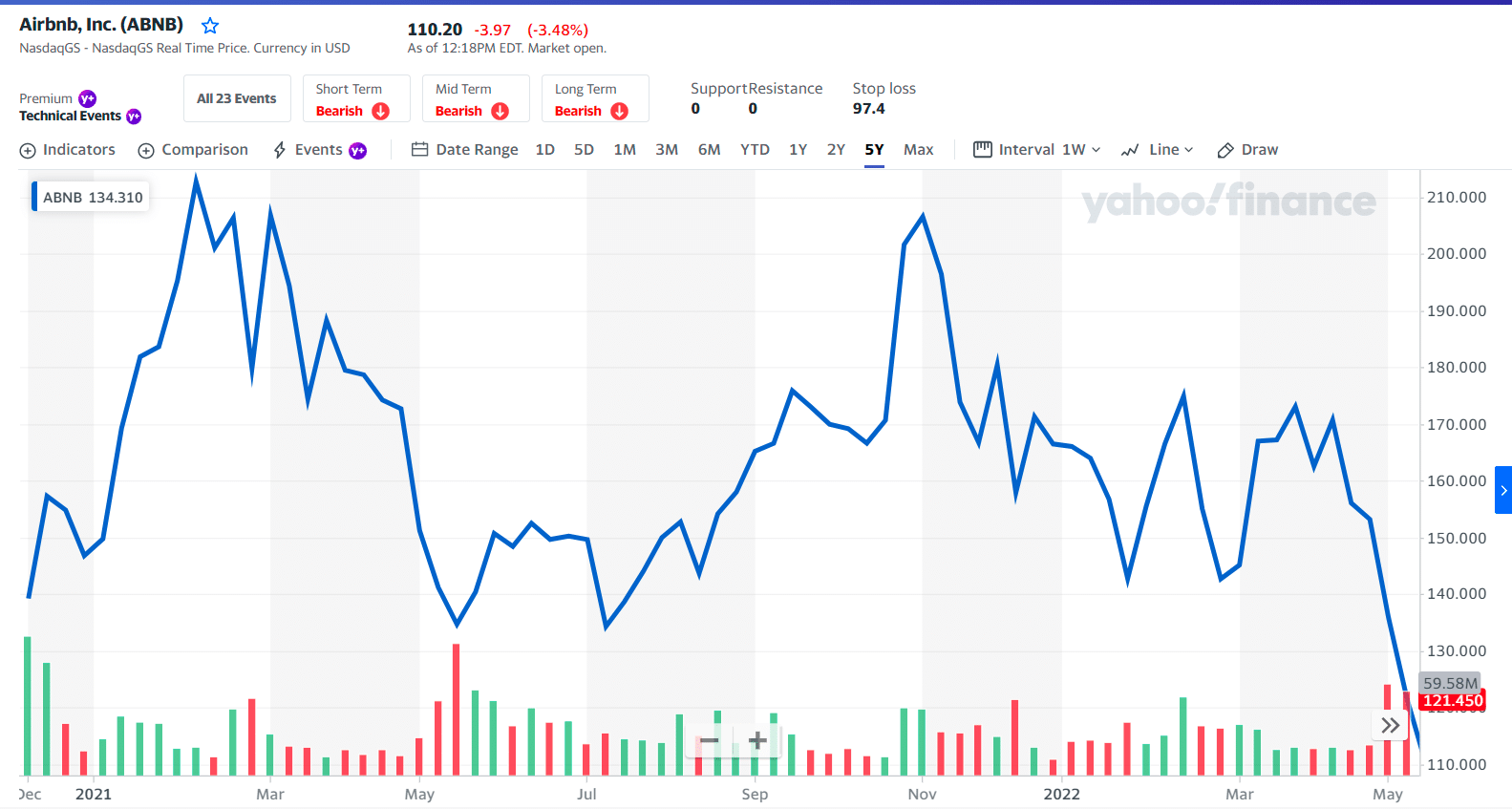

ABNB price chart

The company recently improved its platform, introducing adaptable search options and making the host application process easy and quick. Airbnb had years of tremendous development before the pandemic, prolonging that streak.

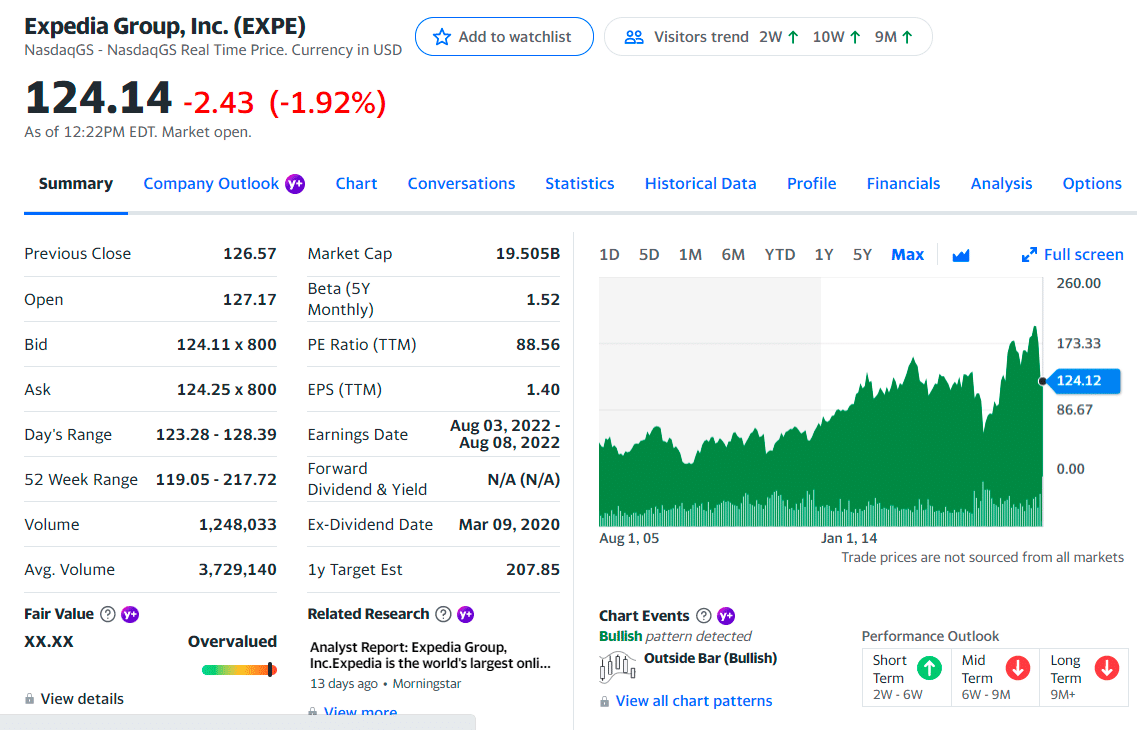

2. Expedia Group (EXPE)

Price: $124.14

52-week range: $126.04-$217.72

EXPE 1-year price change: -27.01%

EXPE summary

Expedia, Incorporated is a public and small travel business firm based in the United States. Expedia.com, Vrbo, Hotels.com, Hotwire.com, Orbitz, Travelocity, and CarRentals.com are among its websites that are predominantly travel pricing organizers and launched engines.

Expedia reported sales of $2.96 billion in the third quarter, up 97% over the previous year. Following a loss of 22 cents per share in the third quarter of 2020, earnings came in at $3.53.

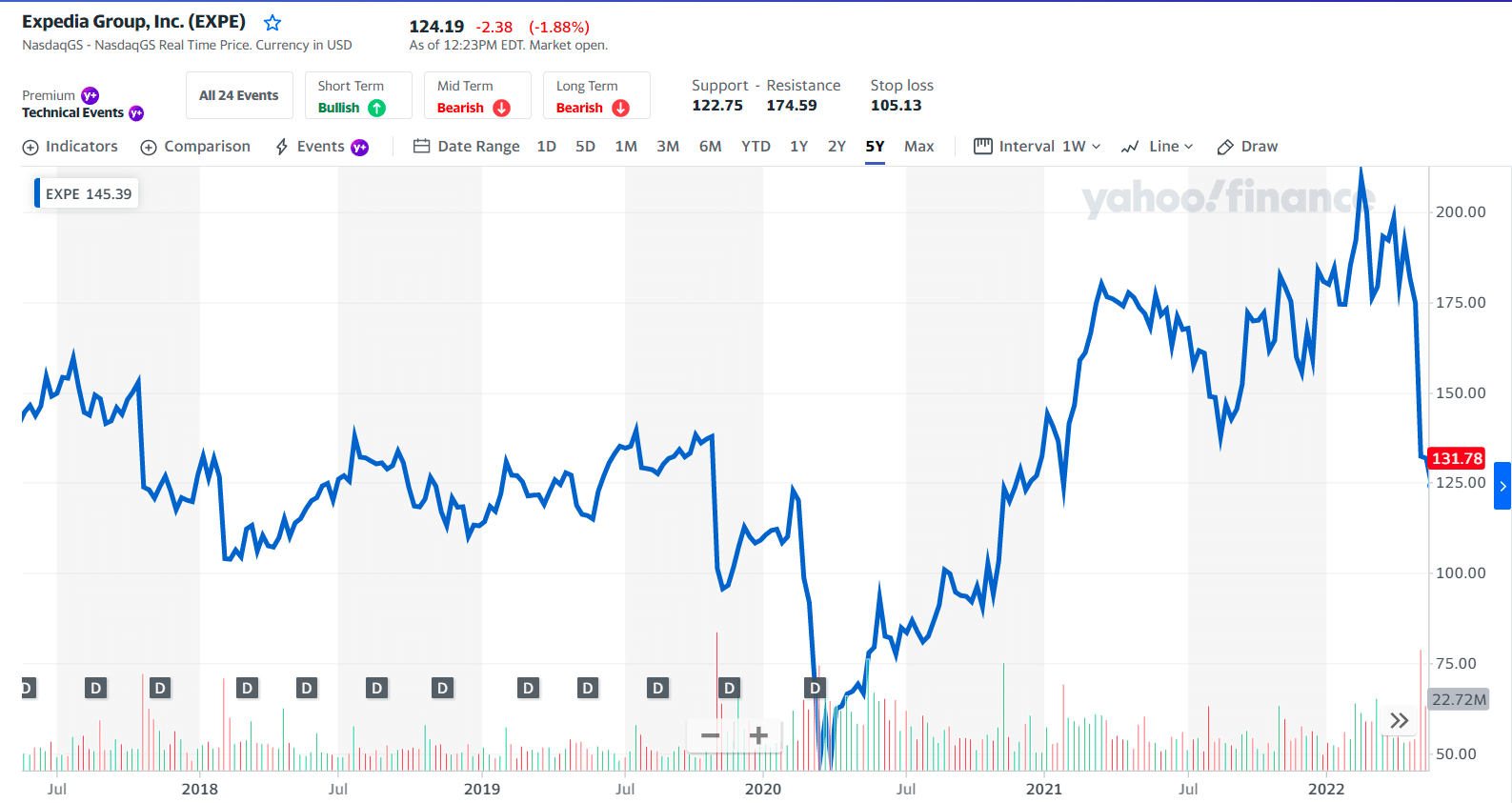

EXPE price chart

EXPE stock has dominated Booking over the last two years. EXPE stock has increased by more than 45% during the previous two years, whereas BKNG has only increased by 9%. In addition, Expedia has gained 21% this year, whereas Booking has lost money.

Expedia reached new highs in late November but dropped 7% due to omicron. Nevertheless, I believe EXPE stock will swiftly recover and become one of the most incredible travel stocks to invest in.

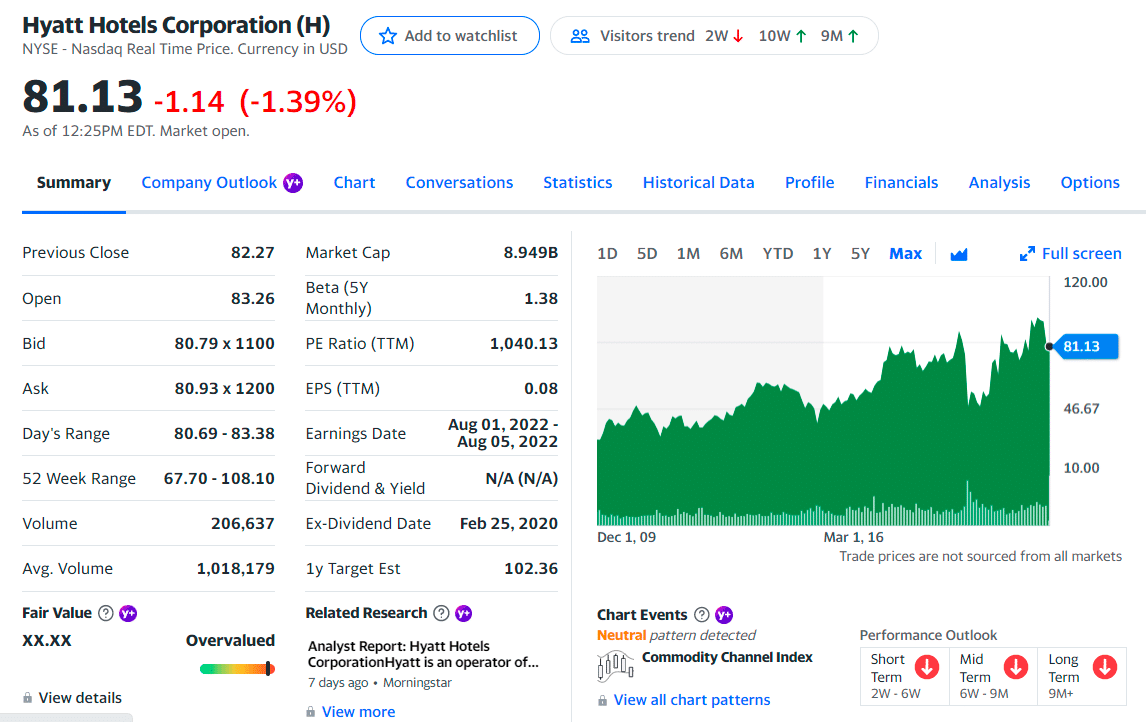

3. Hyatt Hotels (H)

Price: $81.13

52-week range: $67.70-$108.10

Hyatt Hotels (H) 1-year price change: 5.53%

H summary

Hyatt Hotels and Resorts, formerly Hyatt Hotels Corporation, is a global hospitality firm based in Chicago’s Riverside Avenue neighborhood that maintains and leases premium and commercial motels, resorts, and summer homes.

Hyatt Hotels with over 1,150 hotels and all-inclusive resorts in 70 countries on six continents. The earnings for the entire year are estimated to be over $3 billion, rising from $4.26 billion to $5.74 billion in 2022.

In its largest acquisition in company history, Hyatt acquired the Apple Leisure Group and its integrated resort properties under the AMR Group, comprising Hidden Resorts & Spas, Alua, & Sunscape Resorts, by 2021.

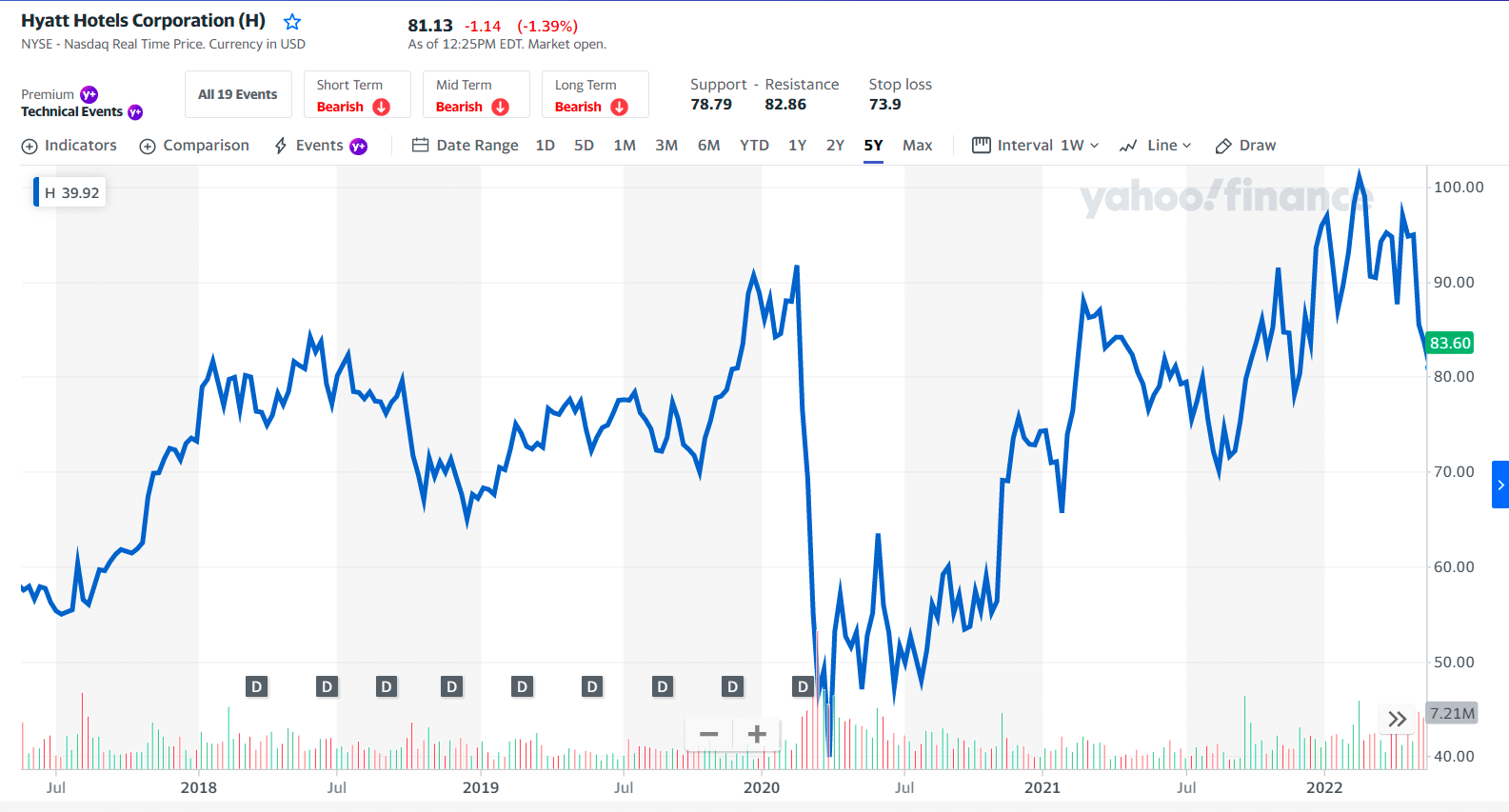

H price chart

In mid-November, Hyatt stock peaked at $95 but has now fallen around 7% on concerns that lockdowns may resume. In addition, h stock had a turnover of $851 million in the third quarter, which was less than experts’ expectations of $860 million.

It did, however, outperform experts’ expectations with a profitability of $2.31 per share versus a loss of 39 % per share.

Pros and cons

| Pros | Cons |

| Travel stocks are the most significant purchase investments. | These assets will take a long time to restore compared to pre standards. |

| The travel business brings in a lot of money, and the stock market is booming. | For the past couple of years, travel stocks have generally underperformed. |

| These stocks deliver great capital array diversity. | Brief investing is not encouraged with travel stocks. |

Final thoughts

Since travel companies are frequently niche, investors can trade in a range of travel and tourism stocks that suit their specific interests and investing goals. The performance of the travel sector over the next several years may determine the growth of travel stocks.

Although travel stock is among the trendiest investment sector, it is about to bloom after the world kicks off the pandemic.

Comments