The term wealth creation refers to the process of building a steady and secure source of income so that the individual would not have to struggle when financial support is needed or to meet business goals.

This process will be most effective if started early as early stages of life are best to give a head start for achieving goals. One day all of us will not be able to work or earn income; therefore, planning a safe and secure life for the future is what wealth creation options are all about.

The two broadly considered wealth creation options are investing and saving. Both options are essential for raising a solid financial treasure, but they are not the same. However, you can achieve a restful financial future using both, but people need to know the differences and choose the best one accordingly.

Concept of investment

Investing helps you buy assets like stocks, mutual funds, or cryptos with the help of your money. Which can later generate a reasonable return that will make you wealthier over time; in other words, to earn more, we put our hard-earned money to work so that money can make more money.

People who own a business or have an eye on other growing companies put their money into these businesses and expect to increase their wealth; this is an investment. Investing money can generate returns that will increase your net worth.

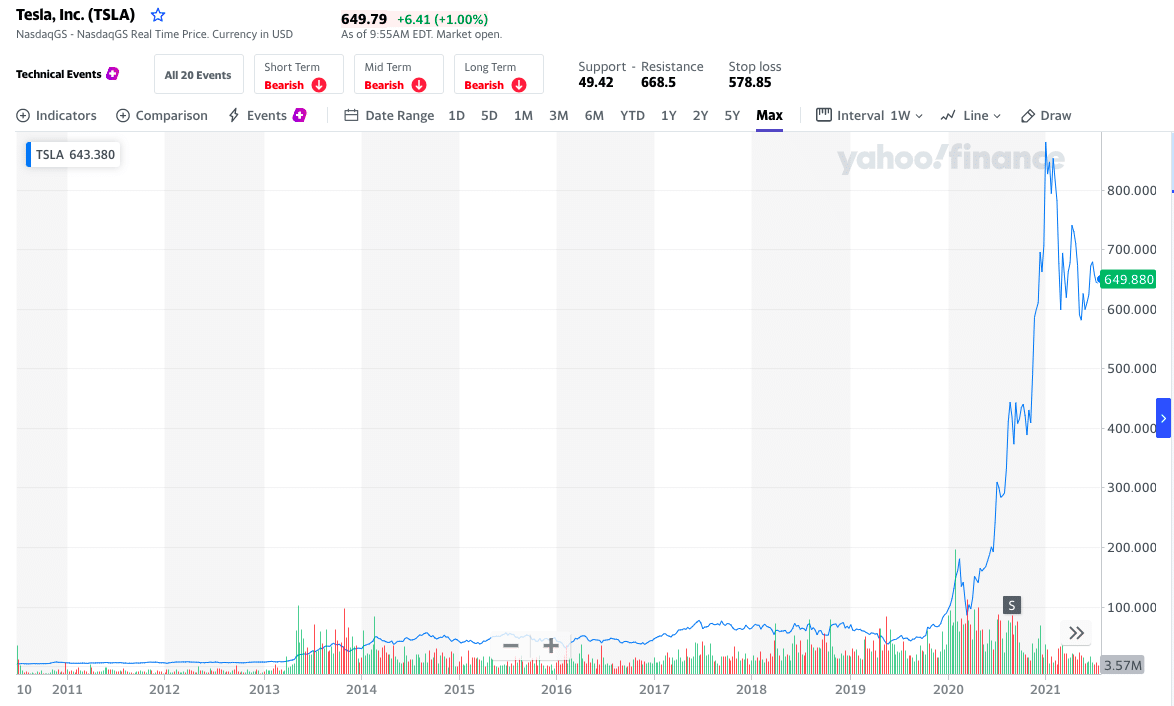

Tesla, Inc. chart

In the above example of the stock investment, we have taken the chart of Tesla, Inc., founded on 1st July 2003 by Elon Musk. Tesla is an automobile company that makes self-driving and electric cars. The rise in the usage of AI gave Tesla popularity and its shares in just one year rose from $98 to $880.20 per share from 2020 to 2021. Investing and holding the shares of such companies that have a solid vision has a good ROI.

Therefore, whether you think of buying an expensive car, a house, a child’s future, or any extended term planning, investing helps you achieve all such goals. If you invest your money correctly, you can achieve your long-term goals by multiplying your investment to a greater extent.

Concept of saving

Saving typically means putting away money for an emergency or future expense, and it is readily available when needed. If you are saving money, the risk of losing value is shallow because the funds in your bank account won’t decrease except until you withdraw funds. However, interest rates on savings accounts are low, allowing your money to grow slowly.

Savings allow you to achieve short-term goals. For example, if you plan for a smartphone whose cost is $1000, you might want to save $1000 in 5 months to withdraw in the 6th month and buy your smartphone. You then know the required amount you need to save every month and withdraw it without fees to purchase your desired smartphone.

It is always a good decision to save a portion of at least 3-6 months of your income for a crisis or emergency. Because emergencies can happen unannounced at any time, such as a medical emergency or business collapse, in such times, you need some money to face the situation.

Which is better?

Many people say that both investing and saving are the same. But in comparison, both are alike in many aspects. Here, the critical decision-maker is the goal you have. Your goal will help you decide which option is more beneficial for you between investing and saving.

You should learn the difference between them and understand when investing or saving can be effective. The main difference here is what these two options do to your money. Saving is more inclined towards security while investing is more focused on growth.

Suppose you have targeted something that is not so expensive. It will help if you go with savings. However, you will need money to raise that much money by saving for a few months and then buying that thing. And if you are planning something long-term and can bear few losses, you should go with investing.

We all know that investing can make us wealthier. But not only this as there are some more perks as well as drawbacks of investing. Similarly, you might keep your money safe by saving, but that also has some disadvantages. Let’s see some pros and cons of these two types.

Investing

| Pros | Cons |

|

|

Saving

| Pros | Cons |

|

|

Final thoughts

It is for you to decide which option between these two is more suitable for your financial goals. Sometimes you can use both depending on the objectives. With savings accounts, your growth rate is limited as you rely on the interest rate to grow your account, whereas investing allows you to diversify according to risk appetite.

However, it is always advisable to do proper research before investment if you are planning to invest. Because surprisingly, you can lose even all of your investment if you don’t know what you’re doing. Although investing is risky, when compared, investing helps you more in growing your capital.

Comments