The history of trading commodities goes back to 4000 BC, and even then, it was not used as investment but as a form of bartering goods and paying for services. Precious metals were used later and were attractive due to their beauty, making them more valuable.

Nowadays, the markets have evolved, and commodities can be day traded or used as mid to long-term investments. However, these markets are complex, and you require some expertise and knowledge.

In this article, we have listed pro tips to help you understand what to consider and which investment forms are available.

Understanding commodities market

Commodities refer to the raw material used commercially, and the buying and selling of these items occur on the commodity market. Examples are coffee, sugar, copper, gold, silver, oil, grains, livestock, etc. There are currently about 100 commodities traded in 50 markets across the world.

Materials are bought either for direct consumption or to be further processed into other goods.

Commodities fall into two categories:

- Hard commodities — precious metals like platinum, silver, copper; natural resources like gas and oil.

- Soft commodities — agricultural products like coffee, sugar, corn, etc., and livestock.

There are numerous ways of investing in commodities without having to own the goods. But before we introduce you to the different types of funds, check out these valuable tips to allow you to make a proper decision.

Top seven tips for investing in commodities

These top tips will assist you in choosing the investment type that suits your portfolio.

-

Unpredictability

The commodity markets are highly volatile, which comes with high risk. Many factors can influence a commodity’s price, such as:

- Political events

- Supply and demand

- Adverse weather conditions

- Spread of disease amongst livestock

-

Diversification

A popular investment strategy is diversification — allowing you to invest in various assets to minimize your risk and maximize returns. It’s an excellent way to hedge your portfolio during uncertain economic times.

-

Fund manager

Now, there are just as many fund managers as there are trading assets, probably. When you decide to invest, you have to consider which fund to choose. Fund managers are a crucial part of your investment as the firm you select will be responsible for taking care of your portfolio. Points to consider are reputation, expertise, historical performance, and customer support.

-

Taxes

For individuals who opt to invest in gold, you have to be aware of capital gains taxes. Gains earned on gold ETFs, for example, require payment of capital gains taxes.

- Short-term investments of less than three years do not pay significant taxes.

- However, long-term investors will have to pay taxes once their fund matures.

You could be required to pay up to 20% of your earnings, depending on your investment length.

-

Physical ownership

When you own actual goods, you will have to consider storage facilities, security, insurance, and other fees. Especially critical for agricultural goods which are prone to decay.

-

Potential returns

When buying gold, for example, you need to be aware that you don’t earn dividends like stocks; your earnings are dependent on the value of the item. Commodity prices, as we mentioned, are hugely impacted by speculative forecasts, global production, and weather conditions.

-

Investment type to choose

Multiple investment forms exist; you don’t inevitably have to purchase the physical stock. Common investment types are ETFs, stocks, and futures contracts. However, the basic principle around these investments is that you gain profits from the value of the funds. You can purchase commodities by investing in different types of asset classes.

Let’s look at the most popular types of investments:

-

Invest in ETFs

Exchange-traded funds are an excellent way to invest in commodities since you don’t own the actual material. The ETF mimics the price of the underlying asset. On the plus side, you get tax benefits with ETFs as you only incur taxes once the ETF matures.

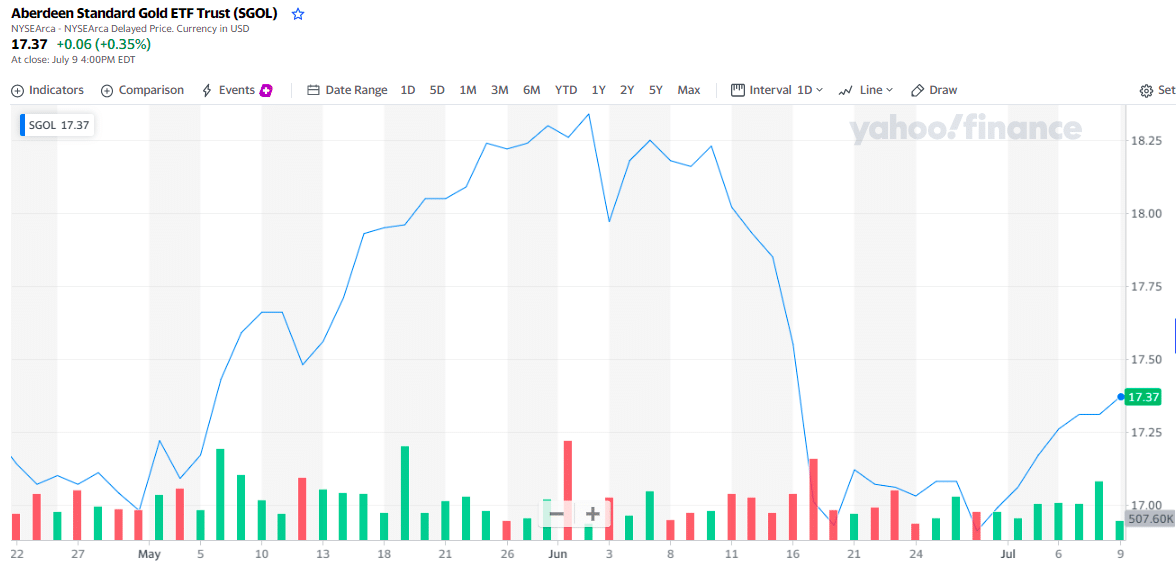

Aberdeen Standard Gold ETF Trust (SGOL) chart

Let’s look at the example of Aberdeen Standard Gold ETF Trust. The fund tracks the performance of gold bullion. The SGOL tracks the performance of gold bullion. Investors choose this fund as a way to invest in physical gold.

-

Invest in futures contracts

When you purchase a futures contract, you buy it intending to sell it at a future date. Futures don’t require you to own the actual commodity; you profit from the price difference. Investing in futures requires some good market knowledge and a fair amount of capital. You can trade futures on the major exchanges like the S&P 500, Nikkei 225, Dow Jones, and Nasdaq.

Crude oil chart

An example of crude oil futures chart — NYMEX WTI Light Sweet Crude Oil futures is the world’s most liquid oil futures contract.

-

Invest in commodity companies

You can select a company that produces the commodity and purchase the stocks of these companies, and if you choose the right company, you can have good dividend payouts. An example is BHP, which has diverse operations in coal, petroleum, and chemicals. Dividend payouts are less frequent than standard stocks but are very generous.

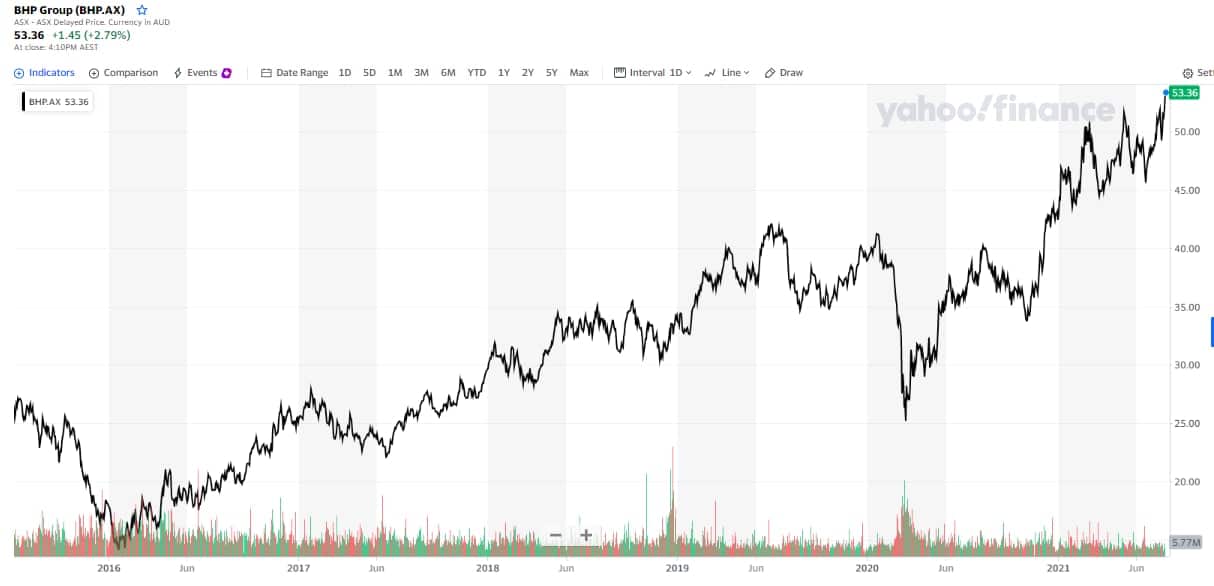

BHP Group chart

An example of BHP Energy Stock price chart — a global leading energy and resources company; its operations include oil, gas, and minerals.

-

Invest in an index fund

An index fund is a type of ETF and is similar in that both allow investing in the underlying asset; however, index funds need to be traded based on the price set at the close of the trading day. Index funds have fewer fees and expenses associated with them.

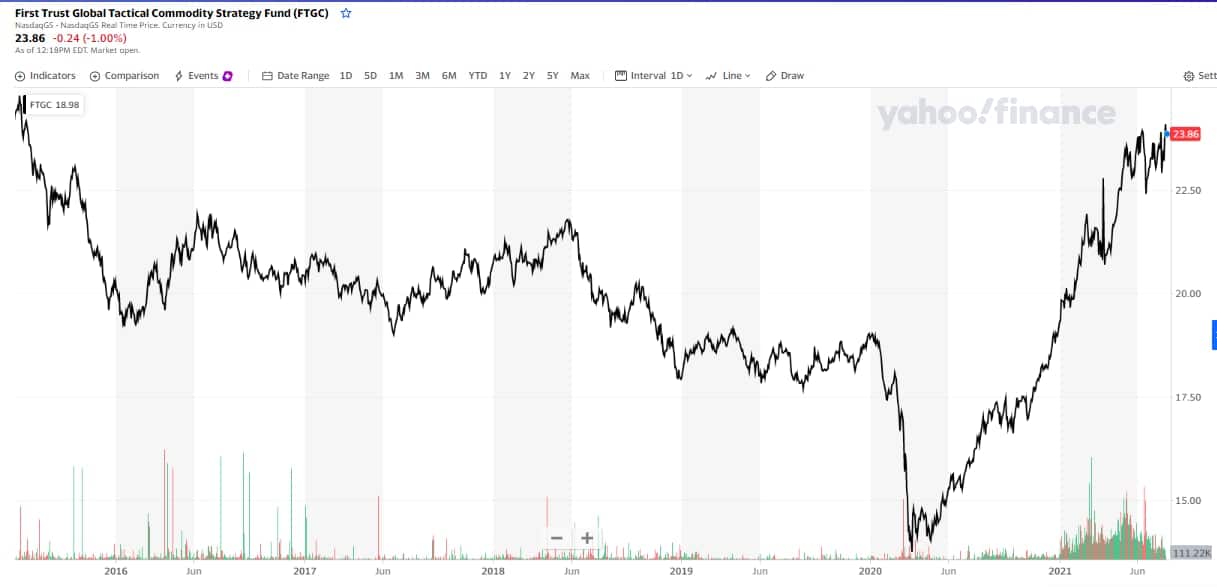

First Trust Global Tactical Commodity Strategy Fund chart (FTGC)

The First Trust Global Tactical Commodity Strategy Fund gives investors exposure to investing in commodity index funds.

-

Buy the physical commodity

Last but not least is buying the physical commodity. This requires some clever strategy as you need to decide what item is best to purchase.

For example, if you choose to buy soybeans, you will have to consider spoilage, storage fees, insurance; in addition, you will have to find a buyer when you’re ready to sell. And if you are not familiar with the type of market, you could be stuck with items that you cannot sell, in addition to a lot of expenses and headaches.

This type of investment requires advanced expertise in the particular commodity and associated industry.

Final thoughts

Commodities investments are diverse and can be a safe hedge as the stock market does not influence them. It is a tough market and not for the faint-hearted or novice investor. Therefore it’s advisable to follow the tips we shared. Key learnings from this would be understanding the market performance and finding the most lucrative, low-risk investment with optimal returns.

Comments