Forex robots are software or trading platforms that can automatically make trades based on previously set parameters. Many people claim that they have earned a good profit from FX robots, while others argue that it is effortless.

Technology changed financial trading by implementing many materials to make trading effective, and the FX robot is one of them. People can earn by both making such mechanical persons and following it with a profitable parameter. Trading happens through a decentralized network where the overall process moves through an electronic system, which follows some rules that a robot can catch.

It is often controversial whether FX robots work or not. After reading the whole section, you will know how the FX robot works and how you can benefit from it.

What is an FX robot?

It is a software or automated trading program that automatically integrates forex trading platforms to take and manage trades.

There are multiple uses of such mechanical persons. For example, some may automatically change stop losses or risk calculation where the main power remains in traders’ hands. On the other hand, advanced robots make all decisions without any intervention from traders.

One of the most used forex trading platforms is MetaTrader 4, and it has an integrated automated trading function known as expert advisors (EAs).

MT4 EA uses MQL4 languages, and you can build trading robots for MT4 platforms. As soon as you attach the robot to the platform and allow trading, it will start taking action.

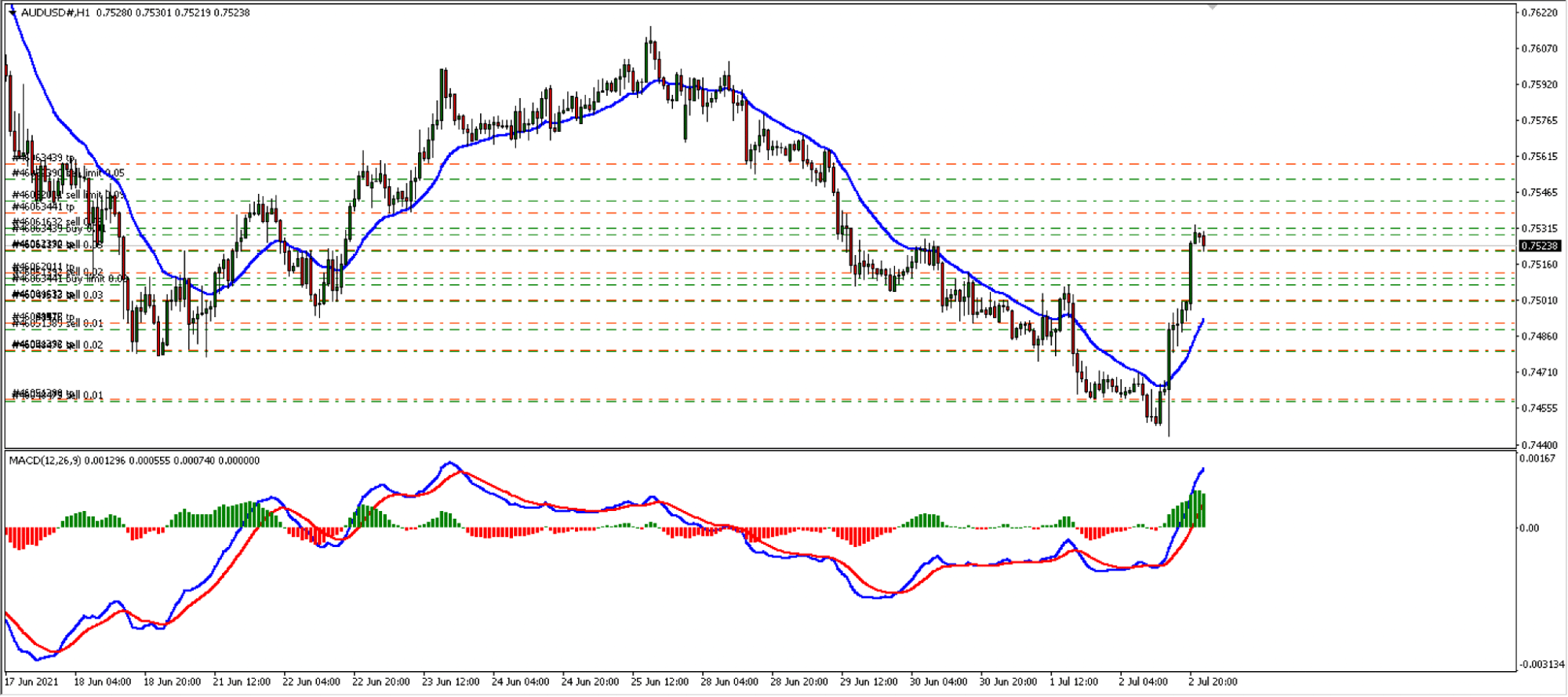

Let’s see an MT4 interface of an FX trading mechanical person.

Thousands of trading robots are available online for free, and traders can build their robots by applying multiple confirmations.

How do FX robots provide signals?

The best part of using an FX robot is that you don’t have to monitor your trading as the robot will process everything. However, it does not mean robots are superior to the human brain.

In technical analysis, if we see the price to reject from the lower Bollinger Bands and Relative Strength Index is moving up from the 20 levels, we can consider it as a buy trade. Therefore, you will open a buy position after calculating the risk and rewards.

On the other hand, if you build a robot using the same strategy, it will take the same trades but automatically. Therefore, you don’t have to spend a lot of time trading.

However, to achieve this performance, you should build a mechanical person. Creating an intelligent machine is a complex process where trade needs to do many calculations and writing using the codes. As a result, many traders hire coders and provide trading logic to them, while some people take building robots as a career.

However, the biggest drawback of an FX robot is that it can only provide signals based on some fixed parameters using technical analysis. In trading, the market is ever-changing, and where a fixed system might not work all the time.

Why do people use FX robots?

There are two types of users:

- Those who do not have time for full-time trading but want to keep the trading platform running with profits.

- A group of people who use robots besides manual trading to diversify the trading portfolio.

The FX trading robot uses a complex calculation and thought over the market that allows traders to make money, usually from a slower market. Therefore, after the New York closing and before the London session, the market remains calm where maximum robots stay active and make profits.

The biggest reason for using these robots is to ensure a solid profit from the market using artificial intelligence.

Is it wise to use FX robots?

There is no way to consider FX robots as money-making machines. It is not like setting the EA, bringing you millions of dollars after a year. Although many robot makers claim themselves as profitable service providers, there are no specific statistics regarding how much robots are profitable.

Many websites offer exciting results with a solid history to attract investors’ attention. Their main aim is to sell the mechanical person, not make money using it. Many people pay attention to such companies and buy robots, but the success depends on how the market is reacting at that particular time.

Pros and cons of using FX robots

Pros

- Robots provide profits without the involvement of a trader.

- The human brain has some problems, like forgetting an error that EAs can eliminate.

- Robots can do millions of calculations in a second that a human brain cannot do.

- Traders can make money by using a profitable robot or being a coder, or selling robots.

Cons

- Robots cannot change trading decisions like humans.

- During the market crash, robots may fail to initiate manual trading.

- Many robots have histories of blowing accounts after a certain period.

Final thoughts

After the above discussion, it’s up to you whether you will use a forex trading mechanical person or not. Remember that the FX market is an uncertain marketplace where no robots can make you a millionaire.

The biggest drawback of robot trading is that it cannot change decisions with the market flow. Therefore, there is a possibility of making losses when the market condition is not suitable. In that case, make sure to invest wisely in robot trading and always use mechanical persons with a sound risk management system.

Comments