The FX market mainly deals in transactions between currency pairs from various countries. Nearly 90% of FX trading is speculative trading. This market has evolved into a system that allows people to exchange currencies all over the world.

The US dollar’s most traded currency. Its features in nearly 80% of all forex trades. Meanwhile, the market contains many currency pairs, deciding which ones to trade are difficult. You may be confused about which one to trade. So let’s check the best-performing.

What are the five most profitable currency pairs?

More than 200 currencies are available for trading across the globe. Out of all of these, just a few whole currencies may provide the best returns:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- USD/CAD

Since the greenback is a reserve currency, the US has the strongest dominant currency globally. The sheer size of America’s economy also contributes to its dominance. As a result of these considerations, the US dollar has become a popular currency to pair with other currencies. The following are some examples of major currencies.

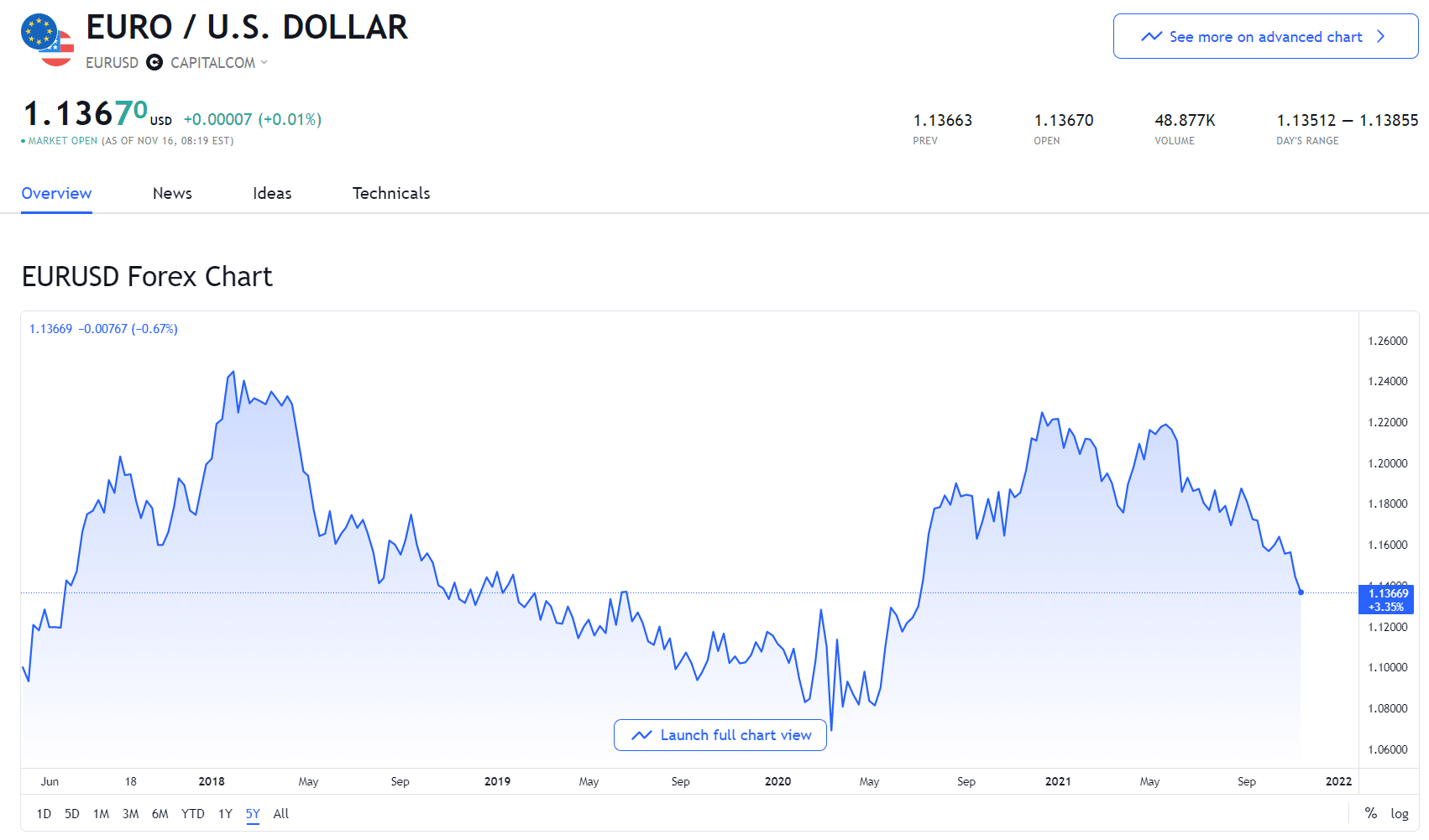

EUR/USD

It is the most commonly traded pair since these currencies represent the world’s two largest economies. The linked exchange rate depends on the series of fundamentals from both economies. In particular, the European Central Bank, the US Federal Reserve interest rates, and the NFP reports remain under the spotlight. It has the most liquidity and is the easiest to forecast.

Moreover, this currency pair is sensitive to essential variables such as the US and EU central banks’ monetary policies. The value of this pair can also be anticipated using information from the US and EU economies and liquid derivatives between the two currencies.

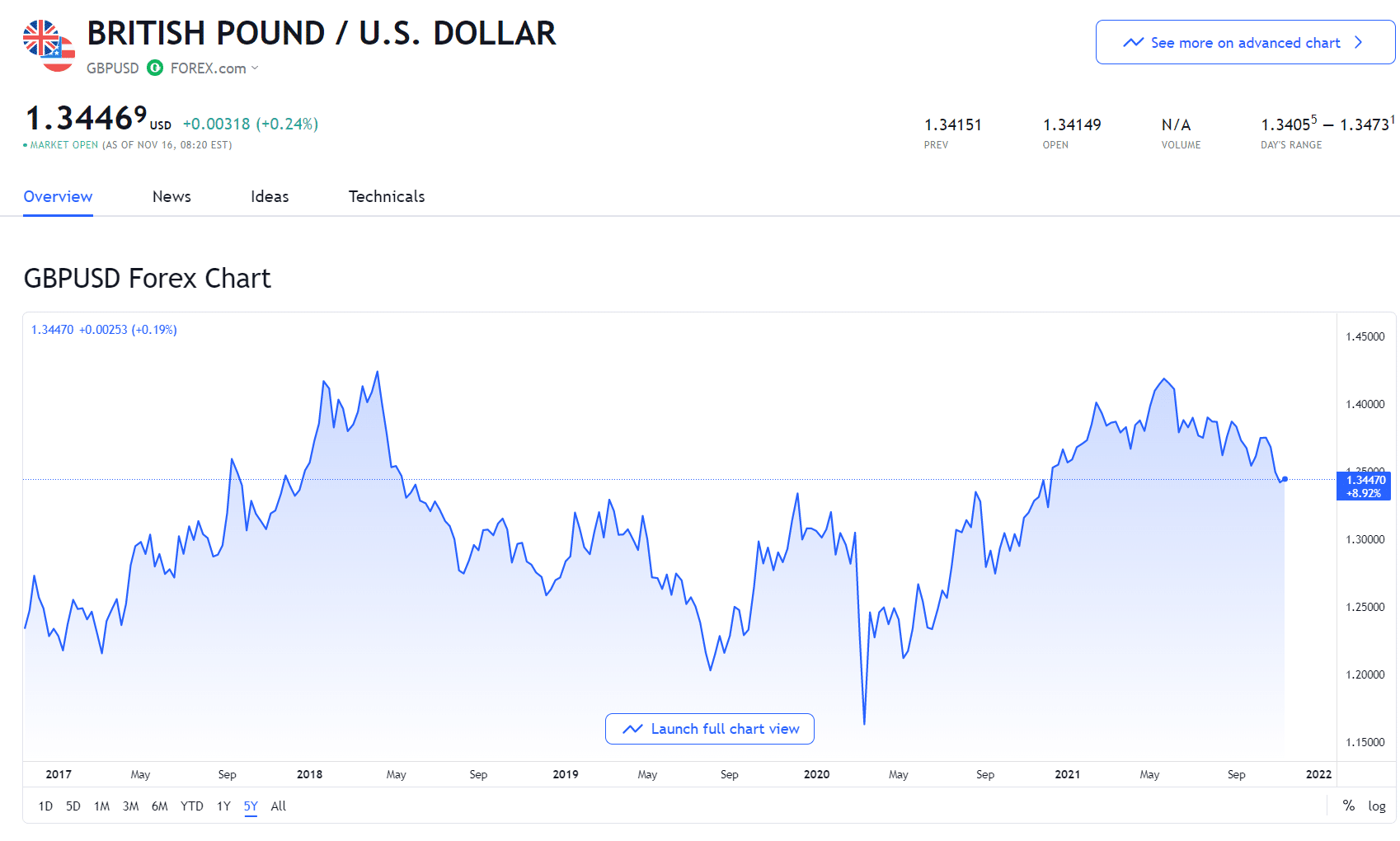

GBP/USD

This crucial pair is composed of the British pound and the US dollar, and it is influenced by the performance of the British and American economies. The interest rates set by the Bank of England and the Federal Reserve of the United States determine the exchange rate for this pair. Another factor to consider with this combination is the United Kingdom’s withdrawal from the European Union.

USD/JPY

This major pair, composed of the US dollar and the Japanese yen, has a high level of liquidity. This is unsurprising given that the US dollar is the world’s most traded currency, while the Japanese yen is the most traded in Asia. The exchange rate for this pair is determined by the interest rates set by the US Federal Reserve and the Bank of Japan.

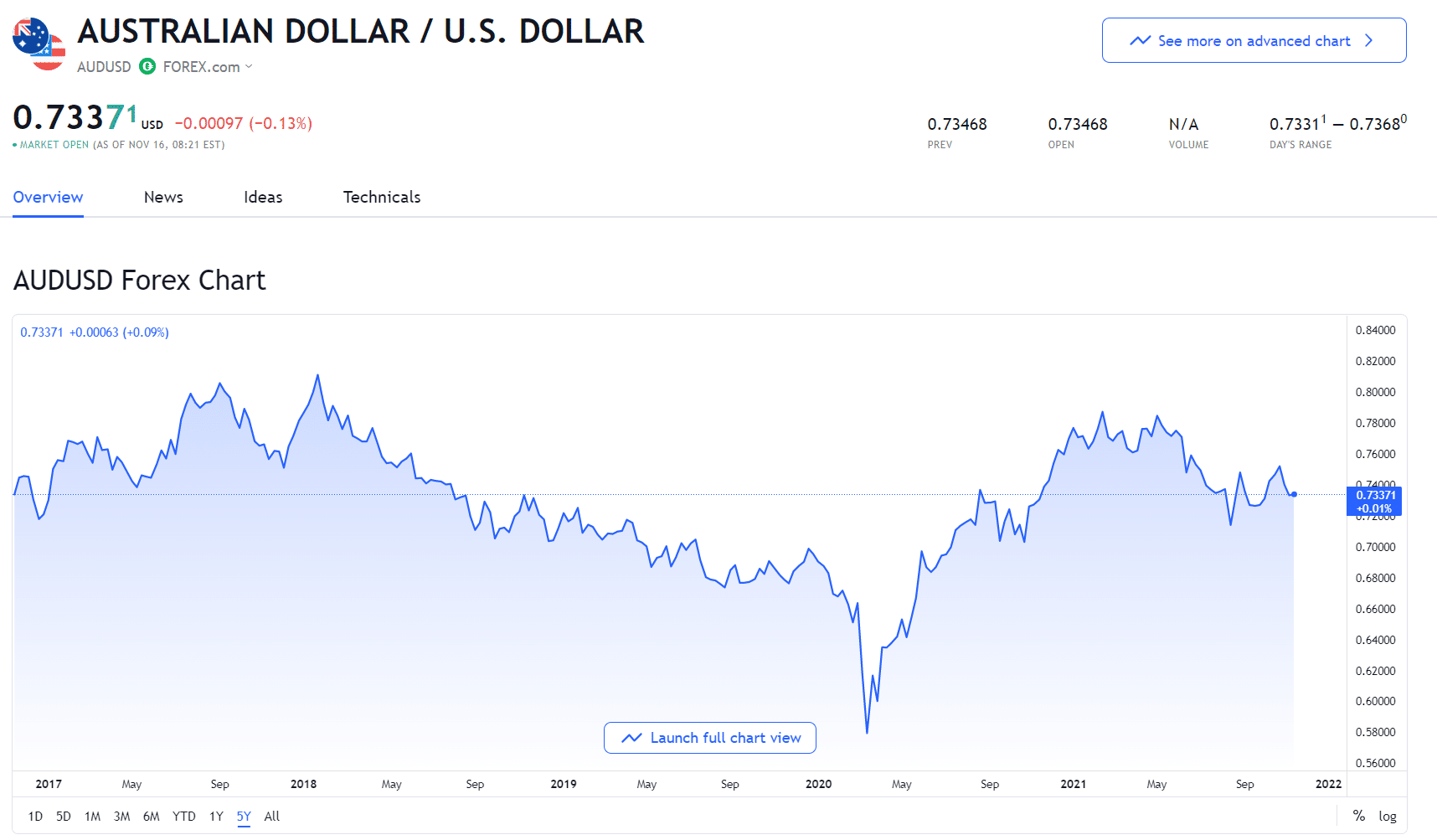

AUD/USD

Another notable currency pair is the Australian dollar and the US dollar. This pair is affected by the value of Australian commodities such as iron ore, gold, and coal and interest rates set by the Reserve Bank of Australia and the US Federal Reserve.

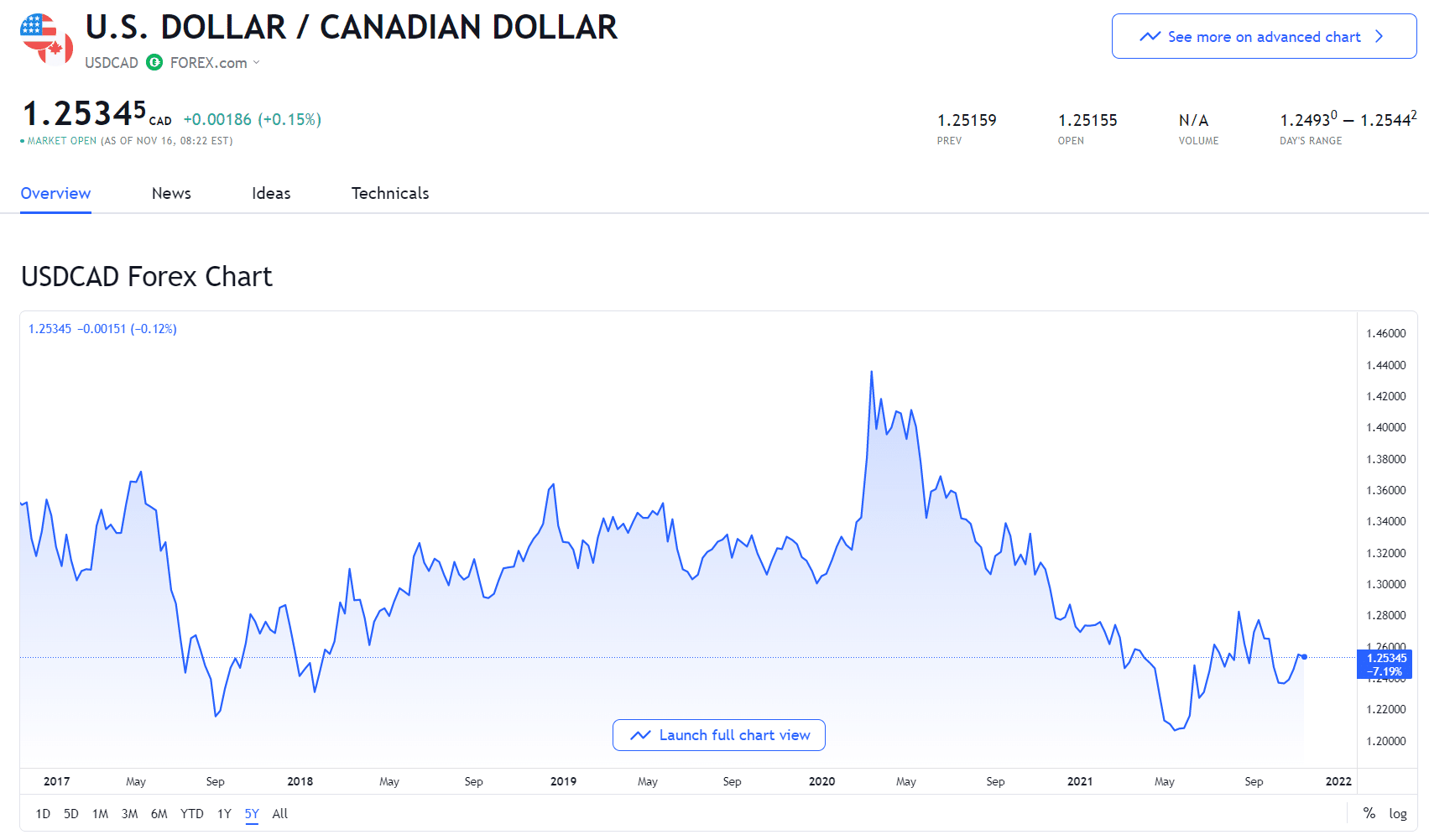

USD/CAD

This indirect currency pair consists of the US dollar and the Canadian dollar. One reason to keep an eye on this pair is Canada’s reliance on the price of oil, its primary export. The Canadian dollar’s value rises in unison with the price of oil.

Top five tips for choosing

When selecting an FX currency pair, what factors should you keep in mind?

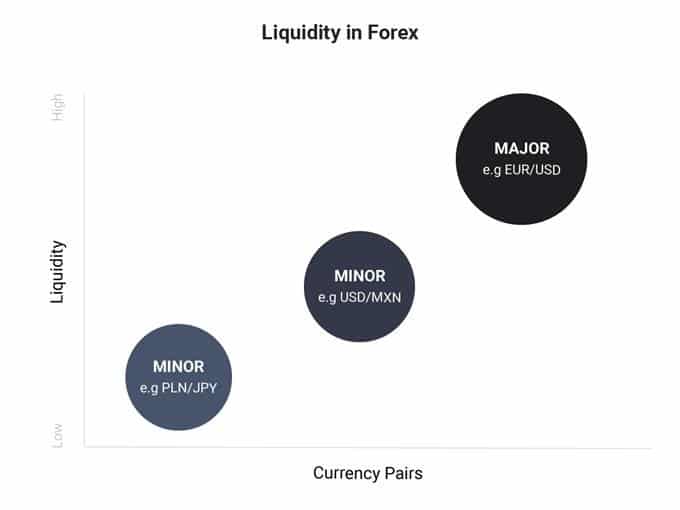

1. Liquidity

It implies a currency pair’s capacity to be purchased and sold without significantly impacting its exchange rate. A forex currency pair is considered to have a high level of liquidity when it can be easily acquired or sold. There is a significant volume of trade activity for that currency pair. The significance of liquidity in trading is evident since it is vital in profiting from a trade.

In a financial market, greater liquidity allows for faster transaction flow and more competitive pricing. As a result, this is regarded as one of the most crucial elements to consider when deciding which currency pairings to trade.

What is the significance of liquidity in forex?

A market’s liquidity has a substantial impact on how volatile its prices are. Liquid markets, such as FX tend to trade in smaller increments due to their high liquidity, resulting in lesser volatility. When numerous traders deal simultaneously, the price tends to swing up and down in small amounts.

2. Price stability

A currency’s price stability is inextricably related to the nation’s economic health or nations associated with that currency. For example, the US economy to the US dollar or the UK economy to the British pound. When determining which currency pair to utilize, consider the predicted economic situations of those countries.

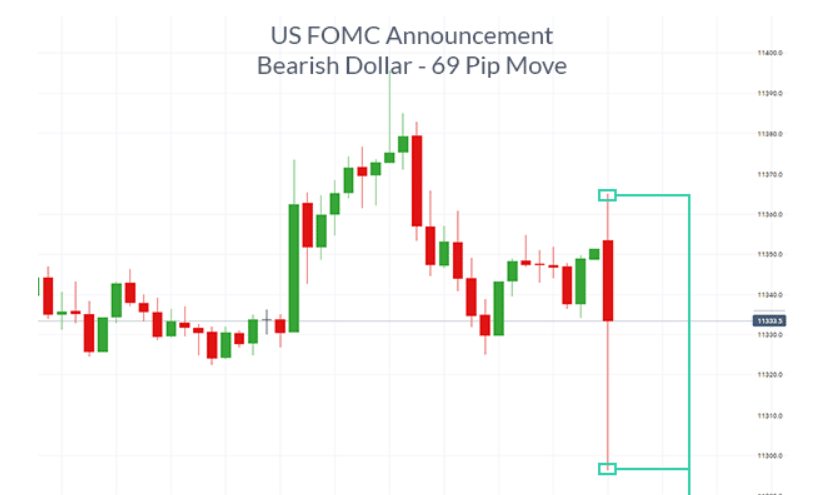

Liquidity on major pairs results in little gaps even during major news

What is the significance of price stability?

Price stability, in essence, safeguards the currency’s integrity and purchasing power. When prices remain constant, people can keep the money for transactions and other purposes without fear of losing the actual worth of their money balances due to inflation.

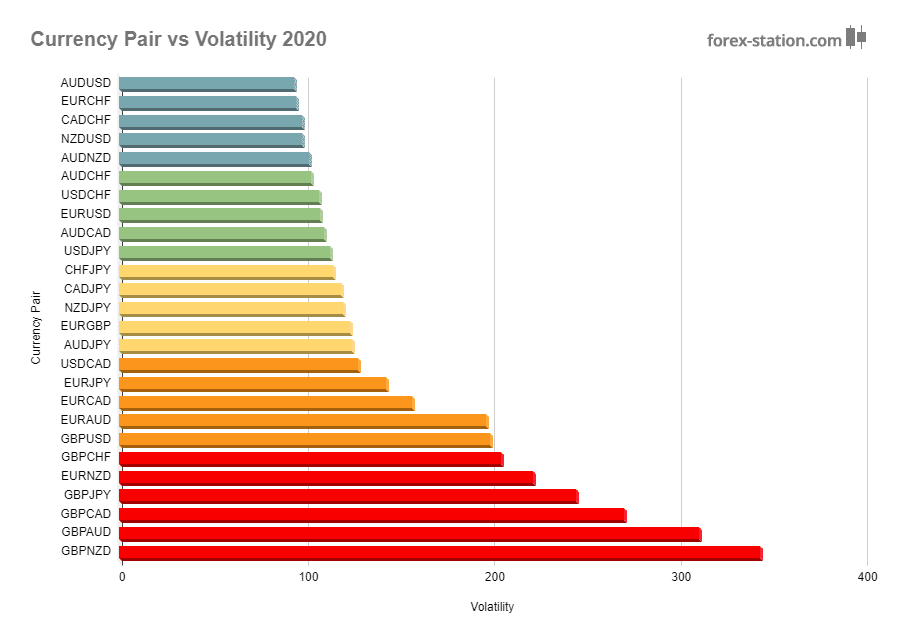

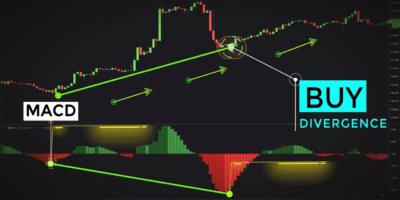

3. Volatility

One factor to consider when selecting the ideal currency pair to trade in forex is market volatility. High volatility helps you spend less time on a running transaction and earn more in the shortest amount of time. High-volatility currency pairs have a larger pip value, while low-volatility currency pairs have a lower pip value. This is because the value of a pip rises as volatility rises.

If you want to trade high-volatility currency pairs, keep this in mind. It would be best if you utilized large stops, or you would encounter early knock-outs. When important economic news is released, high volatility is more likely — the interest rate, the NFP, and the unemployment rate.

Comparing the fluctuations of numerous currency pairings may assist you in determining which pair is the best to trade.

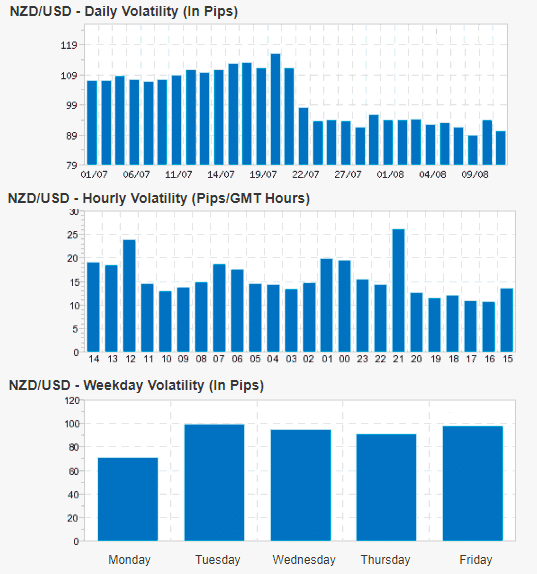

4. Timing of trading

When selecting the optimal pair to trade, your trading time is also very significant. The FX is open twenty-four hours a day, five days a week. You can trade at any time of day or night, or both. However, you must be informed of the FX market trading sessions, which pairings to trade, and when.

Why is it important to know trading hours?

When choosing which currency to trade, it is vital to be informed of the market hours. The four key trading sessions are:

- London

- New York

- Singapore

- Tokyo

For market participants to be able to execute their trades, the market must have sufficient volume. There is no liquidity if there is no volume. When there is liquidity and volume, and spreads are at their smallest, the markets are most active. This is the ideal time to begin trading.

There is no purpose in trading forex when no liquidity or other traders is dealing. It is also critical to focus on the currency of the current trading session. For example, when trading in the European session, the currency pairings to watch are EUR/USD, GBP/USD, and USD/CHF.

5. Strength of a pair

Knowing the strength of a currency pair is also essential while trading. You don’t want to get involved in a trade that isn’t moving. It takes longer than expected.

The best pair to trade is when one currency is losing value while the other is growing. As a result, the currency pair you choose will move in a single direction.

Assume you’re trading the EUR/USD. You must have a stronger base currency (EUR) than the quoted currency (USD) to purchase this currency pair. If you want to sell the pair, the opposite is true.

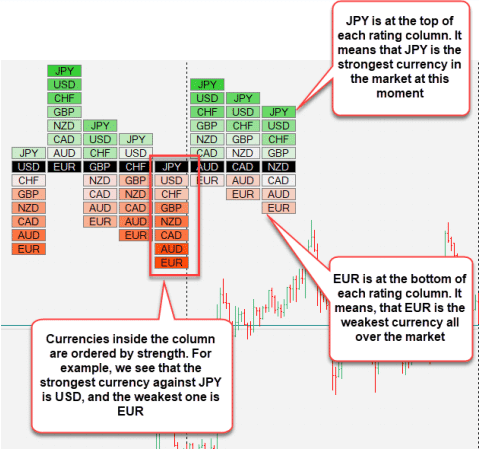

Currency strength indicator

How can you choose the ideal currency pair to trade?

Currency correlation is one of the most straightforward and most successful approaches. Regarding currency correlation, currency pairs can move in the same direction, oppose one another, or have no link at all. This is true when there is a link between currency pairs.

Assume you’re working with the EUR/USD currency pair. When you look at the other pairs, you’ll notice that GBP/USD, AUD/USD, and NZD/USD have the same layout. That appears to be good news.

All of these forex pairs have the US dollar as their currency in common. This means they almost always move in the same direction. However, you will not be able to trade all of the pairs. You only require one. To trade, you’ll need one of the top pairs.

- Evaluate their movements and compare market volumes.

- Look at their trends to discover which pair is trending and at a level of support or resistance.

- Determine which pair is most likely to be exchanged by other market participants.

Final thoughts

Many currency pairings are available for trading on the FX market, but this does not mean that they are all appropriate for trading. It’s more likely that your strategy will be successful if you choose the ideal currency pair to trade in forex.

Now that you understand how to determine a currency pair’s strength, you will identify the best currency pair to trade.

The best forex currency pair to trade should have a modest spread, significant volatility, and generally stable movement. If you examine the points we discussed above, you will see a substantial impact on your business.

Comments