Welcome to the journey of currency. Whether you want to make a living out of trading or just looking to secure a bit of extra income, we will do our best to cover all bases and equip you with the tools you need to dive into the world of forex.

With all the media coverage it has been getting, forex trading sounds fun and convenient, but still, for someone who has never done it, it could be overwhelming. So, let’s do the forex trading thing.

What is the forex market, and why should you consider investing in it?

Let’s start with the basics. The foreign exchange market, also known as FX for short, is a global market for exchanging various national currencies.

In brief, national currencies are not universally accepted. Therefore, before any international trade or transaction occurs, the two parties need to exchange one currency for the other, usually called the exchange rate pair.

If you live in the United Kingdom and want to visit Vietnam, you will have a hard time paying for street meat with your native currency, and you will probably have to exchange your pound sterling for Vietnamese dong first. The rate between the two, and the amount of local money you will get for your own, is ultimately determined by the global FX.

Understanding forex trading in-depth

People participate in forex as a trader or an investor. But whatever the case may be, you can dive into this volatile market and take our sustainable income if done correctly.

Trading in any financial market is hazardous, especially in forex, where the daily transaction is $6.6 trillion making it the most liquid financial market in the world. On the other hand, Investing is far better than trading.

Investing is a lot more cost-efficient. Also, you do not need to sit for long hours in front of the screen like forex traders. Instead, investors take a long-term goal and increase their portfolio with a suitable investment.

Now let us see some basic terminologies that we will need to learn to participate in the FX.

-

Forex broker

The very first thing to do to trade in forex is to open a broker’s account. Forex brokers help you trade with flexibility from anywhere around the globe as long as we have a good internet connection. Of course, while investing, you must make sure to choose the right broker.

-

Commission

Forex brokers make money by the difference in ask and bid price called the spread. The Ask price is the price we pay to buy, and Bid price is the price at which we sell an asset. Few brokers have raw spread and make their money by taking a commission, for example, $15 for every standard lot.

-

Currency pair

Forex is all about buying and selling different currencies simultaneously (exchanging). Two currencies together form a currency pair. It is represented as AAA/BBB, for ex: EUR/USD. Here EUR is called the base currency, and USD is called the quote currency. If we feel the value of EUR will rise concerning USD, we will buy EUR/USD and vice-versa.

There are three types of currency pair:

-

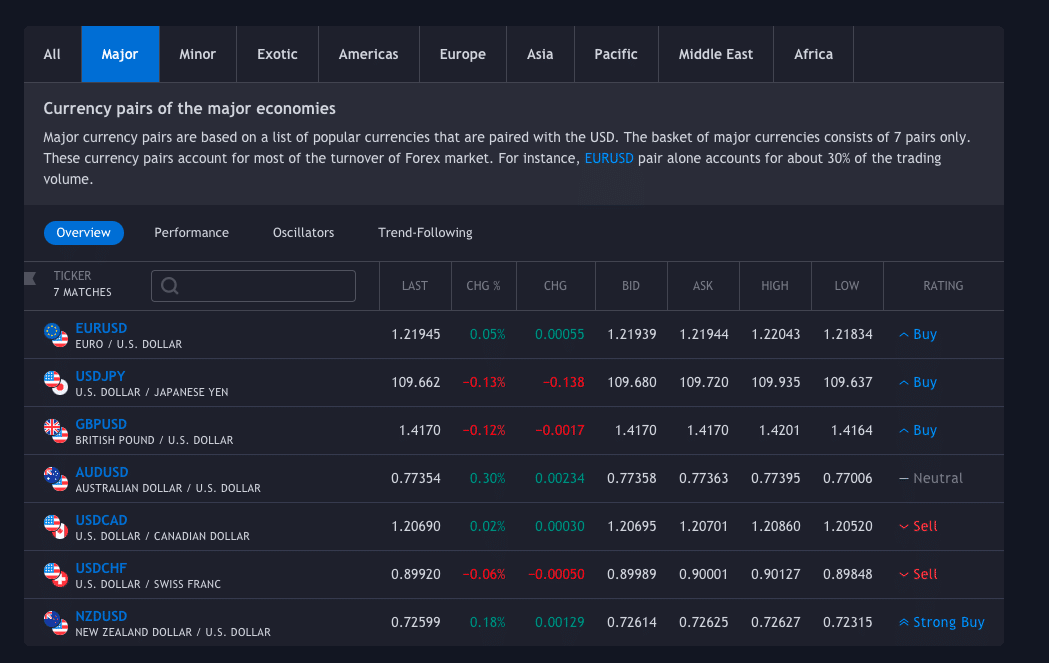

Major pairs

Pairs that have USD on one of the sides: base or quote. These pairs are the most volatile in the market, as EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

-

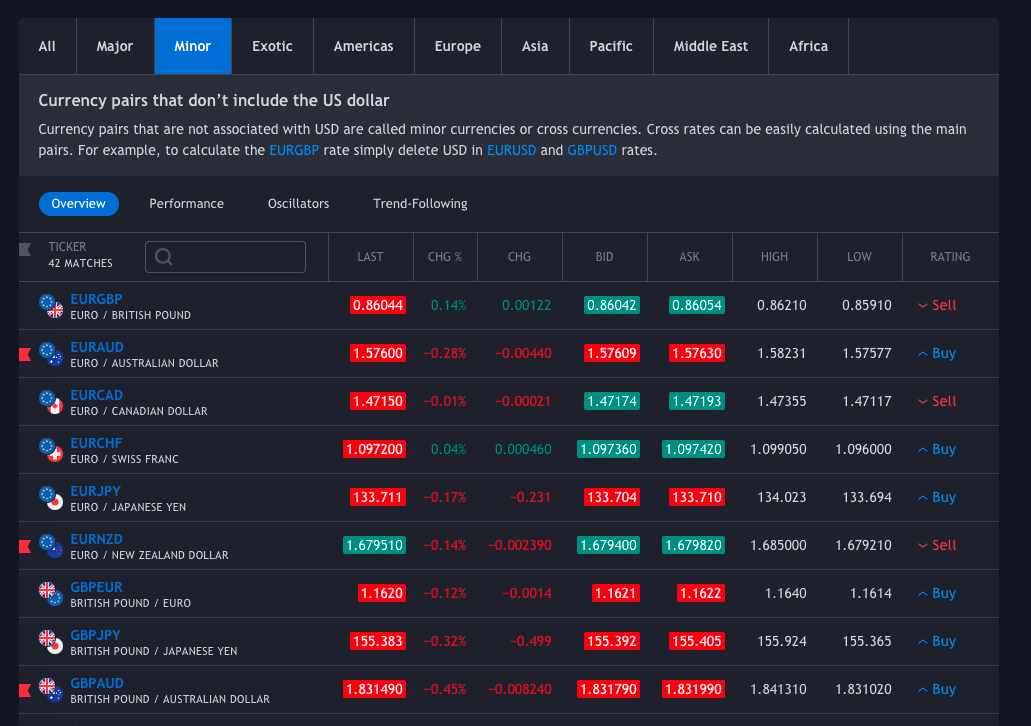

Minor pairs

These are the pairs that do not have USD in them but still have a significant volume, EUR/GBP, EUR/CHF, EUR/JPY, etc.

-

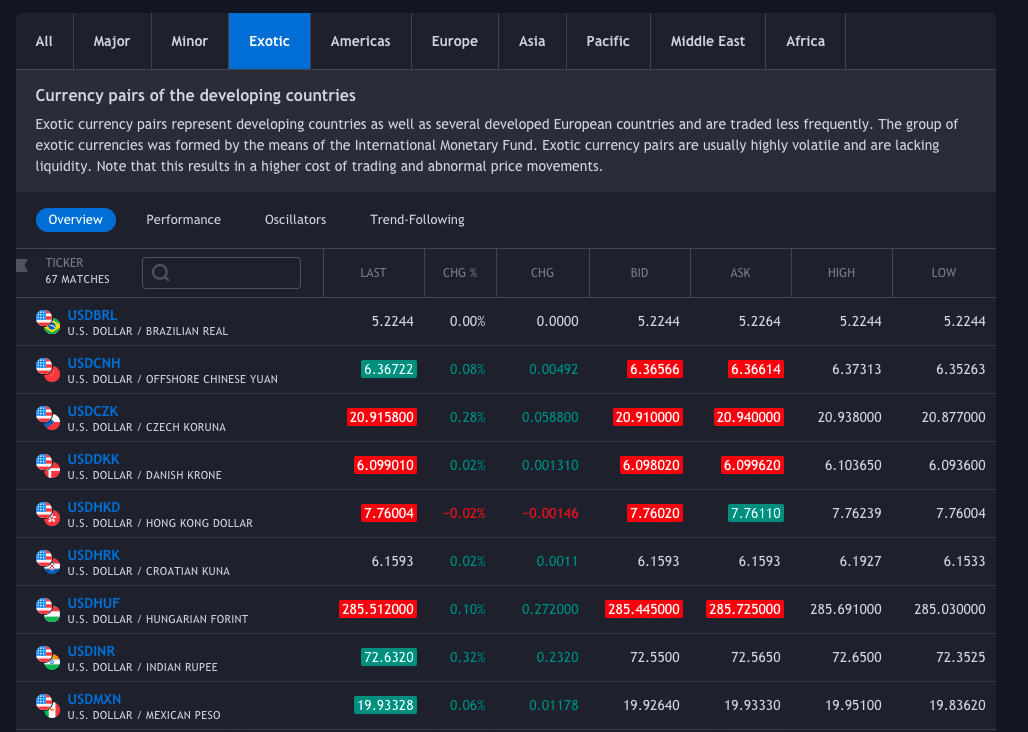

Exotic pairs

These pairs are emerging pairs that have one major currency and a less traded currency. Exotic pairs are less volatile and have a high trading fee, such as GBP/NOK, GBP/TRY, etc.

Once you know what a currency pair is, the next important thing is the pip and the lot size.

-

Pips

Pip is the slightest change in the price movement in the FX. The full form of pip is “percentage in point.” Let’s take the exchange rate of EUR/USD to be 1.2280. If the market moves from 1.2280 to 1.2282, that is a rise of 2 pip.

-

Lot size

Lot is the unit in which a trader buys or sells currency. The standard size for a lot is 100,000 units of currency, and now, there are also mini micro and nano lot sizes that are 10,000, 1,000, and 100 units.

-

Leverage

Leverage is capital that we borrow from the forex broker. It gives us an added advantage to trade in forex with less money and make a good income.

-

Volatility

Volatility is the measurement of how fast the exchange rate changes in the FX. The higher the volatility, the lower is the commission, and the lower volatility, the higher the commission.

-

Take profit & stop loss

We use TP and SL to limit our profits and losses. It simply lets the broker know how much we are willing to profit and how much to lose.

-

Long or buy & short or sell

You will go long or buy a currency pair when you think the base currency value will arise concerning the quoted currency. Conversely, you will go short or sell a currency pair when you believe the base currency value will fall concerning the quote currency.

Benefits and risk

-

Truly continuous marketplace

One of the most significant benefits of forex markets is that it represents the only truly continuous marketplace in the world. So while investing here, you need not worry about the working hours of different stock exchanges. Moreover, not having to memorize the holidays during which the bourses are closed is undoubtedly a welcome change of pace.

-

Decentralization

Another upside for the FX is that it relies on your general ability to grasp significant geopolitical and economic concepts and trends worldwide. As you can see, investing in forex has very little to do with luck. If you put in the work and the research needed before deciding to make a transaction, your chances of actually making a profit will increase drastically instead of just winging.

-

Leverage

When it comes to downsides or cons of forex market trading, the leverage allows springs to mind. Leverage itself refers to the use of borrowed capital to get higher returns. Unfortunately, the amount of leverage that financial institutions and brokers allow in the foreign exchange market is higher than in other forms of trading, which can be a double-edged sword because your gains and losses can multiply, potentially leaving you insolvent.

Guidelines

The first piece of advice has little to do with the actual investing but is an essential piece of information to hold onto. It fits into three simple words: make a plan.

Before finding a suitable platform and making the first trade, determine your goal and figure out the best strategy conducive to making that dream a reality. Trading is a numbers game, so give it your best to leave the emotions aside.

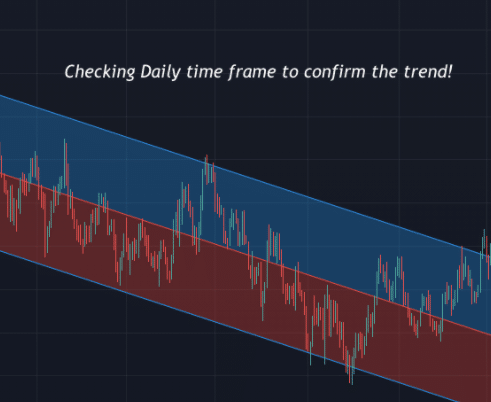

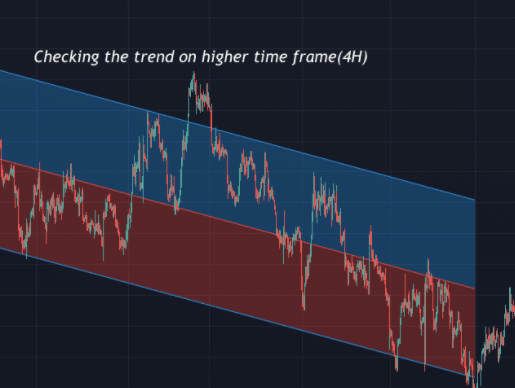

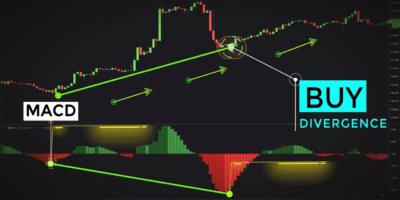

After determining the basics, it is essential to research the trends. Investing is a skill, and one should accept it as such. For example, investing in forex, you must always use a higher time frame starting from monthly, weekly, and daily.

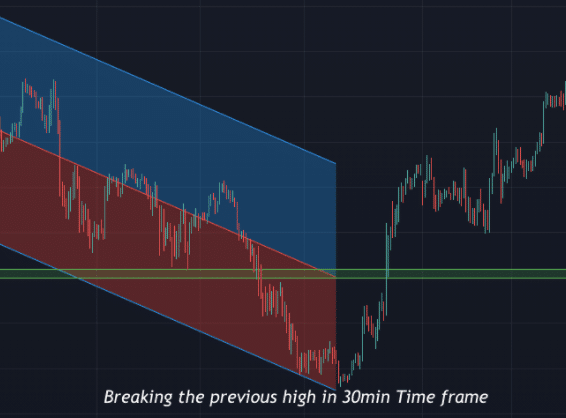

That means taking baby steps:

1. You might want to find a single exchange pair and try to make sense of how the pair moves over different time frames.

|

Checking the daily time frame to confirm the trend |

Checking the trend on higher time frame (4H) |

Breaking the previous high in 30 minutes time frame |

|

|

|

2. Test various setups, and remember to stay patient throughout the process, especially initially.

3. Be sure to check the news that you think could influence the pair, and you will be on your way to a better understanding of the FX.

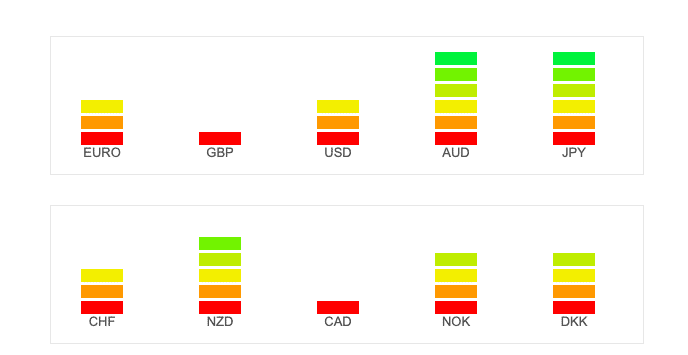

4. Better to also have an understanding of currency strength and co-relations.

The final caveat I am going to leave you with is that you should always know your limits, personally, especially regarding available funds. So don’t rush even if your learning and trial period turn out to be a complete blowout. Investing takes time and practice, so embrace the process, and your future self will thank you.

Conclusion

More and more people are discovering the foreign exchange market by the day, and it is clear why. Be that as it may, in its essence, this type of trading carries no significant difference from any other sort of trade. It relies on the discrepancy between supply and demand, and it’s based on hard work and thorough research. We may have just scratched the surface with today’s summary, as forex investing and trading is a continuous learning journey.

Comments