The Nasdaq 100 index includes the top 100 traded US companies listed on the Nasdaq Stock Exchange. Involving a stock in an Index like Nasdaq 100 may bring a considerable change in the stock price.

The beginning of the Nasdaq 100 index was back on January 31, 1985. However, in the last year, this index made itself quite clear that it is different from other indices such as the S&P 500 index, as NDX outperformed the S&P 500 by 31.3% last year.

This index is a basket of retail, technology, industrial, health care, biotechnology, etc., companies. On the other hand, it excludes financial industries like investment banks and commercials. Besides stocks like Tesla, Apple, Amazon, Netflix, etc., some metal and energy stocks were responsible for the outperformance of the Nasdaq 100 index last year.

However, before trading in the Nasdaq 100 stocks, you must have some primary and clear concepts about it. It is different from the other index, such as S&P 500, how the companies get listed in Nasdaq 100 or essential criteria, and how its addition boosts the share price of any particular stock. The article covers all these answers. These are the basic or primary levels of must-know information to help you understand the assets and the pricing. So you can make more efficient decisions when you start to invest in any stock listed on the Nasdaq 100 index.

Who can list their shares on Nasdaq?

Not every company can list its shares for trading on the Nasqad. To be listed, a company must:

- Be registered with the United States Securities and Exchange Commission.

- Have at least three market makers: financial institutions that conduct brokerage or dealer activities in specific shares.

- Meet the minimum requirements for the number of capital, shares in circulation on the exchange, and the number of shareholders.

Initially, the Nasdaq exchange specialized in high-tech companies. This specialization has been partially preserved to this day. Therefore the phrase Nasdaq stocks often mean stocks of high-tech companies. Shares of companies such as Microsoft Corporation, Google Inc. are traded on the exchange. They are leaders in their industries in the United States and all over the world.

How is the Nasdaq 100 different from the S&P 500?

Both the Nasdaq 100 and S&P 500 are two of the most popular equity indexes in the US.

- The creation date of the S&P 500 is 1957.

- The creation date of the Nasdaq 100 is 1985.

In comparison to the creation date, Nasdaq 100 is much younger than the S&P 500 index. Although there are differences in listing companies, both are market-cap-weighted in the US large-cap indexes.

- Nasdaq 100 is the basket that lists the top 100 nonfinancial companies that are trading in the US equity market.

- The S&P 500 or the standard and poor 500 index is a collection of 500 companies trading on the US equity market.

Some committees decide the companies that are listed on the S&P 500 index. Some companies of the Nasdaq 100 index, such as Facebook, Amazon, Apple, Microsoft, Tesla, are also on the S&P 500 index. Additionally, 80% of Nasdaq’s 100 listing companies are also on the S&P 500 index.

| Nasdaq-100 TR | S&P 500 TR | |

| Cumulative return | 327% | 128% |

| Annualized return | 12.6% | 7% |

| Annualized volatility | 23% | 21% |

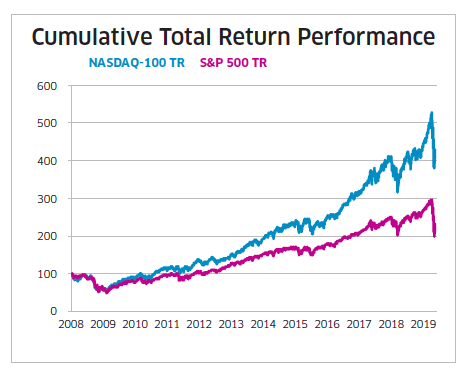

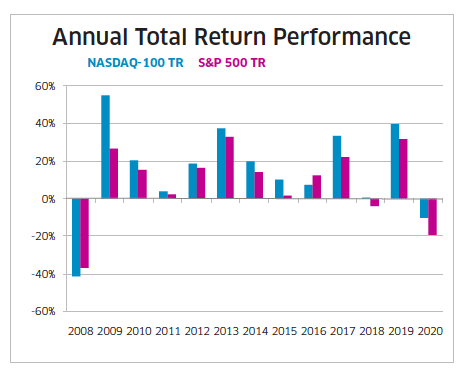

However, the performance is different at the stock prices for the Nasdaq 100 and S&P 500 index. Between 2007 and 2019, the Nasdaq 100 listed companies dramatically grew and outperformed the S&P 500 index. Nowadays, overlapping companies’ percentage in both indexes is near 80%, which was not always the same. Fifteen years back the figure was only 50%.

|

The charts above show the annual growth and historical performance for both the Nasdaq 100 and S&P 500 index. It clearly shows the rapid growth of the Nasdaq 100. As of 2020, the Nasdaq 100 index represents 31% of the US equity market cap, which was just 11% back in 2003. So the stocks of the Nasdaq 100 index are also more volatile than other companies of the S&P 500 index.

How do companies get into the Nasdaq 100?

The Nasdaq 100 is different as some rules such as:

- Securities must be ‘eligible’ on the Nasdaq listing.

- This type of index excludes financials and includes tech, healthcare, retail, service sectors, etc. Excluding financials based on ICB sector criteria.

- Many of the new growth-oriented companies want to list on the Nasdaq. So the technology firms are dominating between 52% and 64% over the last 19 years.

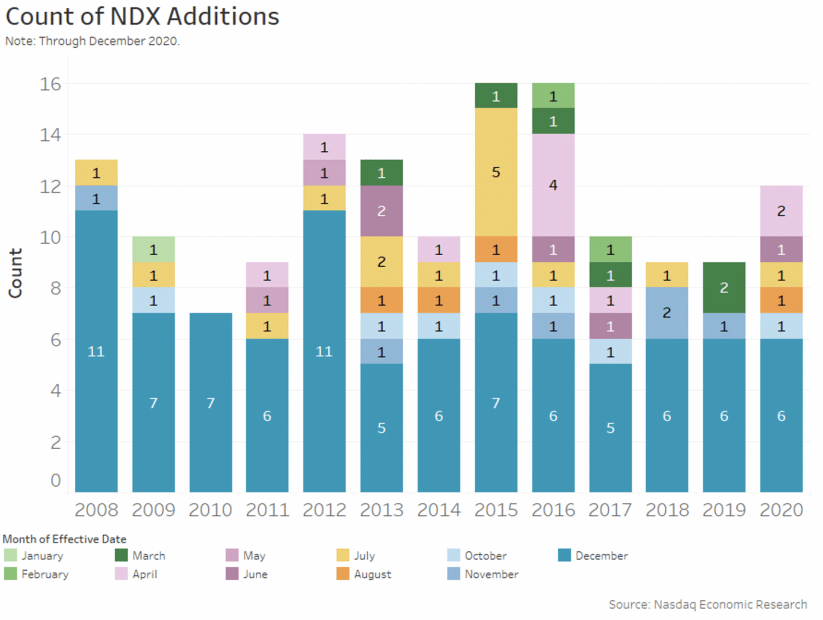

On the 3rd Friday of December, each year, the Nasdaq 100 index gets officially rebalanced. So most of the additions also take place during this time. Anyway, this index change can happen during the whole year if any specific stock fails to ‘Continued Eligibility Criteria.’ Historically 10% of the stocks get out of the Nasdaq 100 each year.

Most of the time, the rotated companies are small in size, so there is no significant impact on the turnover. The companies must not be financials but securities such as ADRs with enough US liquidity. Then the stocks are ranked based on market cap, and the most significant 100 qualify for next year’s list. This addition and deletion of companies from the basket usually occurs in early December of every year.

How does the Nasdaq 100 addition boost the share price?

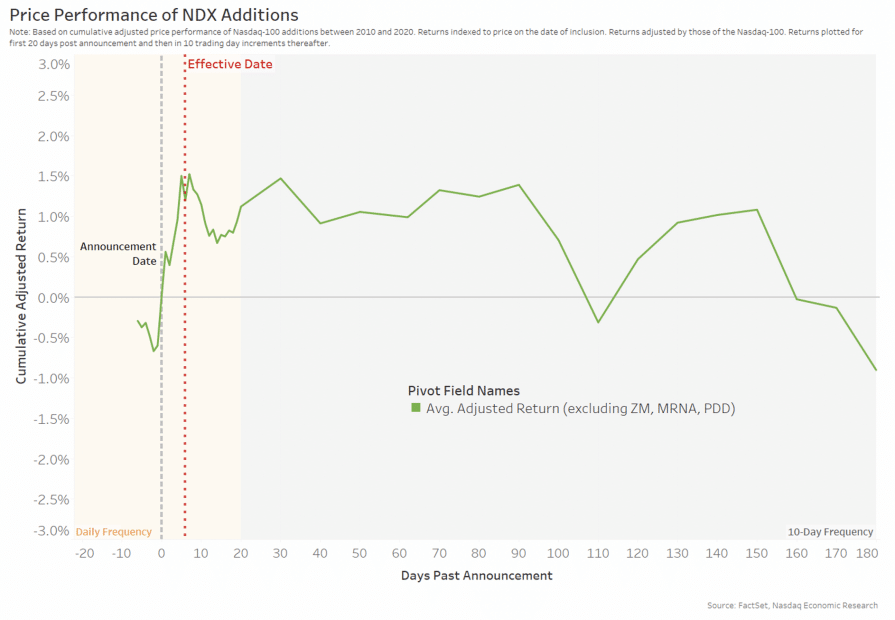

The Nasdaq 100 index is a popular index among investors with other mutual funds than $140 billion from QQQ ETF. So the amount is not so small. Several types of research already took place to find out the ‘membership impact’ of any company’s share prices after being listed on Nasdaq 100.

Although some studies show mixed results, most of them confirm the share prices get boosted after any company is counted or declared on the list of the Nasdaq 100 index. Some reasons you can’t ignore for increasing the share prices such as:

- Stock valuation gets elevated when it is listed.

- Investor demand rises for a particular stock when it is listed on the Nasdaq 100 index.

- It decreases the cost of capital. Simply the trading cost decreases after listing any company shares on this index.

- After being listed on the Nasdaq 100 index, some long-term investors may get interested.

The above chart shows the performance after the addition of the stocks on the Nasdaq 100 index. Our study confirms that not all stock prices are boosting after the announcement of the acquisition. Only 64% of them rose rapidly in five days after the announcement of the addition.

Final thoughts

Finally, by observing the volatility of the stock prices, we see the Nasdaq 100 index companies show dramatic growth as most of the companies of this basket are related to technology, services, and healthcare.

Nowadays, technology makes our lives better, so people and investors get more attracted to technology-based things. So the trend is more likely to continue in the recent future. We suggest choosing the stocks carefully before making any investment and follow fair trade and money management during trading.

Comments