It is an individual retirement account in which physical gold or other approved precious metals are held in custody for the benefit of the account owner. It has the same functions as a standard individual retirement account. But there is one difference: it holds physical gold coins and bars instead of money.

The IRS permits self-directed IRA holders to purchase gold, silver, platinum, palladium bars, coins, or other approved physical forms. The Gold IRA retirement plan protects an individual against inflation and diversifies their portfolio.

Let’s go through the Gold IRA’s main features and decide whether it is worth retirement or not.

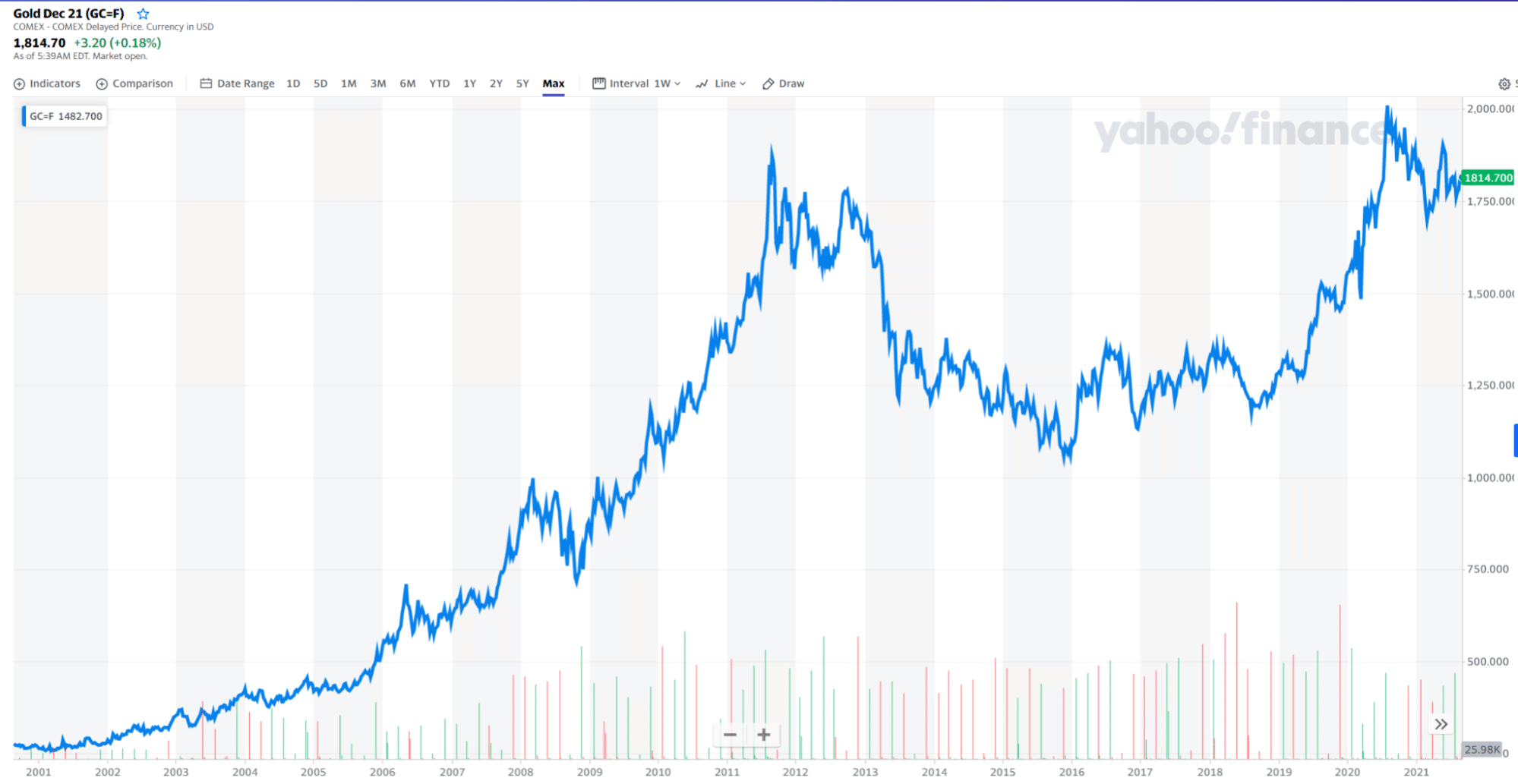

The Gold shifting price

Gold prices have been fluctuating. In September 1999, it was $255 per ounce till $1,937 in August 2020. Since March 2021, gold has been selling in a range of $1,700 – $1,900 per ounce. Thus, gold has been getting expensive as time passes.

Gold price range since 2001

Gold IRAs: why is it trendy?

Diversifying a portfolio and protecting it against inflation is another benefit of gold IRAs. It attracts investors because, unlike money, gold’s value keeps on increasing as time progresses. Keeping paper assets as a reserve for a long time can lead to loss because of inflation, but having gold can help you earn profit depending on when you’re selling it. Therefore, long-term investors should consider this asset.

How to open a Gold IRA account?

To open a gold account, the investor must first open a self-directed IRA. You may need the services of an investment brokerage company to open an account. The minimum setup fee can be $50 to $250 for the account.

Top 3 best Gold IRA companies of 2021

You might be wondering how to choose the best company. We have made things easier for you. Let’s take a look at our selected best three companies that might be suitable for you.

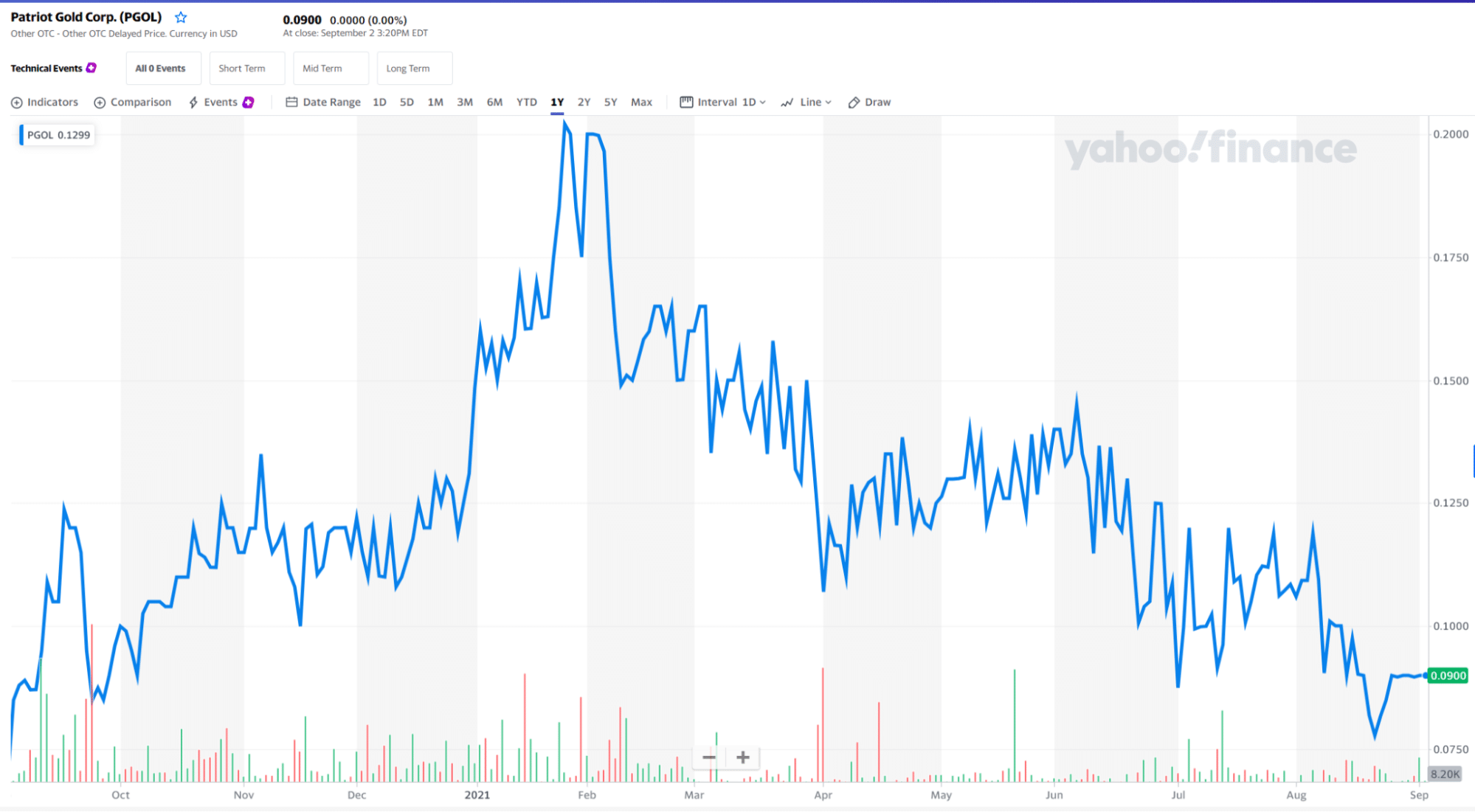

1. Patriot Gold Corp. (PGOL)

PGOL

The company’s headquarters are in Los Angeles. The complete first started in 1990 and has been operating for three decades. This company is a professional coin grading service and a member of the Numismatic Guaranty Corporation.

Pros

- The company simplifies the process of setting up and maintaining an IRA. They work with the custodian on setting up your account and communicate with the IRS for you.

- It also acts as a broker to ensure that everything goes according to plan and has no legal or financial hurdles.

- For anyone without a background in tax law or finance, this company helps them to establish self-directed IRAs.

Cons

- Patriot Gold has a setup fee of $225 that is more expensive than other gold IRAs companies.

- It might be frustrating for people with a budget because you won’t be told how much you will be paying right away.

- Its buyback program is a little time-consuming because you won’t be told right away how much you will be paid, and you will have to fill out an application to get a quote.

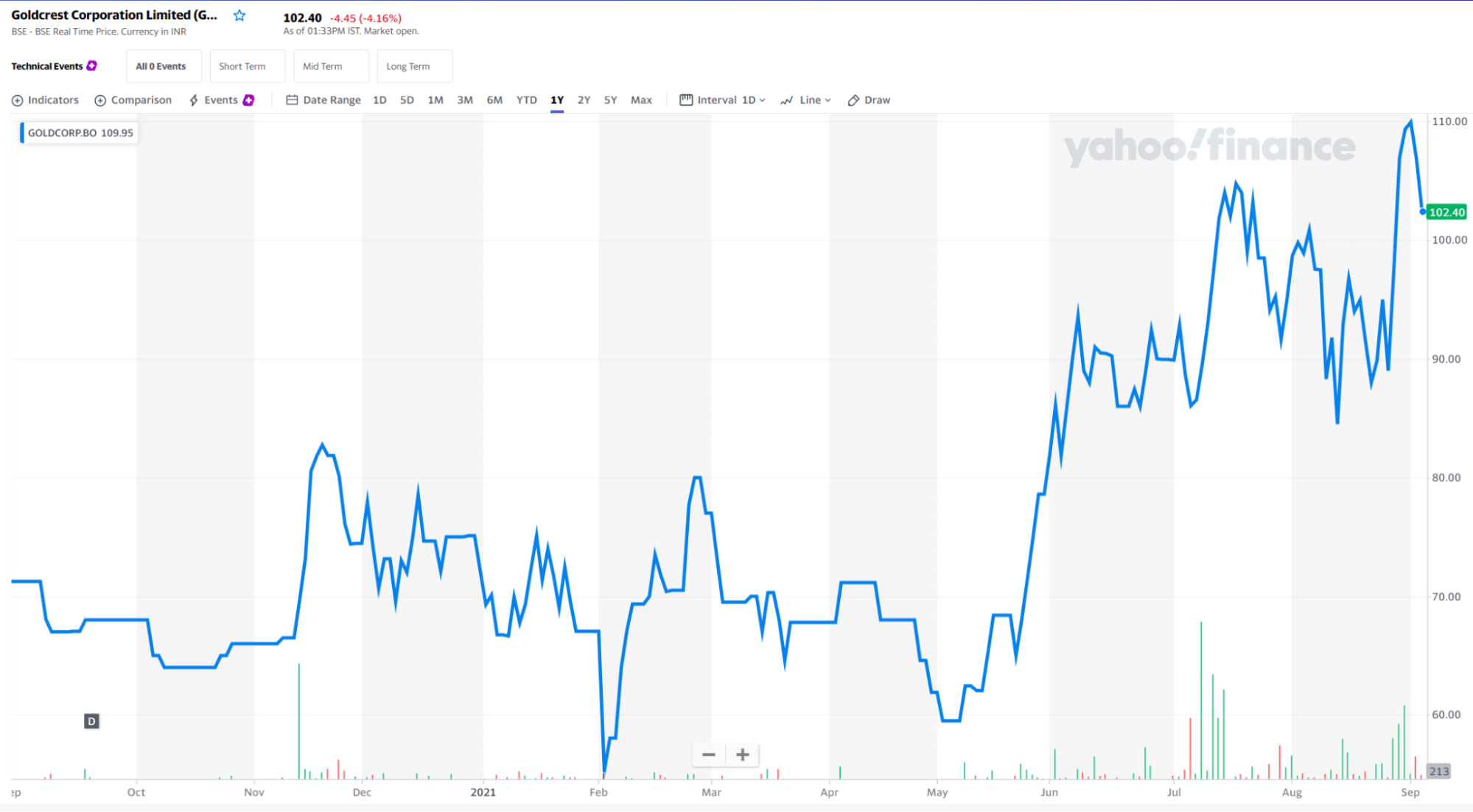

2. Goldco Precious Metals

Goldco Comp.

Goldco is a corporation that functions related to precious metals in the US. It specializes in gold and silver IRAs and sells precious metals to its customers. It used to be called Gerson Financial Group LLC, which used to be a precious metal share organization for business-to-business sales. The company is based in Woodland Hills, California.

Pros

- The company’s starting fees are low as compared to other IRAs.

- It has special offers available for new customers.

- It has good customer service and guides its customers along the way.

Cons

- It does not provide custodian and storage services.

- You cannot set up an account online.

- The minimum deposit starts at $25,000.

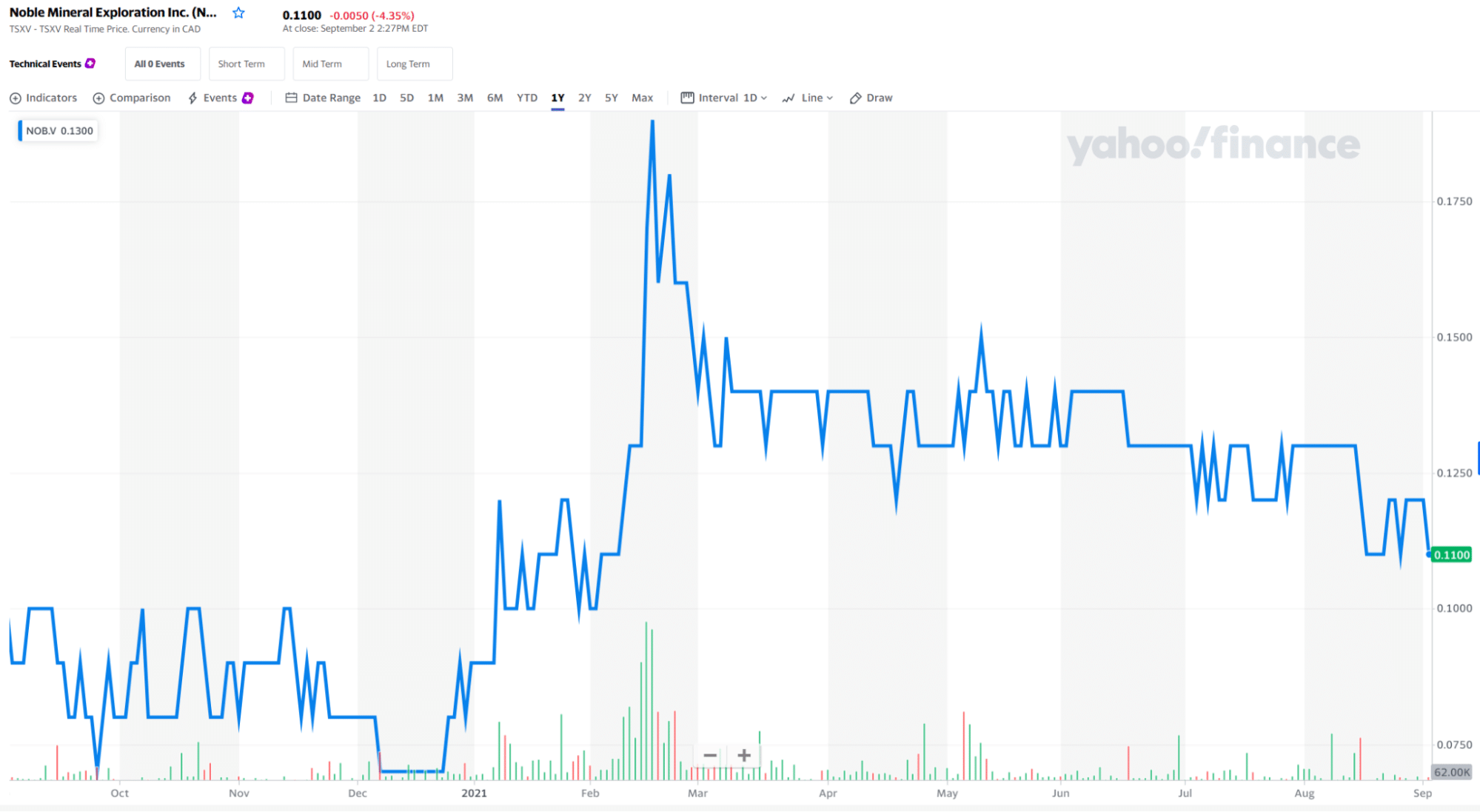

3. Noble Mineral Exploration Inc. (NOB.V)

NOB.V

Noble Mineral Exploration Inc. is based in Pasadena, California. Two financial experts and life-long friends Collin Plume and Charles Thorngren, establish this company. They established this company because many precious metals companies exploit their customers and profit from their investments. Therefore, they felt the need to create a company to educate their customers on investing in precious metals. This company provides services in a friendly and honest manner.

Pros

- The company has a buyback program where you can sell the precious metals you invested in without any queries.

- It educates the customers so they can choose what is best for them.

- The company has a low minimum for investments.

Cons

- It is a relatively new organization.

- The company doesn’t have international storage services.

- They only provide a national storage service.

How to pick the best broker for an IRA account?

Study the characteristics of a broker before choosing one. In contrast to traditional IRAs, which can be configured and managed easily through a repository, a Gold IRA involves several more moving parts. Investors may require an authorized custodian in some circumstances.

To ensure that the custodian bank can handle the gold, it must be purchased from the custodian bank and transferred to the bank. An IRA gold firm that facilitates the gold purchasing process for investors must be trustworthy. Apart from the fees, account minimums, investment options, customer satisfaction, and online tools must consider other factors while seeking a brokerage.

Here are a few:

- Quality of services

- Regulation

- Technology and tools

What are the special costs of an IRA account?

There are a few special fees that an investor has to pay when having an IRA account.

- The seller fees

A one-time fee that depends on the seller.

- Account setup fee

A one-time fee for setting up your account also depends on the organization you are working with.

- Custodian fees

Usually paid for any IRA, but they may be higher for gold IRA. They are paid annually, along with transactional fees and associated assets.

- Storage fees

Fees paid for the storage of gold or any precious metal.

- Cashout costs

If you sell your gold or precious metal at a lower price than you bought it for, that cost of loss will be a cashout cost.

Is the Gold IRA worth the investment?

Gold IRA is the best option to diversify your portfolio, as gold has been on the rise for the past several years. The buying power of a currency may reduce amid inflation, but gold can be used as a hedge against inflation.

Moreover, it is a safe-haven asset that may appreciate during calamities and recession times. Though it is risky as the gold price may plummet significantly, you should consult a finance expert about it.

Significant bullish trend of gold since 2005

It is a good idea to invest a portion of your wealth to be safe instead of all your wealth. Gold IRA also can give you high returns. It is not a good short-term investment. If you want to invest your money for the long run, Gold IRA is a good option.

Comments