401K accounts and retirement investing have become synonymous. The worst thing that could happen to a working individual would be retiring and having nothing to show for it. It is the reason why $80 million-plus workers participate in 401K plans, resulting in a market valuation of over $5.7 trillion. The beauty of 401K plans is that they benefit both the employer and the employee.

To fully understand the perks of 401K accounts, we first need to know what they are.

What are 401k accounts?

They are retirement accounts set up by the employer for the employee, contributing to the account balance. Since its inception in 1978, 401K has evolved to become an integral part of the labor market to the extent that it is one of the bargaining chips used in labor contracts.

401K is coined from the US internal revenue system about the clauses that detail how these accounts are managed.

401K accounts are available to employees in two variants:

-

Traditional 401k accounts

Contributions towards this account are made pre-tax, resulting in lower nominal tax rates. The taxman takes their due on withdrawal from the account.

-

Roth 401k accounts

Roth 401k is the new kid on the block that has existed since 2006. Here, contributions are made after-tax, with no taxation attached to the withdrawals. It is a very popular option for employees with a mapped-out career growth plan since it results in a higher tax bracket during retirement.

The IRA stipulates the amounts contributable towards the 401K accounts. For the 2021 financial year, the maximum contribution cap is set at $19500, irrespective of the type and number of 401K accounts held. However, this cap is stretched to a maximum of $26000 for age 50 and above.

Unlike normal savings accounts, 401K accounts invest in low-risk investment assets, ensuring the account’s growth for a hassle-free retirement.

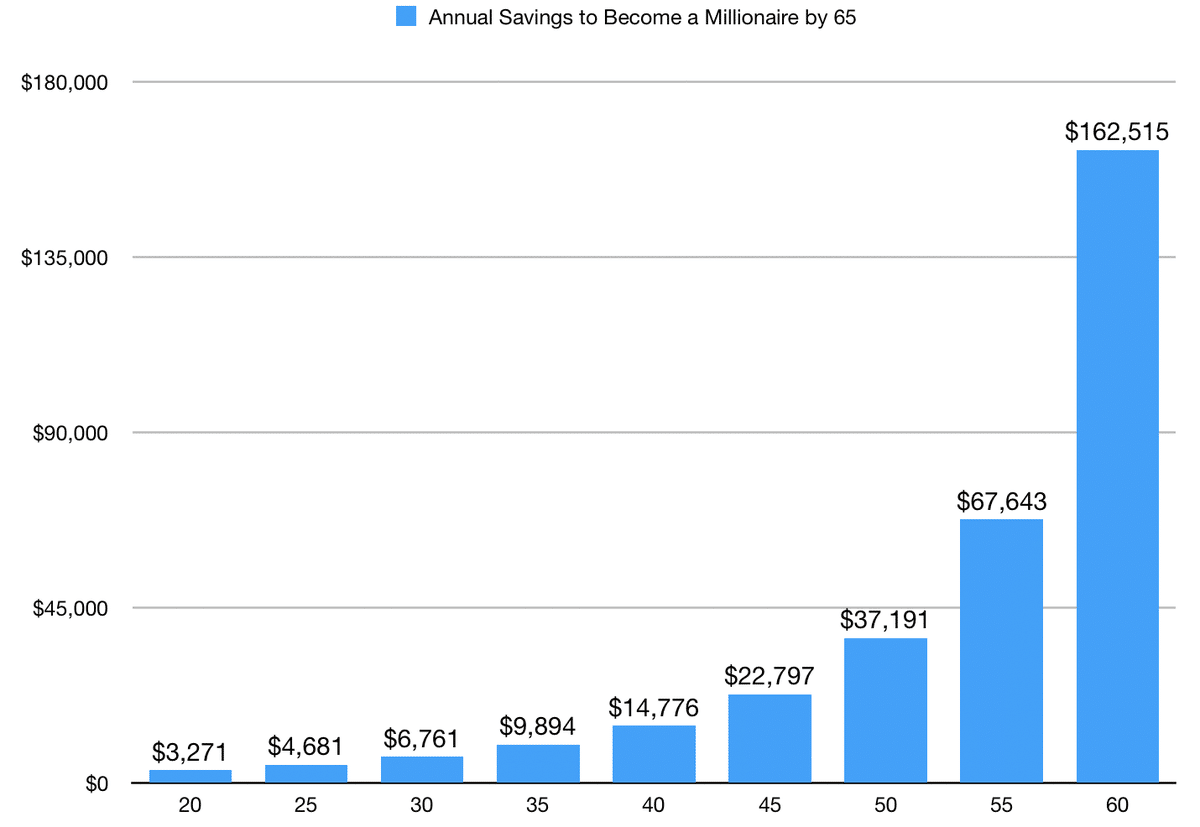

Annual savings graph to be a millionaire by 65 years

A look at the graph above shows that if you start saving in your 20s, you would be a millionaire by the age of 65, starting with an amount that is approximately 17% of the allowable yearly 401K contribution. Combine these savings with the compounding effect of money made from 401K account investments, and living a blissful retirement life should be for everyone.

401K benefits

Except being a millionaire during retirement with the correct 401K account mapping, they also result in the following benefits:

- Employer matching

- Tax-related merits

- Credit sheltering

- Loan option

- Time

- You can take it with you

- Easy payroll deductions

- Control

1. Employer matching

Employer match-up is the primary reason for the popularity of the 401K accounts. If someone were to offer you an option of matching the value of your investment in a venture, without it being a loan and with no strings attached, you would be crazy not to jump at such an option.

It is exactly what the employer 401K match-up does. Employer matching involves the employer contributing a similar amount to what an employee contributes to their 401 K or partial sum. It is an instant reward for agreeing to save.

Employer matching comes in two options:

- Partial match-up; this approach restricts how much an employer can contribute, usually a percentage of the annual income. For example, a 30% contribution matches up to 7% of the annual employee income. Suppose an employee earns $43500 annually, contributing 7% to their 401K account, the employer match-up value would be $913.5, taking the annual total contribution to$3958.5.

- A pre-determined dollar value regardless of the employee’s yearly income. For example, a dollar-for-dollar match-up with a maximum of $9000.

For maximum optimization of this 401K feature, go for the contribution that elicits the maximum employer match-up contribution.

2. Tax benefits

Depending on the 401K account, holders either enjoy tax benefits at contribution or during withdrawal. Employees enjoy lower taxes for traditional 401K accounts as pre-tax donations, while 401K account holders enjoy tax benefits during withdrawals. In both instances, the net amount received by the employee is more than their counterparts on the same tax bracket without 401K accounts.

3. Credit sheltering

401K accounts fall under the protection of the Employee Retirement Income Security Act of 1978. In translation, creditors cannot seize 401K accounts to repay accrued debts.

4. Loan option

401K accounts come with a provision to borrow up to 50% of the account value as a loan, with a repayment period of five years. This arrangement allows for the use of the 401K account without attracting penalties for early withdrawal.

5. Time

The beauty of 401K accounts is that you can make savings from the instance you get employed to when you retire. In addition, these accounts enjoy compounding since both their interest and incomes are tax-protected until withdrawal time.

6. You can take it with you

Unlike other employer-related savings schemes, 401K accounts allow employees to transfer their savings between different employer 401K schemes. However, some employers attach a vesting period to their plans, usually five years, without which you cannot transfer the savings. If interested in starting afresh with a new employer, the IRA allows for the roll-over of 401K accounts into IRA account.

7. Simplified payroll deduction

One of the hardest things in personal finance is having the discipline to save consistently. 401K account deductions happen at source, facilitating an easy savings plan devoid of biases.

8. Control

Except for the maximum allowable annual contribution, 401K account contributions are at the mercy of the employee. One can customize their contributions to align with their savings objectives and the prevailing market conditions.

Final thoughts

2020 Retirement Confidence Survey showed that 51% of retirees with 401K plans had a minimum of $250000 in savings compared to only 5% of retirees with the same amount but without a 401K account. With the right optimization, 401K accounts have many benefits, ensuring a hassle-free retirement life.

Comments