Selecting the correct retirement plan is a crucial decision you can make as an employer. After all, you want to demonstrate that you care about the future of your employees.

More than 99% of the 28.7 million companies in America are small enterprises. If your business belongs to this category and you want to get talented employees to join your team, including a retirement benefit in your compensation package is one strategy you can use.

As a small business owner, you can start with two simple options: simple 401k and simple IRA. While the two options look similar, there are a few differences anyhow.

In this article, you will learn about the benefits, rules, and opportunities offered by the simple 401k. Keep reading to the end to find out if this plan suits you better.

What is a Simple 401k plan?

Only those with 100 or fewer employees can set up such a plan. The type of enterprise does not matter at all. It can be a partnership, sole proprietorship, or corporation if the required number of employees is satisfied.

What are the benefits of a Simple 401k plan?

You can get a lot of benefits from an established simple 401k plan in the workplace. This plan is a win-win solution for both the employer and the employee. These benefits include, but are not limited to, the following:

- Employers and employees have high contribution limits. As an employee, you can make contributions up to a certain limit, that is, $13,500 for 2021. If your age right now is 50 or above, you can top up $3,000 more for a total of $16,500. Meanwhile, employers can set a 100% match up to 3% of the employee contribution.

- Based on IRS regulations, employees immediately own 100 percent of the employer match. If you meet the necessary requirements, you can immediately withdraw the overall balance from the account anytime you want to. Also, you will not lose money from the retirement account if you change employment.

- While you cannot withdraw funds from your account before retirement due to the associated penalty, loaning against your plan is possible. Typically, this is the case. Your employer often includes this feature in your simple 401k plan. If you are not yet eligible to get distributions, you may tap into your account if you are in dire cash needs through a loan.

What are the rules of a Simple 401k plan?

The IRS forbids companies to enroll employees already granted with simple 401k to other retirement programs. If you are not covered with the simple 401k yet, your employer can arrange another type of retirement plan for you.

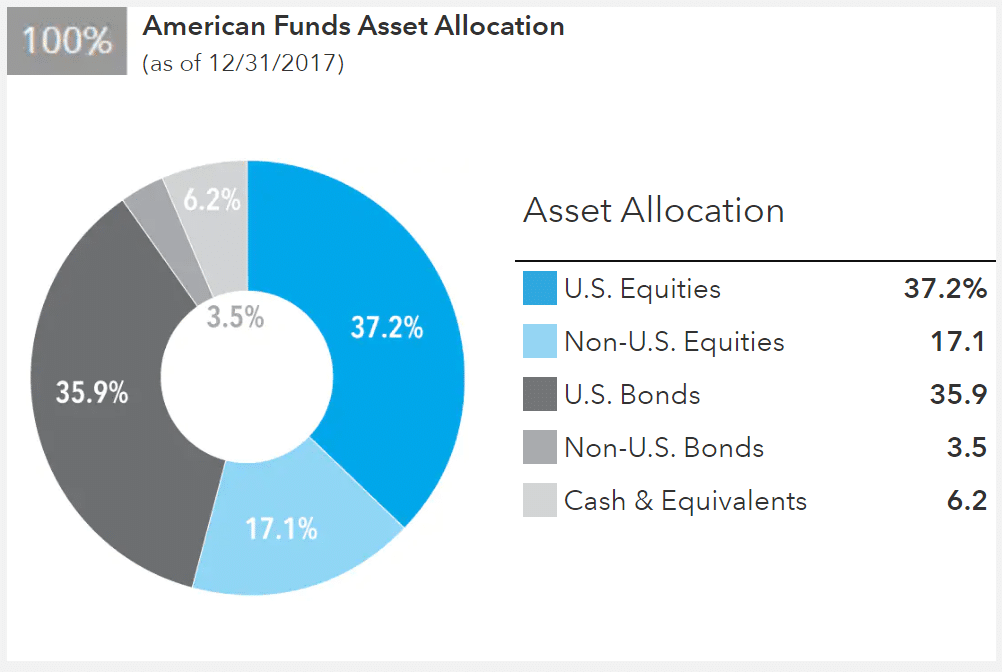

If you get a simple 401k, your employer will manage it the same way as a traditional 401k. Then your plan provider will invest the funds in the investment options you have chosen. The total amount is credited to your account (i.e., without tax deductions).

In addition to a one-to-one dollar matching up to three percent, employers can use non-elective contributions when putting money into the retirement accounts of 401k-enrolled employees. Regardless of the type of employer contribution, the combined employer-employee contribution should not exceed $290,000 for 2021.

What are the opportunities of a Simple 401k?

It provides a lot of benefits on the part of the employer. Putting in place such a plan is one way for the business to keep existing employees and thus reduce the attrition rate. Small business owners can also use this strategy to attract new talents and compete with big corporations in the industry. Plus, setting up this plan is much easier than other types of plans.

Who may take part in a Simple 401k plan?

You must satisfy three requirements to become eligible to enroll in the Simple 401k plan. The list below contains these requirements:

- You must be 21 years of age or older.

- You must have served the company for at least one year.

- You must have received a salary of $5,000 at minimum from the previous year.

How to start a Simple 401k plan?

As a business owner looking to establish a 401k plan for your employees, you have to take steps to do it the right way. This section outlines these steps.

- Draft the retirement plan. This written document defines how the plan will operate daily.

- Explore your options for providers whom you will consider as investment choices for your plan holders.

- Choose a system or record keeper who will monitor contributions, distributions, losses, and revenues. This entity or individual can assist in preparing the report for the annual return, which you must submit to the federal government.

- Choose someone outside of your organization to keep the document containing the retirement plan, execute day-to-day operations, and comply with applicable laws. If you want to, you can ask your financial advisor to select a recordkeeper or third-party admin in your stead.

- Provide the summary of the plan to eligible employees for the simple 401k plan. This document defines the eligibility requirements and the workings of the plan.

Why should you choose a Simple 401k plan?

As an owner of a small business enterprise, you have two simple options when setting up a retirement plan for your employees. The simple IRA and simple 401k are good options for you. They have a lot of similarities and seem more accessible to establish than the traditional plans. However, the simple 401k is still relatively simpler to assimilate and easier to set up between these two simple options.

It’s great to hear that anyone above 21yo can apply for a 401K and that it isn’t simply limited to those with lots of money. I want to start planning for my retirement as early as now so I’ll be sure to look around for someone that can help me plan out my own 401K design. My parents didn’t have one of their own and are having a hard tie with their retirement years so I plan to learn from my mistakes and ensure my own financial future.