When it comes to retirement investing, 401K accounts are the first thing that comes to mind. However, they are not the only retirement investing option available.

There are also ROTH IRA accounts, which have characteristics similar to ROTH 401k accounts but are unique enough to provide a second retirement nest.

Here we explore the points of intersection and convergence between these two retirement accounts, facilitating an informed decision on whether to hold just one or both.

ROTH 401k vs ROTH IRA

The conventional 401K accounts are traceable back to 1978 before evolving to provide the ROTH 401k variant in 2001 due to ROTH IRA growth in popularity after inception in 1997. Whereas ROTH 401k is an employer-initiated retirement savings plan, ROTH IRA accounts are individual project accounts.

ROTH 401k vs ROTH IRA savings and distribution

In choosing between the two, the following factors merit careful consideration:

- Contributions

- Employer match-up

- Time

- Loan option

- Allowable investments instruments

- Required minimum distributions

Contributions

The IRA stipulates the amounts contributable towards both ROTH IRA and 401k accounts. The maximum contribution cap for the 2021 financial year is $19.500 for 401k accounts and $6000 for ROTH IRA accounts. These maximum allowable amounts stretch with an additional $6500 and $1000 for ROTH 401k and ROTH IRA, respectively, for those aged 50 years and above.

In addition to the higher contributions allowable for 401k accounts, they don’t limit who can contribute. On the other hand, ROTH IRA has an earning cap for those contributing, $140.000 for individual income earners and $208.000 for married couples.

The prudent decision for full retirement investing contribution is having both accounts since the IRS does not restrict contribution to just one account.

Employer match-up

It is the primary reason for the popularity of the 401K accounts. It is a 401k feature that allows for instant return on savings for employees. It involves an employer contributing towards the retirement scheme, and it is in two:

- Partial match-up

An employer contribution is dependent on the amount an employee contributes, usually a percentage capping. For example, a 45% contribution match-up to 12% of the annual employee income. In such a situation, an employee who earns $48000 annually and contributes 12% of their salary into a 401k account would get $2592 as employer match-up contribution-total contribution of $8352.

- A pre-determined dollar value

It is independent of the employee’s annual income. For example, a dollar-for-dollar match-up up to a maximum contribution of $8750.

Financial analysts and retirement investment advisors advocate for employees ensuring their contributions result in the maximum allowable employer match-up contribution.

Employer contributions go to traditional 401k accounts and not ROTH 401k accounts since employer contributions are pre-tax.

Unfortunately, ROTH IRA schemes do not come with employer match-ups and wholly depend on individual savings objectives.

Time

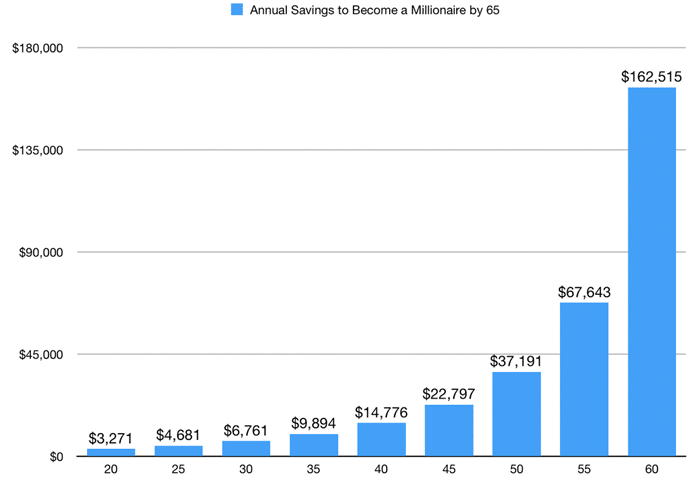

The early bird catches the worm. The earlier you start saving up for retirement, the better. Data shows that with an optimized savings plan, it is possible to be a millionaire in retirement.

Annual savings graph to be a millionaire by 65 years

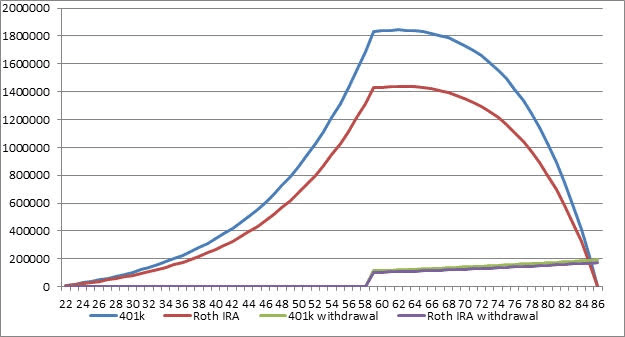

Operating both the ROTH 401k and ROTH IRA accounts ensures that on retirement, one has an option of rolling over a ROTH 401k into a ROTH IRA, guaranteeing a more extended period for savings without IRS penalties.

Loan

A ROTH 401k account is a great loan option without the need for collateral. The IRS has a provision that allows 401k account owners to borrow up to 50% of their account balance or $50.000, whichever is less, with a repayment period of five years.

ROTH IRA accounts don’t provide a loan option. However, one can use the rollover amnesty period to use the entire account value as a loan, albeit with a sixty-day repayment period.

Investment menu

Depending on the age of the retirement account owner, the investment objectives and acceptable risk levels are different. As such, ROTH 401k accounts come with a limited number of investment options cause the objective is steady account growth at minimal risks.

The IRS restricts the allowable investment assets for 401k accounts to ensure retirement accounts are not wiped out living retirees without a penny to enjoy the sacrifices done. With a ROTH IRA account, the account holder has absolute control over the choice of investment assets. The investment strategy is also at the discretion of the account holder.

Required minimum distributions

When holding a 401K account, whether the traditional account or the ROTH 401k account, it is an IRS requirement for withdrawals once you hit 72 years of age; otherwise, the account attracts a penalty. ROTH IRA accounts have no RMDs attached to them. Savvy retirees use ROTH IRAs to channel their 401k funds and avoid the 72 years required minimum distributions.

Except for conversion into ROTH IRA, the 401k RMD is only avoidable if still in active employment in an organization that you own less than a 5% equity stake.

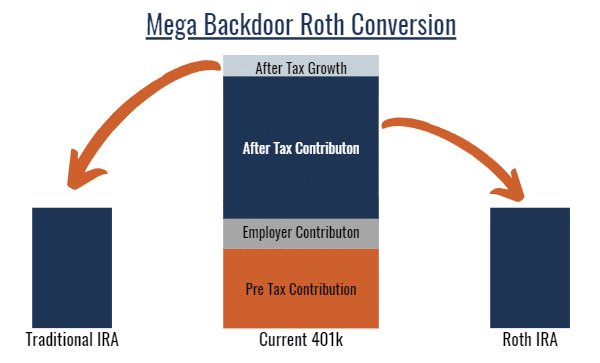

Backdoor Roth

M

The strategy is simple to follow. You make an after-tax contribution to a traditional IRA and then convert it to Roth. While your contributions do not enjoy tax breaks, your investment grows tax-free.

Final thought

No retirement account is inherently better than the other one. The intelligent decision is to have both accounts for genuinely blissful retirement life. Experts advise on maxing out employer contribution first before dipping your toes into the ROTH IRA.

Comments