An individual with an IRA account can retrieve their money from their account at any time. However, in money withdrawal before a specific age, the owner will pay a certain amount as a penalty. The period for early withdrawals is sixty-nine and a half, while the disadvantage is ten percent. In addition, the owner of the account has to pay taxes eligible for an early withdrawal. This withdrawal of money before the required age is known as an early withdrawal.

It includes retrieving an amount of savings from the investments before the scheduled date. This occurs when the funds set for fixed-term investments are retrieved before a certain point. An early withdrawal causes the owner to pay a fee. This fee includes taxes and the penalty fee that the retiree should pay. Early departures have features of the products like the certificate of deposits, annuities, and life insurances.

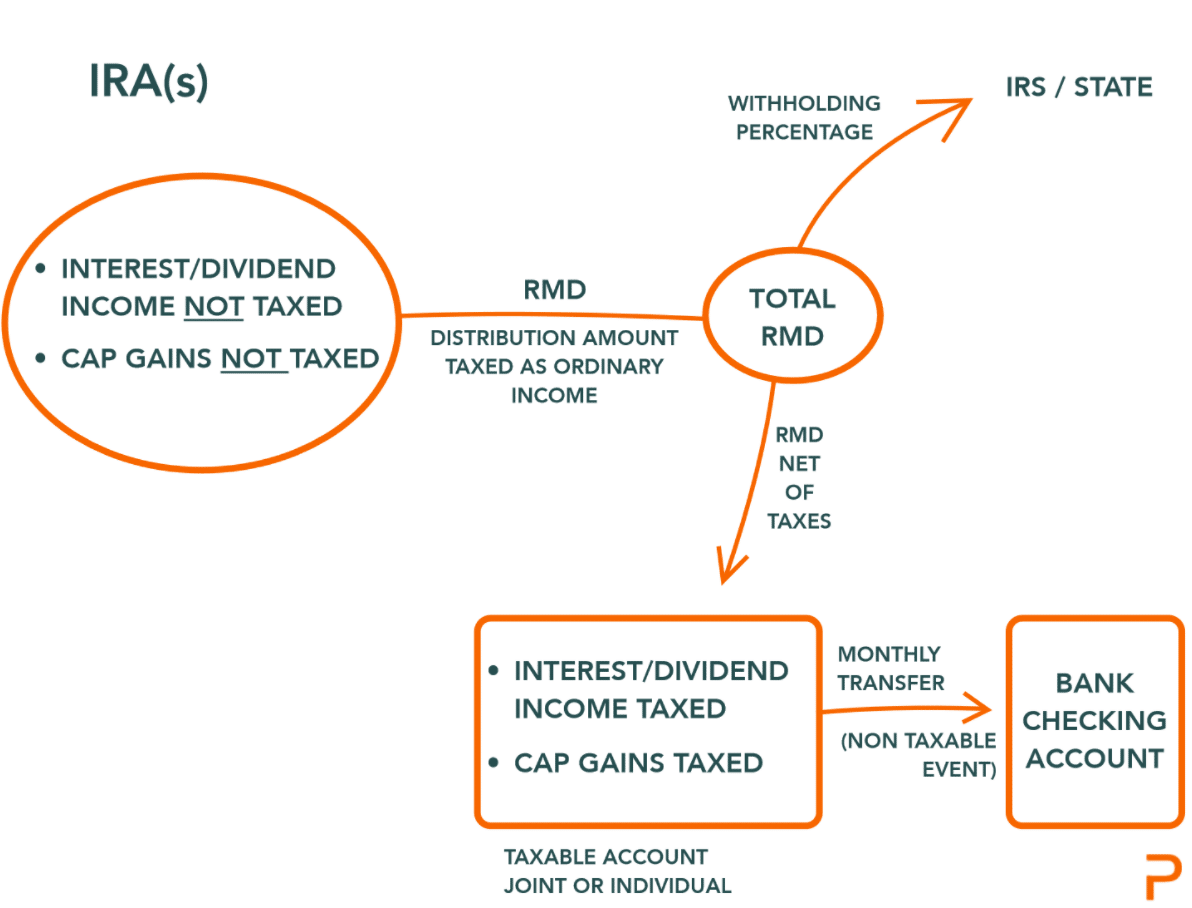

How does required minimum distribution work?

Individuals who own an IRA can face penalties if they don’t withdraw the amount by a specific date. This is because one can not keep their retirement funds in the account indefinitely.

The amount required to be retrieved from your account annually is a required minimum distribution (RMD). The age for the RMD withdrawal is seventy and a half. These withdrawals will be included in the taxable income.

If a person fails to make the RMD standardized withdrawals, they can be charged with penalties. These also have a 50 percent excise tax. Therefore, the amount withdrawn from the account can be more than the required minimum distribution.

Required minimum distribution flow diagram

Different worksheets and tables can be made to calculate the distributions required.

Top 3 best retirement withdrawal strategies

For a successful retirement plan, an individual needs to choose a retirement withdrawal strategy. This important decision can be made more accessible by reviewing the following.

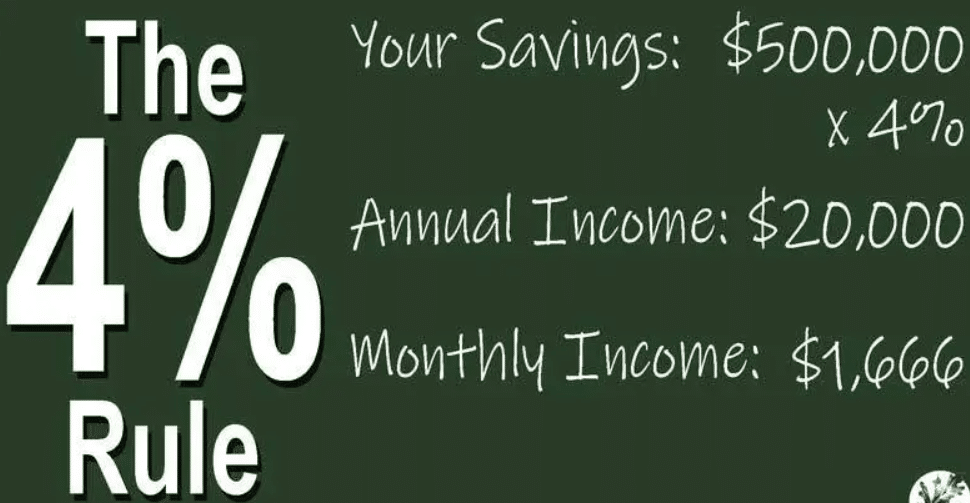

The four percent rule

Generally, retirement withdrawals are calculated using a four percent rule. Therefore, upon retirement, individuals are required to withdraw four percent of their savings.

4 percent rule assumption

Following that, the individual will continue to withdraw four percent of their retirement fund. Using this method, you can adjust your calculations for inflation and ensure that scale is correct. For example, a two percent annual increase is one way of adjusting for inflation.

For example, if an individual has two million dollars saved under this strategy. Now they would have to withdraw 80,000 dollars during their first year of retirement. Then, 81,600 dollars would be taken out over the next year (the original amount plus 2%). There will be a withdrawal of 82,416 dollars in the third year (the same amount from the previous year, a two percent increase). Each year, the amount will increase.

Thus, the four percent rule may be deemed safe for someone who wants to keep income flowing throughout their retirement.

Pros |

Cons |

|

|

|

|

|

|

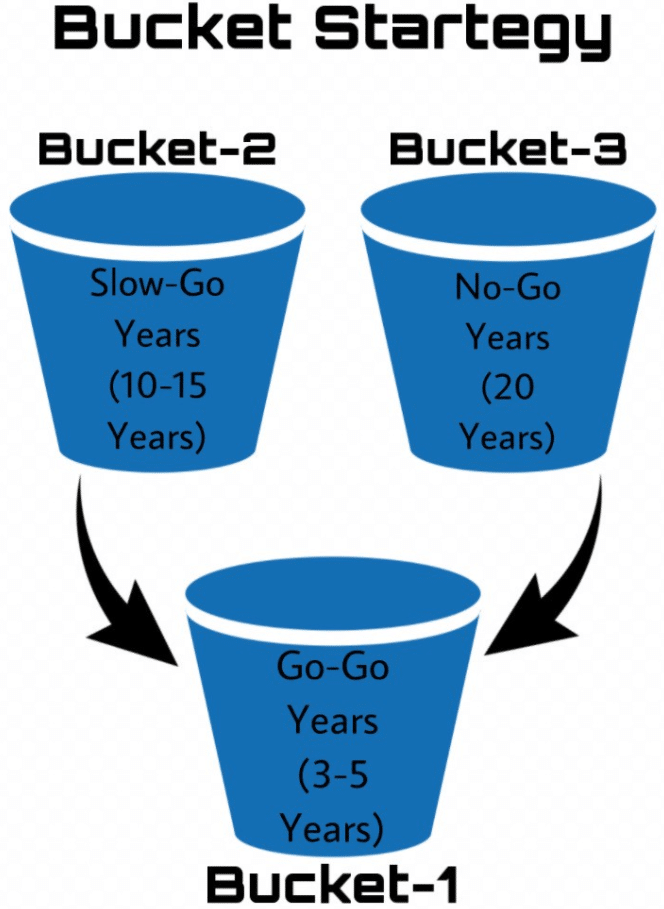

Bucket strategy

Bucket strategy divides assets into different types of accounts based on expenses. Under this strategy, the first bucket contains some percentage of the savings in a statement. The second bucket has fixed-income securities.

Bucket strategy illustration

Bucket strategy illustration

For example, there might be living expenses needed over the next few years in the first bucket. At the same time, the second bucket may have living expenses in the form of fixed-income investments. These include securities such as certificates of deposits and municipal bonds.

Lastly, the third bucket may contain investments in riskier equities. This investment amount will not have to be sold as stocks in the subsequent years.

Thus, through the bucket strategy, the investments seem to grow over time ideally. This approach is seen to be less risky for the people.

Pros |

Cons |

|

|

|

|

|

|

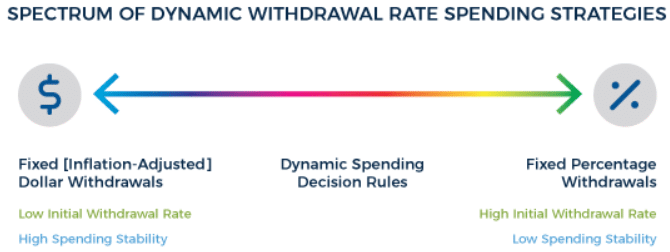

Dynamic withdrawals strategy

This strategy offers investment to be made with much flexibility. The retiree has many options for retrieving money each year. The investments made are across a broad spectrum. The target is to allocate a single asset allocation.

Dynamic withdrawal/spending

At the same time, the annual withdrawals are predicted to be four percent to five percent each year. The portfolio of the retiree is checked and rebalanced often to account for the leaves.

These dynamic spending rules allow the retiree to change their annual placement of assets. This distribution of funds each year is based on the fluctuating market performance.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

An individual needs to evaluate the best retirement withdrawal strategies for a successful retirement plan. The best of the system includes the four percent rule, bucket strategy, and the dynamic withdrawal strategy. All three of them have their advantages and disadvantages.

Comments