While buying crypto coins could offer great rewards in terms of return, there is a risk that you could lose a considerable amount of money if you make the wrong call. This is because of the excessive volatility that is pervasive in this market.

When you buy crypto assets at meager prices, the volatility risk will not worry you so much. However, if you buy already high-value assets such as Bitcoin and Ethereum, you could suffer significant losses if these markets turn against you in the short term.

If you are an experienced investor with significant capital, you have other options available for crypto investing. These are crypto indexes and crypto index funds, and these options have gained a lot of momentum lately among investors.

Of course, there are risks associated with every investment product. That is why this article will shed light on the pros and cons of this relatively new investment option. After reading this post, you will come to understand if this option is suitable for you.

Crypto index and crypto index fund

Trading an index or a fund has a distinct advantage compared to trading individual crypto assets. A crypto index is a group of crypto assets put together based on criteria, while a crypto index fund follows the performance of an index. Since you trade a portfolio of assets, the trade risk is spread and reduced.

In addition, in a crypto index or fund, experts select the assets included in the index. Compared to crypto traders and investors who may be trading and investing on the side, these experts focus on this field, doing research, studying economic events, and analyzing the market to identify potential risks and opportunities.

The Bitwise 10 index fund (BITW)

The Bitwise 10 index fund (ticker BITW) was the first-ever crypto index fund listed and traded in over-the-counter markets. This fund monitors the BITX index, an index composed of the ten large-cap crypto assets. Consider the above daily chart of BITW.

How a crypto index works

Like stock market indexes, a crypto index tracks the direction and performance of crypto assets in the holding in the same fashion. The difference is that the stock and crypto markets use different approaches when putting together crypto assets in an index. In the crypto market, the selection of assets is primarily based on one of these two weightings:

- Market cap

- Price

Market-cap weighting occurs when crypto coins with the largest market capitalizations influence the index’s valuation the most. On the other hand, price weighting happens when crypto assets with higher prices move the index’s price more than those with lower prices.

Creation of a crypto index

As crypto indexes come into the market, investors are considering building their crypto indexing solutions. While you might not plan to make your custom crypto index publicly available, knowing how to build an index might be beneficial when you create your portfolio. If you are leaning toward this direction, you must do a few steps to accomplish this.

The first step is making an initial list of crypto assets. You can use several criteria in preparing this list. Most often, traders base their selection on market capitalization, starting from the largest and moving down. Humans as we are, we like to work with whole numbers. Therefore, your list may contain 10, 20, or 30 crypto assets.

The next step in the process is allocating your investment. While you can allocate funds based on market cap, another option is to appropriate funds based on the type of crypto asset. Digital assets belong to one or more of these common types:

- Mined coins

- Premined coins

- Stablecoins

- Security tokens

- Utility coins

Crypto indexes and funds in existence

More crypto indexes will emerge as years go by. For example, there are rumors about the emergence of a crypto index ETF that will track the NASDAQ Crypto Index (ticker NCI). Currently, several indexes and funds are already in operation. The most popular of these are the following:

- Bitwise DeFi Crypto Index Fund (DeFi)

- Crypto Volatility Index (CVIX)

- Bloomberg Galaxy Crypto Index (BGCI)

- Crypto Index 100 (CIX100)

- CF Benchmark’s Ultra Cap 5 (CFUC5)

- CRYPTO20 (C20)

- Bitpanda Crypto indexes 5, 10, and 25 (BCI5, BCI10, BCI25)

- CMC Crypto 200 Index (CMC200)

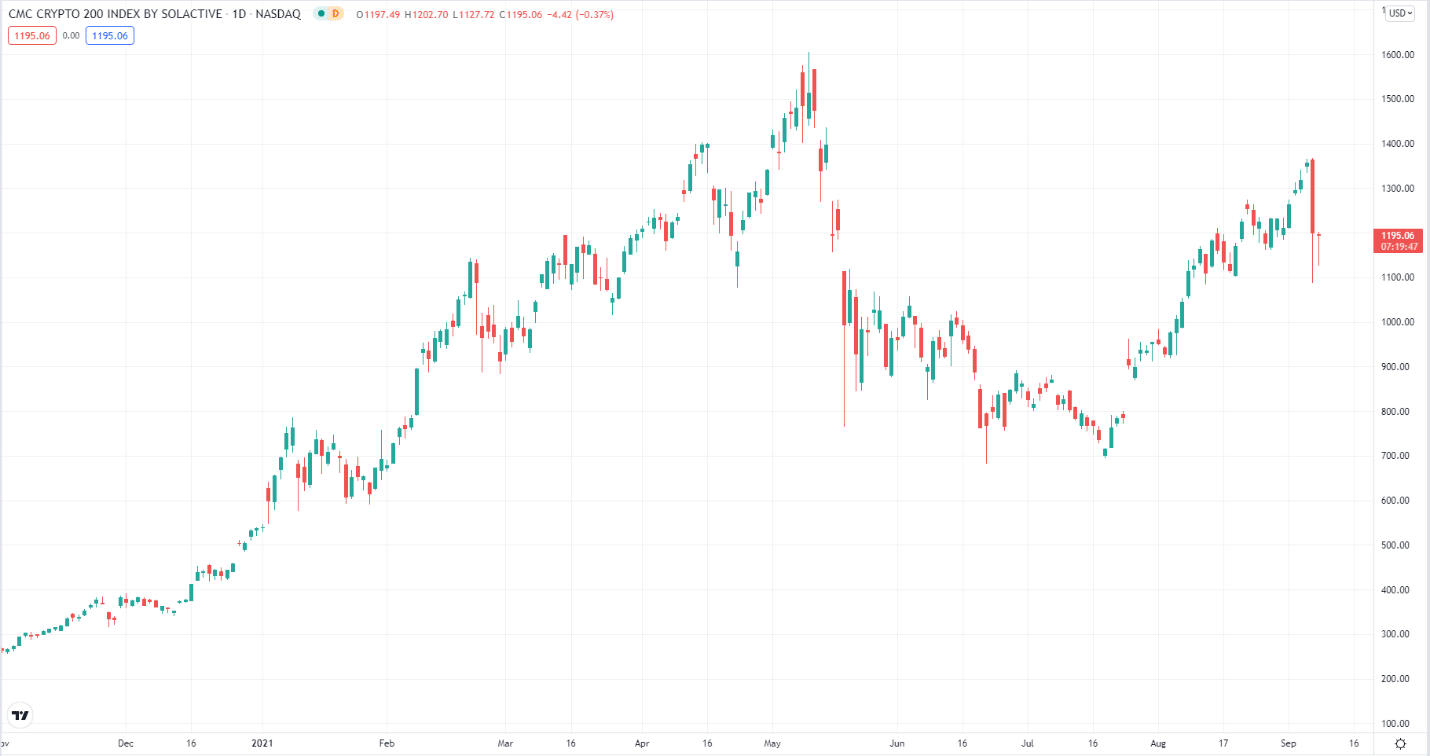

CMC 200 index 1D chart

Let us consider the crypto index with a ticker CMC 200. CoinMarketCap owns this index, which tracks the performance of the top 200 crypto assets in terms of capitalization. You can see the daily chart of this index in the above image.

Pros and cons of crypto indexes

Trading crypto indexes comes with advantages and disadvantages you have to keep in mind. This way, you can make better decisions when selecting which index to trade.

Trading in a crypto index has a lot of benefits for traders and investors, such as the following:

- Invest with little stress

If you are a business person or a full-time employee, you might not have enough time to watch the charts of cryptocurrencies, much less be updated with news about the latest developments in the crypto space. If that is your case, investing in crypto indexes makes sense to you.

- Limited risk

Trading in a crypto index is far less risky than trading individual coins. When you trade individual coins, making a bad call can be devastating to your account. With an index, you can trade a group of carefully selected crypto assets with one purchase. Indeed, investing in digital assets has never been safer with the advent of crypto indexes.

- Diversification

In relation to the point mentioned above, diversification is the reason why trading in crypto indexes is less risky. Since an index contains several crypto assets, the risk is evenly distributed among the assets. Plus, since investment experts put together an index, you have more confidence in your investment.

- Easy monitoring

You can easily track the performance of a crypto index than you would monitoring a bunch of crypto assets. This is because an algorithm tracks the performance, and data is updated in real-time.

Outlines the risks

When you are considering buying a crypto index, you have to be aware of the risks associated with this trading option.

- Smaller profits

Although crypto index trading is much safer than manually trading the crypto market, the downside is smaller returns in the short term. Therefore, you have to be clear about your intention in trading crypto.

Do you want to take huge risks with concomitant large returns? Or do you want a safer investment vehicle at the expense of smaller returns? If you come to the crypto market with big capital in your pocket, you may consider the option of buying crypto indexes instead of individual coins.

- Large minimum requirement

At the moment, only professional traders have access to several crypto indexes. The minimum capital requirement is vast for the rest of the indexes where you can have access, which can run to hundreds of thousands of dollars.

Final thoughts

Since crypto indexes are new investment vehicles, you will not have easy access to them. You must meet specific requirements before you can start engaging in this option. If you qualify as a professional trader, make sure you open an account with a regulated broker. This way, you will have peace of mind knowing that your broker will not run away with your money.

Comments