Twenty-five percent of Americans have no retirement plans. If you belong to this class, it might be time for a change. Having a retirement plan will give you peace of mind, knowing you can retire comfortably and leave an inheritance to the people you care for.

No one is too old or too young to start a retirement plan. The key here is just to get started. You have several retirement options to choose from. One popular option is the 401k plan.

To help you on your journey toward building a 401k plan, we prepared a step-by-step guide on how to go about this process. Following this guide will set you in the right direction at the get-go.

Step 1. Talk to a financial adviser

Planning for retirement is an arduous task, but you can make the process less stressful by seeking help early. Regardless of your age and your savings status, a financial adviser can pinpoint areas you can improve.

Before you start searching for a financial advisor, make sure that you have a clear goal in mind. Then relate this goal to your financial advisor. To find an advisor, you can ask friends and acquaintances for referrals. This is a good starting point.

Step 2. Research retirement options

If your company does not offer a 401k, do not worry. You have many other options available to you, such as the following:

- Simple IRA. This plan is intended for small business owners and the self-employed.

- 403(b). This plan is designed for select ministers, employees in public schools, and employees working in tax-excused organizations.

- Solo 401k. You can open this type of 401 k plan for yourself if you are self-employed.

- SEP IRA. This option applies to you if you are self-employed, whether or not you have employees.

- IRA. You can open an IRA account if you have consistent income the whole year-round. The downside is that it has a lower contribution limit.

- Roth IRA. This individual retirement plan lets you contribute funds tax-free and withdraw cash on your retirement tax-free.

Step 3. Choose a plan and be on top of it

After you have determined your options, select one plan and be on top of it. Your financial adviser can significantly help you in this regard. To have a well-rounded plan, life insurance and estate planning should be in place. This will ease the burden of distributing your assets to your beneficiaries in the unexpected event of your death.

Step 4. Get a 401k match

Your employer’s counterpart 401k contribution is a big boon to your account. Even just a 50 percent employer match up to six percent of your payment will significantly impact. If you earn $50,000 yearly, the employer match can magnify your retirement plan by $1,500 per year.

If your employer does not provide a counterpart contribution to your 401k, do not lose heart. There are still benefits to investing in a 401k even without the employer match. One benefit is the tax break. In 2021, the maximum 401k contribution is $19,500. Plus, contributions are tax-deferred until you start withdrawing profits on your retirement.

Step 5. Pick diversified 401k investments

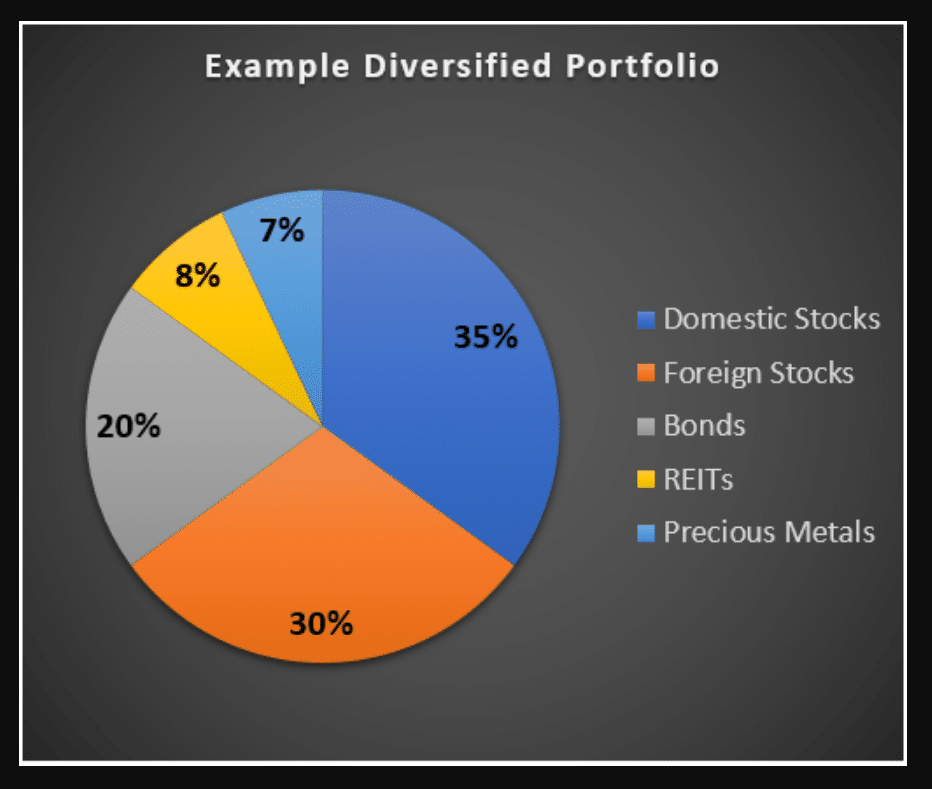

Your 401k plan offers a small number of investments for you to choose from. You should select a combination of bonds, stocks, and cash that suits your risk appetite. See a sample portfolio in the image below. Your risk tolerance often rests on your age. If you are young, you can take risky investments as you have more time to recover.

As you get older, you should replace riskier investments with less risky alternatives. If you are nearing retirement, you want to secure your funds. Experts counsel that one should not invest more than five percent of his funds on one stock.

Sample diversified portfolio

Step 6. Check 401k costs low

Be aware of the costs involved in the investments your company offers. These costs can significantly affect the profitability of your investments in the long run. Take note that providers deduct these costs yearly from your profits no matter how the portfolio performs within that period.

Your 401k plan provider has a legal obligation to provide you with a disclosure statement containing the expenses you incurred each year for each asset in your plan. Make sure to review this statement yearly so you can find a way to cut costs by shifting to less costly investments.

Step 7. Balance saving with your expenses

You might find it hard to save money for retirement if you have to pay a student loan. Naturally, it is a good idea to pay off high-interest debts before going for your retirement savings plan. Credit card debt belongs to this category, but student loans do not. If you have student loans, you can go ahead with your retirement savings.

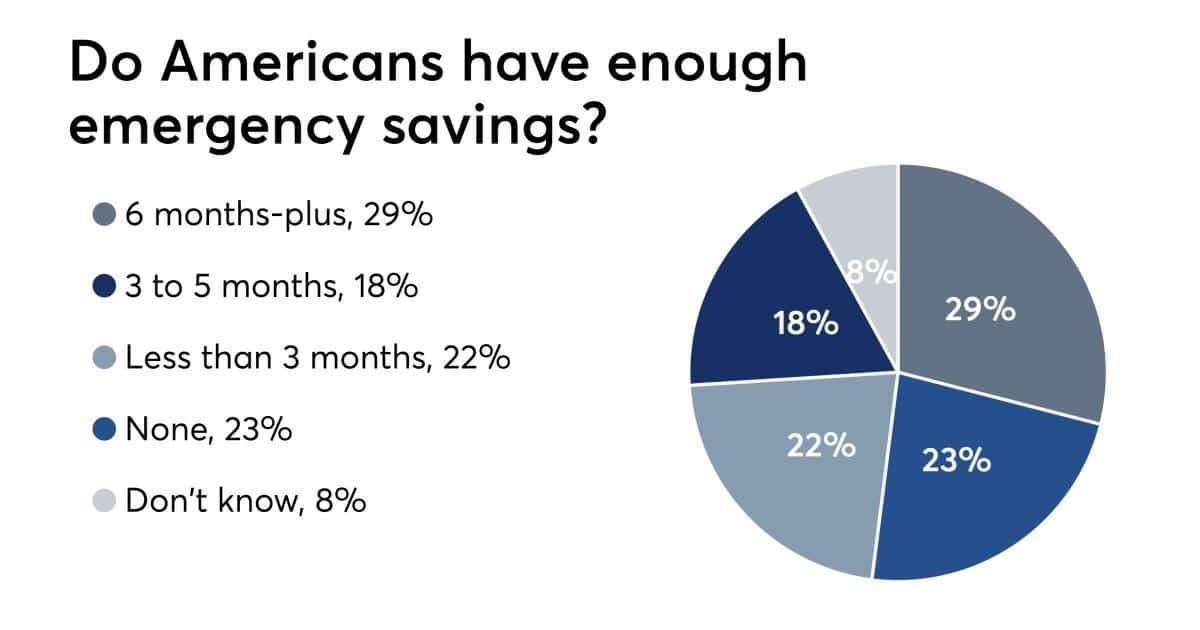

Having an emergency fund can significantly help you when building a retirement account. With an emergency fund, you have buffer cash that you can use in emergencies. This will prevent you from diverting money that is allotted to your retirement savings to something else.

The image below shows statistics about the emergency savings habit of Americans. Make it a goal to be in the camp with three to five months or more of emergency funds.

Savings habit of Americans

Step 8. Decided to change the job? Rollover your 401k

It is good practice not to pull out funds from your 401k when you leave your job. When you cash out your balance before you reach 59.5 years old, that is subject to a 10% penalty. Plus, regular income tax will apply to your withdrawal.

Consider moving your funds into your new 401k account from your new employer to avoid penalties and tax. Alternatively, you can transfer funds to an IRA. This way, your contributions are reflected in your 401k without tax deductions.

Step 9. Focus on finding a low-fee option

Reducing costs can have a great effect on your retirement plan’s return. Here are three tips to reduce overhead costs:

- Choose exchange-traded funds over mutual funds. The former option often has lower expense ratios than the latter.

- Steer clear of funds with back-end loads, front-end loads, or 12b-1 fees. Mutual funds normally have these costs, while ETFs do not.

- Find ETFs that do not charge fees on trade transactions. The number of ETFs waiving this cost is growing.

Step 10. Be smart

Establishing a 401k is a smart choice if you want to have a comfortable retirement. However, the process is not as easy as accomplishing some forms and allocating a portion of your salary.

- Be on top of this process.

- Know the rules and be in control.

- Select the investments carefully.

- Monitor your plan regularly.

Comments