It is possible to make money from the market without spending too much time in front of the computer. That way of trading is called swing trading.

Successful market participants of this trading style can make almost 25% profit annually. That’s an even better return than Warren Buffett’s investment pool. By spending just a few hours per day, swing traders can profit without sacrificing their professional careers.

Let’s find out how to deal like a pro to be much more profitable in less time.

Where can you trade stocks?

Trading stocks used to be a Wall Street task, but the internet ended that, and now you can buy and sell stocks quickly from home. There are many regulated online brokers where you can put your money and trade confidently.

Here are some recommendations:

- TD Ameritrade

- Interactive Brokers

- Robinhood

- Fidelity

- E*Trade

How to trade stocks as a swing trader?

A swing trader buys stocks and holds his position for days and even weeks waiting for the right time to sell the stock he owns. Thus, you could think of swing trading as the middle point between day trading and investing. There are many ways of swing trade, and depending on your strategy, you can choose different techniques.

In addition to Fibonacci retracement, support, and resistance levels, moving average and fundamental analysis are also popular. Traders combine these techniques and indicators to develop their trading strategy. Besides that, choosing the right asset is also a crucial part of swing trading. A key to being successful at swing trading is to know how to pick your stocks.

How to pick stocks for swing trading?

Strategies to swing trade are different among traders, but a common thing to most swing traders is the factors they use to pick their stocks. So let’s talk about those factors.

News

They are related to fundamental analysis. The developments around the company affect directly or indirectly its stock price.

The releases of the company or scandals can take the price up or down. Swing trading can take days or weeks. So, the stock may be more susceptible to news announcements.

Volatility

Depending on your level of experience, volatility can be a good or a bad thing. In general, experienced swing traders want to enter volatile markets to be able to profit primarily. However, significant movements could go against you, so the risk is also more considerable.

Volume

Traders make money from market fluctuations. For the price to move, you need traders buying and selling. Swing traders need liquid markets to buy and sell quickly. Stocks with a daily volume of over 500,000 shares are a good choice.

Best stock for swing trading

Now you know the crux of swing trading, let’s find the top three stocks that serve your purpose.

The company owns the world’s largest social networks, including Instagram, Whatsapp, and Facebook itself.

Facebook’s market capitalization is $962.845B. The average trading volume is 13,596,140 shares.

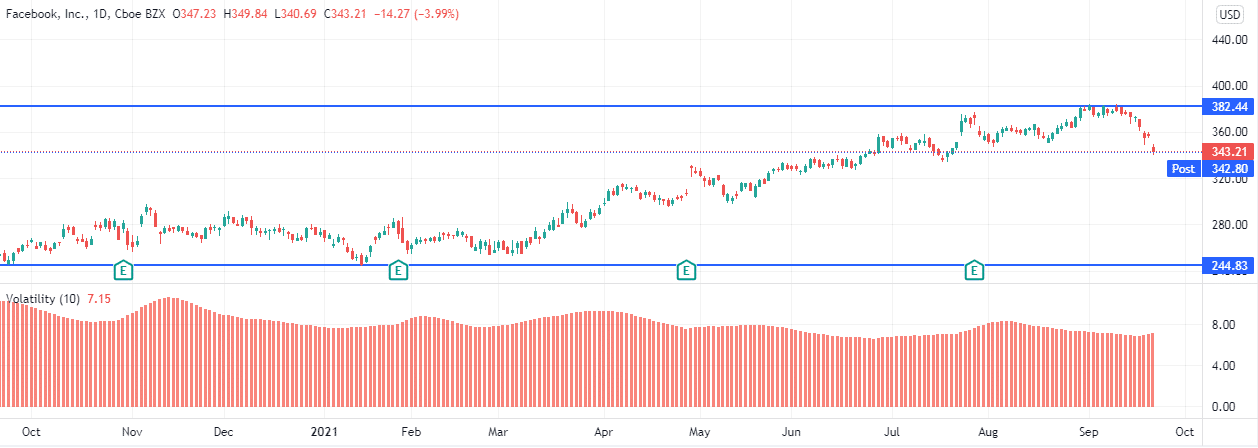

Facebook, Inc. chart

In the last 52 weeks, the highest stock price was $244.61, and the lowest price was $384.33. Facebook’s volatility was 1.82%, and it has a 5y monthly beta of 1.30, which makes this stock a high volatility stock.

Microsoft

It is a tech company that offers software, devices, solutions, and many other productivity applications in the technology industry. Microsoft’s market capitalization is $2211.63B. The average trading volume is 22,398,762 shares.

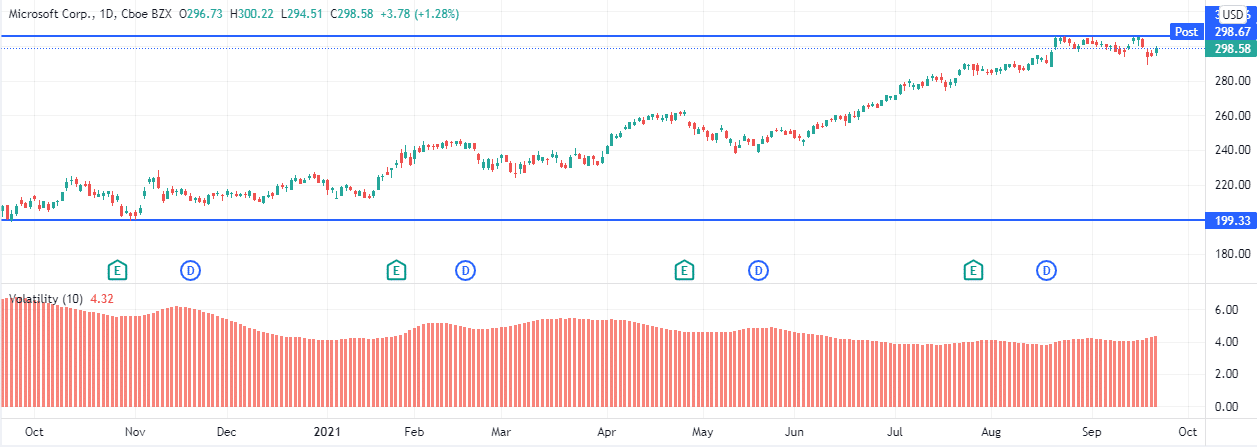

Microsoft Corp. chart

In the last 52 weeks, the highest stock price was $199.20, and the lowest quote was $305.84. Facebook’s volatility was 1.37%, and it has a 5y monthly beta of 0.78. So the volatility of this stock hasn’t been significant. However, the price is always rising. Last year, the difference between the lowest and the highest price was over $100, so swing traders can profit from it.

Caterpillar

It is an industrial company that engages in the manufacture of equipment for construction and mining. Caterpillar’s market capitalization is $104.759B. The average trading volume is 3,590,875 shares.

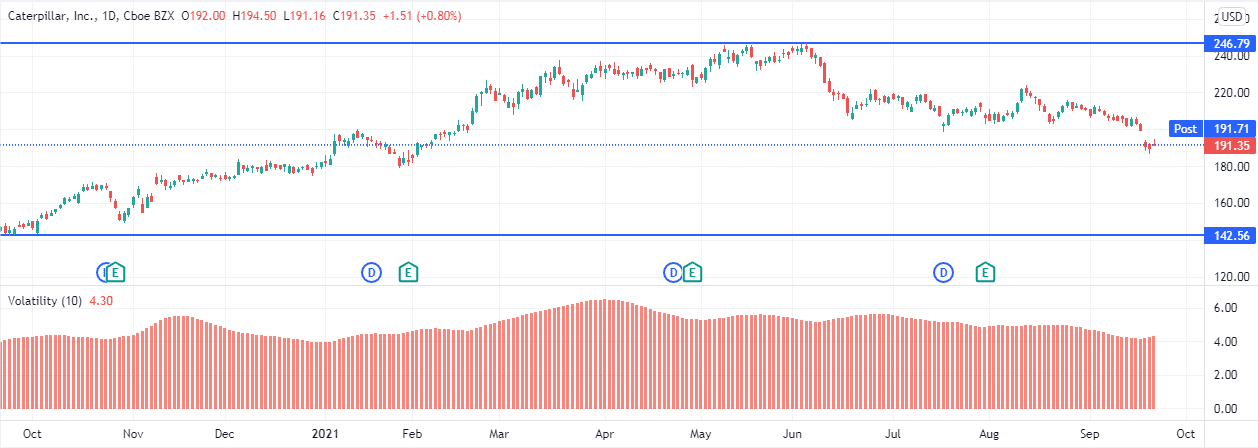

Caterpillar, Inc. chart

In the last 52 weeks, the highest stock price was $142.63, and the lowest price was $246.69. Caterpillar’s volatility was 1.8%, and it has a 5y monthly beta of 0.89, making this stock a medium volatility stock.

Bullish trade setup

When trading with the trend, you want to find the right moment to enter and exit the trade. Moving averages are great to find bullish trends. Particularly the 50-days moving average is a great indicator since many swing traders use it. So, it is, to a certain point, a self-fulfilling prophecy. But, first, you need to find a trend that respects the 50-period moving average.

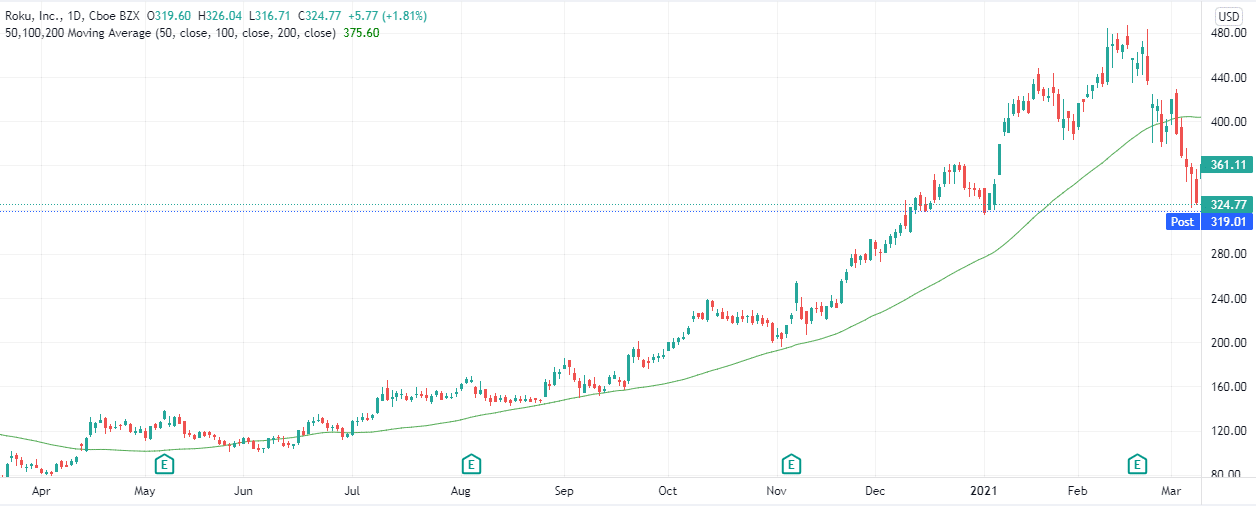

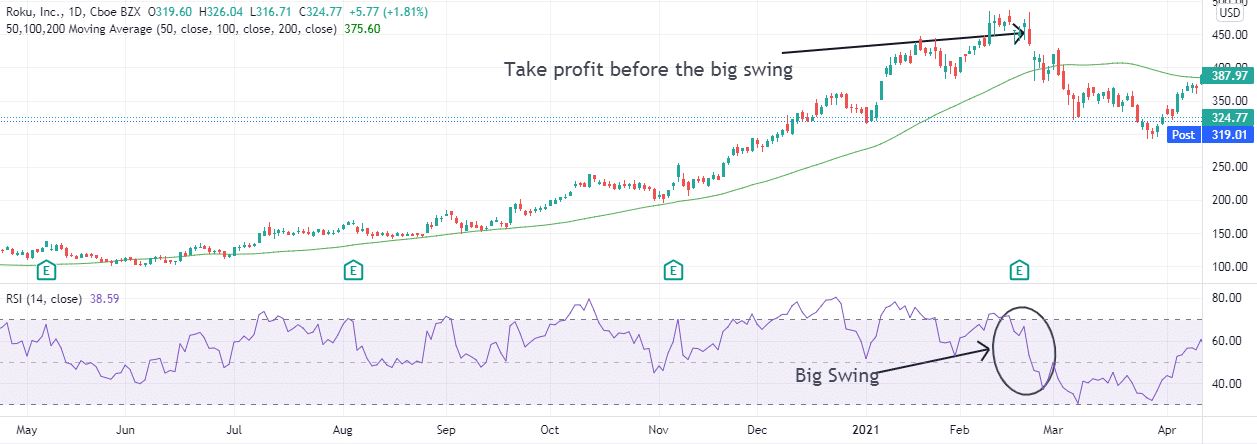

Roku’s, Inc. stocks have trended above the MA since mid-2020

Where to enter?

For stocks trending above the 50 moving average, you want to enter once the price reaches the 50-days MA level that is working as a support level.

Where to take profit?

You want to take your profit right before the big swing. Once the price crosses the 50-days MA, you should exit the trade. However, the RSI can help us to predict the big swing before it happens.

Roku’s stock price fell with the RSI in March

Where to set stop-loss?

Swing trading is a risky trade since we are using high volatile markets to trade. That’s why the stop-loss is set just 3 or 4% below the stock price.

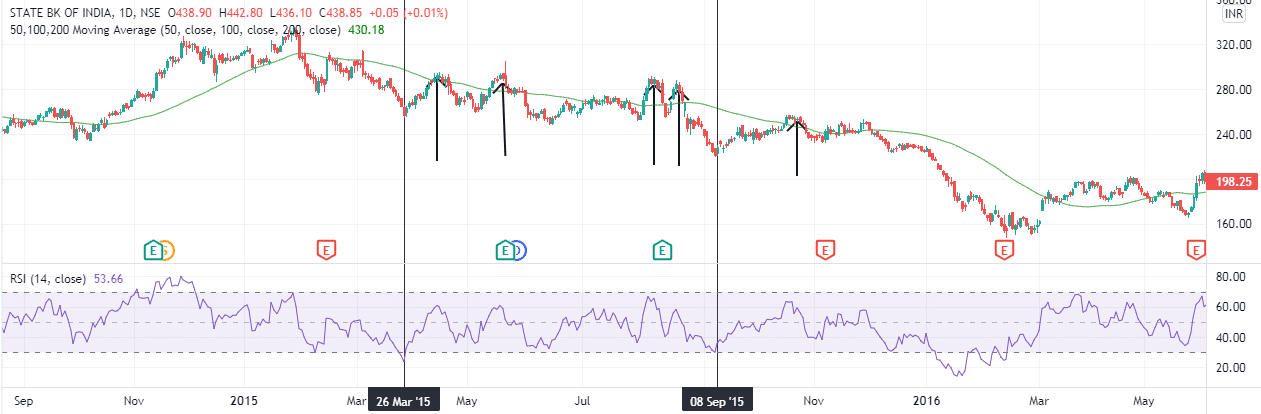

Bearish trade setup

You can still trade stocks and make a profit on bearish trends. The RSI and the moving average can also help you find entry and exit points.

Where to enter?

Traders should enter the trade once the price goes far from 50-days MA. Then, to more precision, enter the position when the RSI touches the 20% level and then rise.

The black lines show entry points when the RSI rises from the 20% level

The arrows indicate selling points when the price reaches the 50-days MA.

Where to take profit?

We have to sell when the price reaches the 50-days moving average area.

Where to put the stop-loss?

The stop-loss should be 3 or 4% below the entry price.

Final thoughts

Swing trading is an excellent option for beginners since you can do it without quitting your job. In contrast to day trading, you may hold swing positions for weeks and even months. Catalyst, volatility, and volume are the factors to swing trade, but as important as know-how to swing trade, it is to know which stocks are right to swing trading.

Comments