Whether a beginner investor or a seasoned veteran in the investment field, procuring stocks at an affordable rate and selling them at a high value is the primary objective. As such, investors are on the lookout for stocks that cost not more than $5-$20-dollar stocks. These stocks are cheap, attract many traders, hence highly liquid, and have the potential for colossal price rallies, therefore big profits. An understanding of the game rules is the only prerequisite to making money in the dollar stock market.

Suppose you bought 1,000 shares at $10 apiece, for a total of $10,000. If the stock price rises to $15, you will earn 5,000, which is already a 50% return investment. Unfortunately, the dollar stock market isn’t so black and white. The reality is that this market is complex, and picking the right stock for profitability is quite a hard nut. As a result, many investors lose all their investments.

Let’s look at dollar stocks and decide if it’s worth the headache.

What is a dollar stock?

Dollar stocks comprise small organizations or start-up companies that, in most cases, have just gone through an IPO.

Most people use the names dollar stocks and penny stocks interchangeably. Traditionally, the first one comprised companies whose equities traded between $1-$5. However, the Securities and Exchange Commission redefined penny stocks to all those equities trading at less than $5. Concurrently, expansion of dollar stocks definition occurred to include all stocks trading between $5-$20 and registered with the leading stock exchanges.

Not all stocks will turn out to be the next Tesla. However, dollar stocks might be worth the headache due to their vast growth potential — they represent a high-risk, high-return investment asset.

How is a dollar stock created?

Companies issue shares to the general public in exchange for capital to attain a particular organizational milestone. IPOs are especially significant to small organizations trying to skill up operations or launch new products to the market. In most cases, entities are unknown market participants during an IPO. As such, the equity prices are usually relatively low, falling in the dollar category bracket.

Like all publicly traded shares, a dollar share goes through an initial public offering. Once the SEC approves registration, organizations invite investors to bid on their claims.

Why are dollar stocks risky?

Except for dollar stocks of established companies, those issued by relatively new ventures are a hazardous investment vehicle. Therefore, it calls for prudence when taking part in the dollar stock market.

The primary consideration before leaping into these murky waters are:

-

High market volatility

$20 represents an amount readily available to the mass populace. As such, anyone with little experience and lots of guts can be part of the dollar stock market. The effect of this affordability is a multitude of market participants all gunning to be the next Warren Buffet, which enhances the volatility of these stocks.

Therefore, dollar stocks need close monitoring since they exhibit unprecedented market movements regularly.

-

Operational inefficiency

Relatively cheap stocks are coupled to small-cap organizations in the scaling-up phase. There are no guarantees as to the profitability of the ventures and operations funded by the IPOs. There are also no guarantees that these organizations will operate profitability. Hence the equities yield returns and increase in value. In simple terms, they are stocks for risk-takers and highly risk-tolerant investors.

Choosing dollar stocks

Due to their volatility and relatively higher risks, the following help mitigating against investment loss:

-

Extensive market research

The first cardinal rule of any investment is conducting market research. This rule is even more critical when dealing with dollar stocks. When dealing with dollar stocks that have just gone through an IPO, information in the public domain is not as extensive as that of more established organizations. The use of stock screeners also ensures the choice of stock is in line with individual risk tolerance levels and return requirements.

-

Monitoring fundamentals

Dollar stocks are highly susceptible to change due to fundamentals, both industry-specific and overall market news. Having an ear on the ground and being able to filter fundamental releases that impact the dollar stock market is a critical skill in their investment. The relatively low prices of these stocks result in substantial price rallies and market volatility around significant fundamental releases.

Investing vs. trading in dollar stocks

The primary methods of being part of the dollar stock market are trading and investing. Trading dollar stocks involves speculating on their prices through contracts for differences, CFDs.

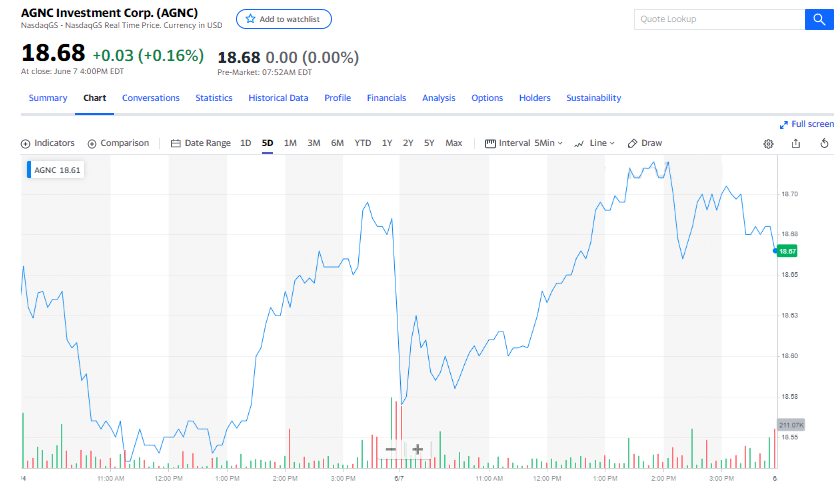

For example, traders can speculate on the price of AGNC Investment Corp., which is in real estate. A trader who speculated on the price of AGNC rising in mid-May when the cost was $17.29 would have a return on investment of 8%, currently trading at $18.68.

On the other hand, investing involves staking money in an organization by buying equity. An investor is issued with a share certificate and has a voice in the running of the organization. In return, they enjoy a share of the organization’s profit, dividends.

For example, one can own 1606 shares of AGNC at the current price of $18.68 with an investment of $30,000. At the current dividend yield of 7.72%, this dollar stock is worth the headache.

Summary

Dollar stocks are not as risky as penny stocks but provide almost the same growth potential. However, not all dollar stocks are on the verge of an unprecedented bullish rally. Nevertheless, careful screening of this market and sound considerations go a long way in ensuring risk minimization and good money down the road.

Comments