Like penny stocks, crypto penny stocks trade for a few pennies or less than $5 per unit. Despite being high-risk investments because of their small market capitalization, they are cheap to invest in. Although the best penny crypto stocks to invest in should have the potential for value increment over time. Otherwise, it makes no sense.

What are crypto penny stocks?

Crypto penny stocks are stocks of companies that mine, hold, or invest in BTC, crypto altcoins, or blockchain technology. These can include companies entering the Metaverse and NFT space since both use blockchain technology. Crypto stocks went on an insane run in 2017. But they consolidated for years until Bitcoin broke out to new highs in November 2021.

How to buy crypto penny stocks?

There are several reasons you may want to invest in penny cryptos. Other than the fact that they are cheap, there is a chance that if blockchain technology and other cryptos become more mainstream, penny cryptos could rise in value and make strong gains. Also, having a diversified portfolio is often touted as the key to a balanced and healthy investment portfolio. It is the same when investing in cryptos.

Some of the best value stocks you will find below. You need to have an account with an online brokerage platform to buy these stocks. When choosing the best stocks to invest in, you should conduct detailed research while considering the volatility found in this marketplace.

Top 3 crypto penny stocks to buy in 2022

Below are some crypto penny stocks that have some room to grow.

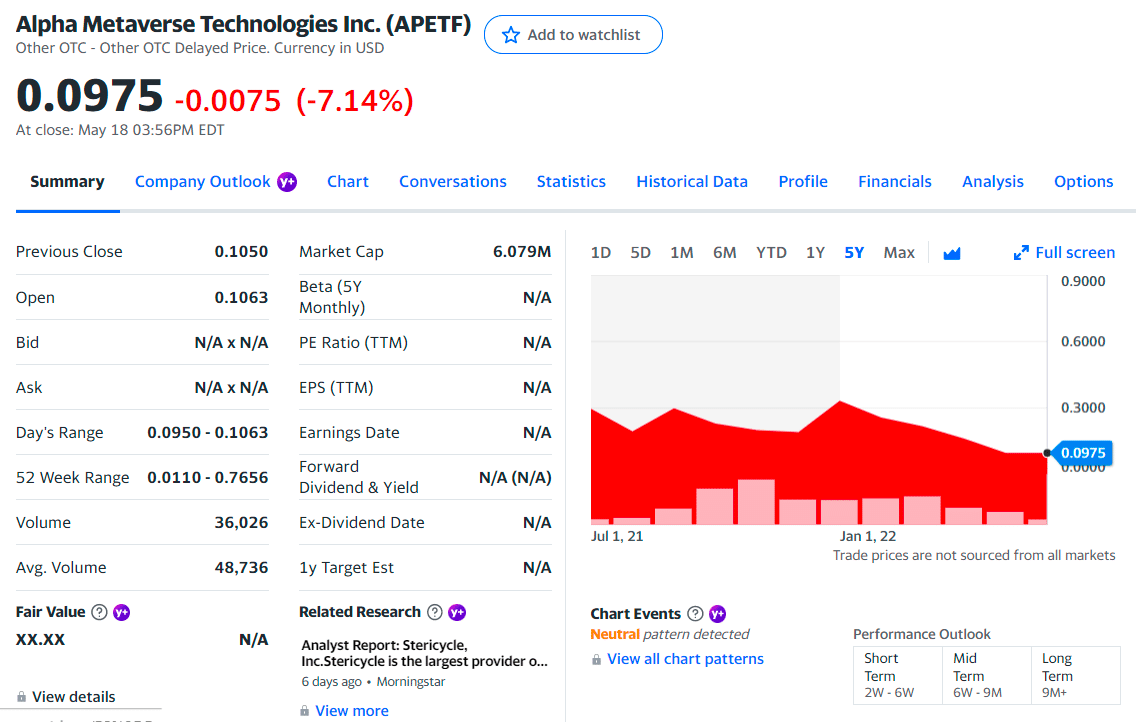

No. 1. Alpha Metaverse Tech (APETF)

Price: $0.09

EPS: N/A

Market cap: $6.079M

APETF summary

It’s a new company founded in 2019. It hardly has a record on the stock market and was only listed a year ago, in June 2021. And its stock has already had a couple of nice spikes.

Alpha is a tech company that focuses on esports. And if you didn’t know, esports is competitive video games played between two or more people or teams.

Besides esports, Alpha is involved with e-commerce, blockchain, and mobile gaming. And all those industries are young and growing. Its platform allows gamers to compete with their peers and participate in daily tournaments. It also facilitates live-streaming of its players’ gameplay for others to view.

So that makes Alpha poised and ready for enormous growth over the coming years.

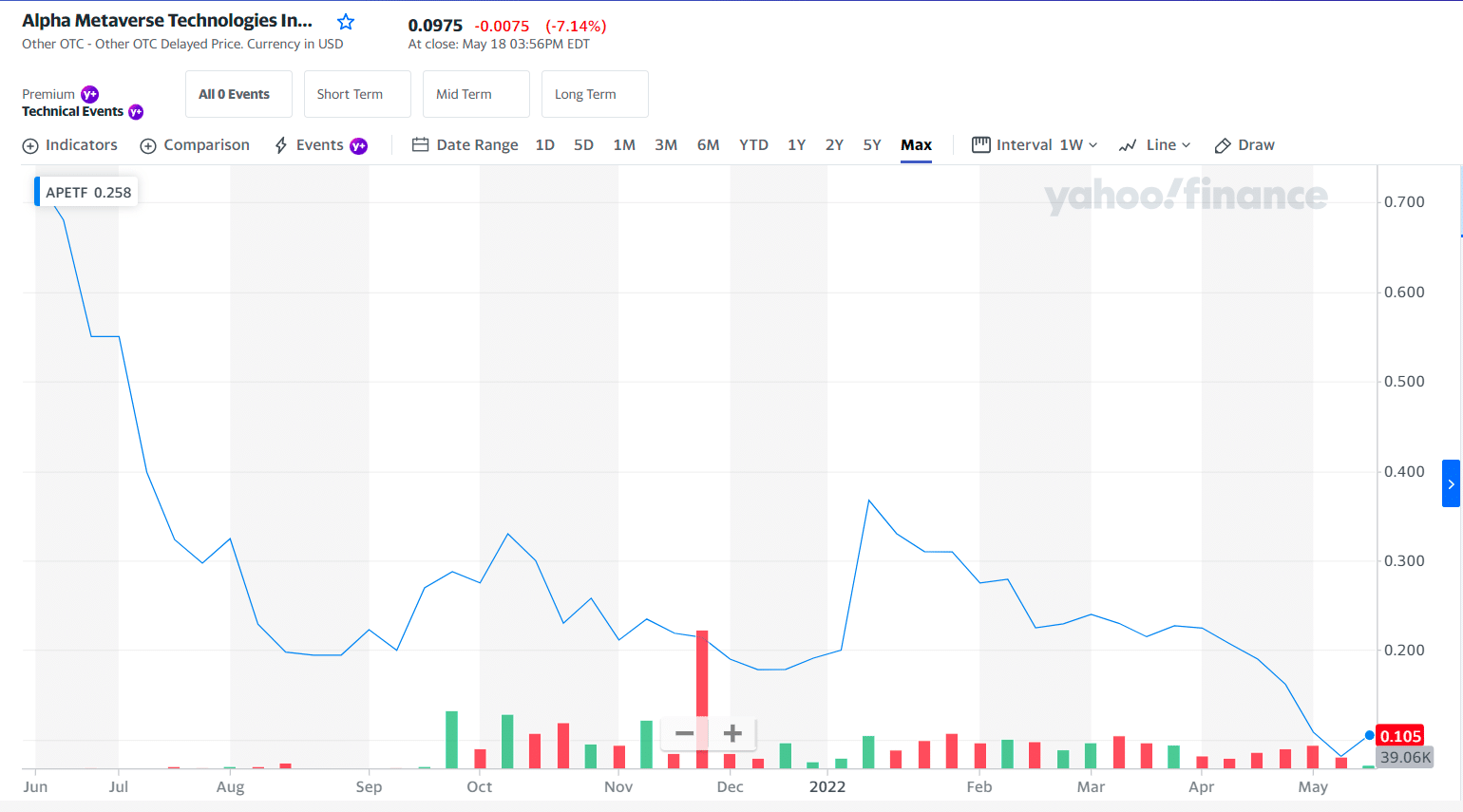

APETF price chart

The first holdings:

- N/A — % of Shares Held by All Insider

- N/A — % of Shares Held by Institutions

- N/A — % of Float Held by Institutions

- N/A — Number of Institutions Holding Shares

APETF price prediction

The RSI oscillator for APETF moved out of the oversold territory on May 16, 2022. This could signify that the stock is shifting from a downward trend to an upward trend. Traders may want to buy the stock or call options.

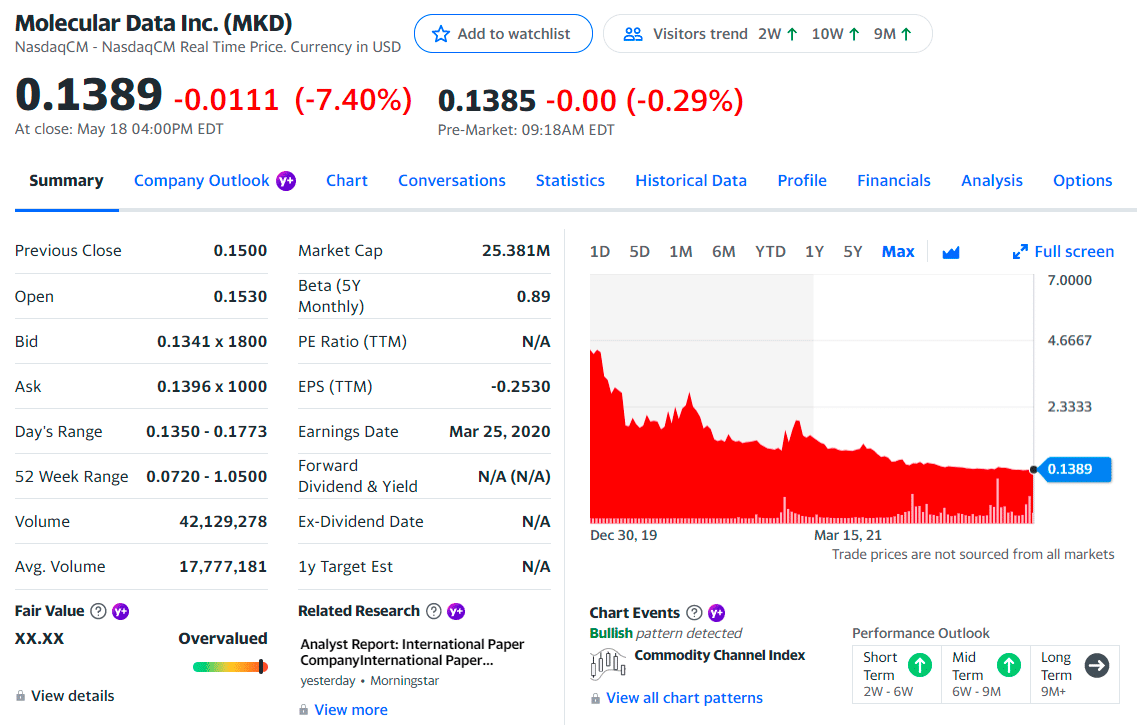

No. 2. Molecular Data Inc. (MKD)

Price: $0.13

EPS: -0.2

Market cap: 25.381M

MKD summary

Molecular Data Inc is a Chinese company that deals with chemicals. It uses in-house technology and Software as a Service (SaaS) to solve some of the value and supply chain pain points.

The company offers e-commerce, financial, and logistics solutions. Its website brags that it was “the largest chemical e-commerce platform in China in 2018 and 2017.” So it knows what it’s doing.

Molecular Data owns multiple platforms and websites. It also recently partnered with investors to introduce global blockchain centers that hold and manage data. This could be a huge step up for the company and stockholders.

If you want to get into a biotech company with an edge in the tech arena, it is a great company.

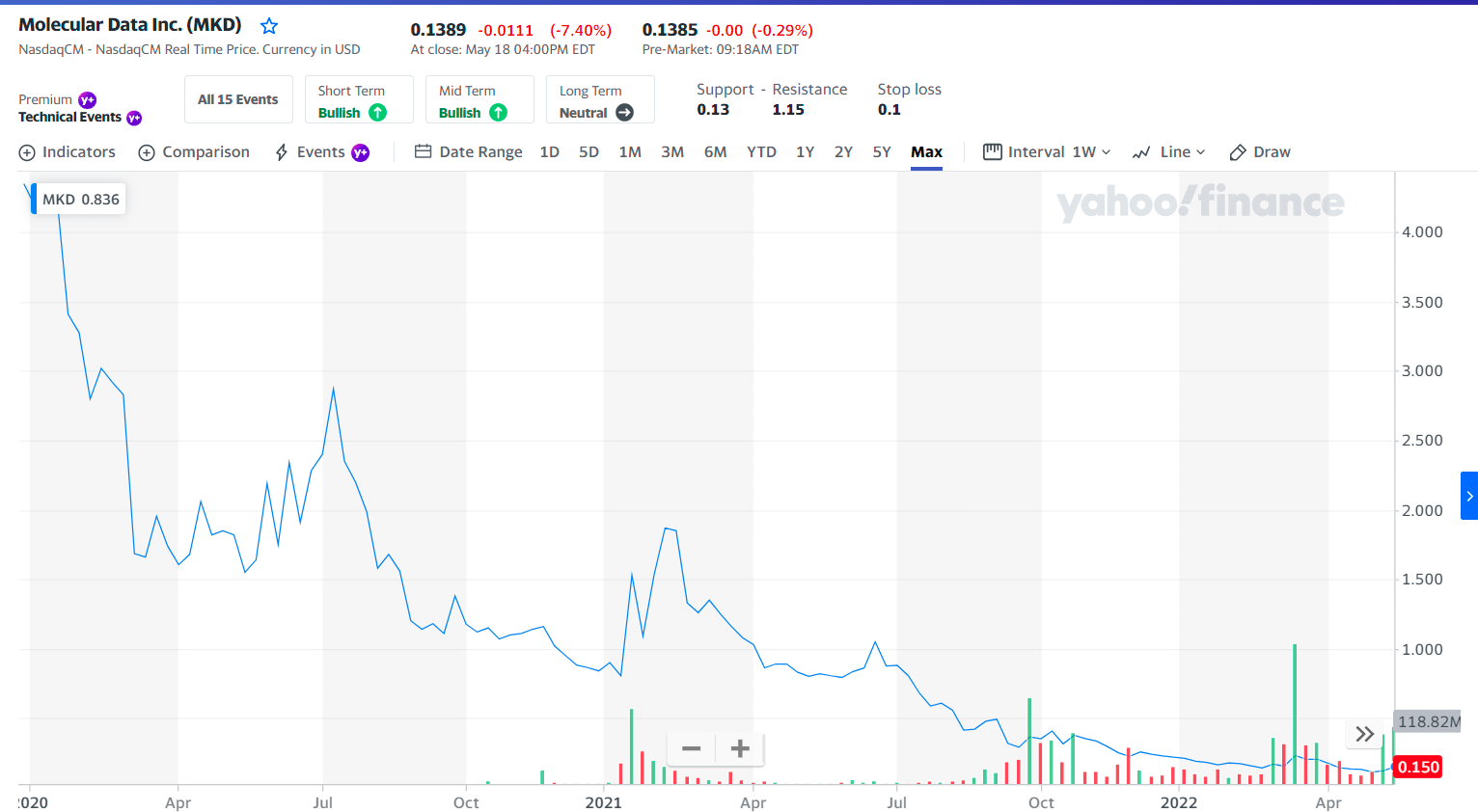

MKD price chart

The first three holdings:

- % of Shares Held by All Insider — 10.08%

- % of Shares Held by Institutions — 2.15%

- % of Float Held by Institutions — 2.39%

MKD price prediction

The stock lies in the middle of a vast and falling trend in the short term, and further fall within the trend is signaled. Given the current short-term trend, the stock is expected to fall -by 29.86% during the next three months and, with a 90% probability, hold a price between $0.0502 and $0.13 at the end of these three months.

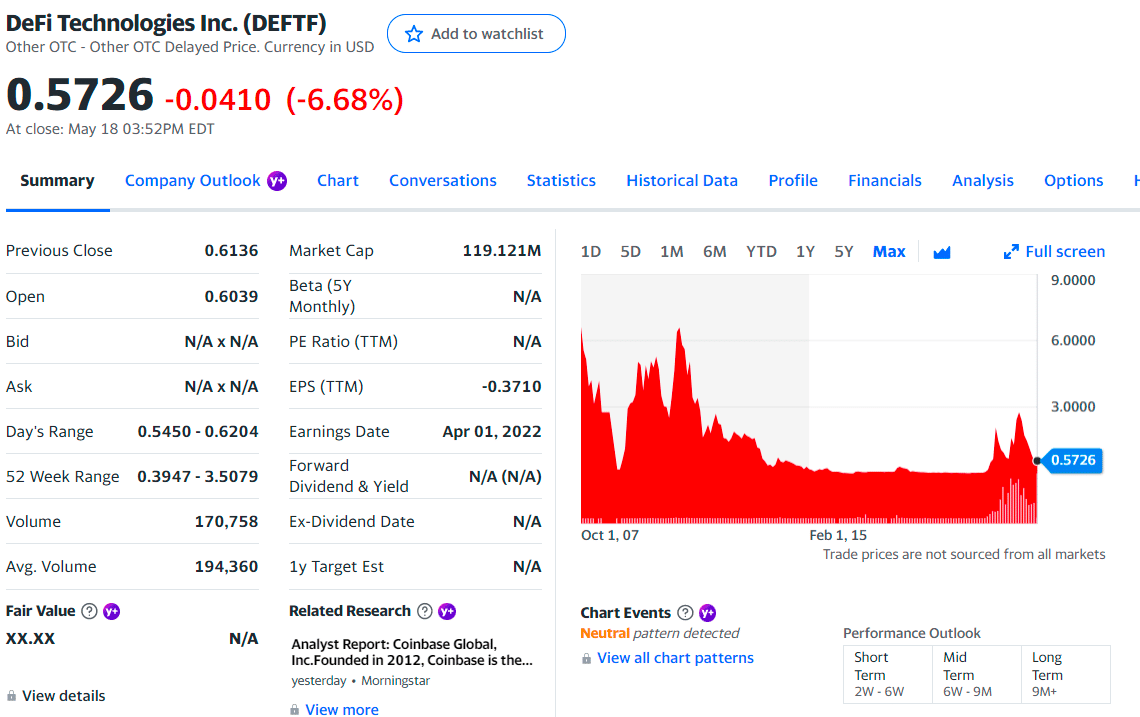

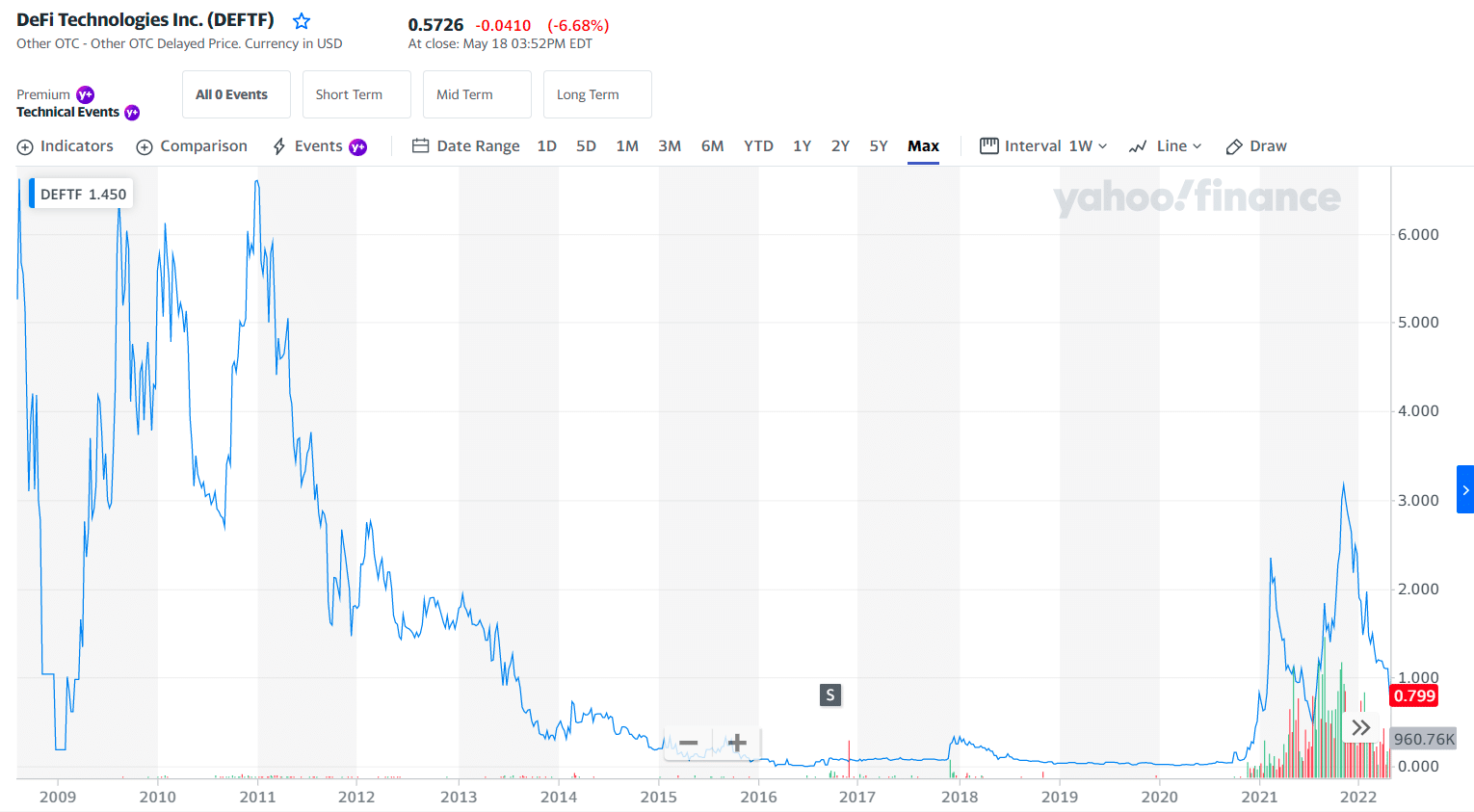

No. 3. DeFi Technologies (DEFTF)

Price: $0.57

EPS: $-3.37

Market cap: 119.12M

DEFTF summary

DeFi Technologies Inc., a technology company, provides investors access to decentralized finance (DeFi) and the digital economy. The company builds and invests in new technologies and ventures to provide exposure across the decentralized finance ecosystem on behalf of its shareholders and investors. The company was formerly known as Routemaster Capital Inc. and changed its name to DeFi Technologies Inc. in February 2021. DeFi Technologies Inc. is headquartered in Toronto, Canada.

DEFTF price chart

Crypto is making its way into our lives a little at a time. DeFi takes crypto blockchain technology and applies it to finances. DeFi strives to disrupt the financial landscape by breaking the bureaucracy of centralized finance. Consumers get full control of their financial assets. DeFi also strives to provide financial services to those who have none.

They’ve got a solid leadership team. They possess a strong commitment to the mission. And they’re at the front of a transformative industry. DeFi could be a great business to invest in.

The first three holdings:

- % of Shares Held by All Insider — 11.72%

- % of Shares Held by Institutions — 0.15%

- % of Float Held by Institutions — 0.17%

DEFTF price prediction

The stock lies in the lower of a vast and falling trend in the short term, and this may typically pose a perfect buying opportunity. If the lower trend floor at $0.52 is broken, it will indicate a stronger fall rate. Given the current short-term trend, the stock is expected to fall -by 41.70% during the next three months and, with a 90% probability, hold a price between $0.30 and $0.55 at the end of these three months.

Final thoughts

The value of investments and their income may go down and up. It is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Comments