Blockchain technology has a promising future in the world of digital currency. However, it is a risky investment that may not be right for you, despite the recent introduction of hundreds of cryptocurrencies.

Don’t worry, however. Many publicly listed firms are experimenting with and employing blockchain technology. An ETF based on these firms is a great way to become involved in blockchain.

Let’s go through the fundamentals of blockchain ETFs, how to acquire them, and which ones to invest in for 2022.

What are blockchain ETFs?

Unlike other cryptocurrencies ETFs, these funds invest in a much wider variety of assets. While the most well-known blockchain applications are cryptocurrencies like Bitcoin and Ethereum, the technology may be utilized for a wide range of other reasons.

How to buy blockchain ETFs?

Exchange-traded funds provide investors with an easy and low-risk way to become involved in the blockchain. It is up to them whether they want to use it for themselves or take advantage of its services. A blockchain ETF allows investors to buy shares in publicly traded companies that use blockchain technology.

Blockchain ETFs do not hold Bitcoin directly. When it comes to investing in global firms, many of which are blue-chip IT giants like Apple and Google, these funds go the other way. You can either directly buy blockchain ETFs or contact any future broker to help you buy these.

Top five blockchain ETFs to buy in 2022

Let’s look at the top-five blockchain funds to buy in 2022.

Amplify Transformational Data Sharing ETF (BLOK)

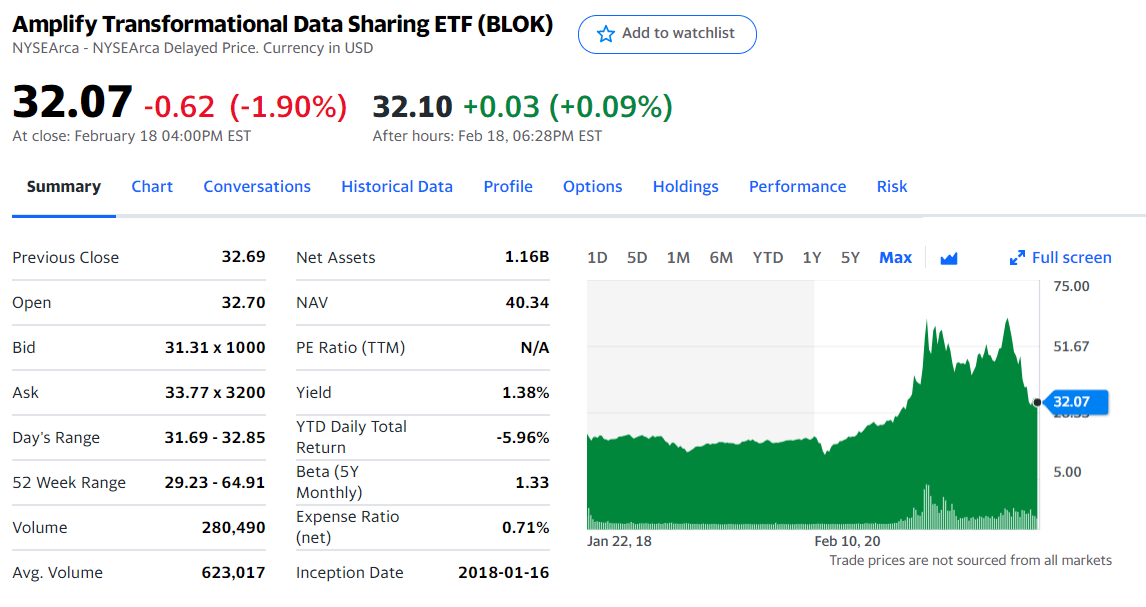

BLOK summary

In terms of assets, the Amplify Transformational Data Sharing ETF is a great place to begin your search for the best blockchain and crypto sector ETFs since it manages $1.06 billion as of January 2022. Assuming you put $1,000 into the fund, the costs will eat up $7.10 every year, or 0.71 percent of the fund’s return.

Approximately three-quarters of the ETF’s holdings are in North America, with the remaining holdings spread throughout Asia and Europe. It began in January 2018 and has almost doubled in value, with the bulk of the increase occurring in 2020, when high-growth technology firms rose early in the year.

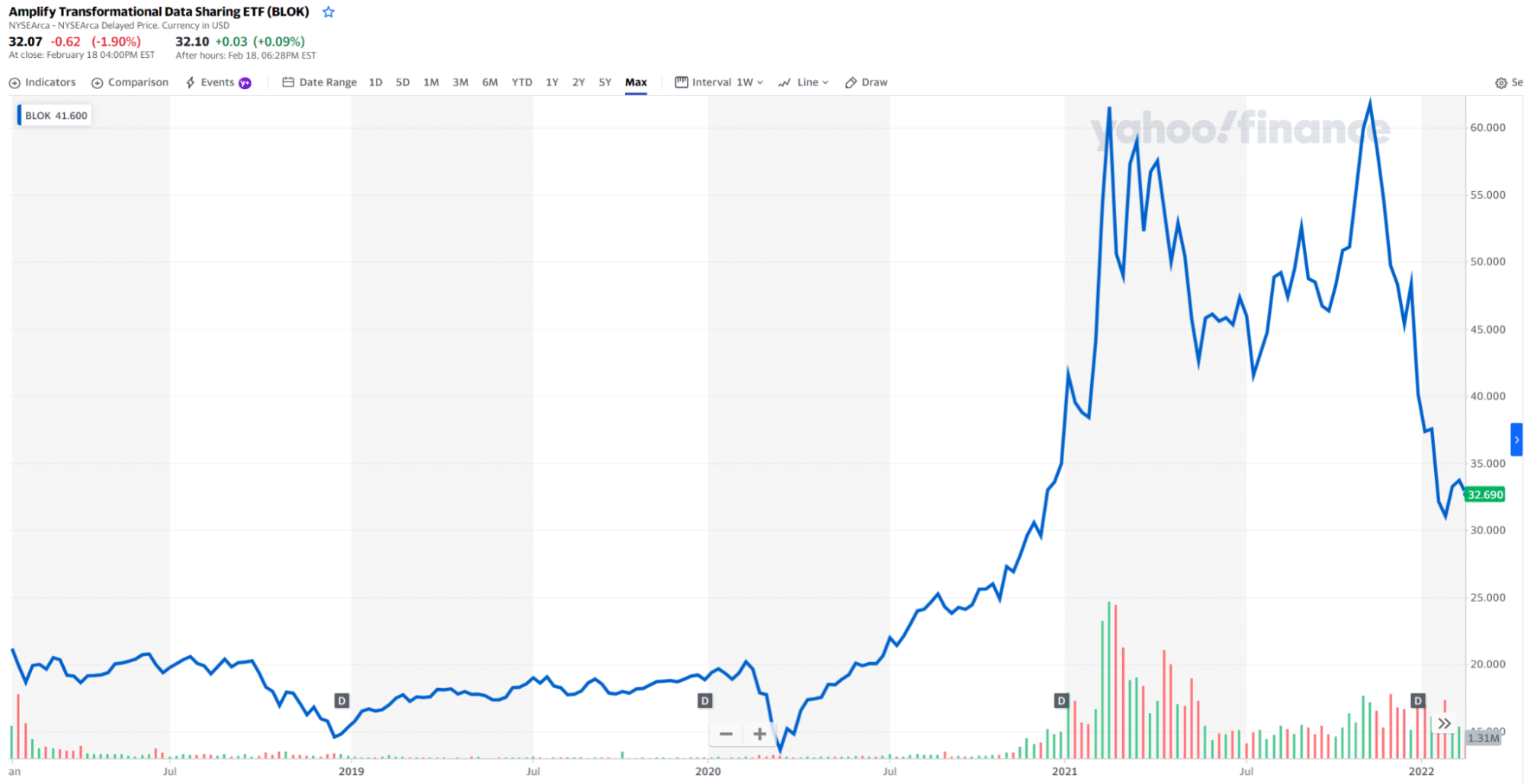

BLOK price chart

The first three holdings with their asset percentage are:

- MicroStrategy Inc. Class A — 6.35%

- PayPal Holdings Inc. — 4.81%

- Square Inc A — 4.59%

Siren Nasdaq NexGen Economy ETF (BLCN)

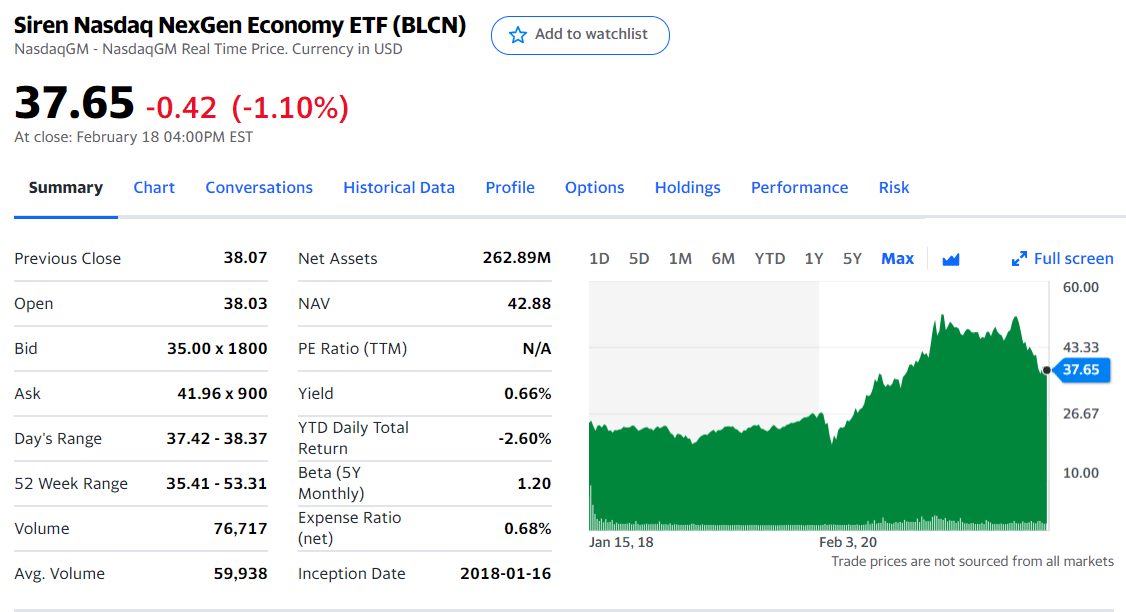

BLCN summary

While Amplify’s blockchain ETF is substantially larger, Siren Nasdaq NexGen Economy ETF gives investors a distinct take on the topic. It has less exposure to bitcoin holding companies than other similar ETFs since it comprises 64 stocks and focuses on technology enterprises. It has a cost-to-income ratio of 68%.

An almost 50/50 split of holdings comes from local and foreign companies in this exchange-traded fund. It was launched in January 2018 and, as of this writing, has repaid more than 70% of its initial investment.

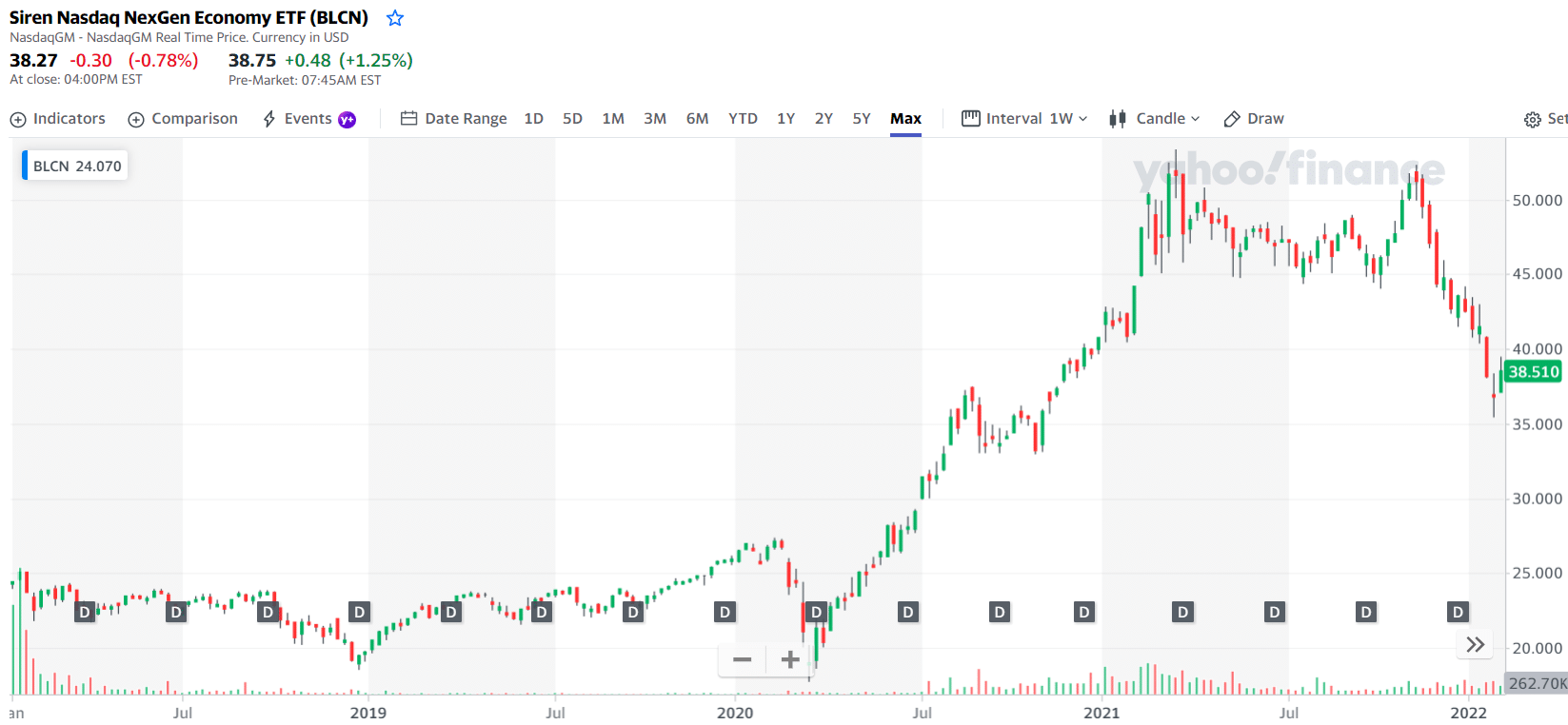

BLCN price chart

The first three holdings with their asset percentage are:

- Coinbase Global Inc Ordinary Shares – Class A — 2.27%

- Accenture PLC Class A — 2.05%

- Square Inc A — 2.05%

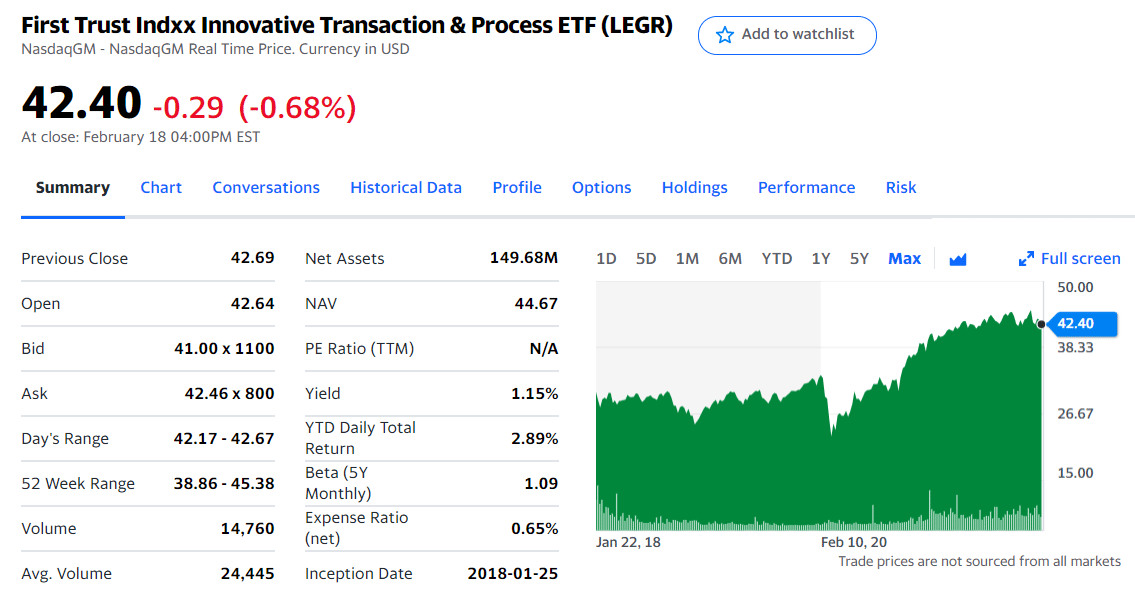

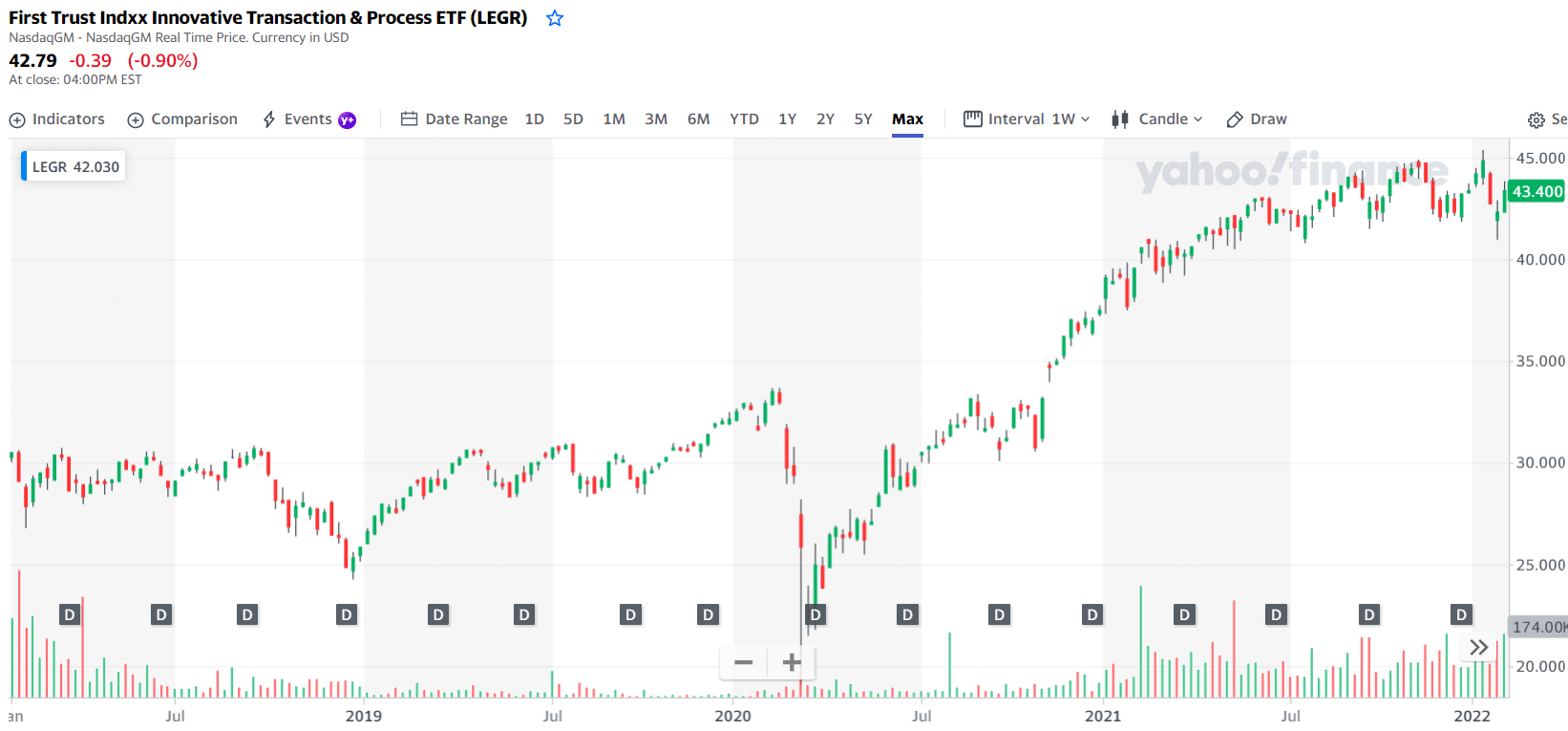

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

LEGR price chart

The First Trust Indxx New Transaction & Process ETF comes next. One of First Trust’s latest offerings was introduced in January 2018. It is a natural consequence since the corporation has a long history of generating ETFs and other financial products. A total of 103 companies are included in our most comprehensive blockchain and cryptocurrency ETF. The First Trust Indxx Innovative Transaction & Process ETF has an annual cost ratio of 0.65%.

One-third of the company’s assets are held in the United States. After Europe and Asia, China has the second-largest covered area, with 11% ownership. Since 2018, investors’ desire to invest in publicly traded firms outside the United States has negatively impacted mutual fund performance. Since its start, the ETF’s return has been below 50%.

LEGR price chart

The first three holdings with their asset percentage are:

- NVIDIA Corp. — 1.93%

- Fujitsu Ltd — 1.58%

- A. P. Moller Maersk A/S B — 1.57%

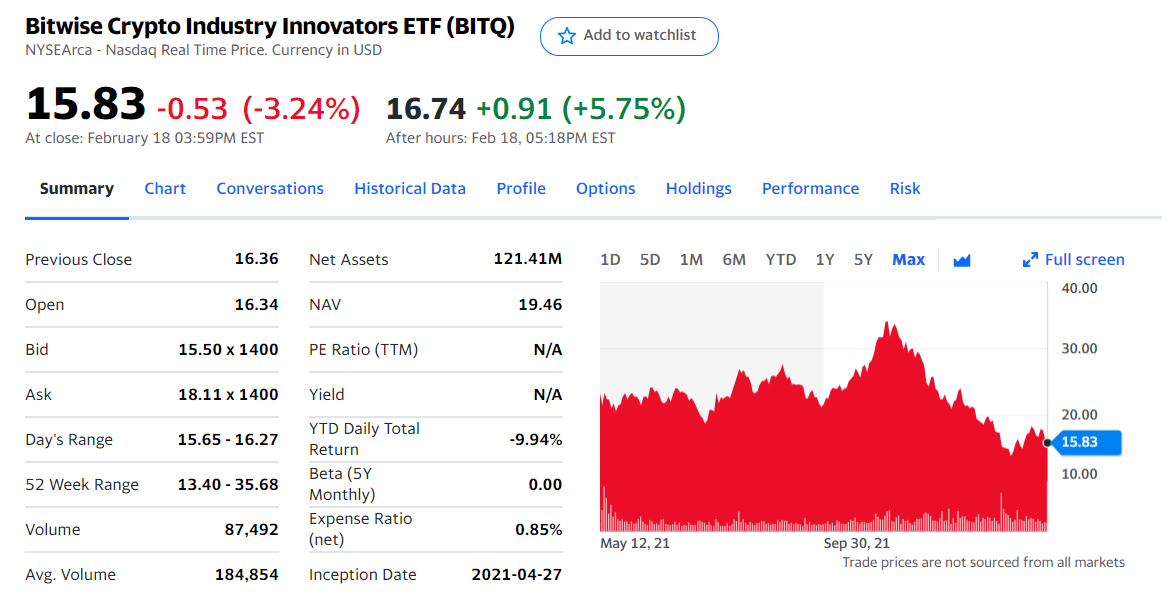

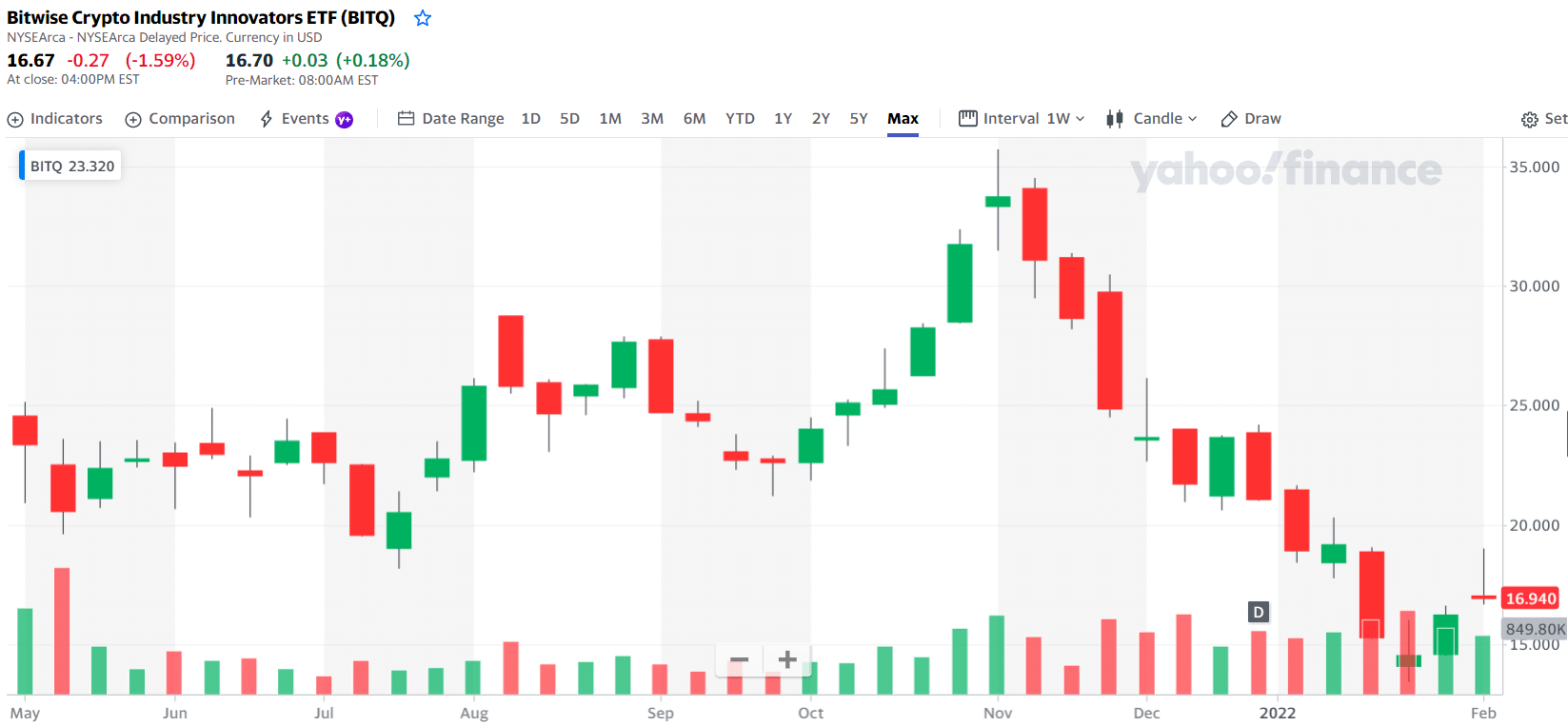

Bitwise Crypto Industry Innovators ETF (BITQ)

BITQ price chart

The Bitwise Crypto Industry Innovators ETF, a newcomer to the blockchain, debuted in May 2021. A mutual fund has a relatively high-cost ratio of 0.85%.

The Bitwise Crypto Industry Innovators ETF differs from the others in one sense. Companies in the portfolio mine significant amounts of Bitcoin and other key cryptocurrencies. Coinbase has the most cryptocurrency in January 2022. As of this writing, MicroStrategy (MSTR), which runs various institutional bitcoin trading platforms, is the second-largest Bitcoin holder. These companies hold one-third of the ETF’s assets.

Consequently, since its launch, this fund has closely tracked the price of Bitcoin. As a result, we have no clue how this ETF will perform soon. Nevertheless, it may be a wise alternative for you if you want to avoid the inconvenience of investing directly in cryptocurrencies.

BITQ price chart

The first three holdings with their asset percentage are:

- MicroStrategy Inc Class A — 13.06%

- Coinbase Global Inc Ordinary Shares — Class – 10.54%

- Silvergate Capital Corp Class A — 9.53%

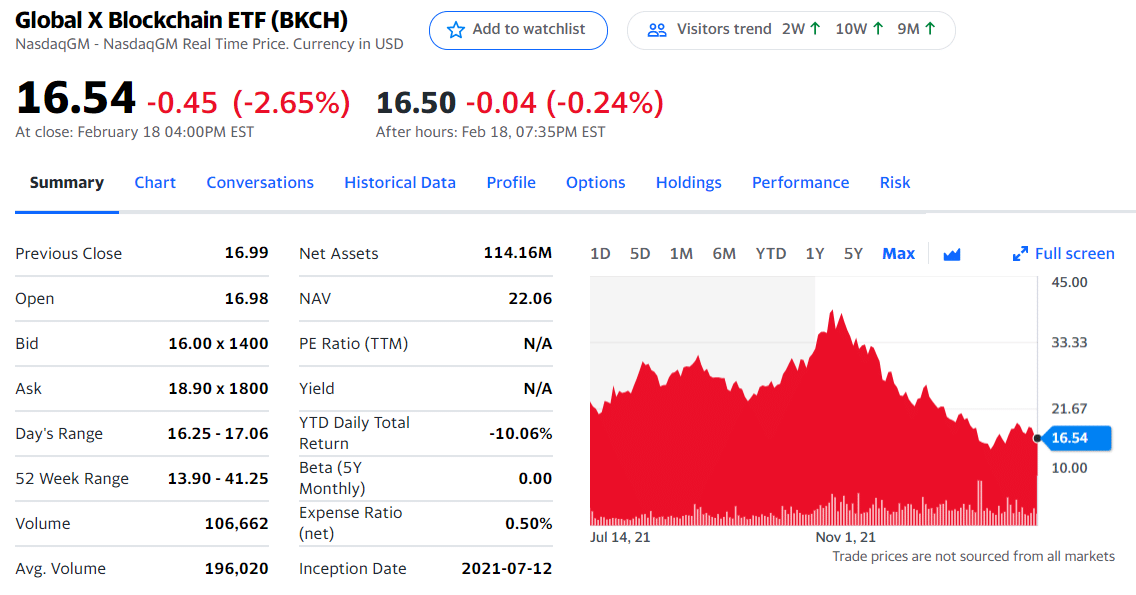

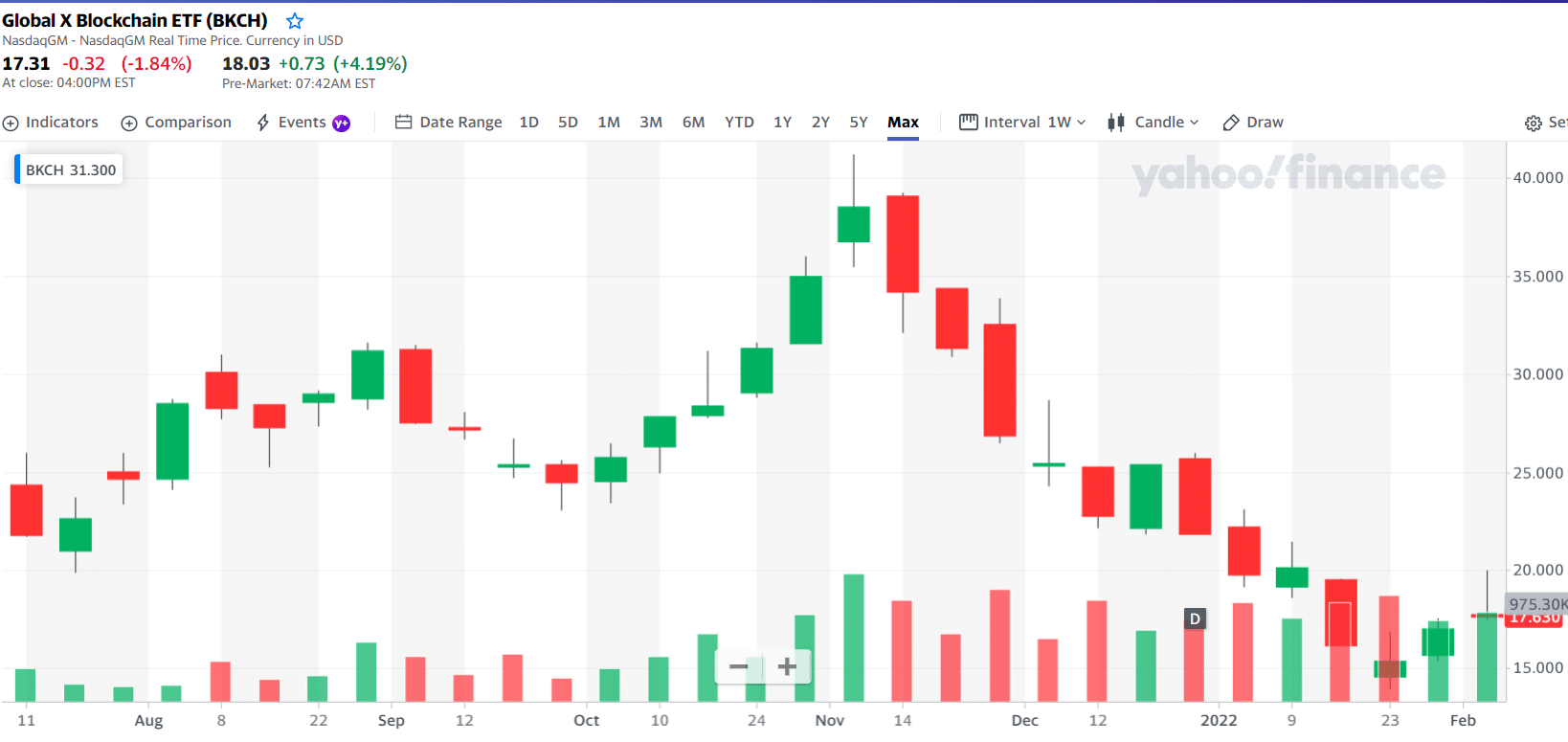

Global X Blockchain ETF (BKCH)

BKCH price chart

More minor than the Global X Blockchain ETF, there are no other blockchain funds on this list. In addition, the ETF, which launched in July 2021 and charged an annual fee of 0.5%, only includes 25 stocks.

The year-to-date performance of the Global X Blockchain ETF suggests that high-growth technology companies had a bad year in 2021 as of this writing. Riot Blockchain (RIOT), Hut 8 Mining Company (HUT), and all three Bitcoin miners are represented in this fund. However, these three companies account for just a minor fraction of the portfolio’s assets. Anyone interested in blockchain and cryptocurrency should consider this an exciting alternative.

BKCH price chart

The first three holdings with their asset percentage are:

- Coinbase Global Inc. — 13.13%

- Riot Blockchain Inc. — 11.71%

- Marathon Digital Holdings Inc. — 9.82%

Final thoughts

Because blockchain technology is still in its infancy, these ETFs are projected to be more volatile than traditional funds. If blockchain and crypto economies do not take off as rapidly as some anticipate, the value of the assets may decline over time. In this quickly growing fintech business, a long-term perspective and a small initial investment are suggested.

Comments