According to a crypto app tracker, decentralized applications, commonly known as “Dapps,” are now running on the Ethereum blockchain. These apps are meant to give customers greater control over the data they gather compared to typical mobile and web-based applications.

A central authority, such as Robinhood or Twitter, ultimately controls how customers’ data is secured and used for conventional apps.

In this article, we give a brief overview of the best Ethereum Metaverse projects.

Why is it most in-demand for investors?

Decentralized applications adopt a decentralized approach to data management using blockchain technology, which forms the basis of the Ethereum network. This is supposed to restore control to the end-user. ETH refers to the second-largest cryptocurrency, behind BTC in market capitalization and the first blockchain platform allowing the development of Dapps. Investors prefer it because of its favorable range and high profitability rate.

For those who believe in the potential of ETH, the fact that it is an open-source platform means that the applications created on it are frequently experimental. Therefore, you should do thorough research before making any financial investment.

Best Ethereum (ETH) Metaverse projects

What is Uniswap?

Like other decentralized exchanges, Uniswap never controls the cash of its users. Nevertheless, its use is the most prevalent yet. This exchange facilitates currency exchanges within Ethereum’s DeFi movement while also serving as a cornerstone of the organization’s current growth. A “vampire” competitor called SushiSwap tried to siphon off its consumers’ money in response to the initiative.

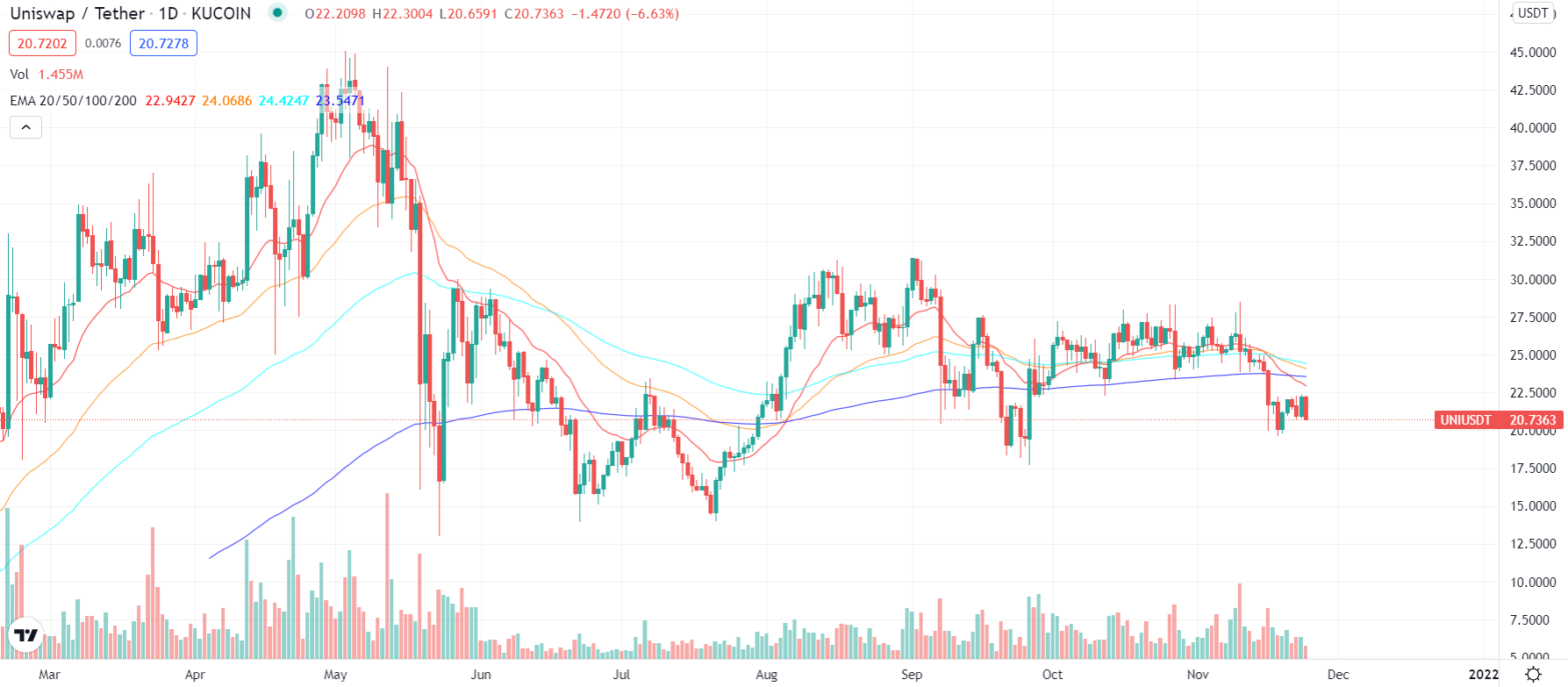

Uniswap price evaluation

Another distinguishing feature of Uniswap is its automated market maker (AMM) system to facilitate trading. This means that the underlying liquidity pools that manage the actual coin-swapping are managed by smart contracts rather than a traditional order book system, making it more efficient.

When trading on a traditional centralized crypto exchange, the supply and demand decide the market price for an asset. Therefore, trading requires finding someone on the other side of the order book who can supply liquidity to execute a transaction to purchase and sell effectively.

Uniswap price prediction 2025

According to some analysts, the Uniswap (UNI) currency is expected to trade at roughly $100 in 2025, indicating that a price correction may be successful during this time frame.

When using an AMM-based exchange, such as Uniswap, a pricing algorithm calculates the market price of each item traded on the exchange. Thus, investors are rewarded for supplying liquidity, pooled collectively, and utilized to execute all transactions at the predetermined market pricing.

What is Chainlink?

Network of Decentralized Oracles Chainlink is an Ethereum-based currency that provides power to the Chainlink decentralized oracle network. In addition, ETH smart contracts may securely link to other data sources, APIs, and payment systems via the Ethereum Interconnect network.

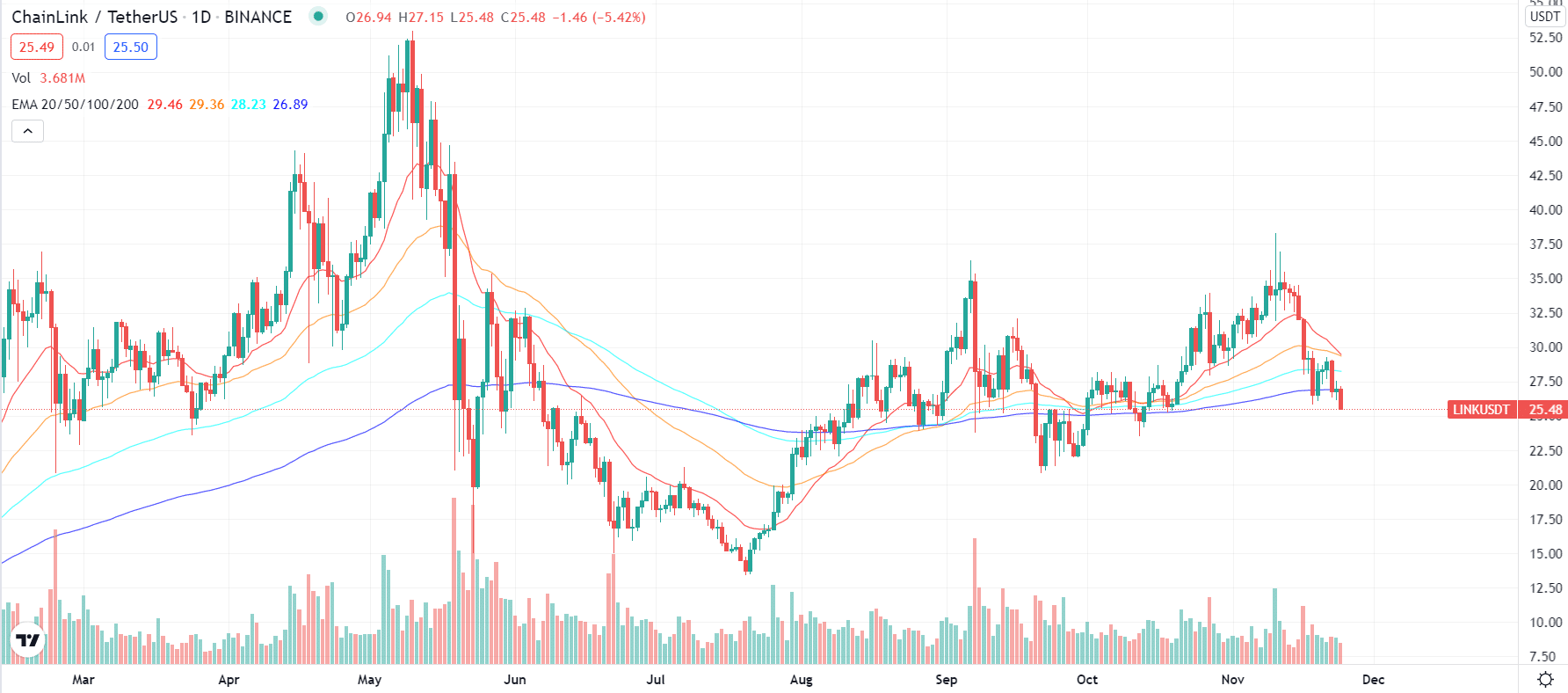

Chainlink market price and trends

LINK is a cryptocurrency used to pay for services on the network. It motivates nodes to conduct verifiably honest labor and deliver correct data. Thus, it is a form of payment for services on the network.

The staking of these tokens into a smart contract must become a node and supply data to Chainlink oracles. Although, this serves as a deterrent against misbehaving or sending fraudulent data to the network. It also serves as a reward for doing so.

Unlike other blockchain platforms, Chainlink is an oracle platform, which means it integrates smart contracts with real-time data from the outside world, such as weather forecasts or stock market values. A smart contract makes use of this information to carry out pre-defined commands.

Chainlink price prediction 2025

According to the most recent long-term estimate, the price of this coin would reach $50 by the middle of 2024 and then $75 by the end of 2025. Its price is expected to grow to $200 by the year 2028.

While Chainlink has been around since 2017, the project didn’t truly come to the forefront of the sector until 2019, when it collaborated with Google to bring it to the forefront of the industry. Chainlink is powered by the LINK crypto-token, an ERC-20 token, and operates on the ETH blockchain.

What is Axie Infinity (AXS)?

Because of its widespread popularity and high income, investors have questioned whether or not they should invest. So if you’re thinking of purchasing Axie Infinity, here are some things you should know.

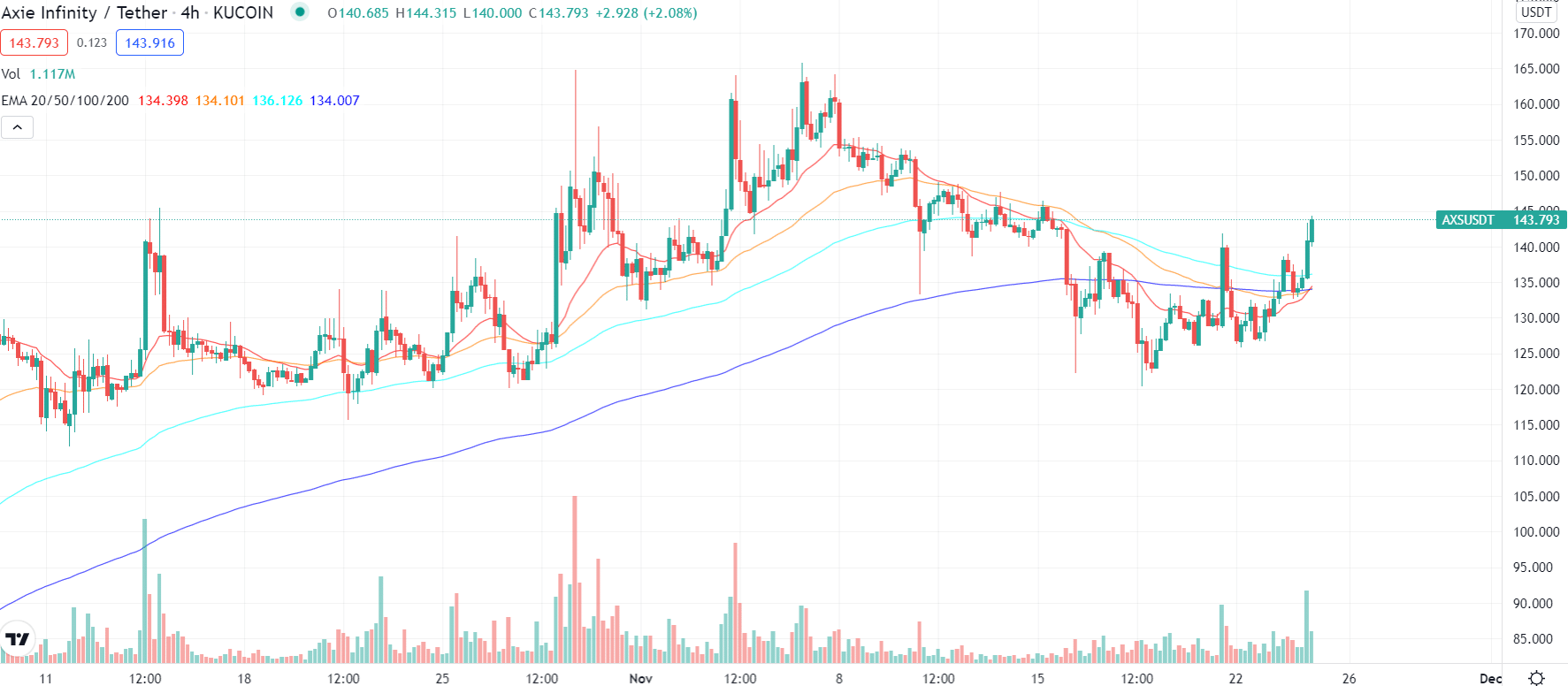

Axie Infinity market analysis

Axie Infinity, a blockchain-based game accessible for Android, iOS, Windows, and macOS, includes gameplay and goals that may be recognizable to certain players who have previously played similar games.

Blockchain is a distributed ledger technology that permits recording transactions and monitoring assets in a digital network. Put another way, it is a system that allows users to record financial information while also protecting that information against alterations and hacking attempts.

A copy of the ledger exists throughout the whole user network. As you may have guessed, blockchain technology is the technology that permits the development of cryptocurrencies such as BTC and ETH, among other things. For example, each Bitcoin transaction carried out by other users impacts the value of the crypto. Therefore, its corresponding value in real-world money is affected as a result of this.

Axie price prediction 2025

Axie Infinity’s recent price movement suggests a mild correction, as seen by its market capitalization of $2,686,832,085 and trading volume of $2,097,401,279. As a result, prices are expected to reach $475 by the end of 2025.

The Axie with the highest-grossing price tag was sold at EUR 950,000. Recently, the game gained popularity because individuals in Vietnam and the Philippines started using it to earn money after the Communist Party of Vietnam (COVID) robbed them of their ability to work.

Final thoughts

Many Ethereum projects are focusing on decentralized finance. The tokens will be used in more complex financial transactions, such as loans and derivatives, according to DeFi.

From $650 million at the beginning of the year to $16.05 billion by the end, the value of crypto assets locked in DeFi protocols surged by over 2,000 percent in 2020. In addition, Dapp users fight for faster transaction processing by miners. The greater the transaction price, the faster an ETH miner will add it to the blockchain.

Comments