A dream of every investor is to find cheap stocks that become extremely valuable over time. Penny stocks are shares of companies quoting below the $5 level and with a low market volume. Some great companies have been quoted as penny stocks, such as the case of Monster Beverage or Ford.

The next penny stock that will explode is out there, and you can find it to profit big time before it’s too late. However, most of them are bad investments that will only make you lose money. To learn how to differentiate the good from the bad, read this article until the end, and you’ll learn how to profit from penny stocks.

What are penny stocks?

The definition of penny stocks can vary a little depending on who you ask, but for The US Securities and Exchange Commission, wants (SEC) penny stocks are those shares of companies quoting below $5.

The appeal of these companies is the possibility of buying many of those stocks before their price rises. Nonetheless, this is an unlikely scenario, and the price of these stocks is so low for a reason.

Many of them are in bad financial shape or don’t offer reliable information. As a result, penny stocks are high-risk investments that make traders lose money to inexperienced investors every year. Nevertheless, some stocks are worthy of investment, but they are very hard to find among all the failed companies. Next will explain to you under what conditions it is worth it to invest in penny stocks.

Are penny stocks worth investing in?

The quick answer is no. It is better to invest $100 in one stock of a large company than to buy 100 shares of a rare company for $1. While it is true that you only need the stock to raise $1 to double your investment, it is also true that that rarely happens. Even when it happens, it is hard to get the entire profit from it because of the low liquidity the penny stock market has. So, when you buy penny stocks, you may be stuck with them for a long time, and the small window of opportunity you have to profit may close before you can sell.

There are ways to profit from penny stocks, but you need to differentiate yourself from the rest of the investors. So before investing in penny stocks, you should check how the company is doing and forecast how it will do in the future.

Which are the best stocks to invest in during 2021/2022?

When you look for information about a company you want to invest in, don’t trust only the info the company gives you. Instead, look for alternative sources of information, and only when you confirm your expectations start investing in the company.

Let’s now see some of the best-looking companies to invest in during 2021/2022.

1. eMagin Corporation (EMAN)

Price: $2.21

The company engages in the design, development, and manufacturing of its OLED microdisplay with its patented technology, Direct Patterning, which gives the advantage in the market and puts eMagin ahead of its competitors.

OLED technology is present in the military, medical, and industrial sectors, and the demand for smartphones, augmented reality (AR), and virtual reality (VR) will increase that demand to new levels.

The OLED industry is forecasted to increase its market by over 13% annually over the next five years, and eMagin Corporation seems to have everything to capture most of that growth.

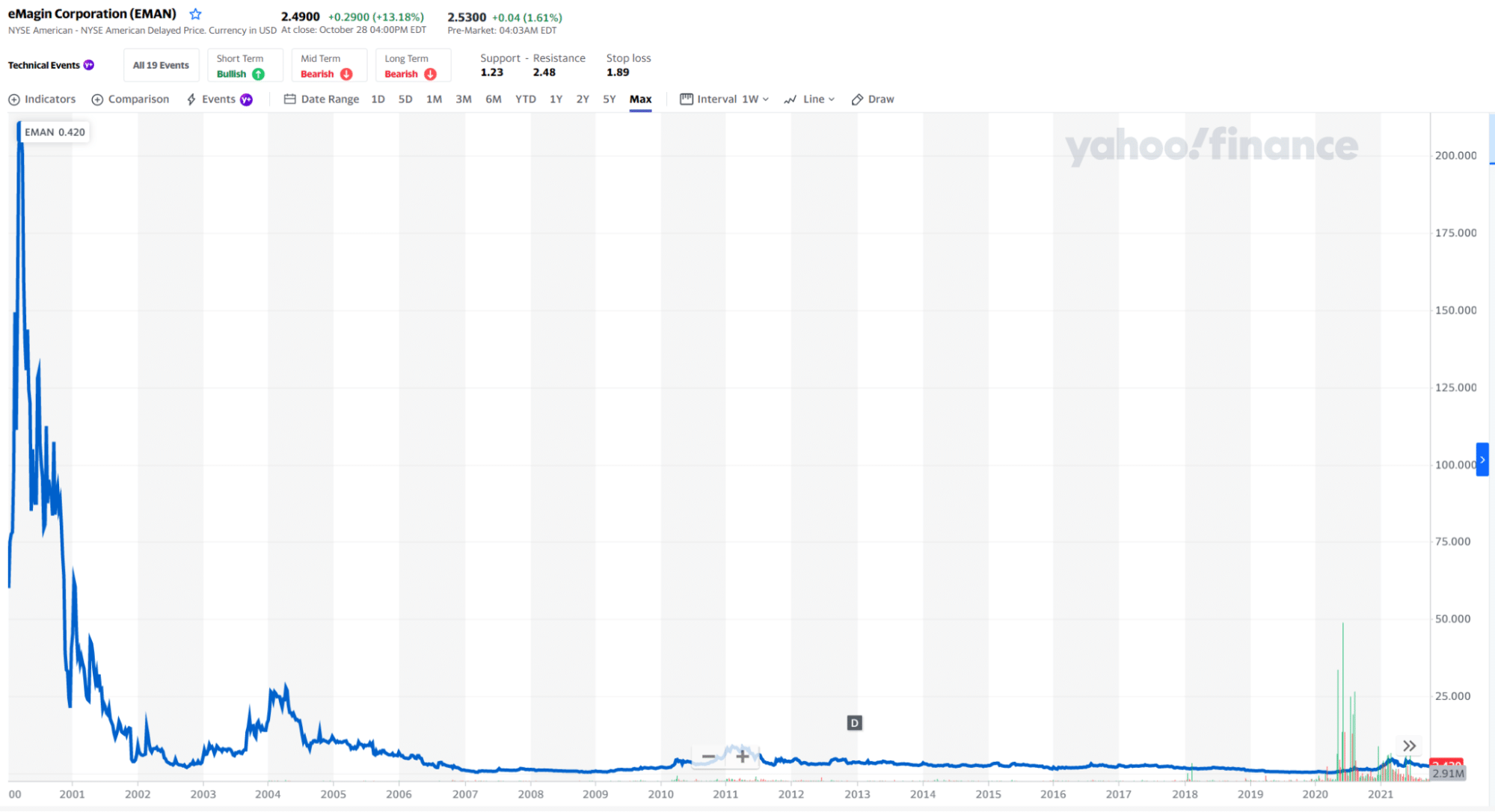

eMagin price chart

The company shares are currently quoted at $2.21. The stock price has been increasing since 2020. Even when the price has been down-trending since June 2021, it is near its past low in May, so the trend could reverse anytime and increase the price constantly in the following weeks and months.

2. Boxlight Corporation (BOXL)

Price: $2.16

Boxlight Corp. is an education technology company developing classroom solutions for the global educational market. Although the company aims to improve communication in educational environments, it also has found acceptance in the business sector. Workers are constantly trying to impress managers with their presentations to sell their ideas or products.

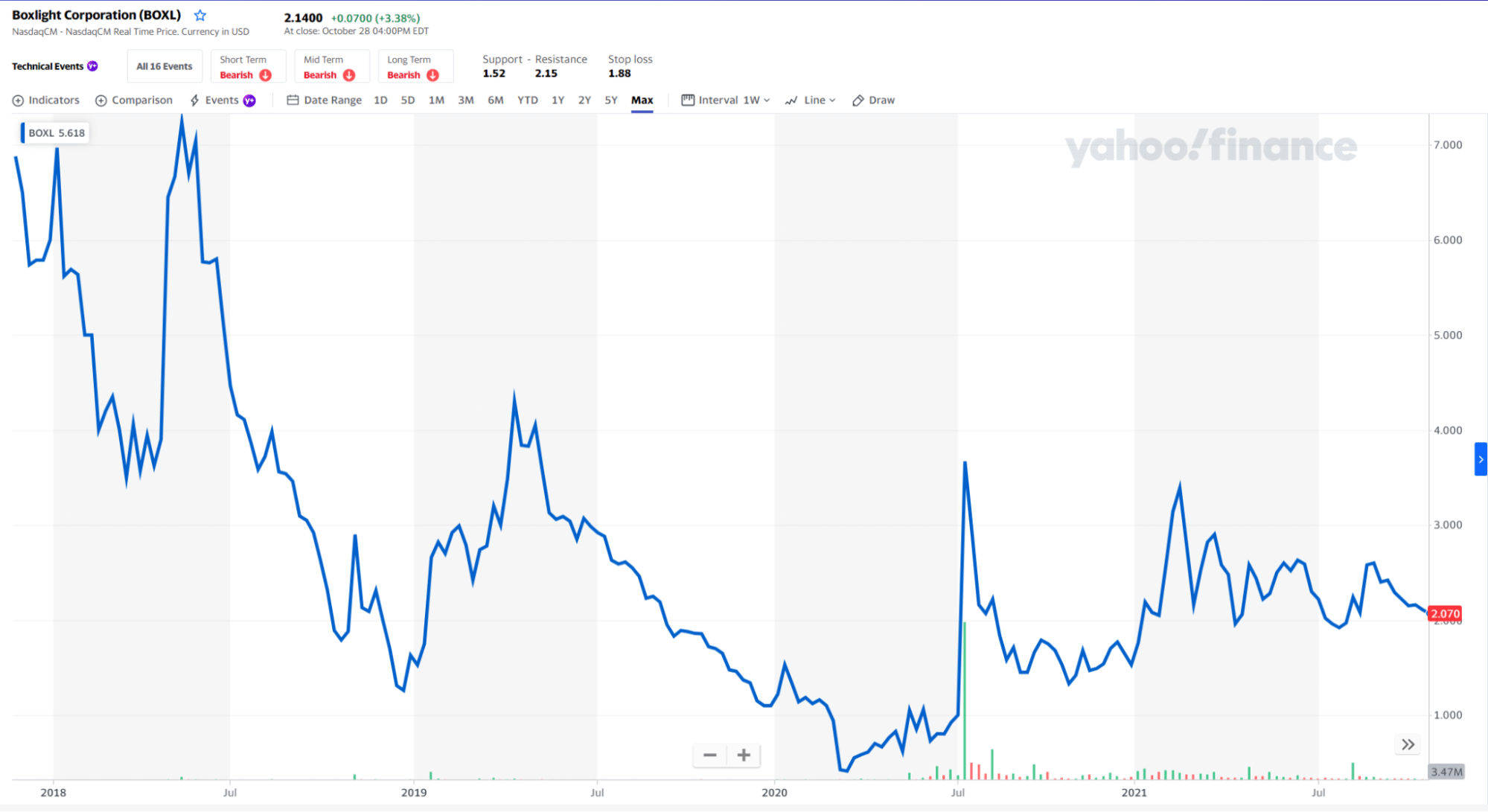

BOXL price chart

The company went public in 2017 with an initial public offering of $7. After the first months of enthusiasm, the price slowly drops to the level we see today. After the pandemic, we expect the company to grow since the online classes have raised the bar, and using technology in the classroom is gaining territory.

3. Exela Technologies (XELA)

Price: $1.70

Exela Technologies is a tech company that offers business automation to more than 4000 customers in 50 different countries. The company serves a wide range of business sectors, including healthcare solutions, legal & loss prevention solutions, and information solutions.

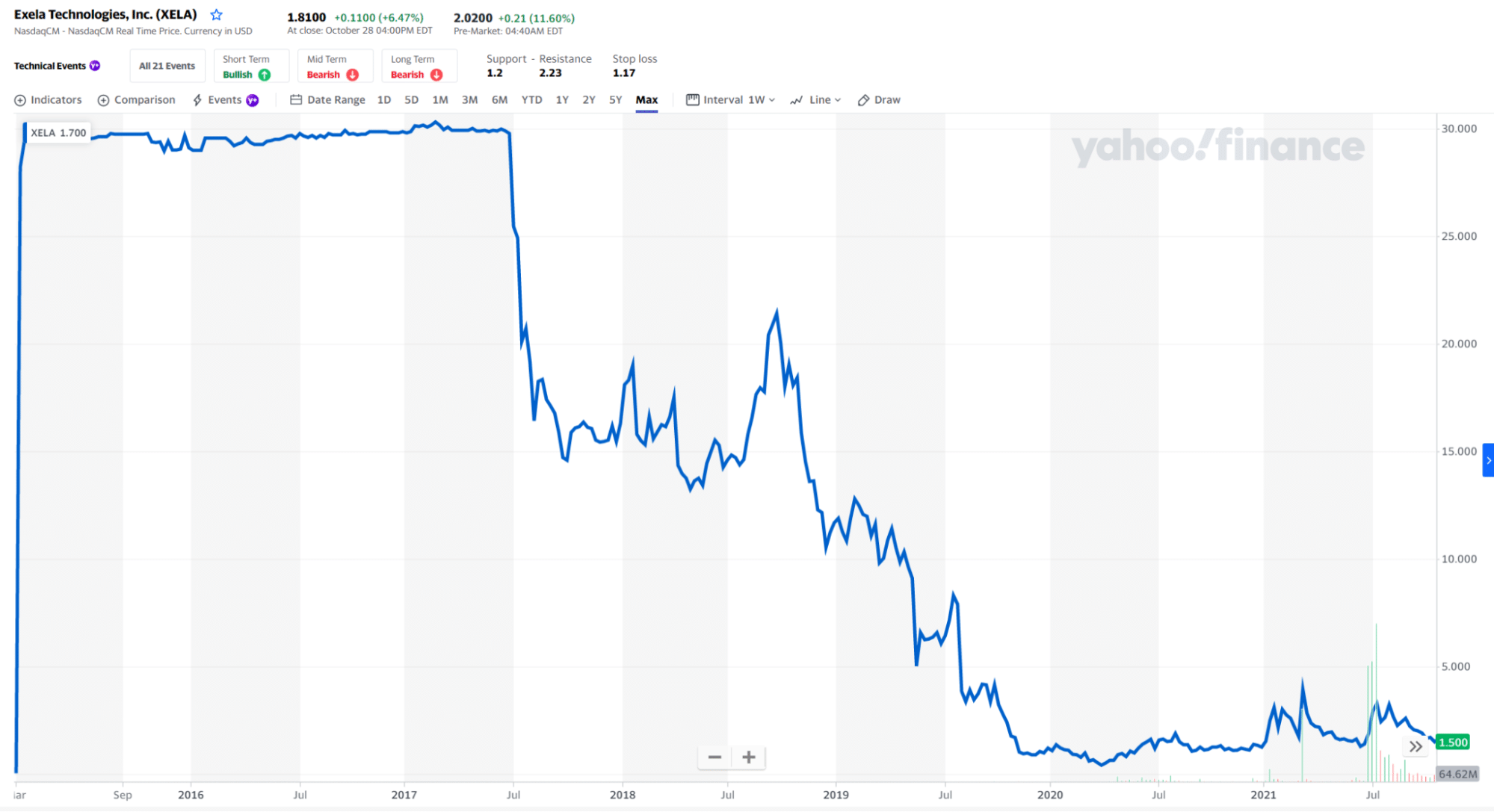

XELA price chart

It has been in the market for more than 30 years, and it is partnered with more than 60 companies included in the Fortune 100 list. However, the company suffered a long downtrend before the pandemic that left it at current price levels. Exela’s biggest problem is the massive debt of $95 million, but reports say that Exela will improve annual cash flow by $25 million.

4. Mind Medicine (MNMD)

Price: $2.35

This company is also known as Minded, is a biotechnological company established in New York. The company develops and deploys psychedelic medicines and therapies to improve health. The psychedelics developed by the company are a non-hallucinogenic version of the psychedelic ibogaine.

The market for these kinds of drugs is still nascent, so the risk involved in the investment is not low. However, for those risk-risk-tolerant investors, the company represents an exciting opportunity to engage in a long-term investment that could result in decent profits in the future.

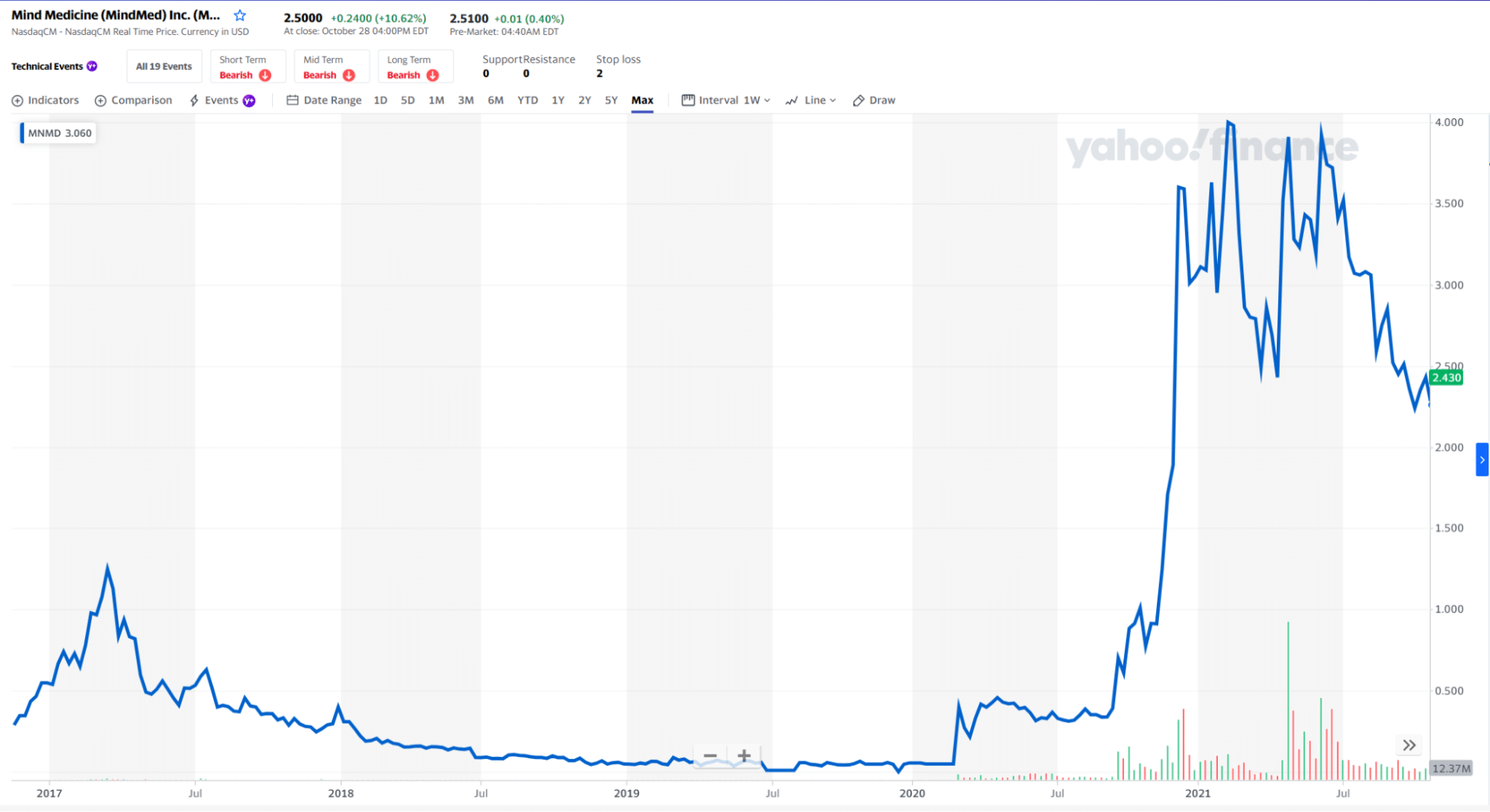

MNMD price chart

The company went public in April 2020, and since then, its performance has been quite exciting.

5. Biocept Inc. (BIOC)

Price: $3.86

Biocept is an oncology laboratory focused on developing diagnostic methods for lung, breast, gastric, colorectal, and prostate cancers and melanoma. Thus, a natural partnership is created between the company and many healthcare providers in providing the best cancer treatments.

Also, Biocept develops polymerase chain reaction (PCR)-based assay to detect coronavirus in early stages. Thanks to this, over the past semester, the company has experienced incredible revenue growth.

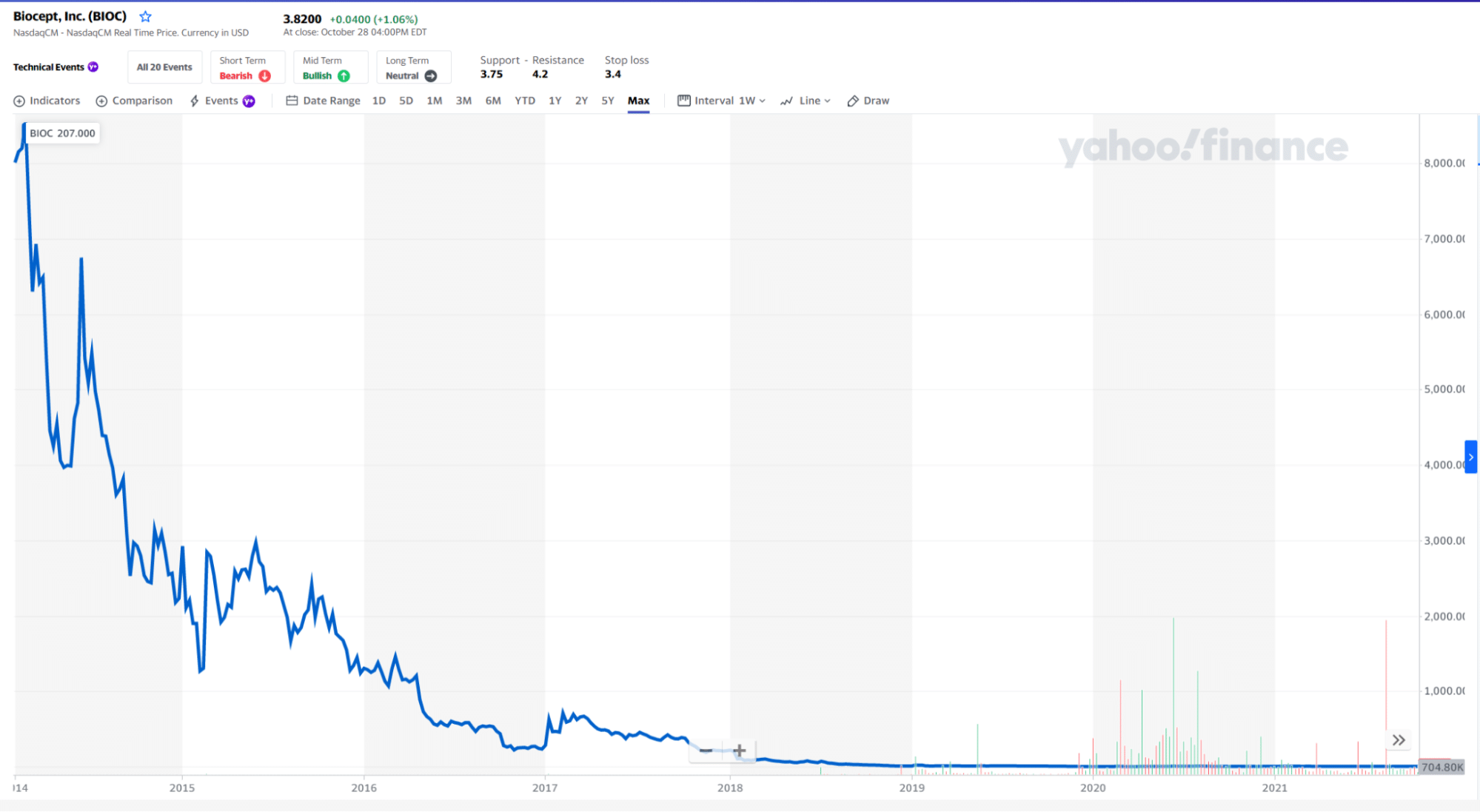

BIOC price chart

The company’s stock price dropped before the pandemic, but the downtrend stopped at the beginning of 2020. During the pandemic, the price has consolidated around the current price level after an uptrend. However, the present scenario looks like the resumption of an uptrend.

Final thoughts

Don’t be fooled by the penny stocks. Just because you can afford many stocks from a company doesn’t mean they are cheap. Stocks are inexpensive compared to their intrinsic value. If you buy $1,000,000 stocks of a company at $0,001 and they have no intrinsic value, you are just throwing $1,000 into the trash. Penny stocks are only worth buying after a careful analysis of the company and the market that forecast an increase of the price in the long run.

Comments