It might not seem like it, but AI has already had a tremendous effect on our daily lives. From IBM’s Watson, which is used for diagnostics in the health care sector, autonomous vehicles are now becoming a daily occurrence coupled with regular updates. Maybe it is because of the movie Terminator, but most laypeople associate artificial intelligence with walking machines.

At the same time, many can not imagine a world without Apple’s Siri. AI has been incorporated in so many facets of our lives, with the only difference being the complexity of the AI in use.

AI technology is ever-evolving, and with its capability for enhancing efficiency, it has proven to boost productivity resulting in lower cost and increased profitability. Sector at the forefront of its adoption and utilization include healthcare, technology, information technology, finance, energy, utilities, and industrial. This list is by no means inclusive, but so far, AI is heavily in use in these sectors of the economy.

According to Mark Purdy and Paul Daugherty, “AI has the potential to double economic growth in terms of the gross value added.” With such projections, how do you make money out of this tech niche? The answer is exchange-traded funds, given the volatility associated with individual equities for emerging markets.

What is an AI ETF?

AI exchange-traded funds comprise a basket of investment assets with interests in the artificial intelligence landscape. Companies primarily involved in AI research and development, AI-based products and services, and organizations generating at least 25% of their revenues from AI activities.

In addition, some ETFs use AI technology to pick their underlying holdings, and since they make money through this technology, they also qualify as artificial intelligence ETFs.

AI ETFs for Q4 2021

In 2020, the AI technology investments were valued at $62.4 billion globally. Having proven to be a highly dynamic emerging market with round-the-clock research and innovation-driven by global tech giants, the projections are for this tech niche to grow at an annual compounding rate of 40% from 2021-2028. Given their historical performances, the three ETFs below are in pole position to make money off this market in Q4 2021.

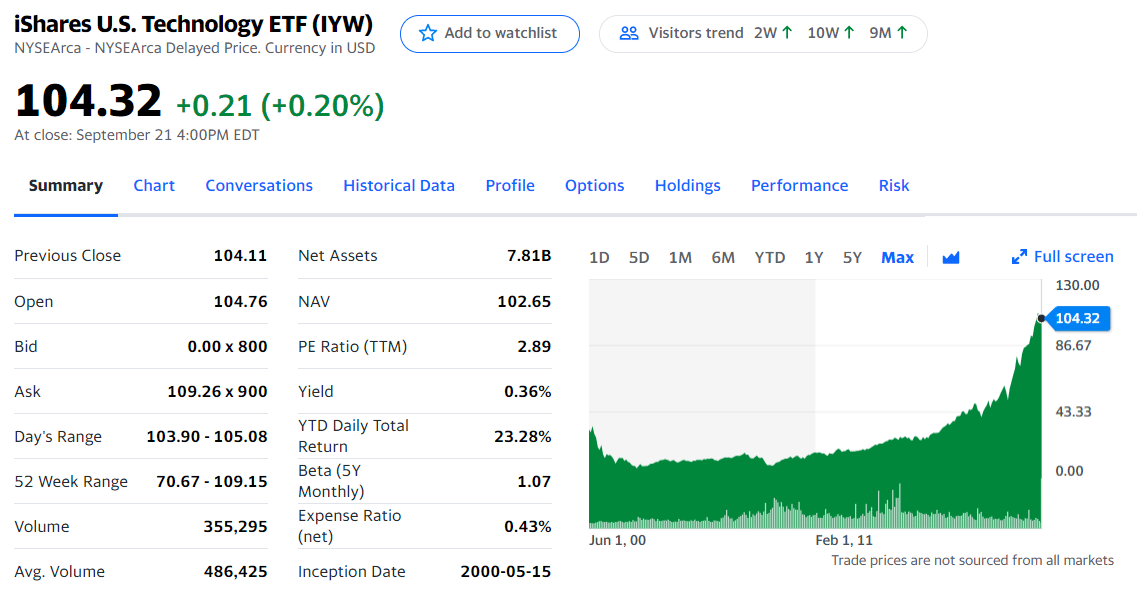

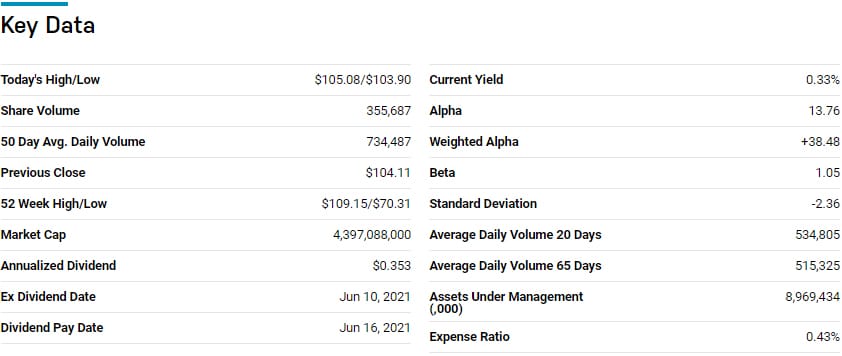

№ 1. iShares US Technology ETF (IYW)

Price: $104.32

Expense ratio: 0.41%

In a list of 91 technology-based ETFs, the IYW is ranked № 28 by US News. It is no surprise given that the top three holdings of this ETF are Apple Inc. with a weighting of 17.94%, Microsoft Corporation with a weighting of 17.67%, and Alphabet Inc. Class A Shares with a weighting of 5.50%.

The 5-year returns of 269.35%, 3-year returns of 120.93%, pandemic year returns of 44.41%, and current year to date returns of 22.85%. The couple, this performance to a holding base with the most prominent AI technology utilization and the ETF, provides a diversified approach to AI investment.

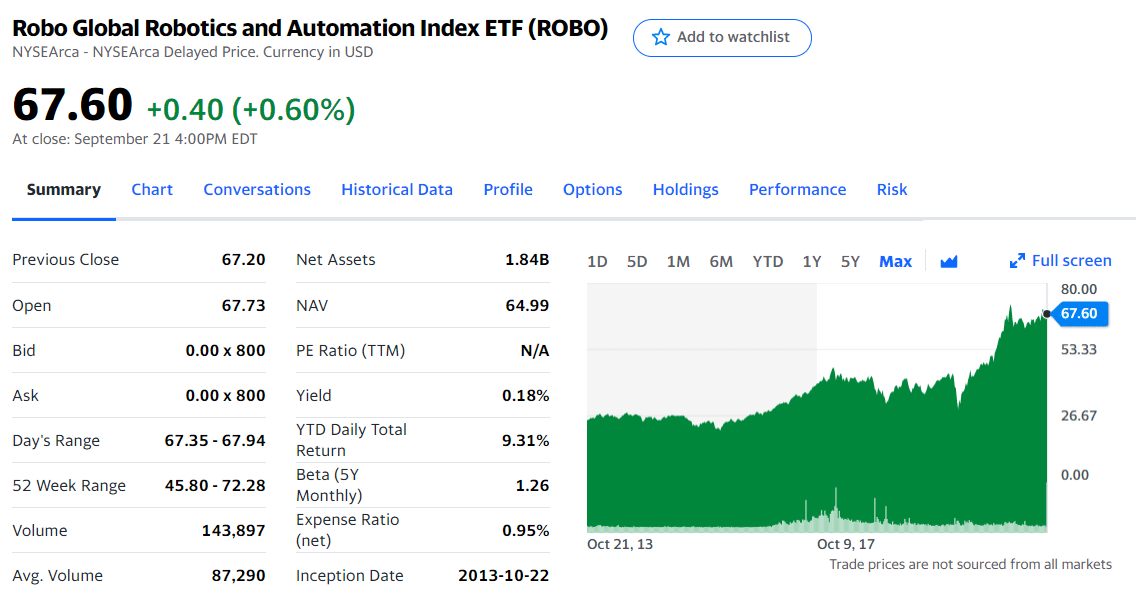

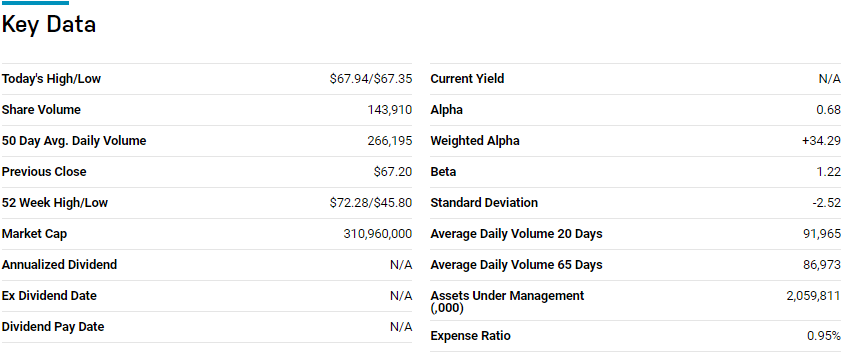

№ 2. ROBO Global Robotics and Automation Index ETF (ROBO)

Price: $67.60

Expense ratio: 0.95%

This non-diversified fund is ranked №1 by US News among global small/midcap equities. Its arsenal has these three holdings as the top dogs; ServiceNow Inc. — 2.02%, Intuitive Surgical Inc. — 1.94%, and Kardex Holdings AG — 1.91%.

The 5-year returns of 149.67%, 3-year returns of 60.49%, pandemic year returns of 44.14%.

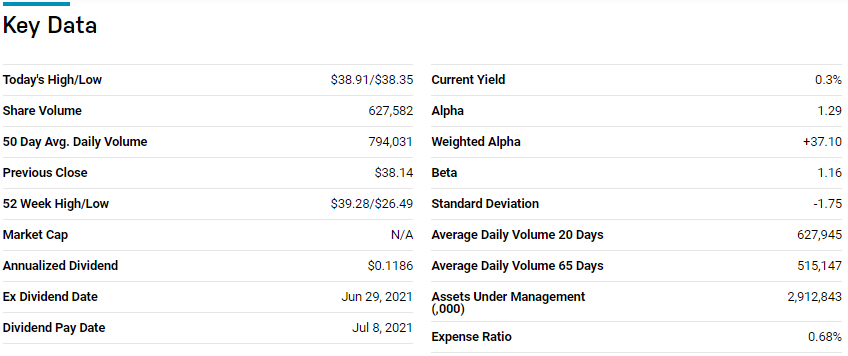

№ 3. Global X Robotics and Artificial Intelligence ETF (BOTZ)

Price: $38.69

Expense ratio:0.68%

This non-diversified fund has in its arsenal the following equities as the top 3 holdings; Upstart Holdings — 9.61%, Keyence Corporation — 9.05%, and NVIDIA Corporation — 8.22%.

Combine the aforementioned with diversification in terms of interest sectors. What you get is an ETF ready to take advantage of all things AI; healthcare, industrials, technology, energy, and others. A look at its historical performance shows the BOTZ does make money for its investors.

The 5-year returns of 165.83%, 3-year returns of 72.39%, pandemic year returns of 44.32%.

Final thoughts

AI has proven to be a disruptive technology not only for specific industries but one that will permeate across the entire economic divide. With the increased adoption rate and human nature’s need for a simplified life, the AI market is on the verge of explosion, and the ETFs above can make money for investors, starting with Q4 2021.

Comments