A look at retirement accounts might reveal a boatload of cash. However, a common oversight is the IRS claim on these accounts, except that one attracts tax before contributions. Nonetheless, careful planning and intrigue of such accounts provide some leeway on when the tax is due and what value.

The general expert consensus is that taxes increase with time. Hence one can bank on paying higher taxes on retiring. However, it does not mean that everyone retiring is in a higher tax bracket.

This guide helps answer:

- Does the tax burden on retirement have to “eat” a large chunk of the income?

- Are there strategies that minimize retirement income tax?

Use of Roth accounts

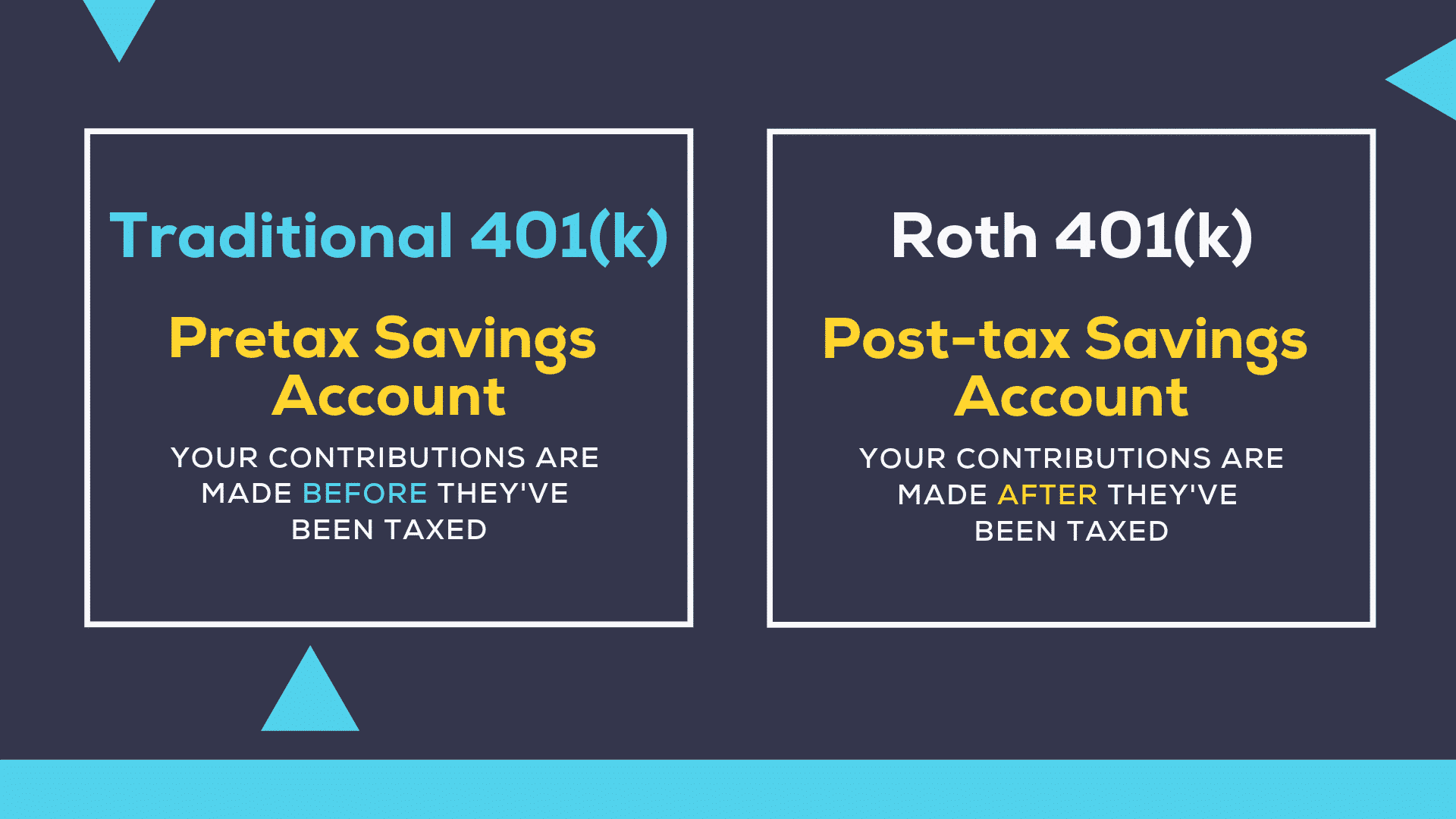

In life, as one progresses in their career, the more they earn. So the 401k accounts attract taxation on withdrawal when retiring. In most cases, the taxation bracket during retirement is higher than during contribution.

The use of 401k Roth accounts and pure Roth accounts provide an avenue for avoiding high taxes during retirement. This is because, as a general rule, Roth accounts taxation occurs when making contributions.

For example, an individual earning $39.000 currently is subject to taxation at 12%, if single. However, suppose this individual has a traditional 401k account with an annual retirement income of $60.000. So the tax bracket changes with the taxation rate going up to 22%.

Using a Roth account, the same individual would have paid a 12% tax liability on the contributions and 0 tax on the withdrawals.

Investment diversification

Different investments attract taxation at different rates. The key to any investment portfolio is diversity to ensure net returns and reduce the taxation burden. Retirement life requires an income portfolio mix of non-taxable accounts and taxable accounts. Call on non-taxable accounts when income is high and call on the taxable incomes in low-income seasons.

Such accounts also provide avenues for tax reduction.

- For taxable accounts, choose investment instruments that attract low taxation rates, long-term capital gains, ETFs, tax-exempt bonds, among others.

- For the non-taxable accounts, choose investment instruments that attract more tax; short-term capital gains, real estate, commodities, among others.

Conversion

Roth conversion strategy is beneficial to those anticipating a higher taxation burden on retirement. It is nigh impossible to accurately forecast the taxation rate during retirement, but the consensus is that they will be higher than the present.

For example, a person earning $32.000 exclusive of conversion can convert their other retirement accounts, $8.500, to a Roth account and enjoy taxes at a rate of 12% since the total is still below the $40.526. However, only smart conversion leads to reduced tax rates. The same investor converting $10.000 pushes them to the next tax bracket, whose taxation rate is 22%.

The formula for converting to enjoy tax benefits gets more complex when dealing with after-tax dollars conversion. Consult a tax or financial advisor to ensure conversion results in the desired outcome. You don’t have to do a one-off conversion. The law provides for partial conversions: spread conversions over several years to ensure maximum tax benefits.

Tax-loss harvesting

The IRS provides for offsetting of tax burden through deduction of losses incurred during the selling of securities. This strategy’s popularity is due to its ability to limit short-term capital gains, which attract taxation at a higher rate than long-term capital gains.

Implementation of tax-loss harvesting, commonly known as tax-loss selling, usually happens at the end of the year, although it can occur at any time within the year. It involves selling an asset whose loss is unrealized and then utilizing the resulting negative gains to offset cumulative portfolio gains. Once the filing of taxes for the year is complete, replacing the asset sold with a similar profile occurs. The replacement ensures portfolio rebalancing-expected returns and acceptable risk levels.

For example, a person earning $90.000 annually with:

- A mutual fund investment held for two years sells it and realizes $30.000 capital gain

- An ETF held for 16 months that is doing poorly and has an unrealized loss of $24.000

- Stocks bought six months ago and sold for a realized capital gain of $40.000

The total taxation burden for this individual without tax-loss selling is $14.100; ($30.000*15%) + ($40.000*24%).

Selling the asset with unrealized loss allows for tax-loss harvesting resulting in a tax burden of $8.340; ($30.000*15%) + (($40.000-$24.000) *24%). Through tax-loss selling, the tax burden reduces by $5.760.

Before utilizing the sales proceeds to replace the sold assets with similar investments, the IRS 30-day wait period is worth noting if the loss incurred offsets the tax liability.

401k rollover

For 401k retirement accounts, accounts of previous employers are either treatable as individual accounts or coupled to the current employer account, subject to fulfillment of vesting period requirements. On reaching 72 years, new IRS regulations, it is mandatory to make minimum withdrawals from retirement accounts if not working.

The mandatory withdrawals attract taxation at the current income tax bracket rate. Rolling over all 401k accounts into the active 401k account and working squashes the mandatory withdrawal policy, effectively deferring the tax liability. If you no longer earn an income on retiring, the withdrawals will be at a lower tax rate.

401K account loans

For investments using 401k accounts, it is always advisable to borrow a loan against the account rather than withdraw and invest. This is because early withdrawal from the accounts attracts a 20% penalty and taxation at nominal income rates. By borrowing from the account and investing in an income-generating asset, individuals avoid this tax liability and punishment in case of early withdrawal.

For example, an individual with a 401k account worth $120.000 and earning $80.000 can make either withdrawal of $60.000 and invest, incurring a 22% tax liability, $13.200. To avoid this tax liability, they can borrow the $60.000, allowable limit is 50% of the account value, and repaid within 60 months, the maximum permissible loan repayment period.

An investment in real estate with net monthly returns of $1400 results in net income of $300 if loan repayment installment, inclusive of interest, is $1100 monthly.

Comments