What if you could save part of your salary today, have it invested in a relatively safe instrument hence grow, and enjoy tax benefits while getting instant returns? It might sound a little too good to be accurate, but that is 401k for you.

What is 401k?

The inception of the 401k retirement plan dates back to 1978. By definition, 401k accounts refer to retirement plans initiated by the employer on behalf of the employee. Like so many things in this world, the name 401K is rooted in the US internal revenue code guiding the management and administration of these retirement accounts. Since its inception, this plan has been such a hit with workers that nowadays, it represents one of the significant perks of an employment contract.

As of 2021, the maximum allowable 401k yearly contribution is $19500. This figure applies to both the traditional 401k account and its Roth variant. It also remains the same when combining both variants-total combined contribution capped at $19500.

However, employees aged 50 years and above can top their yearly donation with an additional $6500 in catch-up contributions. These funds don’t just sit in the accounts to accrue interest. Instead, employers provide investment instrument choices for the funds to ensure the growth of the account and returns.

There are two types of 401K accounts depending on the taxation method applied:

-

Traditional 401k accounts

Here, employee and employer contributions are pre-tax, and it is deducted before taxation of income. As such, the employee enjoys taxation at a lower tax bracket, with taxation on the 401k account being upon withdrawal.

-

Roth 401k accounts

Roth 401k accounts are a relatively new addition to the 401k account family, 2006. They give workers a chance to withdraw their 401k accounts and associated returns at no tax cost. They draw their name from Delaware Senator William Roth, who sponsored the Roth bill in 1997.

The Roth accounts were slow to catch on. However, their popularity now has traction. It offers employees rising career lifeline-pay taxes at the current income rates and enjoy tax-free funds later, even if at a higher tax bracket.

Why invest in 401k accounts?

The widespread adoption of the 401k accounts to the level of being a critical bargaining chip in an employment contract is mainly due to the benefits they offer to employees:

- Match-up returns

- Tax benefits

- Credit sheltering

- Unimpaired investment growth

- Transferability

A deeper delve into the factors above should be enough to highlight the significance of the 401k accounts for blissful retirement life.

-

Match-up returns

The most significant driver for the popularity of 401k is employer match-up. Employers have a right to match their employees’ contributions to the 401k account, either fully or partially. Most have adopted the match-up as a different way to motivate their employees and retain their services since match-up is an instant return on voluntary savings.

Employer match-up takes two approaches:

- Partial match-up capped at a predetermined annual income percentage.

For example, a 50% match-up up to 3% of the income-an employee earning $40,000 and contributing 3% gets a match-up of $600. It is totaling an annual contribution of $1800.

- A pre-agreed upon dollar amount, regardless of the employee’s annual income.

For example, a dollar-for-dollar match-up capped at $10000.

The ideal individual yearly contribution is one resulting in the maximum employer match-up value.

-

Tax benefits

401k traditional accounts result in employees tax benefits in two ways:

- Easier savings through pre-tax income.

- Lower taxation rates due to reduced taxable income as a result of pre-tax savings.

401k Roth accounts, on the other hand, are ideal for employees whose future income is on an upward trajectory. The use of this 401K Roth account ensures taxation at the prevailing income tax bracket and respite on withdrawing the account value and all associated incomes on retiring.

-

Credit sheltering

The Employee Retirement Income Security Act has employees falling on difficult times protected-came into effect in 1974. Unlike other forms of investments, 401k funds enjoy protection from creditors’ recovery machination.

-

Unimpaired investment growth

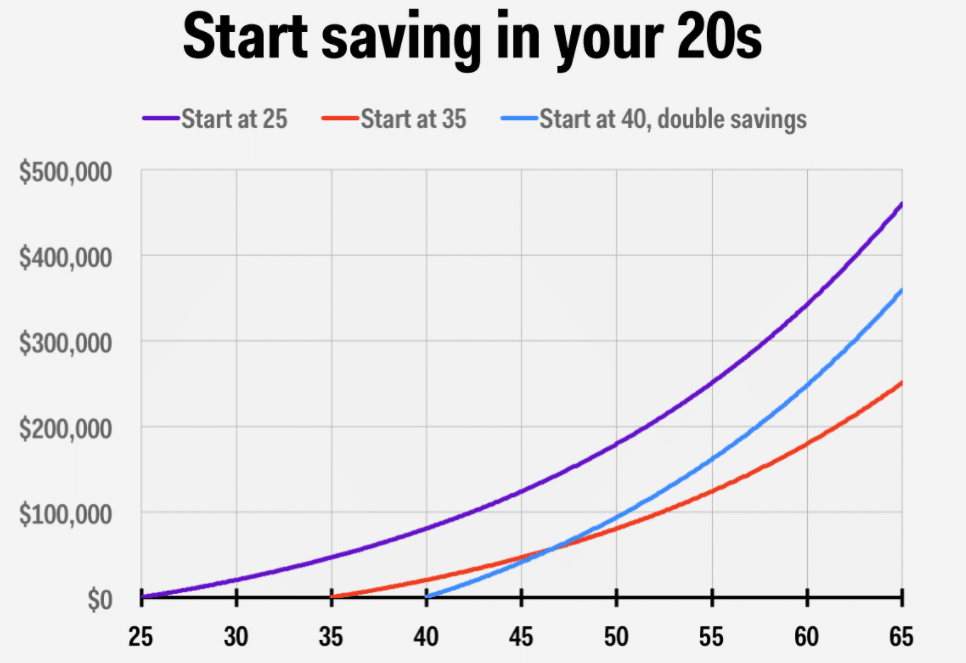

Unlike other investments and accounts, 401k account interests and incomes are tax-protected until withdrawal. The resulting compounding effect on returns hence accelerated growth.

-

Transferability

It would be unfair to contribute to a savings plan and then have all your efforts go to waste due to looking for greener pastures. Therefore, 401k accounts are transferable from one employer to the next. The catch is in the allowable vesting period-time frame within which employer contribution passes over to the employee in full.

The norm is a contribution vesting period of five years. In fulfillment of the vesting period requirements, employees can transfer their 401k account, both individual and employer contribution, to the “green pasture’s” plan.

If not interested in moving with your current 401k account, the IRS allows for a rollover to an IRA account-has more flexibility in terms of the investment instruments available.

Bottom line

No single investment instrument is risk-free. As a result, a 401k investment may lose value leading to loss of your retirement funds. Use the 401k plan’s sponsor to identify and analyze the best investment instruments for your retirement funds that are conservative and still result in returns.

Always ensure your contribution aligns to the maximum amount that results in a 100% employer match-up to enjoy the benefits of 401k accounts fully.

Comments