A retirement plan is your gateway to a stress-free life after your stopping work. Also, you can leave it as an inheritance to your spouse or children in the event of your death. Regardless of your age right now, it is not too late to start building your retirement plan. Of course, the earlier you start, the better.

If your age today is 35, your annual salary is $100,000, and you are just starting with your 401k plan, you will have a retirement account of $1.46 million when you retire at 65. This is possible if you save 10% of your annual salary and your employer gives a 100% match. If you find out later that you need more money than this during retirement, there are several things you can do to achieve this.

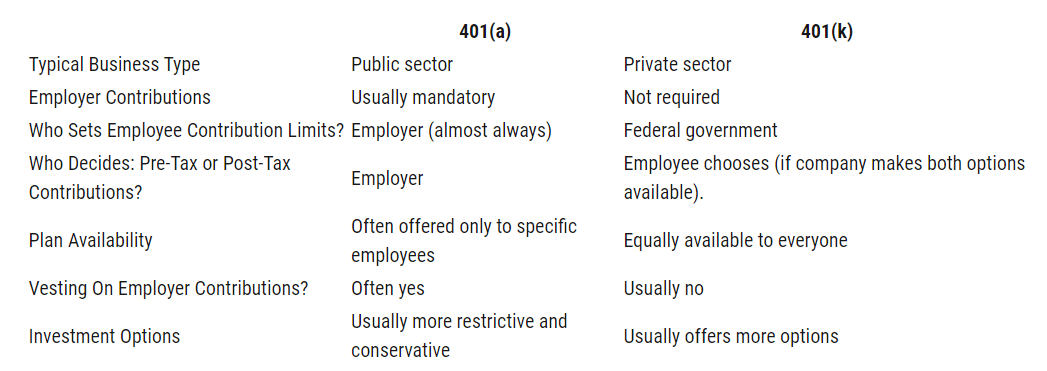

The above example is just one of the retirement options available to you. There are several others out there. In this article, we will cover the 401a plan as well. We will look at the differences between 401a and 401k plans, the pros and cons, contribution limits, tax rules, and others that will guide you in your decisions.

What is a 401a retirement plan?

It is a plan sponsored by your employer if you are connected to a government agency or a non-profit association or work in an educational institution. As a sponsor for this plan, your employer outlines the investments you can choose from and defines the vesting timetable when you become the owner of the employer contributions.

What is a 401k retirement plan?

You may get a 401k retirement plan if you work in the private sector. This plan usually is part of the compensation package decided at the time of hiring. Like the 401a plan, your employer designs your retirement plan, offers several investment options for you to consider and select, and defines the vesting timetable. Since you do not pay taxes outright, a 401k plan allows you to save money for retirement faster than when taxes are applied right away.

401a vs. 401k contribution limits

For the year 2021, the contribution for a 401a account has an upper limit of $58,000, which is the sum total of the employee contribution and employer counterpart. If you think you will need more money in your account than this, you have the option to take 401b and 457 plans at the same time.

Meanwhile, employees can contribute up to $19,500 for a 401k plan for 2021. Additionally, at your discretion, you can add up to $6,500 to get a total of $26,000 if you are 50 years old or older.

Further, you have the option to take an IRA account (i.e., traditional IRA or Roth IRA). If you opt for an extra traditional IRA account, the maximum cash-in limit is $6,000, plus $1,000 if you are 50 years old or older.

401a vs. 401k tax rules

This depends on how your employer structures your plan. With a 401a plan, your contributions are either after-taxed or pre-taxed. After-tax means that tax is applied to your contributions before deposit to your account.

Pre-tax means that tax is not applied to your contributions upon deposit but instead later during withdrawal. Meanwhile, a 401k plan is tax-deferred, meaning taxes are not applied immediately during deposit but later on when you decide to start withdrawing profits from your account.

401a vs. 401k investment options

In terms of investment choices, 401a and 401k plans do not vary so much. Both programs offer low-risk investments such as insured portfolios of bonds to high-risk investments such as equities. Some providers may provide investment advice or allow employees to seek support from a financial advisor.

Which maximum amount you’re allowed to borrow?

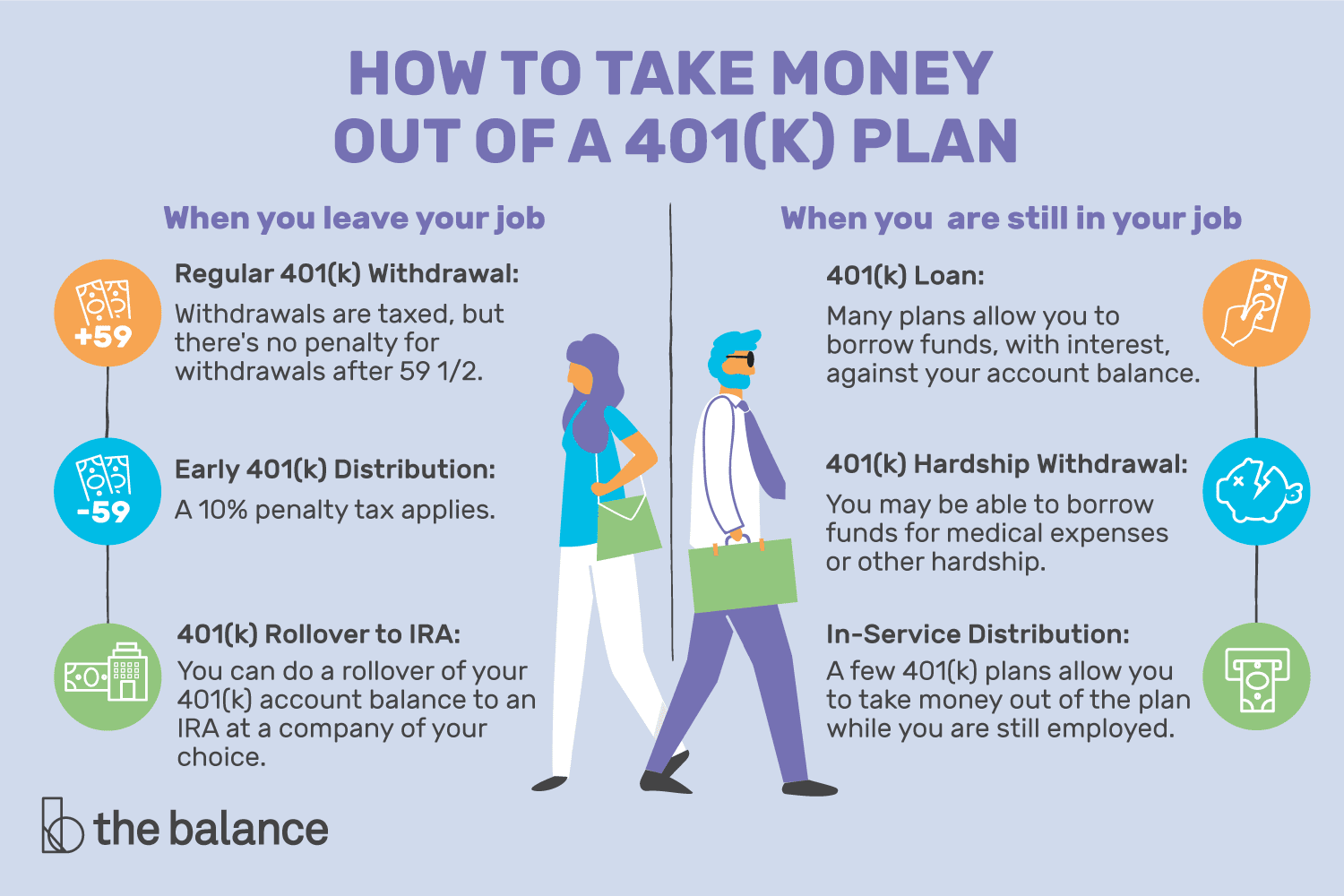

If you need money due to an emergency, be aware that you can borrow from your 401a or 401k plan. However, keep in mind that there are limitations in your borrowing ability, and you might have to pay early withdrawal fees.

Borrowing from a 401a plan

When it comes to 401a plans, your employer may allow you to borrow money or not. When your employer does permit you to take out a loan from your retirement plan, the maximum amount you can take out is one of the two options below, whichever is lower:

- $50,000

- $10,000 or half of your total contribution, whichever is higher

Borrowing from a 401k plan

This plan allows you to take out the same maximum amount as the 401a plan defined above. The difference is that you will lose a tax break if you borrow from your 401k plan, the reason being that repayment will be taxed before being deposited in your account.

You will be taxed again in the future when you start withdrawing funds from your plan, essentially resulting in double taxes.

What are the main similar rollover rules?

Normally, both the 401a and 401k plans follow the same rollover rules. When you choose to leave your job, you have two choices about what to do with your plan: move your funds into a different retirement plan or get a one-time payment of the entire fund’s balance. If you choose the first option, you must complete the process in 60 days from the date of fund movement.

401a vs. 401k: main advantages and disadvantages

The tables below outline the advantages and disadvantages of each plan.

| Plan | Pros | Cons |

|

401a |

|

|

|

|

|

|

|

|

|

401k |

|

|

|

|

|

|

|

Comments