Gold-backed cryptocurrency is a stablecoin where underlying tokens are secure and backed by gold. Compared to Bitcoin, the token price is less volatile since it corresponds to the current gold price.

In theory, 1 Tether token is backed by 1 USD, making it the largest stablecoin by market capitalization. Therefore, it is the most obvious choice after fiat currency as crypto by supporting, although technically, any asset is acceptable.

Enters described it as the new gold in 2017 when 1 Bitcoin was worth the same as one ounce of gold in USD (1 Bitcoin = 1 ounce). The concept of backed assets saw a surge in popularity around this time. These days, it is often purchased online. This article provides a comprehensive overview of the top five of them.

Why is most in-demand for investors?

Investors respond to the choppy stock market and fear of stagflation by investing in gold-backed cryptos this year.

During the same period last year, PAXG and TetherG, two of the top GB cryptocurrencies, together surpassed one billion dollars in market cap. Like PAXG and Tether, coins backed by it form digital tokens whose ownership resides on the blockchain, like popular tokens like Ether and Bitcoin. Tether and PAX tokens each represent one troy fine ounce of gold. Tokens tend to be less susceptible to price fluctuations because they link to a physical asset.

As gold-backed crypto, it serves as a liquid asset that tracks prices without requiring a physical purchase. The process is similar to buying an exchange-traded fund that mimics expense, except that investors can redeem gold-backed tokens for physical metal instead of cash, as with an ETF.

Best gold-backed crypto projects in 2022

Here are a few projects which are trending. Have a look at the most promising ones among them.

DigixGlobal (DGX)

Singapore-based DigixGlobal has created a cryptocurrency backed by it where each DGX token equals one gram of it. In addition, both Singapore and Canada have fully insured vaults for the physical metal, accredited by the Bullion Association.

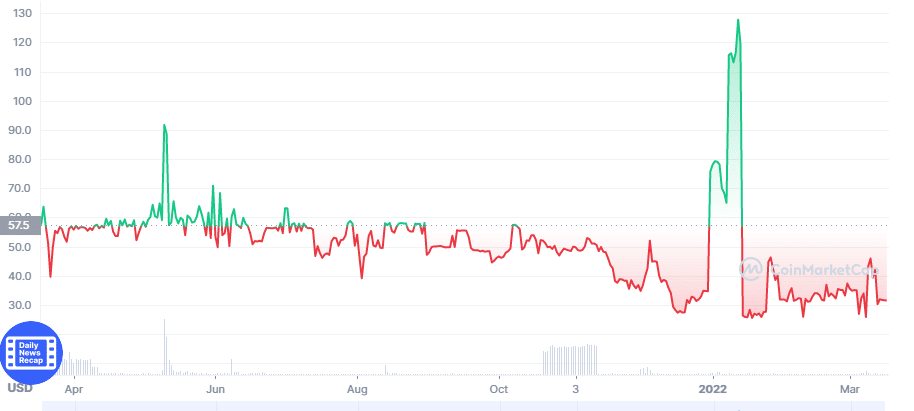

DigixGlobal price chart

Price prediction 2025

Digix Gold Token is forecast to reach a price of $141.97 at the earliest in 2025. By 2025, DGX could reach maximum price levels of $167.08 and an average of $145.91. By creating this tokenized version, the platform wanted to allow anyone to own gold regardless of where they live. DigixGlobal covers the company’s storage costs. A 1% fee applies when trading the tokens for gold, which is relatively low compared to others, making it an excellent investment for the future.

Pax Gold (PAXG)

The Paxos Gold is a cryptocurrency that is the product of Paxos. The company operates the cryptocurrency exchange itBit based in Singapore. Having a charter from the New York State Department of Financial Services, the company became a regulated or legal custodian that offered gold-backed digital currencies or tokens.

By purchasing the ERC-20 token, users can access traditional markets with high-quality gold.

Paxos Gold price chart

Price prediction 2025

In 2025, 1 PAX Gold will cost at least $8,149.77. PAXG expects to reach $9,336.87 as its maximum price, and $8,373.70 as its average price, throughout 2025. Gold can be owned, transferred, stored, and bet on quickly and easily with this crypto – without the size and weight limitations of large gold bars, which are not readily stored, transferred, or even divided. Therefore, it would be an excellent investment for 2025.

Perth Mint Gold Token (PMGT)

A few stablecoins use gold coins other than PMGT, but only PMGT is certified by the Australian government in weight and purity. This product is a product of Perth Mint in Western Australia, which backs its tokens with blocks of this metal and offers digital certificates as proof.

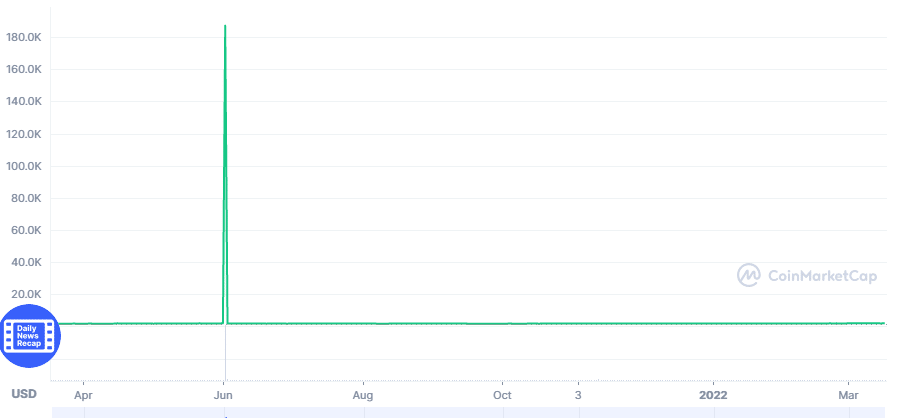

PMGT price chart

Price prediction 2025

The price of 1 PMGT will reach at least $7,971.54 by 2025. Therefore, a PMGT price of $9,793.58 is possible, with an average of $8,208.79 during 2025. In addition, the Perth Mint assumes all the storage, custody, and insurance costs, making it far more cost-effective and competitive than others. Hence, the Perth Mint can be considered a good investment for 2025.

Goldcoin (GLC)

It aims to be decentralized and economically accessible by a peer-to-peer approach to cryptocurrencies. Its development team believes in economic freedom, and its transaction confirmation speed of just two minutes surpasses most cryptocurrencies we are familiar with. Furthermore, you can use any ETH wallet for storing and sending the ERC-20 coin.

Compared to the crypto king or other altcoins without stable assets, it is less volatile due to its backing.

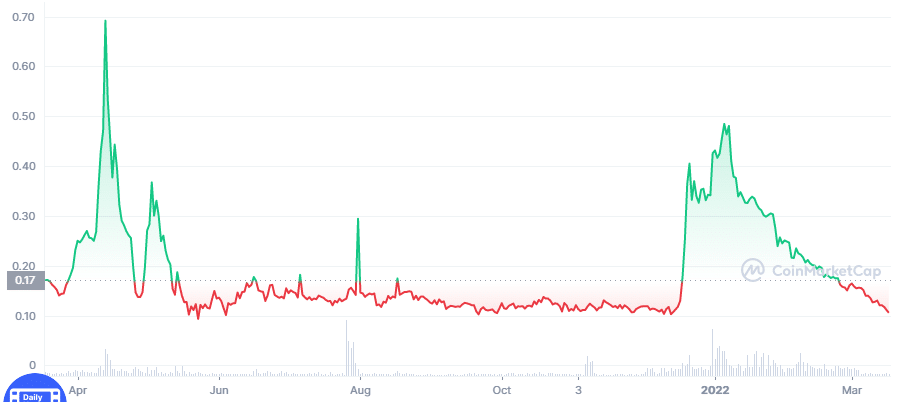

Goldcoin price chart

Price prediction 2025

According to estimates, 1 GLC will cost at least $0.45 in 2025. In 2025, its price will reach a maximum of $0.55 with an average of $0.46. In comparison with metal, GLC is much more divisible, portable, and transferable. We can exchange a cryptocurrency for physical gold whenever the owner wishes. Furthermore, because crypto is a digital asset, it is tradable into a fiat of choice at any time. It, therefore, makes it an attractive investment for traders.

Tether Gold (XAUT)

By market capitalization, Tether is ranked third among cryptos. However, Tether’s US dollar-backed status compelled the crypto to launch another crypto soon. XAUT tokens are available on various blockchains, including ETH and TRON.

Based on a London Good Delivery bar of gold, one XAUT token represents a troy ounce (31.10 grams) of gold. Additionally, token holders can receive cash or actual metal as reimbursement for their tokens.

Tether Gold price chart

Price prediction 2025

One XAUT should reach $7,270.54 in 2025, a minimum level. With an average price of $7,537.57 throughout 2025, XAUT can reach a maximum level of $8,999.27. XAUT’s reserves reside in Swiss vaults, and investors can check the serial numbers of their bars on the company’s website. As a result, this coin is a good choice for your portfolio because it reduces the risk factor for the investors.

Final thoughts

These tokens have several advantages: smooth and fast settlement, no minimum purchase amount, and high transferability. However, redemption can be a bit hit-and-miss. Occasionally, it takes some time.

An auditing mechanism is lacking in the holding company, thus creating an underlying risk to the gold backing the holding company. Additionally, the amount of gold that the government can back is limited.

Comments