If you are an investor looking to engage in cryptocurrency but are worried about its unpredictable volatility, consider stablecoins. Indeed, mainstream crypto Bitcoin and Ethereum have disrupted the financial system and affected how investors look at money.

If not for the downside already pointed out, digital currencies offer a positive outlook for investors to put their money for the long term. Meanwhile, stablecoins are less volatile than standard crypto.

What makes them different from traditional crypto is that such coin is pegged to a real asset, such as fiat currency. You can say this characteristic of stablecoin is an added value. They are much like crypto in general except for this attribute. Thus, stablecoins are a new type of investment you can consider engaging in.

What are stablecoins?

It is a virtual currency like BTC but is supported by tangible assets such as gold and coins. Backed by natural assets, such coins are expected to assume a fixed value, which contrasts with crypto. Digital currencies may fluctuate based on supply and demand.

As a new asset class, cryptocurrencies evolve quickly in the current technological age. As businesses adopt digital currencies, they are prone to market fluctuations, and their values can change rapidly within seconds.

Meanwhile, since tangible assets such as gold and US dollar support stablecoins, you can expect them to have more stable price movements, unlike other cryptos such as BTC. They are susceptible to market speculations and less responsive to market events.

Types of stablecoins

These coins belong to one of three classifications based on the underlying asset, namely:

- Fiat-backed

- Cryptocurrency-backed

- Commodity-backed

Fiat-backed stablecoins

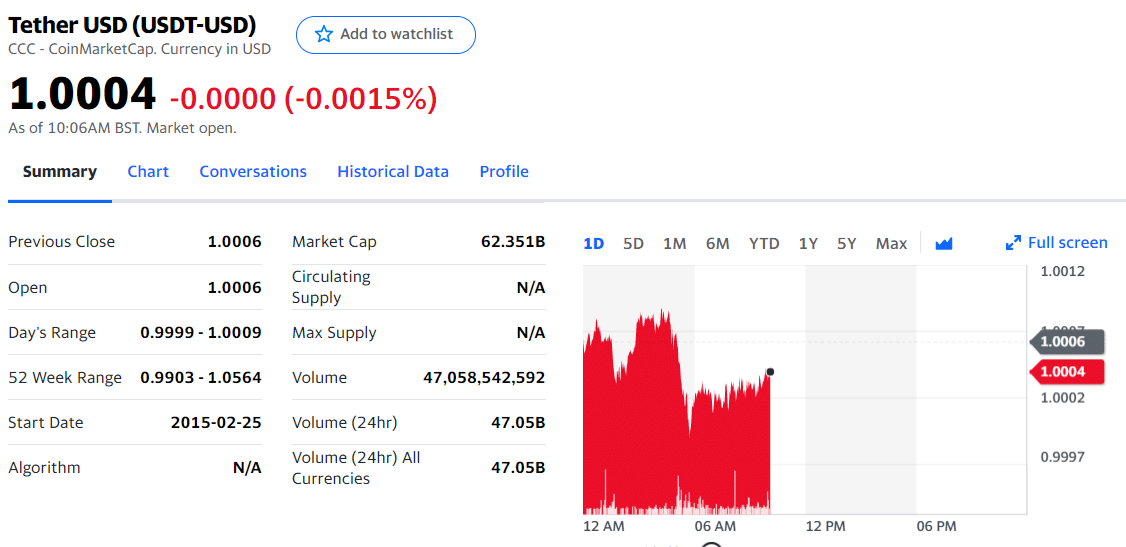

The first stablecoin in the market is Tether. It has the symbol USDT. So far, Tether has the most significant market cap and broadest adoption of all stablecoins in existence. Tether is set against the US dollar in a one-to-one ratio.

USD coin (or USDC) is a stablecoin also pegged to the US dollar at a one-to-one ratio. Launched in September 2018 by Circle and Coinbase, USDC is a centralized stablecoin. By centralized, we mean a financial institution that holds, regulates, or controls the stablecoin. As you might have guessed, this financial institution is Coinbase and Circle.

Of course, there are risks associated with having a central authority controlling stablecoins. One of them is the capacity of the institution to maintain the supply of fiat money corresponding to the number of stablecoins issued. Centralization runs against the original purpose of crypto.

Crypto-backed stablecoins

Dai is the first decentralized and crypto-supported stablecoin in the market, which runs on the Ethereum network. Compared to centralized stablecoins, Dai is not backed by the US dollar through a bank account. Instead, the backing is done through collateral on the maker system. Maker is a smart-contract system running on the Ethereum network.

The brilliant minds behind Dai intend to maintain its value to one US dollar. They plan to achieve this goal by letting users use assets in the Ethereum blockchain to produce Dai on the Maker system without any middlemen. So this means that users will maintain the blockchain and that no single entity or individual controls the blockchain.

Commodity-backed stablecoins

For this type of coin, commodities such as oil and gold provide the needed backing. Among the most popular stablecoins in this group are Paxos Gold and Tether Gold. Compared to fiat-backed and crypto-backed counterparts, commodity-supported stablecoins are more vulnerable to market fluctuations.

However, since we can expect commodities to appreciate in value in the long term, you can use a HODL strategy and realize good returns in time.

Most popular stablecoins

Experts say that the number of such coins currently in existence is more than 200. Let us get to know a few of the most well-known stablecoins. Five stablecoins have been discussed in the previous sections.

| Stablecoin | Symbol | Description |

| Tether | USDT | Most popular stablecoin with the most significant market capitalization |

| USD coin | USDC | Official stablecoin for Coinbase |

| Dai | DAI | Decentralized stablecoin running in Ethereum network |

| Paxos Gold | PAXG | Regulated, gold-backed stablecoin |

| Tether Gold | XAUT | New stablecoin issued by Tether |

| Gemini Dollar | GUSD | USD-backed stablecoin at 1:1 ratio |

| Binance USD | BUSD | Pegged at 1:1 ratio against US dollar |

| Digix Gold | DGX | Token representation of physical gold |

| True USD | TUSD | Cryptocurrency equivalent for US dollar fiat currency |

| Terra USD | UST | Algorithmic stablecoin that simulates US dollar price |

Pros and cons of stablecoin investing

If you have found suitable stablecoins, hold your decision first until you have completed reading this section.

Pros of stablecoin investing

Unlike crypto, these coins have constant price movements. This means that your investment is safe as its value does not fluctuate much. Reflect on the pros of stablecoin investing as outlined below:

- You can expect the price of stablecoins to remain constant over five years. By the way, this is the main feature and appeal of stablecoins.

- Users will not worry about fluctuating exchange rates when conducting business, such as transferring large amounts of money from one country to another. A slight change in the exchange rate from euro to dollar, for example, can have a significant impact on the amount received on the other end of the transaction.

Cons of stablecoin investing

When investing, typically, your goal is to realize profits after a while. However, if you invest in these coins, you might not gain or lose anything after a few years. If that is the case, then there is no sense in stablecoin investing. In the short term, you can use these coins in conducting business transactions online.

Fiat-backed stablecoins have the most stable values among the three types. Because of this, you cannot gain much from buying and holding this asset class in the long term. An apparent downside to investing in this type of coin exists. Since fiat currency supports them and money loses value due to inflation, you will stand to lose putting your money in this asset over the long haul.

Here are the other significant cons of stablecoin investing:

- Trust is an issue with these coins. You can lose them because they are decentralized.

- It is possible that the company managing the project goes out of business or forgoes the project entirely for another project. Thus, you can lose your money kept on the platform.

Final thoughts

In addition to solving the problem of volatility in the crypto market, which frightens off the broad masses and thereby hinders the development of the entire industry, stablecoins can also create some competition with the largest cryptocurrencies as an alternative medium of exchange and storage.

Since these coins are built on the infrastructure already created by BTC and ETH, such competition will not play a key role. They should be viewed as a fundamental element that can bring considerable benefits to the entire ecosystem of digital assets.

Comments