Technology plays a vital role in our daily activities, affecting our finances. Day in and day out, an increasing number of people seek ways to transact online, trying to avoid long queues. This change has contributed to the massive growth of crypto investments.

Out of the range of crypto options, new crypto investors favor stablecoins because of their low volatility. As the number of stablecoins, now over 200 as of January 2022, is steadily growing, you might find it hard to select one option. To help you make the decision, we listed in this article five stablecoins making a noise in the market of late.

What are stablecoins?

A stablecoin is a digital currency that uses an underlying asset as collateral. The specific type of asset being used differs from one coin to another. Several stablecoins combine at a 1:1 ratio with specific fiat money, like Euro or US dollar, and these combinations or instruments are tradable at crypto exchanges. Meanwhile, other stablecoins are backed by other types of assets like other crypto or precious metals.

Top five stablecoins to buy in 2022

This section presents five of the most popular stablecoins in the crypto market. While many assets could back stablecoins, such as precious metals, real estate, and fiat money, the following coins are backed by US dollars only. They are arranged by the amount of market cap from the highest to the lowest.

What is Tether (USDT)?

Tether is a crypto-based blockchain and is backed by US dollars. The exact amount of US dollars supports the total tether tokens in circulation. Because of this, it is expected that the price will stay close to one USD. USDT is the trading symbol of the native token of the Tether network. This token was developed by BitFinex and launched in 2014. As of March 2022, USDT ranks as the third-largest crypto, having about $80 billion in market cap in Coinmarketcap.com.

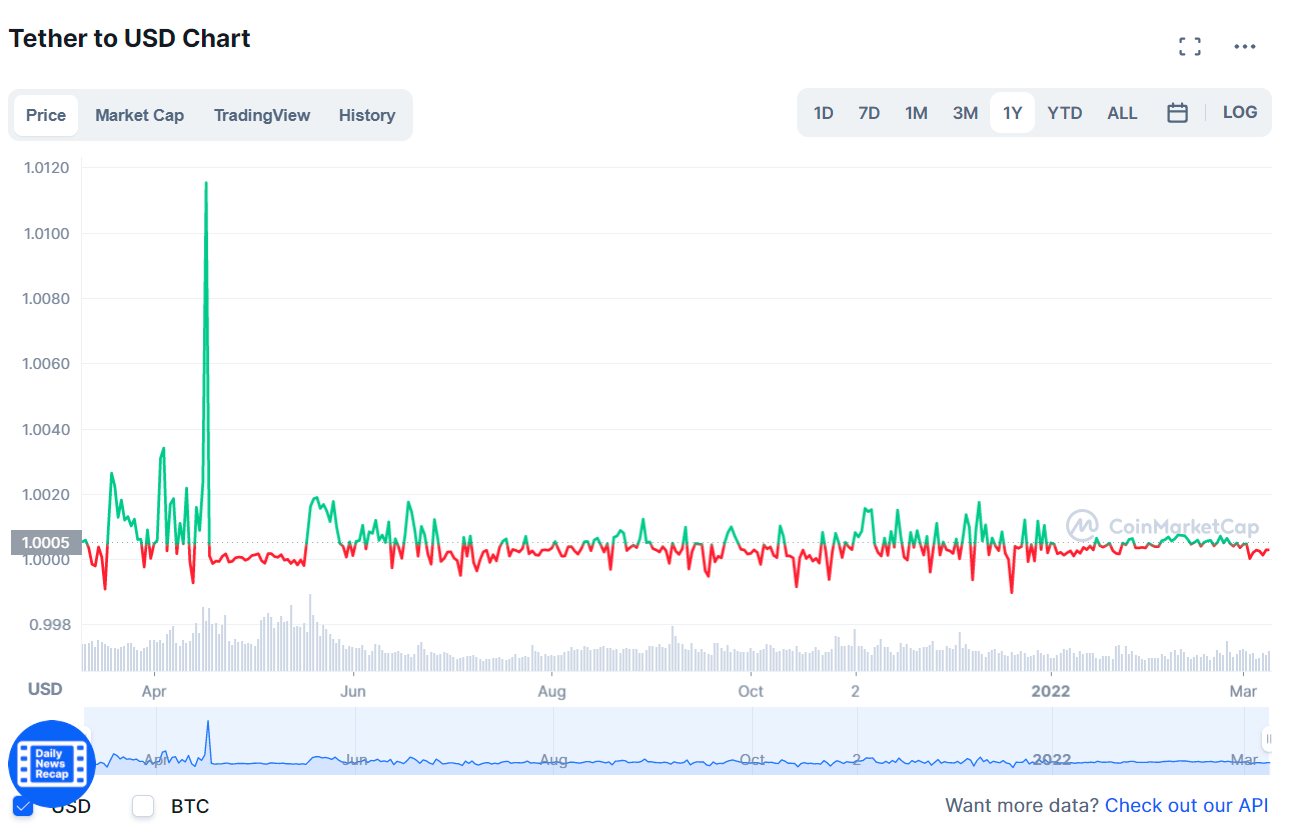

USDT 1Y price history

Entrants to the cryptocurrency world often buy crypto assets using Tether instead of US dollars. That is why you can see some exchanges pairing Bitcoin, for example, with Tether, resulting in the symbol BTC/USDT instead of BTC/USD. The goal is to protect crypto investments against abnormal price fluctuations in the crypto market. Because cryptocurrencies are very volatile, stablecoins provide a safe haven for large investors.

What is a USD coin (USDC)?

USD coin is another virtual currency that uses the US dollar as collateral. USDC is the symbol of the USD coin, which has a 1:1 relationship with the US dollar. The price of USDC is intended to fluctuate in a very narrow range above and below one dollar, making it a stablecoin.

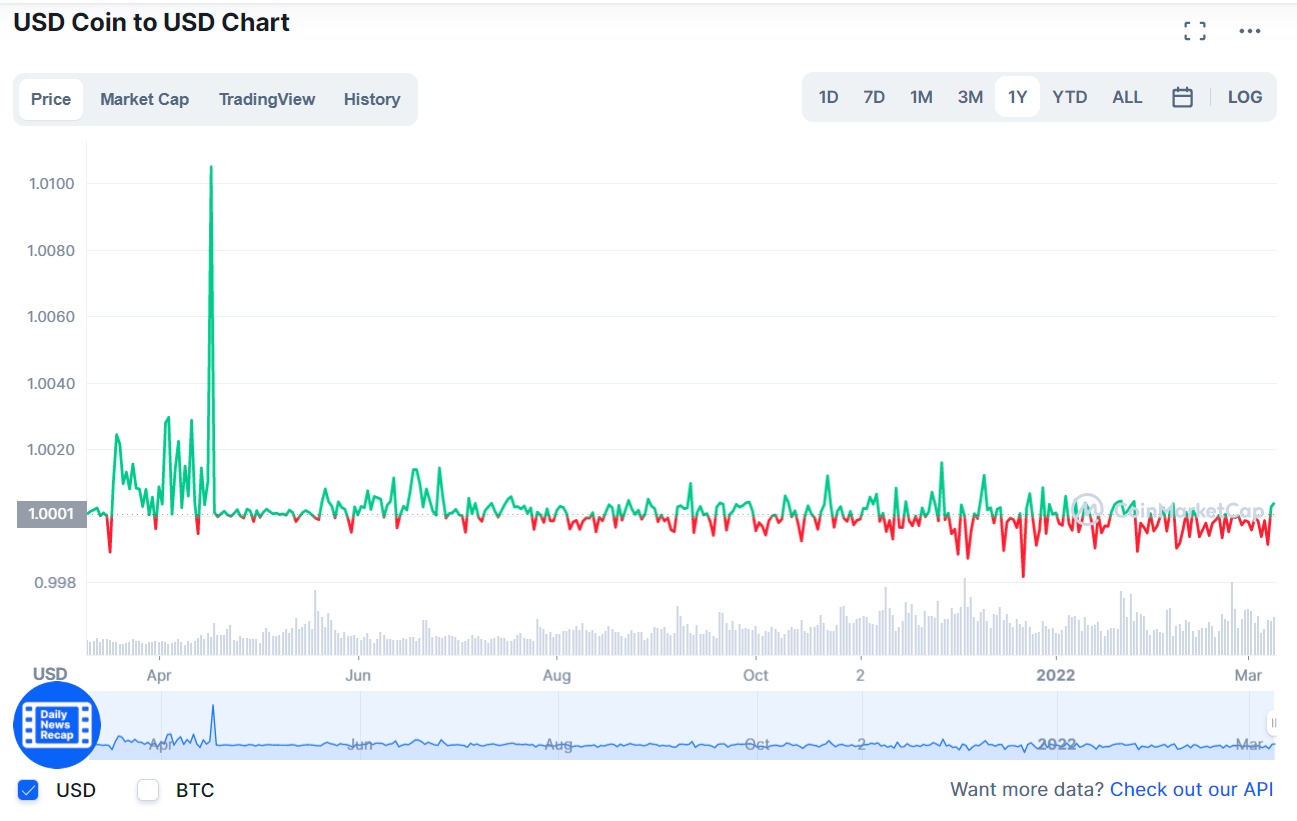

USDC 1Y price history

As you can see in the chart above, USDC is very stable in price when you compare it with mainstream and secondary cryptocurrencies such as Ethereum and Bitcoin. The only time that USDC displayed a volatile behavior happened in one day, 17 April 2021. Be aware that the federal government did not issue or back USDC. This stablecoin uses an open-source code that anyone can refer to at will.

What is Binance USD (BUSD)?

As the name suggests, Binance USD is a stablecoin backed by the US dollar. As a stablecoin, every BUSD token has an equivalent of one US dollar being held in collateral. This means that BUSD supply is matched with the US dollar at a ratio of 1:1. As a BUSD holder, you can convert your BUSD tokens into fiat money and the other way around.

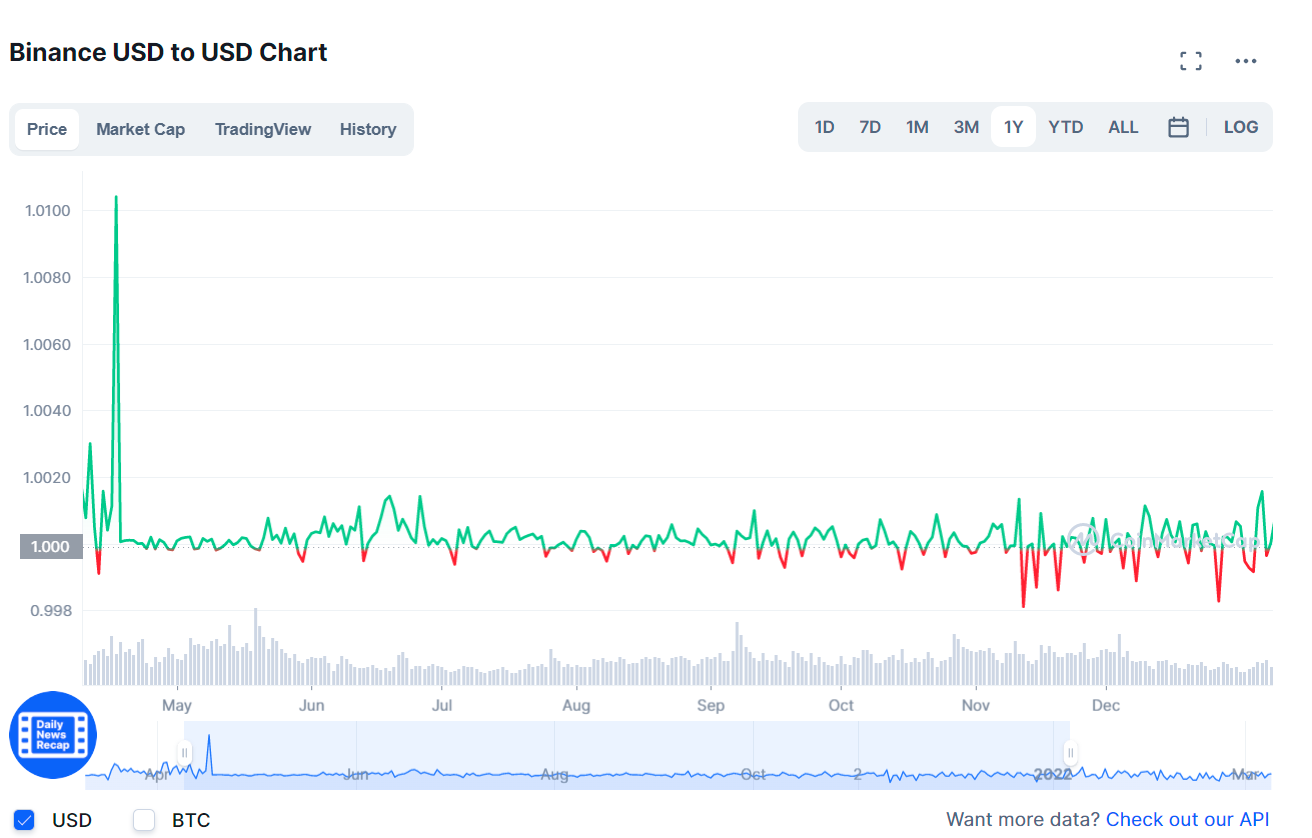

BUSD 1Y price history

Binance wanted to keep a stable market value for the token. If you are a long-term investor, you can keep your crypto investments in BUSD for years without worrying about price fluctuations.

What is True USD (TUSD)?

True USD is a popular stablecoin on the crypto market, and the US dollar backs it. When other stablecoins have been hit by controversies, True USD rose to fame because of its regulatory compliance and transparency. Trading with the symbol TUSD, this coin is an ERC20 token supported by US dollars with a fixed ratio of 1:1. For the record, TUSD is the first stablecoin backed by the US dollar that has gained regulatory compliance.

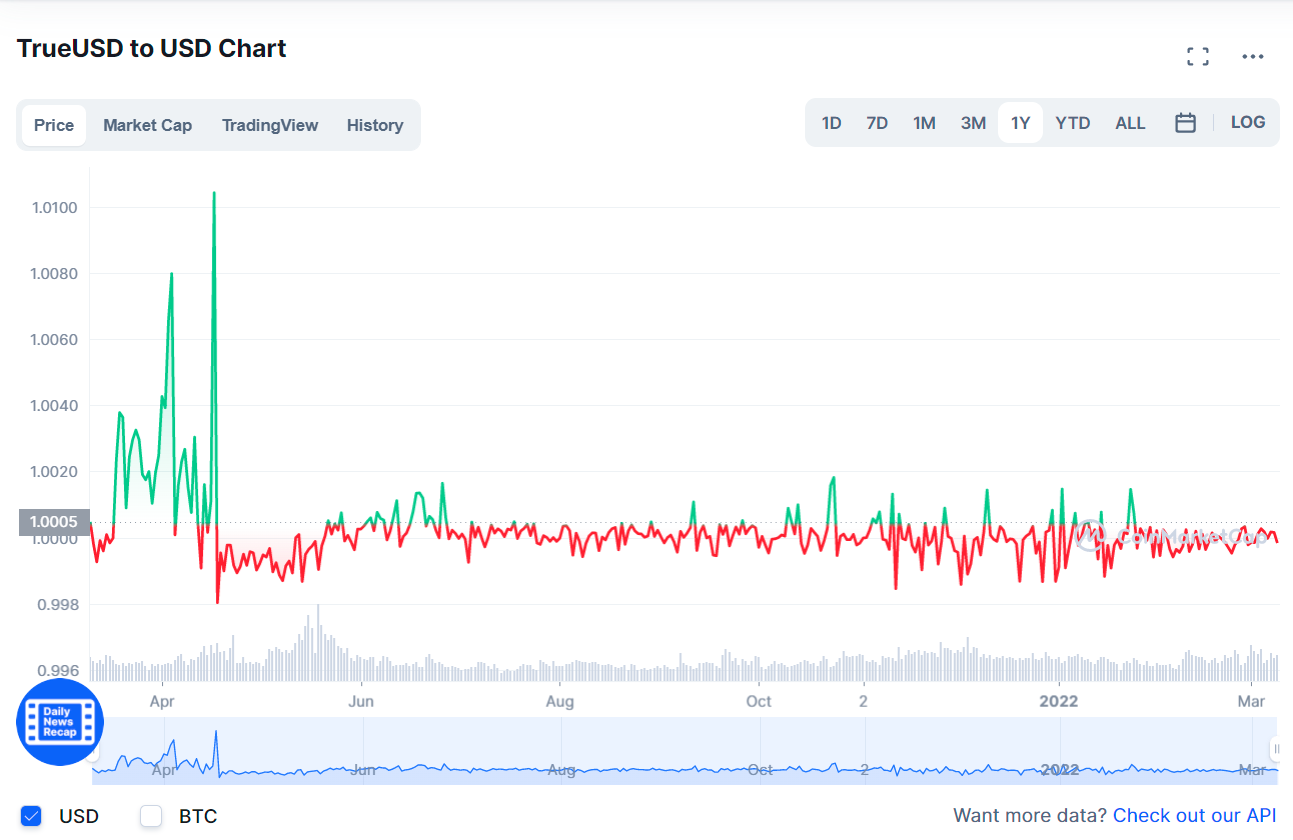

TUSD 1Y price history

The whole TUSD supply in circulation is completely supported by USD dollars. To secure the funds of token holders, TUSD network uses a range of escrow accounts and apportions USD backing in multiple bank accounts from trusted companies. You can count on TUSD as a reliable and secure stablecoin if you want stability, efficiency, and safety when joining the crypto space.

What is Pax dollar (USDP)?

Issued by Paxos Trust Company, USDP is a stablecoin running on the Ethereum platform. Each USDP token is matched to one US dollar. As a result, the price of USDP moves around the $1 mark very closely. This is in stark contrast to standard crypto-assets like Ether and Bitcoin, whose prices fluctuate up and down vigorously every single day. USDP is an exciting option for global remittance, as it facilitates fast transactions using the stable network Ethereum.

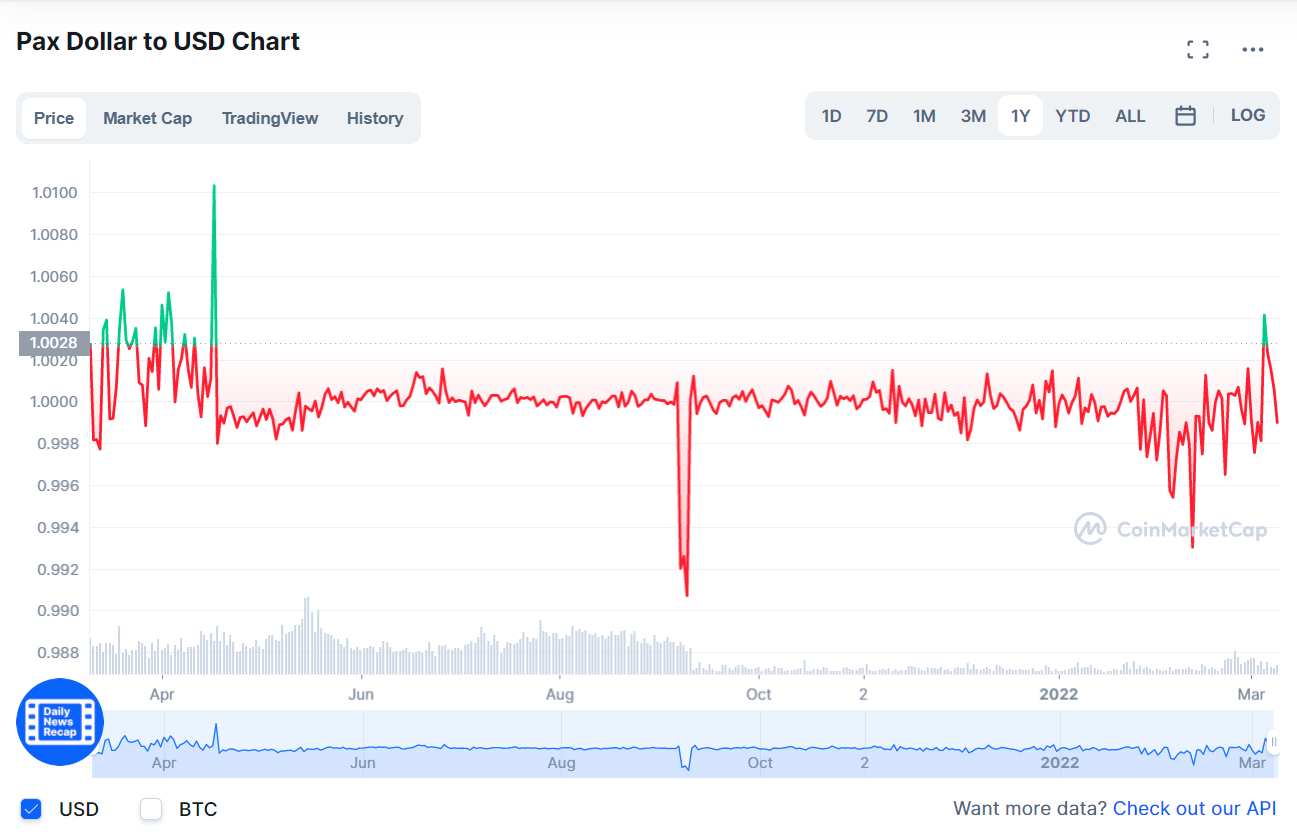

USDP 1Y price history

Being a stablecoin, USDP is expected not to fluctuate too far from the one dollar mark. Unfortunately, the coin reached its all-time high of $1.52 in May 2021. This came as a result of a rumor about the plan of PayPal to launch its very own stablecoin with the assistance of multiple partners. USDP has no supply ceiling, but this is not a problem at all. The team behind the coin only releases new tokens when it has enough supply of US dollars to be used as collateral at a 1:1 ratio.

Final thoughts

The primary role of stablecoins in the crypto market is to keep investments stable over the long term. This is because these tokens are not as volatile as other crypto assets. The introduction of stablecoins has led to new business opportunities in the crypto space. Stablecoin is an exciting front in crypto development with a lot of potential. Stablecoins may become a catalyst for the growth of the digital economy in the coming years.

Comments